Advertisement

Bitcoin (BTC) remained higher late on September 10, when optimistic forecasts suggested that $23,000 was the next mark.

Maintain the $23,000 target

Data from Cointelegraph Markets Pro and TradingView shows BTC/USD hitting $21,730 above — the highest since Aug. 26.

The pair managed to maintain its previous gains despite low trading conditions over the weekend potentially amplifying any weakness.

Analysts are clearly excited to enter the new week, a week that will prove crucial for crypto price action in the short term.

Ethereum’s The Merge (ETH) event and new U.S. Inflation data are the top catalysts expected to affect the market.

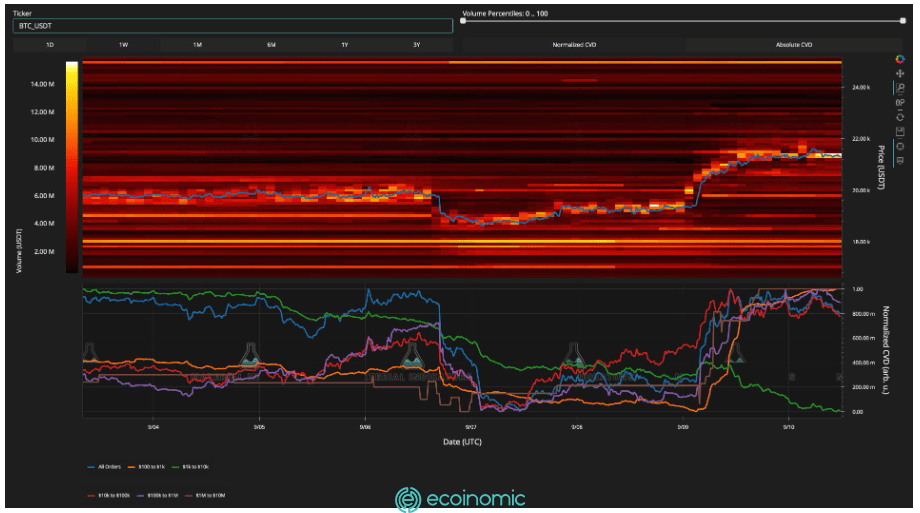

An accompanying chart shows that the Binance BTC/USD order book offers solid resistance near $21,500, a zone that the bulls then broke through.

Meanwhile, the Il Capo of Crypto account thinks that there is still room for the price to rise further.

Short squeeze is not over. 22500-23000 should be next.

— il Capo Of Crypto (@CryptoCapo_) September 11, 2022

However, he added that 90% of BTC price action will return below $20,000 in the future. $23,200 is also a target for trader CJ, who has been looking at different short-term levels for clues about long- and short-term entry positions.

“Septembears” defeated

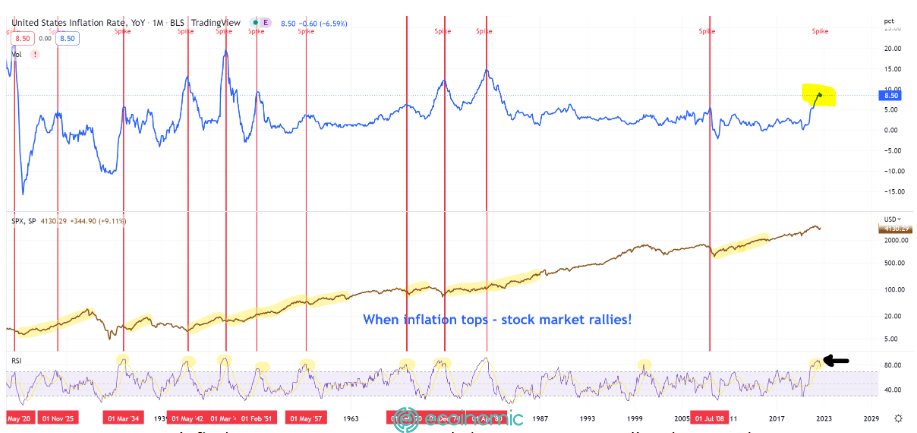

In terms of macro, expect that a rally then becomes stronger, according to analyst Hernik Zeberg.

“Every time Inflation peaks – The stock market is up! ALL THE TIME! And the RSI is in the turnaround zone,”

“The US CPI will be released on Tuesday. This time will be no different!”

July CPI data suggests the U.S. may have seen the highest level of inflation.