Advertisement

Binance Coin [BNB] has not been immune to the prevailing selling pressure that has overwhelmed the cryptocurrency market. In fact, according to data from Coinglass, $1,057,144 has been liquidated from the BNB market in the past 24 hours. This, based on the daily wave of liquidations taking place in the cryptocurrency market as a whole, has become even more pronounced since August 19. At the time of writing, BNB is trading at $290.74, up a meager 1% over the past 21 days.

BNB investors need to be prepared for market impacts

Looking at the daily charts, perhaps the 5th largest cryptocurrency will remain gloomy over the next few weeks. According to data from TradingView, the intersection of the MACD line with the trendline in a downward curve on August 14 indicates the beginning of a new bearish cycle.

Investors inject liquidity into an asset by accumulating sustainable assets that can help boost its price. Since the beginning of the month, price movements on daily charts indicating low liquidity have been thrown into the BNB market. Over the past 21 days, the main indicators to consider to analyze buying/selling behavior have declined continuously, indicating that buying pressure is weakening.

At the time of this writing, BNB’s Relative Strength Index (RSI) stands at 46. Its Cash Flow Index (MFI), which is close to oversold terrain, was spotted at 37. Its Chaikin Cash Flow (CMF) has been in a downtrend since that month began, posting a value of -0.14. The positions marked by these key indices indicate that the overall decline in the market has impacted BNB as more and more investors join the coin distribution to reap profits.

Is there any trouble ahead?

After a long 6-month period of inactivity, BNB took some action in July, with the bull run forcing its price to double digits. However, after that, BNB returned to inactive status even when the market showed many signs of improvement.

While an increased slope signals token accumulation across the network, a prolonged slope is a sign of inactivity and, as a consequence, stagnant prices. Price stagnation has become a bad image of BNB.

Even with minimal price action this month, a large number of BNB holders are still profitable.

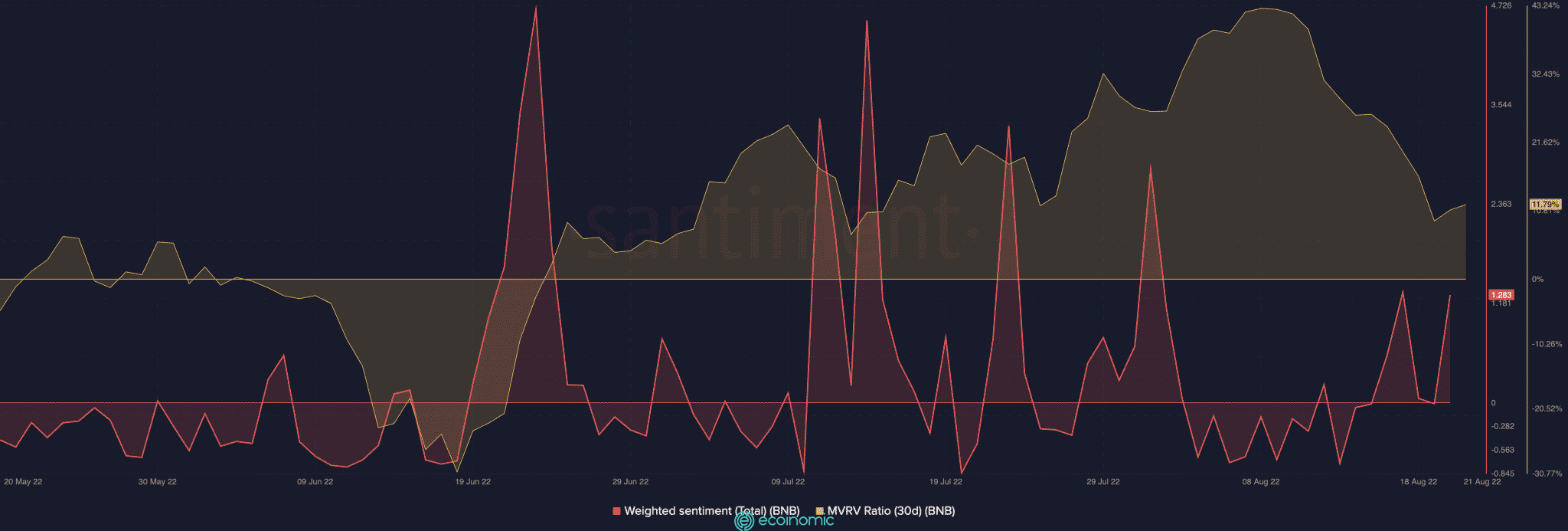

In fact, the 30-day MVRV is +11.79%. Weighty sentiment for BNB also remains positive, despite the overall market looking gloomy.