Advertisement

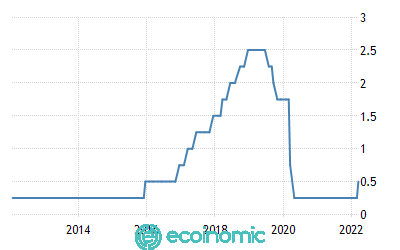

On Wednesday, March 16, 2022, after the end of its monetary policy meeting, the Federal Reserve (FED) decided to raise interest rates at a rate of 0.25-0.5%. The move marks the end of easy monetary policy to soaring Inflation in the midst of the Covid epidemic and the Ukraine war.

In a statement, the Federal Reserve said economic indicators and employment figures have been "continuing to strengthen," but noted that inflation remains high and that the invasion of Ukraine not only "caused great human and economic difficulties" but also "increased inflationary pressures and became a burden of the ukraine." Economic activity" in the United States.

With a dual mission of maximizing jobs and controlling prices, the Federal Reserve has played a significant part in cutting interest rates and creating a stimulus program that will help the job market and the economy recover impressively from the pandemic's lows. However, prices rose 7.9% in the year to February – the highest level of inflation in 40 years.

Normally prices will rise in winter, but by 2021, natural gas prices have risen all year after the lowest level caused by the pandemic in 2020. The predicament of the supply chain has led to price increases in many sectors including used cars, food and utility products, to the detriment of lower-income Americans.

Meanwhile, the U.S. labor market rebounded quickly after the shock close in the spring of 2020 with the largest number of job losses in history. As of February, however, the U.S. was still 2.1 million fewer jobs than at the same time a year earlier.

This suggests that the Federal Reserve has yet to fully complete both the job market and inflation targets.

What will the Fed do next?

At a news conference, Fed Chairman Jerome Powell said the bank was "acutely aware" that it must address inflation decisively and quickly.

The Federal Reserve is expected to raise interest rates six more times this year. However, raising interest rates too quickly risks pushing the U.S. into recession. CNBC's Federal Reserve survey based on tracking the opinions of fund managers, strategists and economists put the probability of a recession in the U.S. at 33 percent over the next 12 months, up 10 percent from the Feb. 1 survey. The latest survey also showed that the probability of a recession in Europe is 50%.

With inflation nearly four times higher than the Fed's target rate of 2 percent, Powell said the central bank would raise rates with the goal of curbing price increases. But some economists cast doubt on the extent of the Fed's influence on such a complex issue.

JW Mason, an associate professor of economics at John Jay College, said a quarter-rate hike is unlikely to have much impact on inflation or the broader economy. He expects inflation to ease without Fed intervention next year. The associate pointed out that car prices, which are currently the biggest source of inflation, have been trending down recently and said that small rate hikes are unlikely to have a major impact overall, instead "a large enough rate hike would have a significant negative impact on real economic activity."

In his view, the government is better able to address price problems in the broader economy, such as house prices or rising gas and electricity and electricity bills. In addition, the government may consider using policies such as price limits to control the situation.