Advertisement

The role of gold.

For thousands of years, gold has served as a store of value. As a result, investors have used gold extensively as a hedging tool against the effects of recession and inflation. In the run-up to recent events such as the Covid19 pandemic or the Russo-Ukrainian war, investors have been looking for alternatives to gold or various precious metals as a hedging option. As we approach the era of technology 4.0, alternatives to gold must be equipped to deal with future risks. Bitcoin is the first choice in asset storage.

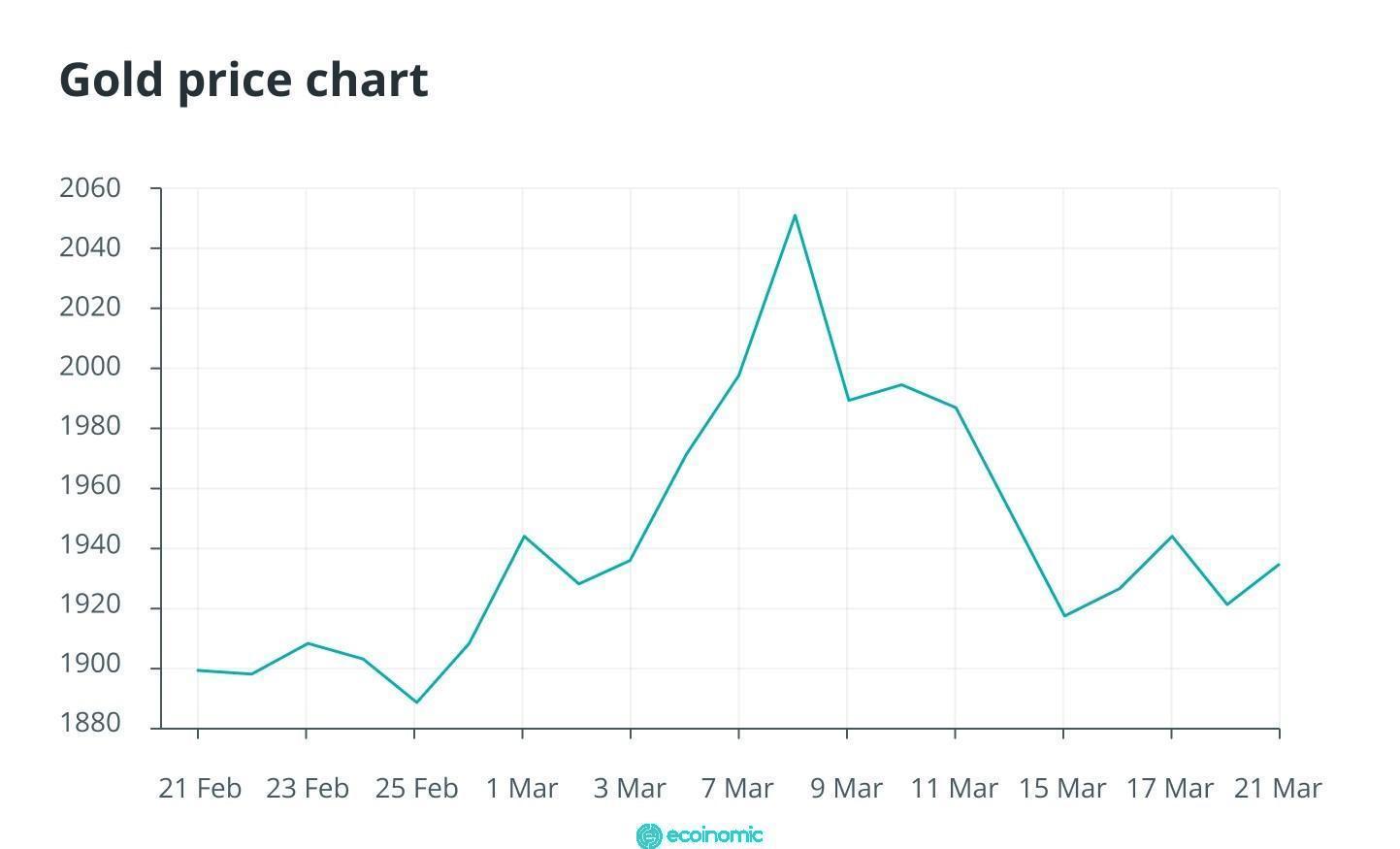

A spike in gold prices is often a sign of instability in traditional stock markets. The price of gold has reached more than $2,000 as investors weigh the political and economic divide of the Russia-Ukraine conflict.

The process of affirming bitcoin's position

During this time, Bitcoin and other cryptocurrencies increased their funding capital. Research firm Fundstrat said Venture Capital buyers invested about $4 billion in the cryptocurrency market in the last three weeks of February 2022. In the first week of March 2022, $400 million was poured into startups. This increase in capital suggests that global investors are seeking to be more exposed to a space they believe can withstand the consequences of the Russia-Ukraine conflict.

The conflict has left the peoples of both countries with economic consequences. A lot of businesses in Ukraine have to close, which is damaging to the local economy. Besides, Russia has been subject to economic sanctions from countries around the world. Trading restrictions on bank accounts, loss of access to most forms of electronic payments, and their rubles depreciated. Due to the decentralized nature of Bitcoin there is still no international law that uniformly regulates cryptocurrencies, this means that BTC maintains value regardless of the position of the owners. Many countries have declared Bitcoin legal.

The crisis that led to migration shows the potential impact that Bitcoin could have in the future. When crossing the border, an individual will not have to declare their Bitcoin number but if carrying gold, the possibility of confiscation or theft is possible.

Bitcoin gradually shines and attracts traditional investors, the advantage over other cryptocurrencies is the mainstream perception. Bitcoin has been around long enough to get people's support and recognition, even if it's gradually trending.

Bitcoin is shining in the face of a crisis.

conflict The global Covid pandemic has proven to many that Bitcoin is slowly shining to withstand the consequences of the Russia-Ukraine conflict. The pandemic has led to the decline of many economic sectors worldwide. Coinbase reportedly collected about $1.4 billion in Fiat coins and cryptocurrencies into wallets on their exchanges within 24 hours during the subsequent peak of the pandemic in March 2020.

In the first half of March 2020, investors quickly noticed that Bitcoin was trying to maintain its value while the traditional stock values around it fell. This increased the amount of capital pouring into cryptocurrencies, eventually leading to an all-time high of around $60,000 in March 2021. The stability shown during the crisis has increased bitcoin's appeal as a hedging option for those who are skeptical about gold's future and viability.

Despite the recent boom, the cryptocurrency market remains under the shadow of traditional market investments in terms of valuation. Through its exposure primarily to bitcoin's potential, it shows that this gap is narrowing at a much faster rate than originally anticipated. Investors are always looking for the most up-to-date and viable options for their portfolios.

Given the advantages that Bitcoin holds over gold, many investors are looking to diversify their portfolios, and Bitcoin seems to be the best option. This increased flow of capital into the cryptocurrency space only allows it to continue for long periods of time until the floodgates finally open allowing Bitcoin to replace it as a new gold.