Advertisement

The biggest lending protocol AAVE successfully survived the April to June crash. Of late, the momentum of the market has changed. And, AAVE has been climbing up the worth charts.

In fact, the protocol and also the token are showing signs of a positive movement.

AAVE climbing up the ladder

Currently, the closest competitor to the DApp is Lido DAO, a Liquid Staking protocol that has over $6.43 billion locked in total value.

AAVE, on the opposite hand, has $6.06 billion in TVL, combining all the various versions of the protocol. However, the probabilities of the lending protocol usurping Lido DAO are pretty meek. this can be because the expansion witnessed by AAVE comes nowhere near Lido DAO.

While the previous noted an 8.82% growth over the last 30 days, the latter recovered by 33.5% within the same fundamental quantity.

In fact, of the highest five DeFi protocols, AAVE is that the only 1 to notice such an occasional growth ratio.

But AAVE, in itself, has been performing well as a lending protocol as compared to Compound and MakerDAO which even have a substantial command within the lending space.

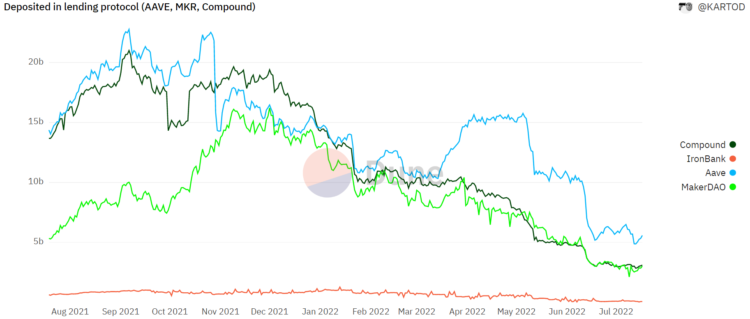

Furthermore, AAVE has the very best amount of deposits, standing at $5.5 billion, as compared to other protocols. Compound and MakerDAO stand somewhere at a touch over $3 billion each.

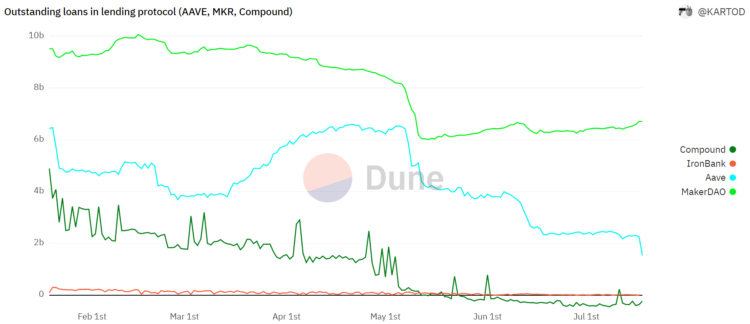

However, an element that creates the difference is that the number of outstanding loans. MakerDAO leads this front with $6.7 billion. AAVE, at one point in May, was on the verge of surpassing the previous.

However, after being hit by the market crash, its total borrowed amount declined and stood at just $1.5 billion at the time of writing.

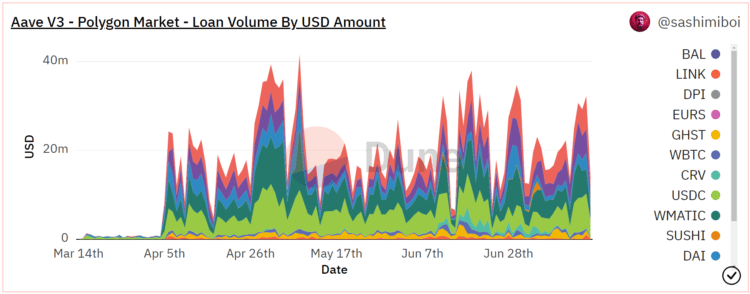

Regardless, AAVE V3’s performance has not declined by an excellent margin- gradually recovering from the downfall and conducting over $24 million in transactions on a median within the Polygon market.

The same within the Optimism market amounts to a bit over $500k on the average, with USDC being the foremost used token in both the markets.

See also: What Are The Differences Between Investment And Speculation?

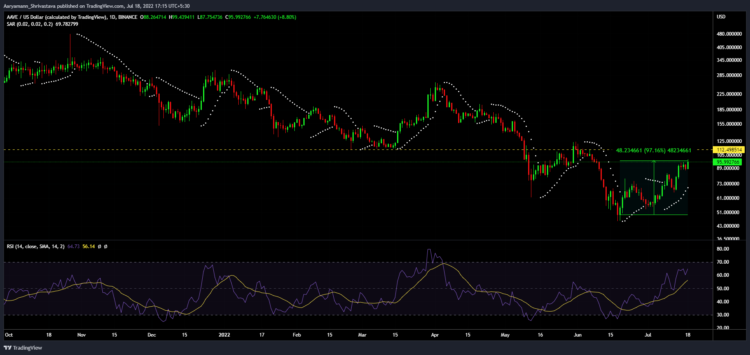

This has, in a way, supported the recovery of AAVE, which within the span of a month, rose by 97.16%. Moreover, this crypto has registered a growth of 39.41% over the last seven days.

People are also interested: How to sign up for FTX is the simplest for beginners