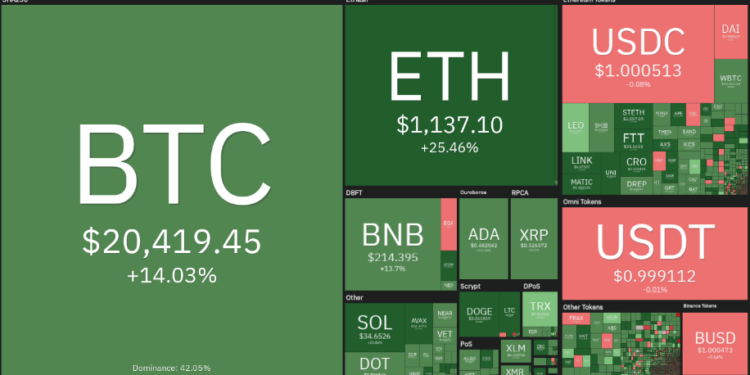

On June 18, Bitcoin (BTC) plummeted to $17,622. This is the first time in history that the price of Bitcoin has fallen below the highest level of the previous cycle. The U.S. Federal Reserve has used aggressive monetary tightening, and there have been crises at cryptocurrencies lending platform C and investment fund Three Arrows Capital that have caused traders to panic and insecurity.

Holger Zschaepitz, a market commentator, said that Bitcoin has had four declines of more than 80% in history, so compared to historical standards, the current price drop of 74% is not a concern. Previously, the “bear” markets had immediately bottomed out at an average of about 200 times. For a long time, Bitcoin may find it hard to stay at its current level of calm if history happens again.

Can Bitcoin’s history of decline be stopped in the short term? The following 5 cryptocurrencies have charts that perform better than other currencies.

Top 5 most notable cryptocurrencies

BTC / USDT

On June 18, Bitcoin had a sharp drop that caused the price of the cryptocurrency to fall below the support level of $ 20,111 and still tend to continue to fall sharply. However, there is still a small positive as seen from the long tail section on the bar should end the session, which suggests that bulls have bought the drop.

The price is being pushed back to the analyst level of $20,111. If you do this, the price drop to $17,622 could be a trap. After that, BTC/USDT can return to the price around $23,362 and create strong resistance again.

Over the past few days, the Relative Strength Index (RSI) has been trading in oversold territory, which is believed to be a sign of a short-term rally.

However, if the price falls from $20,111 then this positive view will be refuted. This shows that the bears have turned to resistance and the possibility of a deep drop to the $17,622 mark and a drop of $16,000.

The RSI is having a positive divergence indicating that the lean side is losing its grip. The chart has shown that the price is recovering gradually to the exponential 20 average.

A break and a close on it could occur pushing the pair up the resistance zone between the simple 50 and $23,362 moving averages.

However, if on the 20 EMA line the price cannot be maintained then this indicates that the “bears” are operating at a higher level. The pair will be pulled up to $17,622 by subsequent sellers.

SOL / USDT

Solana (SOL) is trending down sharply contrary to the favorable divergence on the RSI has shown that this downward momentum is showing signs of weakness.

Ema 20 is the target that the bulls bend up on this road. Pe cows will come back if that’s done. The SOL/USDT pair can rise to SMA 50, which will be where the Bears can defend strongly again.

Bulls will easily ignore their advantage if the price falls below the EMA 20. The seller must try to reduce the price to below $25 and the next phase of the downtrend will begin.

On the 4-hour chart it can be seen that the bulls’ teeth have pushed the price above average and there is an attempt to clear the barrier at the top of the downtrend line. If this is done successfully by them, it will prove that the downtrend may end in the short term. Next, the buyer will move to push the price up to $42.5-$45.

The price that falls from the current level or against the downtrend line or below the moving average, this has shown that the bulls will continue to defend the resistance zone in a positive way. Prices can be pulled in from $27.50 to $25.

LTC / USDT

On June 18, the bears were frolicking Litecoin (LTC) below the support at $40 but the bulls are defending this level very strongly, which is demonstrated in the tail section stretched on the candlestick.

Daily ChartThe relief rally reached the EMA 20 line, which is an important milestone to watch for because of the break and closure on it. It is possible to suggest that there will be a potential change in the trend and the LTC/USDT pair may then rise to SMA 50.

Contrary to this hypothesis, if the price falls from the EMA 20, this is a sign that the trend is still negative and that traders are selling on the rebound. The bears will then make another attempt to push the pair below $40 and continue the downtrend.

chartOn the 4-hour price chart, the price has exited the symmetrical triangle pattern. Often this setting acts as a continuous pattern, but reversation can still occur.

In the short term, if the price drops and returns to the triangle area again then this positive comment will be nullified. It can be seen that the move of having a break above the triangle is a bullish squabble.

LINK / USDT

Although Chainlink (LINK) is in a downtrend, it is still trying to make a bottom near $5.50. Although the bears are trying to push prices below this level on June 13, June 14 and June 18, they cannot remain at other lower levels. This shows that the cow side has bought at this decrease.

Daily chartOn the RSI, the divergence has shown that the downward momentum may weaken. The buyer is trying to push the price back to the downtrend line and this can be a strong resistance.

The bears will continue to fall and keep the LINK/USDT pair below the $5.50 support if the price falls below the downtrend line. There will be a fairly potential change if the buyer pushes the price beyond the downtrend line. The anyf pair will be able to raise $10-$20.

4-hour chartIf the pair reaches the SMA 50 line, it may act as a small resistance.The bears may be losing their grip as the 20 EMA is passing sideways and the RSI is near the midpoint.

The pair could rise to $7.51, if the buyer pushes the price up to SMA 50. Above this resistance, the break and close will complete the two-bottom pattern in the short term. This reversal setup has a sample target of $9.50.

To nullify this bullish view, the bears will have to try to pull and maintain the price below the strong support at $5.50.

BSV / USD

Bitcoin SV (BSV) has formed an expansion pattern and buyers are trying to push the price above the resistance of the set. The positive divergence of the SRI indicator is showing that this downward momentum is increasingly weakening.

The bears can prevent a recovery as the BSV/USD pair rises to the resistance line. This could happen if the bears continue to sell when the price increases. This could leave the pair stuck in the extended squad for a while longer.

If the bulls continue to push the price up the resistance line, it is very likely that the pair will face the risk of bottoming out. After that, the pair can start a new upward move to the price of $80-87.

The pair was trading in the range between $45 and $66 as shown by the 4-hour chart. In the face of the bears’ failed attempt to pull the pair below the range, the bulls moved to push the price above the resistance.

If successful, the pair is most likely to start a new move. The sample target of this setup is $87. There is another possibility that the price will fall below $66. If that happens, the pair may remain confined to this range for an extended period of time.

Related: Binance CEO CZ Says Bitcoin, Ethereum and Rest of Crypto Should Decouple From Stocks