Blockchain infrastructure firm ChainSafe has raised $18.8 million in an oversubscribed Series A round led by Canadian Venture Capital firm Round13.

Other investors in the round include ConsenSys, HashKey Capital, NGC Ventures and Digital Finance, according to a company release.

Aidman Hyman and Hatcher Lipton co-founded ChainSafe at an Ethereum meetup in Toronto in 2017, a time when the blockchain industry was still very nascent and needed better developer tools.

“Bitcoin wasn’t necessarily the thing that excited us,” said Hyman in an interview with The Block. They gravitated toward Ethereum because it could empower a new form of digital relationship, he added.

“Specifically, the idea of unstoppable code was something that once we heard, we couldn’t unhear,” Hyman said.

The five-year-old company has since evolved from its Ethereum days and is now a fully-fledged multi-chain research and development studio that specializes in developer tooling.

A multi-chain solution

Most of ChainSafe’s projects operate across multiple chains. Recent projects include Web3.untity, a software development kit (SDK) for connecting Unity games to blockchain technologies, and cross-chain bridging solutions.

It is still most likely well-known for its role in the Ethereum ecosystem, however. One of the company’s projects is Lodestar, a consensus client for implementing Ethereum’s Proof-Of-Stake algorithm, which played a key role in The Merge.

The team takes the approach of “technical objectivity” when looking to build developer tools for blockchain technologies, Hyman said. They choose build on technologies that they think will still be here in 20, 50 or even 100 years from now.

“One of the things that’s really important for us is to never forget that we come from the open-source movement and that the primitives that we are creating are aimed to be primitives for a future digital world,” Hyman said.

From bootstrapping to Series A

The five-year-old company now has 120 employees in 33 countries. It has predominantly bootstrapped till this point, having only raised an undisclosed amount in a seed round in 2020, according to Crunchbase.

The recent fundraise will accelerate the development of the ChainSafe platform, Lipton said.

“Why at this point? In these markets?” Hyman said. “Really, it wasn’t a matter of market conditions, but rather this was where we were at in our journey.”

The startup closed the Series A round in the middle of September, Lipton said.

Khaled Verjee, a managing partner in Round13’s digital asset fund, will join ChainSafe’s board of directors alongside current board member Joseph Lubin, co-founder of Ethereum and founder of ConsenSys.

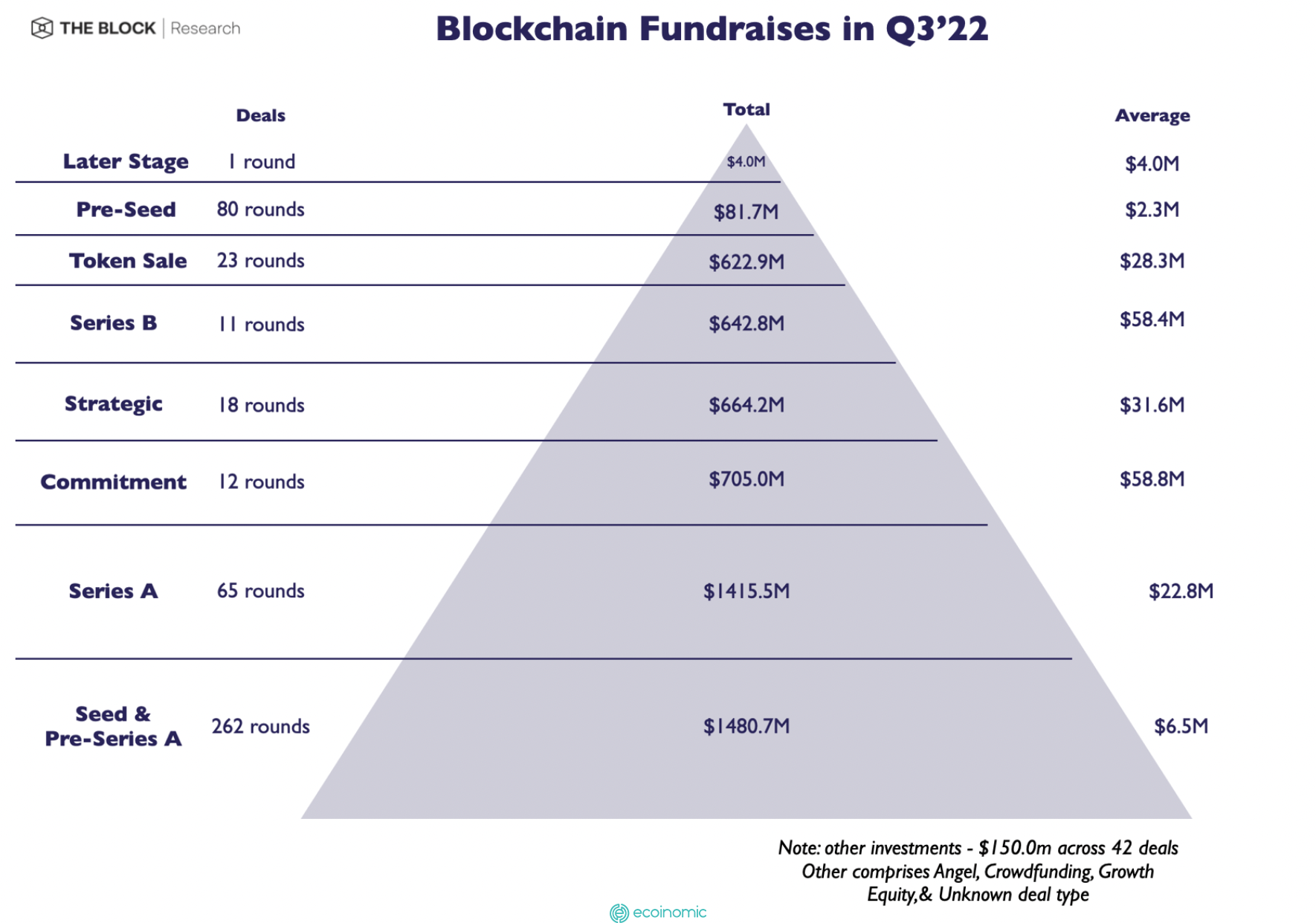

The average amount for a Series A check in the third quarter was $22.8 million, according to data from The Block research.

Source: theblock.co

>>> Related: Polkadot synthetic asset protocol Tapio raises $4 million from Polychain and others