Advertisement

Chainlink is recently announcing some updates that could help LINK in this cryptocurrency market.

According to one of the announcements, Chainlink has launched a new price feed to protect Web3 projects against data manipulation attacks and outlier events such as flash crashes. With the help of this technology, creators in the Web3 space can integrate the ZIL/USD Price Feed on the Optinism network to build a secure DeFi marketplace around Zilliqa’s token.

However, that’s not all as Chainlink has also updated its followers on its work. Chainlink announced that it will work on global carbon credit standards, adding strong incentive models for their development while adding effective climate initiatives.

Chainlink, with the help of hyphen, decimated and coorest, has also taken steps towards the sustainability and climate change aspects.

What happens on social media?

All of these updates seem to have had a positive impact on Chainlink’s social media presence. In fact, Chainlink’s social media mentions have increased by 15.98% while social media engagements have increased by 6.55% over the past week.

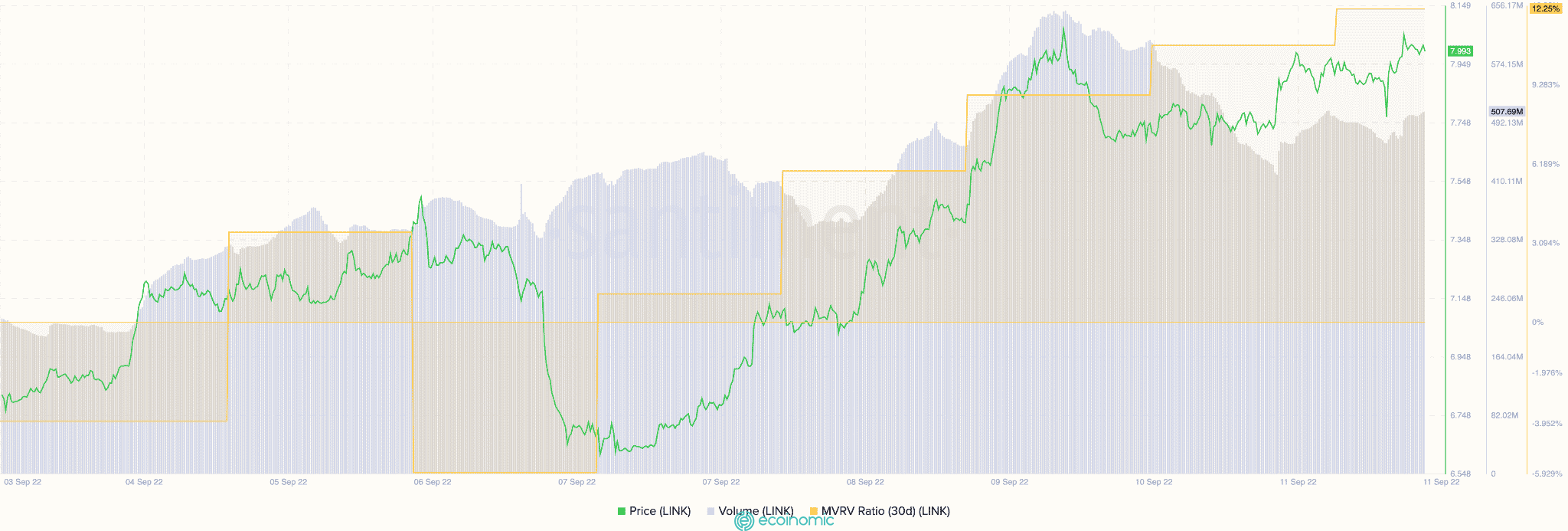

There are also other bullish signs for LINK, the volume of this altcoin is increasing since the beginning of September, from 200 million to 503 million. Along with that, MVRV is also steadily increasing, indicating an optimistic future for this cryptocurrency.

There was also an increase, rather a small increase in the activity of developers. Although horizontal, more updates may come out in the future to support this increase.

What is the bigger context?

However, the development is not perfect for LINK.

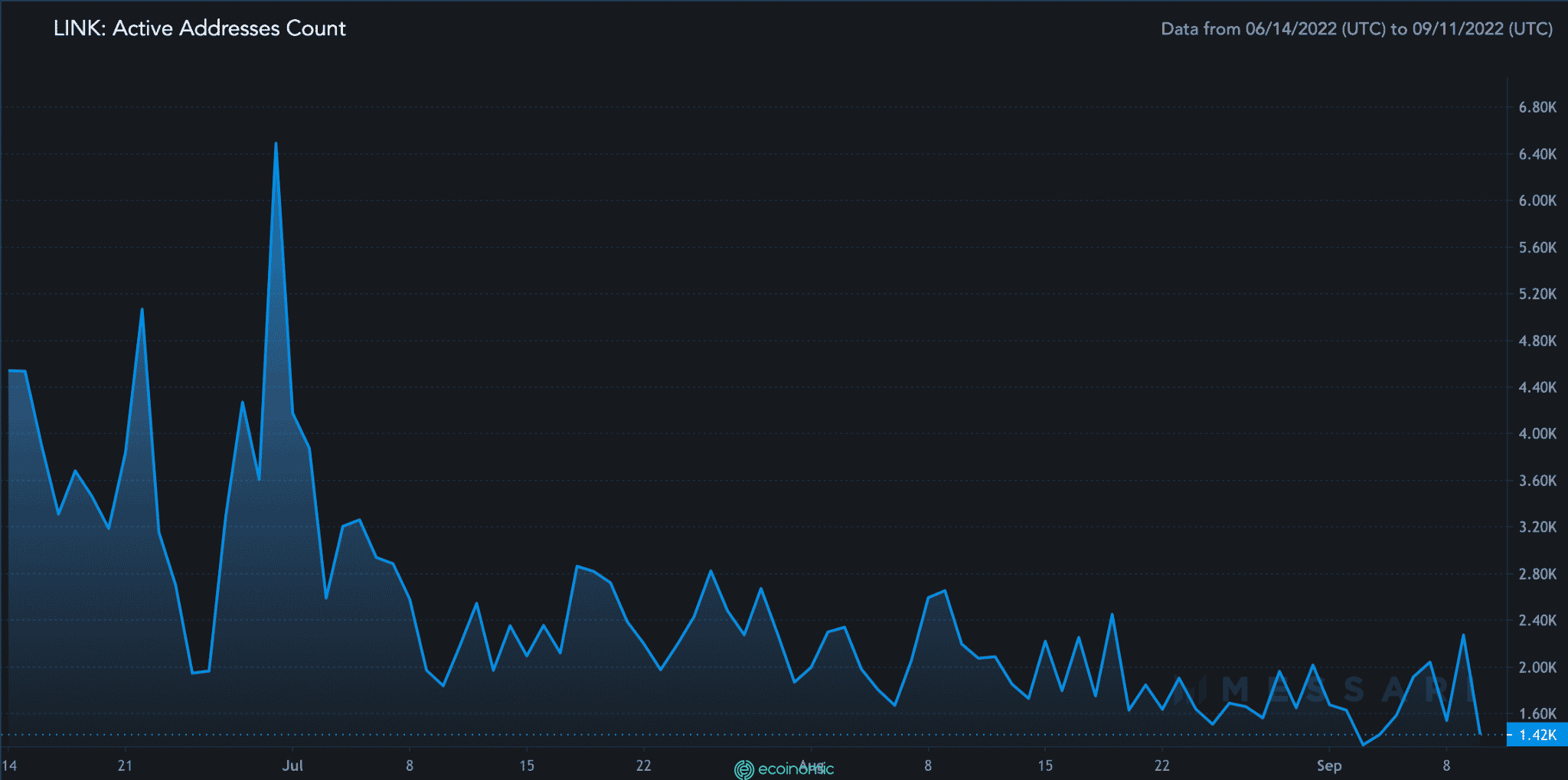

The number of active addresses has decreased in the last 3 months. Its Market Cap dominance is also declining, with its market cap down 4.58% since July. Both of these factors can be a major cause for concern for investors.

The value of LINK has increased by 2.64% in the most recent 24-hour period. At the time of writing, the altcoin’s price has broken through the $7.38 support level and is on its way to testing the $8.18 resistance level.

With RSI at 64.44, this represents buying momentum. However, OBV has gone sideways – a sign that some uncertainty may occur in the future.