Layer 1 blockchain Shardeum closed its $18.2 million seed funding round at a $199 million valuation. The Block first reported that the startup was seeking to raise $18 million at a $200 million valuation in August.

Over 50 investors participated in the seed round, including Spartan Group, Big Brain Holdings, Jane Street and Foresight Ventures, according to a company announcement.

Co-founded by Indian exchange WazirX’s founder Nischal Shetty and blockchain architect Omar Syed, Shardeum is a Proof-Of-Stake blockchain platform that uses dynamic state Sharding technology in pursuit of efficiency gains.

What is sharding?

Sharding helps split blockchain infrastructure into smaller pieces to try to scale the network. It helps increase block space for more transactions and reduces gas fees.

Shardeum’s architecture aims to resolve user experience issues faced by both users and developers of exisiting sharded blockchains, according to the announcement.

“The blockchain trilemma has been a difficult problem to solve, and scalability is the most significant factor that is preventing wider crypto adoption especially in emerging markets like India,” said Shetty in a statement. “The web3 ecosystem has been on a massive growth spree. For web3 to onboard 1 billion users in the next few years, we need a scalable L1 blockchain which ensures 1 cent fees forever while maintaining decentralization. Shardeum aims to make that happen.”

The Layer 1 wars continue

Shardeum is just one of several new Layer 1 blockchains that have raised funds as of late. Others include Aptos, Sui and Sei Labs.

The new funds will be used to ramp up Shardeum’s marketing efforts and grow the development team. The team will be hosting hackathons in India and the U.S. to incentivize developers to build on the ecosystem.

The recent fundraise took place via a private token sale. Shardeum is expected to launch in the first quarter of next year and will later stage a public token sale.

“I invested in Shardeum as I think they are trying an interesting approach to scaling, which increases TPS as more validation Nodes are added,” said Balaji Srinivasan, former chief technology officer of Coinbase, in a statement.

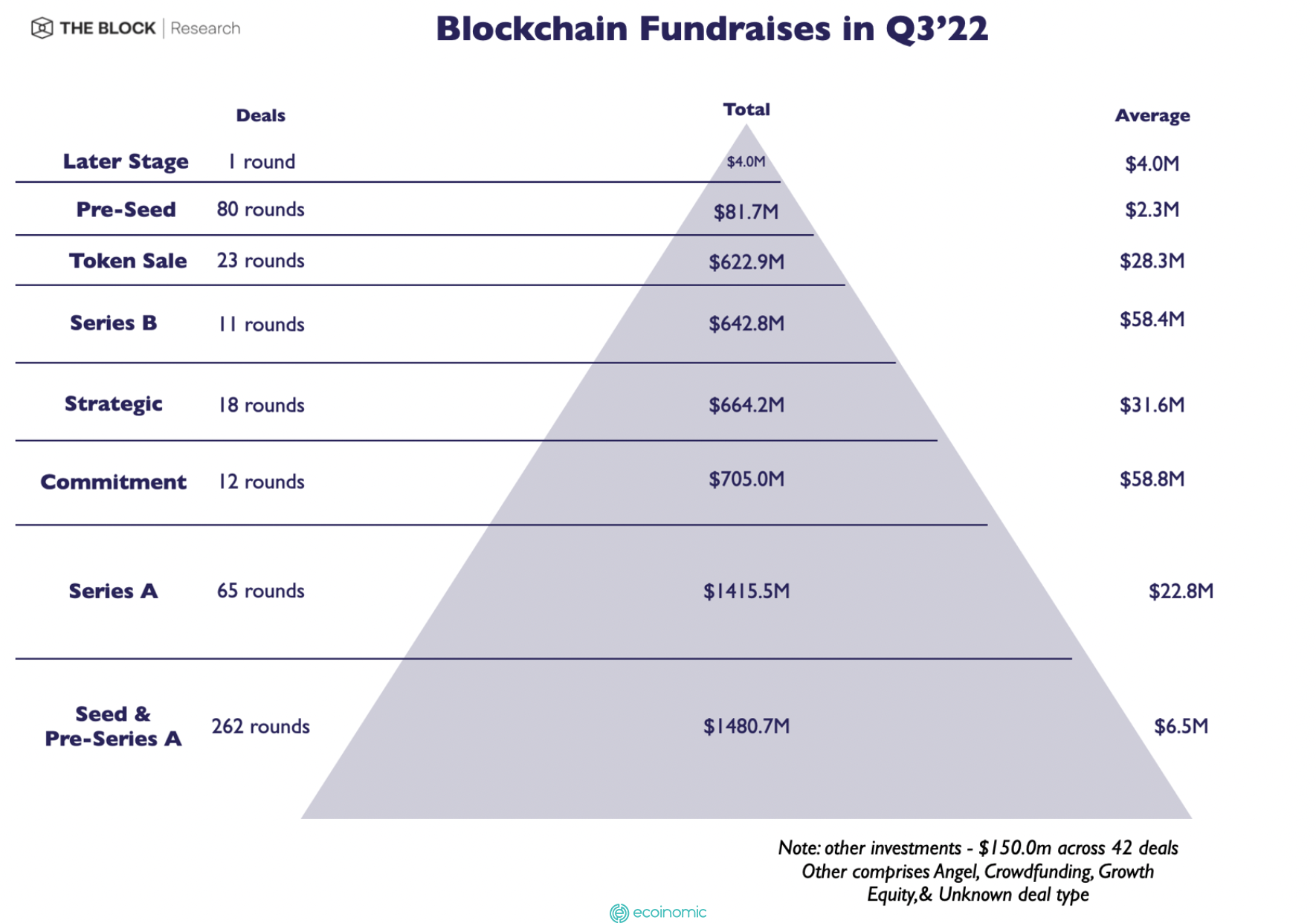

The $18 million raise is well above the average check size for a seed round in the third quarter of the year, according to data from The Block Research. It’s closer to the average Series A check size, which comes in at $22.8 million.

Third quarter blockchain venture deal size from The Block Research