Advertisement

What is market maker?

Market Maker (MM) is an individual or firm who is directly involved in the market as both sellers and buyers.

MM’s main role is to provide liquidity or create opportunities for those participate in the market to buy and sell large quantities of currencies, stocks, derivatives and other trading assets.

Market maker’s participation contributes to maintaining the flexibility and liquidity of an asset, increasing their ability to execute trades and attracting investor interest in that asset.

How do market makers make a profit?

To make it easier to understand, first refer to the related terms below:

- Bid: Purchase price

- Ask: Selling price

- Spread: Price difference between bid and ask

- Long-tails assets: A business strategy that allows companies to make significant profits by selling low quantity of hard-to-find items to multiple customers, rather than just selling large quantities of popular items.

All of us know how to make profit from price spread and so does market maker. They serve as partners in customer transactions and profit from difference between bid and ask at certain time.

They make transactions that are inverse to the client’s trades that means they buy when customers sell and sell when customers buy, but market makers also manage their risk by holding orders and trading directly with their clients.

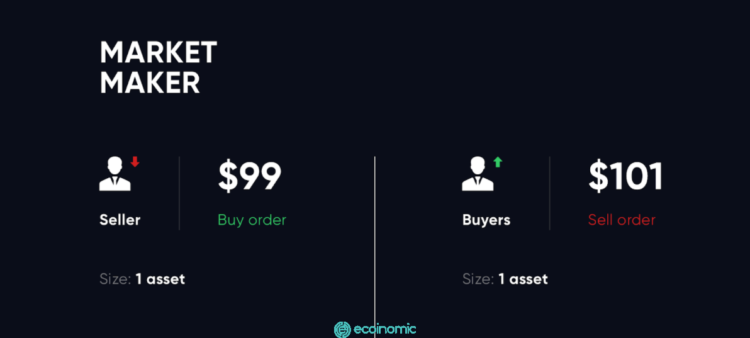

For example: An investor who buys a stock on an exchange, observes that the bid price is $99 but the ask price is $101. This means that the broker buys the stock for $100 and they sell $101 to potential buyers. You see a low spread, but the large number of transactions every day generate great profit.

Two main differences between Market Maker and automated market maker in crypto market

While market maker is directly involved in the market as both a seller and a buyer, automated market maker prices assets based on algorithms.

>> For more detailed information about AMM, refer to the following article: What is AMM?

AMM and MM both bring liquidity to the market, however they have certain differences.

See also: What is the hammer candlestick pattern?

Automated Market Maker (AMM) is a better liquidity solution for LTAs (Long-tails assets)

Basically, AMM and MM can be solutions that provide liquidity to the assets in the market but in reality, very few professional market makers accept the creation of markets for LTAs because of the following characteristics:

- The market price is fluctuating.

- Trading volume is often low and unsustainable

- The goal of MM is making profit. Creating markets for LTAs does not brings high potential returns but carries more risk than popular assets. Therefore, LT is not optimal option.

- With AMM, users don’t need a professional market maker to create a market for their tokens because they can create a market for any token on permissionless Automated Market Maker. At the moment AMM is a better liquidity solution for LTA in crypto market.

In fact very few professional market makers accept the creation of markets for LTAs.

Transaction fee

From a user perspective, the transaction fees of AMM will usually be higher than MM. Users will see more clearly the fee schedule of Binance and Uniswap platforms:

- Uniswap’s standard fee is 0.3% and Binance’s is 0.1%.

- FTX exchange has lower fees than Binance exchange at 0.02%-0.07%

This comes mainly from the risk of providing liquidity to these markets. Liquidity providers in AMM model are almost more at risk than those who are in MM.

If the fees are too low, the incentive for liquidity providers in AMM will also be low, resulting in market created by AMM not attracting potential liquidity providers.

Conclusion

Hopefully, the above article will help you understand about market maker and the difference between AMM and MM. If you have any questions, leave a comment below, Ecoinomic.io will always accompany you on your investment journey.