Advertisement

The tech company's CEO began buying Bitcoin in August 2020 for just under $12,000. Subsequent purchases in subsequent transactions brought the company's holdings to 129,918 Bitcoins, which are now worth less than $3 billion, compared to an initial investment of nearly $4 billion. Much of MSTR's money comes from the sale of speculative bonds and convertible bonds.

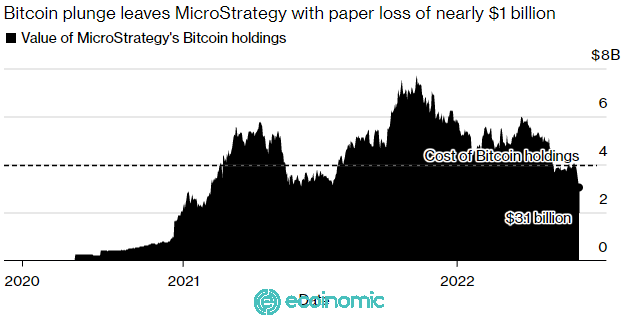

Over the past two years, the software Maker has earned $3.97 billion by amassing nearly 130,000 Bitcoins. The company's average purchase price for those tokens has been steadily increasing with each additional purchase since 2020 and at $30,700 on March 31, according to its latest quarterly report to the U.S. Securities and Exchange Commission.

With Bitcoin down 17 percent to $22,603 on Monday after cryptocurrency lender Celsius Network Ltd. halted withdrawals, swaps and money transfers on its platform, microstrategy's shares are now worth just over $3 billion. That brings the company's Bitcoin-related losses to nearly $1 billion.

MicroStrategy shares fell 25% to $152.15 on Monday and it led the sell-off for crypto-related stocks. The company's stock has become highly correlated with Bitcoin since Saylor began adding the digital currency to its balance sheet in August 2020 as a measure against Inflation instead of keeping cash in the company's funds.

Tysons Corner, the Virginia-based company, was valued at $1.2 billion on August 10, 2020, the day before it announced its entry into the cryptocurrency sector. Saylor doesn't seem to be worried about the latest bitcoin slump, as tweeting via Twitter seems to show his confidence in the strategy.

In #Bitcoin We Trust.

— Michael Saylor⚡️ (@saylor) June 13, 2022

Last month, Saylor denied being hit by margin calls, and he suggested that the problem would occur only if bitcoin reached $3,562.

Among the issues weighing on the company is the threat that a further drop in bitcoin's price will prompt the company to add additional collateral to the $205 million loan it borrowed in March.

>> See also: Nearly $100 million exited U.S. cryptocurrency funds in anticipation of tightening monetary policy.

—

Telegram: https://t.me/+XqnDmxy-bz0wMTE1

Group: https://www.facebook.com/groups/655607162536305

Fanpage: https://www.facebook.com/WikiBinancecom

Twitter: https://twitter.com/wikibinancevn