Advertisement

Most cryptocurrencies had negative trading as early as October 11, when the global cryptocurrency Market Capitalization fell 3.26% the previous day to $916.30 billion. However, over the past 24 hours, the overall cryptocurrency market volume has increased by 63.81% to $54.09 billion.

The total volume in DeFi is $3.64 billion, which is 6.73% of the total 24-hour volume in the cryptocurrency market. The total volume of all stablecoins is $51.01 billion, which is 94.31% of the total 24-hour volume of the cryptocurrency market.

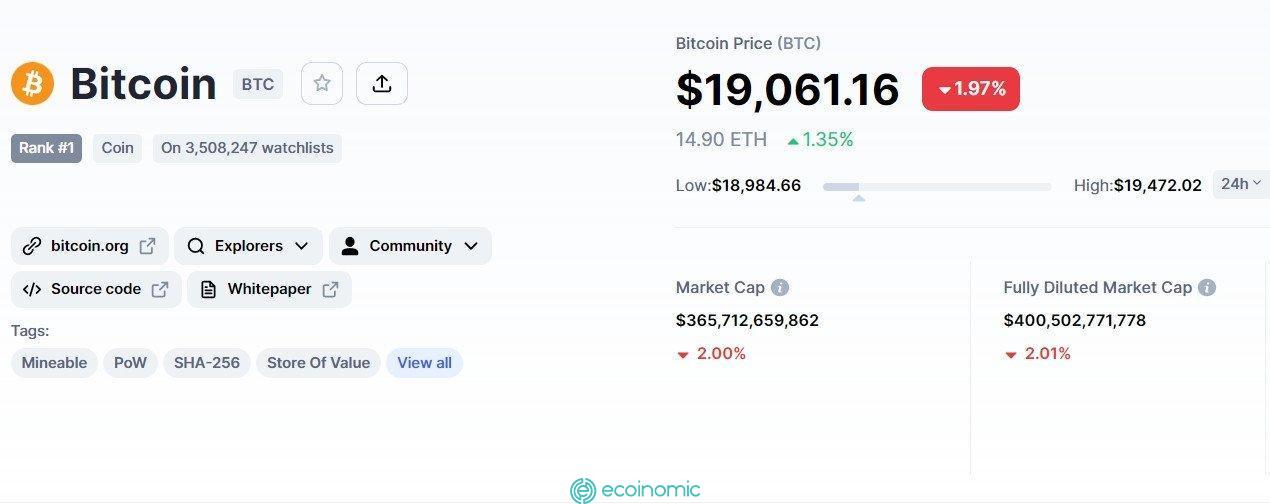

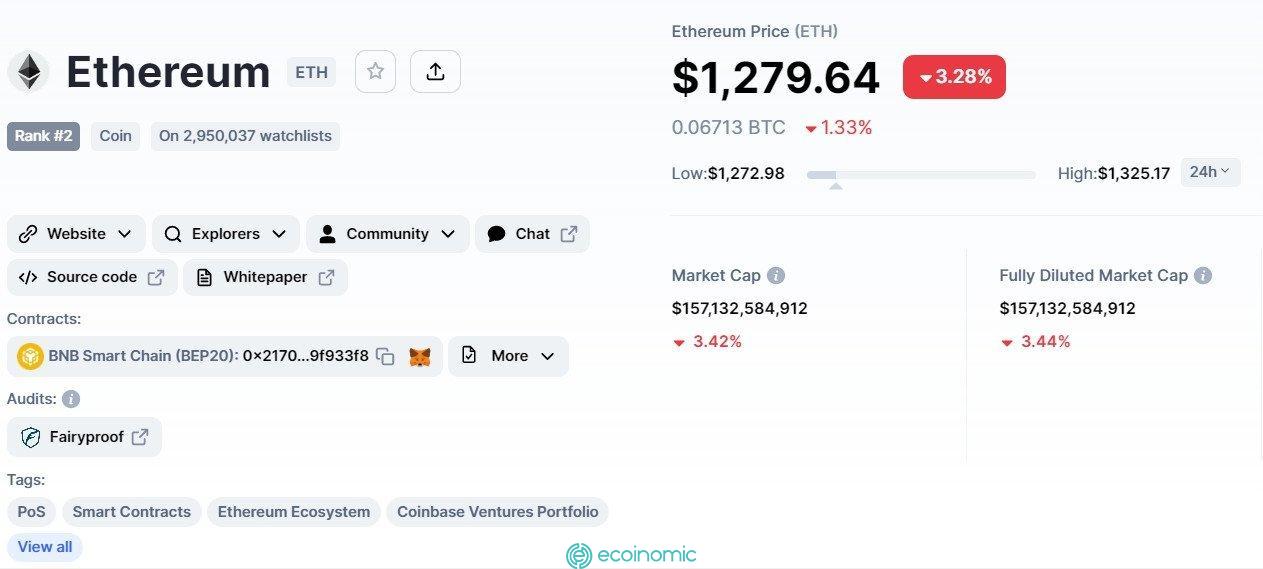

During the Asian session, Bitcoin is trading on a slight downtrend, down 2.05% in 24 hours to trade at $19,061.16. While the second leading cryptocurrency, Ethereum, is down 3.28% to trade at $1,279.64.

Fear and greed index signals “extreme risk”

Investors in the volatile cryptocurrency industry often express extreme emotions. When the market rises, avarice can cause people to act in ways they later regret (for fear of missing out). In addition, the fact that indices show up in red often causes investors to sell their assets for absurd reasons.

The Fear and Greed Index can help investors avoid irrational decisions based on emotions.

On Tuesday, the cryptocurrency market remained in a “risky” state, with the fear and greed index noting “extreme fear”. Typically, investors avoid risky assets and continue to invest in safe-haven assets such as the U.S. dollar, gold, and government bonds.

Extreme fear indicates that investors are overly concerned. It might be a good time to buy.

Bitcoin Price

The current Bitcoin price is $19,071.56 and the 24-hour trading volume is $2.9 billion. Over the past 24 hours, Bitcoin has fallen by 2.01%, with a real Market Cap of $365 billion.

Paul Tudor’s Comments Reinforce Bitcoin Price

Paul Tudor Jones, a well-known investor, and hedge fund manager spoke about Bitcoin and the state of the U.S. economy. Jones founded Tudor Investment Corporation. His current net worth is estimated to be $7.5 billion.

Paul Tudor Jones Tells CNBC ‘Spectacular’ Times for Macro https://t.co/LNKt8tNL6a

— Bloomberg Markets (@markets) October 10, 2022

When asked a question regarding bitcoin’s potential use as a hedge against inflation, Jones said:

I always have a small allocation for it [Bitcoin]… In a time when there is too much money, compared to spending a lot of money, then something like cryptocurrencies, namely Bitcoin and Ethereum will be valuable at some point.

When asked if the cryptocurrency he referenced was “at a much higher price than our current price,” the millionaire said, “Oh, I think so.”

Jones detailed his assessment of the U.S. economy. When asked if the economy was in recession, he replied:

I don’t know if it started now or if it started two months ago. We’re always looking and we’re always surprised at when the recession officially starts, but I suppose we’re going into a recession.

Therefore, Paul Tudor Jones’ comments are benefiting Bitcoin and can help support its price.

Bitcoin Price Prediction & Technical Outlook

Reiterating my Bitcoin price prediction, the BTC/USD pair trades exactly following that trend and is falling to the immediate support of $18,970. The triple bottom pattern is likely to extend support here and BTC could recover if it can sustain above this level.

BTC is still bearish, with the 50-day moving average (MA) providing significant resistance at $19,850. On the downside, a break below the $18,970 support level could push BTC to $18416.59 or $17,709.

Ethereum Price

The current price of Ethereum is $1,280.18, with a 24-hour trading volume of $9.6 billion. Over the past 24 hours, Ethereum has fallen by 3.44%, with a real market cap of $157 billion.

Ethereum supply deflation

Ethereum is facing a conundrum of dealing with unprecedented inflation. Since Saturday, the supply of Ether has dropped by nearly 4,000 tokens, but the price has not reacted similarly.

So far, the price of ETH has dropped 3.6% in the same time period, to $1,307 even though the amount of ETH is declining.

For the first time since the Ethereum network made a historic transition to PoW in September, the network has entered a deflationary phase with more ETH destroyed than ETH was created.

XEN is over 40% of all Ethereum Transactions. pic.twitter.com/Y5HO5MLN9U

— XEN Crypto Official (@XEN_Crypto) October 8, 2022

A new token project, XEN crypto was blamed for the unexpected increase in Ethereum traffic and the subsequent increase in gas fees that caused ETH to deflate. In the last 24 hours, XEN Crypto transactions have consumed 40% of all gas.

Normally, a decrease in supply would drive the coin’s uptrend, but for now, investors seem to be pricing in U.S. dollars, and expectations of a Fed rate hike cause ETH to fall in price.

Ethereum Price Prediction & Technical Outlook

According to previous Ethereum price predictions, the ETH/USD pair broke a trading range that varied from $1,300 to $1,400 on the downside, as did the symmetrical triangle pattern.

ETH has formed a bearish candlestick pattern on the 4-hour chart, potentially holding Ether under bearish pressure. Moreover, RSI and MACD have crossed below 50 and 0, indicating a bullish trend of eth selling.

The bearish breakout of the triangle pattern is expected to push ETH towards the $1262 support level immediately and possibly fall even deeper, the next support level of ETH is $1219.

Altcoin News

Tamadoge, a meme coin that stands out among the super-speed NFTs available on OpenSea, has risen to become the third most valuable meme coin in the cryptocurrency market and can be traded on many exchanges such as OKX, MEXC, BKEX, BitMart, and LBank.

On the other hand, the IMPT token, the project’s native token performed admirably in its presale raising $3.1 million as of October 3. This sale remains open until November 25 or until it sells out.

See also: SHIB investors should pay attention to these signs ahead of Shiba Inu’s next big move