Advertisement

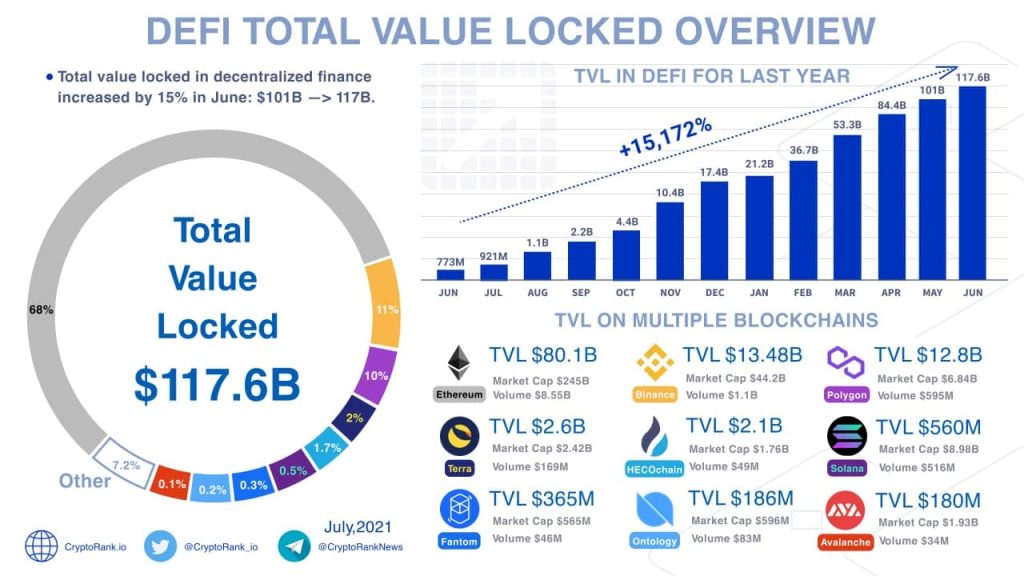

Recently, the decentralized financial market DeFi has been an issue of great concern to the crypto community. The reason is that it is directly related to the blockchain ecosystem and has many differences from the traditional financial market. When you dig deeper into DeFi, most investors will come across a related term, namely Total Value Locked (TVL)

Total value Locked (TVL) which is the locked asset in DeFi’s Smart Contract. The TVL index corresponds to the number of assets currently retained in a given protocol.

In other words, TVL is a parameter that represents the amount of assets in a particular DeFi protocol (excluding debt balances). That’s the total amount of supply guaranteed for an application by the DeFi protocol.

What is TVL?

TVL is calculated by 3 components including Bitcoin (BTC), Ethereum (ETH) and USD (US Dollar).

TVL helps investors know the level of interest and interaction of other investors in DeFi. From this data, investors can assess whether the project has liquidity and potential to be able to make the right decision.

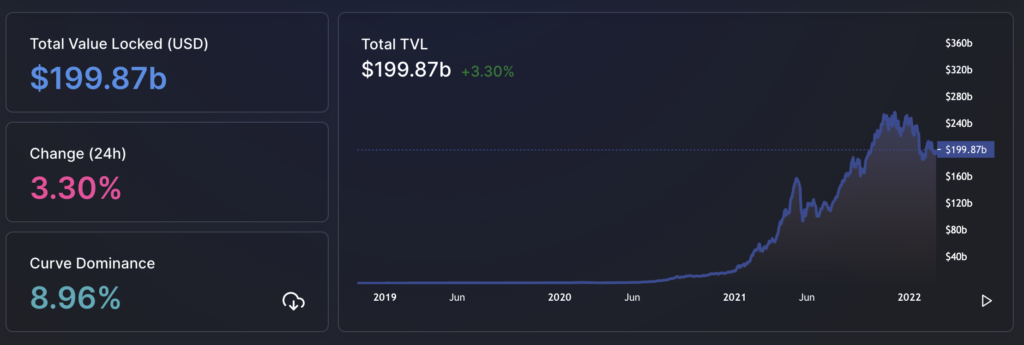

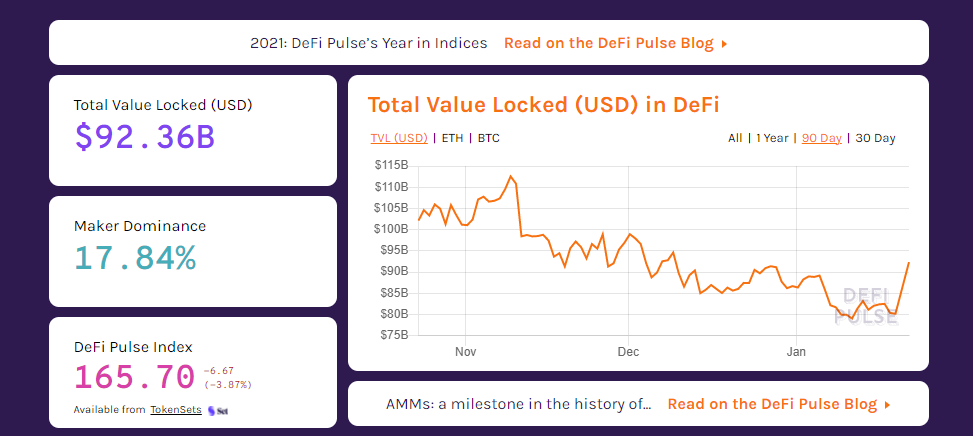

At the moment, the technology is evolving so there are many websites that support computing and re-display as dashboards. This includes the defipulse.com website. This site updates fairly quickly and also ranks TVL.

TVL results on defipulse.com website

The Meaning of Total Value Locked (TVL)

The TVL indicator is used in the DeFi space as a method of evaluation when comparing dApps. Through the total value of the locked tokens, the higher the value of the TVL, the more efficient that DApps are.

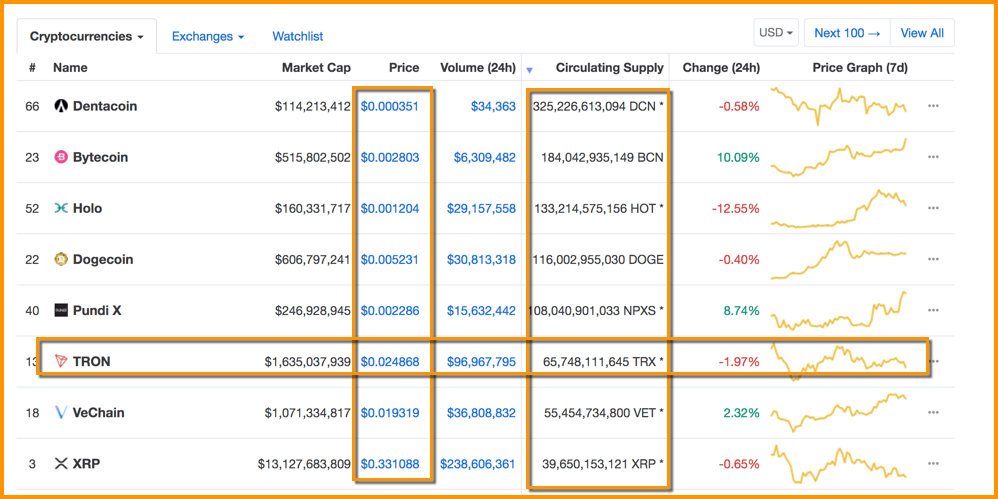

TVL data is used to measure the general condition of DeFi and Yield Farm. This metric appears on many service platforms. When considering the potential of a DeFi project, investors often calculate the Market Capitalization of the services of decentralized finance relative to its VTL. The market capitalization ratio consists of 3 main parameters

- Circulating token supply

- Token’s maximum supply

- Current price

Market cap and TVL

The current market capitalization is the accumulation of circulating supply at current value. The result is understood to be a completely diluted market capitalization.

Formula:Total Market Cap = Circulating Supply x Current PriceTotal Market Cap: Total Circulating Supply Market Capitalization: Total Token CurrentPrice: Current Value Locked Value Value (TVL) is the total amount of locked tokens and the market value of that token.

Formula:Total Value Lockes (TVL) = Total Token Locked x Current PriceTotal Token Locked: Total Current Price Locked Token: The market value ofDeFi’s Market Capitalization Token and TVL denoted value is TVL Ratio, calculated as follows:TVL Ratio = Total Market Cap/TVLTheoretically, The higher the TVL Ratio, the lower the asset value.

However, this indicator doesn’t always show up correctly. Instead, investors often use TVL Ratios to determine if DeFi content is undervalued. If the TVL Ratio is less than 1, it means that the DeFi is undervalued in any case.

In addition, TVL has its own mechanism depending on each protocol and each dApps application. Investors often compare similar applications by analyzing based on different reviews.

Distinguish between TVL on Validator of Proof of Stake and TVL on dApps

As mentioned above, the TVL index is the sum of the token’s locked values in the DeFi protocol. However, it is also applied in blockchain networks with the Proof of Stake consensus algorithm.

Proof of Stake’s blockchain can be simply understood as follows:

- Validators or Node Operators (Nodes) maintain the operation of the network through transaction authentication.

- Each Validator must stake a minimum amount of native tokens of the Blockchain to launch the Note. Require a certain amount of native tokens to ensure security and avoid fraud when trading, since when there is a problem, the staked token locked in the Smart contract will be burned based on the rules of the system if fraud is detected.

- The number of tokens staked is the number of shares or votes that validators have throughout the system when participating in network administration (In the form of voting proposals). The rewards for participating in this activity will be returned in turn to validators based on the number of shares they commit to.

Therefore, the TVL value on the Proof of Stake blockchain reflects the level of security and security of the Blockchain network. Or is it the level of trust of the stake user and their token authorization for validators.

The relationship between Total Value Locked and Circulating Supply

In fact, many investors confuse TVL and circulating supply. To better understand, let’s go for an example analysis when conducting liquidity on Uniswap, UNI/ETH pair:

- The TVL index will include tokens of both UNI and ETH.

- The Circulating Supply Index only includes the number of UNI tokens in circulation (including the number of Stake user tokens in the pools)

A project that is issued only allows a certain amount of tokens to be circulated. This is how to balance supply and demand and maintain the value of tokens. This creates steady growth thanks to reducing the amount of tokens circulating in the market while helping investors make more profit by burning tokens or creating Pool Farms.

When analyzing a DeFi project, investors can easily estimate the actual supply that has circulated in the market by analyzing the amount of tokens carried away from the stake compared to the circulation estimate. This data is called on-chain, which is often chosen by analysts as the cumulative or sell-off trend of each project.

Example of the estimated circulation figure and current price of the Tron coin

Conclusion

Total Value Locked (TVL) reflects how reliable the user is with the project depending on each DeFi protocol. However, in fact in the cryptocurrency market, if we only look at the price of any currency, it will be difficult to accurately assess its value but to consider many different figures. And TVL is one of the reliable indicators for DeFi protocols. However, this is just an overview and TVL is not the only indicator that influences investor reviews and decisions.