What is Uniswap?

Uniswap is a Decentralized exchange with open source, anyone can copy the source to create a product with the same model. Initially, this exchange was built on the Ethereum blockchain in 2018, but now, the exchange is supporting many different blockchains.

Unlike centralized exchanges like Binance and Huobi, Uniswap is a protocol that is not owned by any particular individual but is governed by the community. There were times when Uniswap’s trading volume surpassed that of the Binance exchange to become the top exchange in the cryptocurrency market.

The most significant difference between Uniswap and centralized exchanges is that the Automated market makers model (AMM) compares to the traditional order-book model. This model partly solves the transaction needs of users on the blockchain while ensuring decentralization.

The Information of Uniswap

- Website: https://uniswap.org/

- Supported Chains: Ethereum, Polygon, Optimism, Arbitrum, Celo,…

- Supported Wallets: Metamask, Coinbase Wallet, WalletConnect,…

- Features: Swap, Provide Liquidity, NFT Marketplace

- Audit: Consensys Diligence

- Availabilities: Website

The salient features of Uniswap

- Users do not need to log in and reveal their identity: The exchange does not require users to meet KYC criteria.

- Fully Open-source: Anyone can copy the code to grow their decentralized transactions.

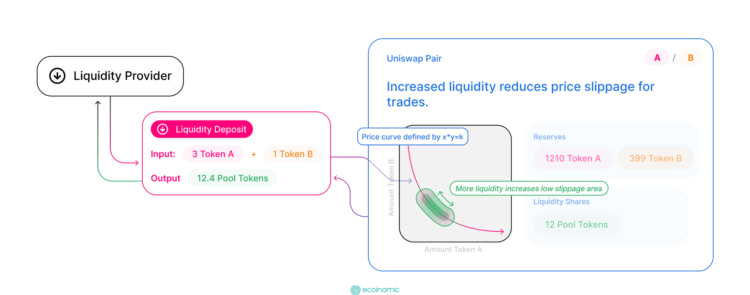

- Provide traders with the Price Impact: When there is a difference between the market price and the estimated price, the exchange will provide this information to ensure transparency and avoid slippage.

- Guarantee the minimum amount received by the trader: Due to the liquidity characteristics, the price is constantly changing according to the AMM model, so the exchange cannot be sure of the amount received by the trader, but the protocol only guarantees minimum quantity.

- No Token Listing Fees: Developers can bypass complicated verification processes when listing coins or tokens. This is of great value to blockchain startups that need to get their products to market and reach potential customers quickly.

- Simple crypto wallet linking process: Users must launch the app and connect to the wallet. In Uniswap, users have full control over their assets.

- Provide routing system: The exchange provides Route to ensure users always pay the lowest price for each transaction. Even in some cases, the transaction is made involving 4 tokens.

For example, a transaction has a Route of USDC>COMP>ETH>AAVE. This is what happens in the system for swap from USDC to AAVE, where users don’t have to interact with COMP and ETH in the middle of the route.

Unswap working mechanism

How does Uniswap work?

Uniswap is built on Ethereum’s Smart contract to help solve the needs of trading, buying, and selling assets between users on the blockchain.

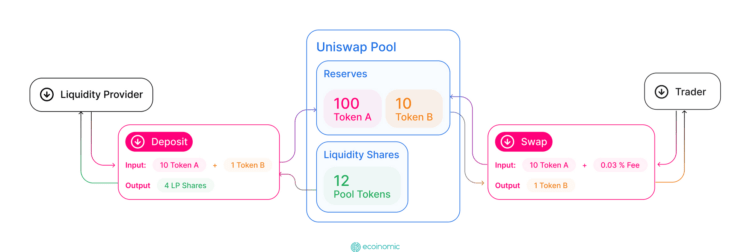

It stores two other tokens in a Liquidity Pool for users can easily transact without the intervention of a third party. These Liquidity Pools can be provided by anyone with a need to be called liquidity providers. In return, users will have to pay fees when generating transactions on Uniswap, part of which will be returned to liquidity providers based on the value that person provides to the pool.

More specifically, liquidity providers will create a Liquidity Pool by adding two types of assets to the same smart contract, to form a pool that helps to store assets. The user can withdraw the asset with the corresponding value at any time.

When users have a need to trade for one of the pool’s two assets, they will have to put an asset into the pool and receive the corresponding asset in the opposite direction.

For example, if users want to buy token B, they will have to transfer token A to the pool containing the A/B trading pair to receive token B and pay a fee of 0.3% of the transaction value.

For each transaction, the transaction fee the user will have to pay for the protocol is 0.3% of which:

- 0.05% is returned to the protocol

- 0.25% is used to pay liquidity providers

In May 2020, the Uniswap v2 version brought to the decentralized financial market an extremely efficient automated market-making protocol. In less than a year, Uniswap v2 has generated over $135Bn in trading volume.

Uniswap v3

Following the success of Uniswap v2, Uniswap Labs officially launched Uniswap v3 on May 5, 2021, on Ethereum and a series of other networks were also deployed shortly thereafter.

Featured update:

- Centralized liquidity allows liquidity providers (LPs) to control the price range they want to offer.

- Multiple fee tiers: Gives LPs appropriate compensation for different levels of risk.

These updates give Uniswap more flexibility and efficiency than most AMMs on the market.

- LPs can provide liquidity with 4000x more efficiency, and get more profit.

- The efficiency of trade execution is also improved when the degree of slippage is minimized.

- Increased exposure to preferred asset classes and reduced risk.

- LPs can sell assets to others at the desired price by adding liquidity at prices below or above market value.

- Uniswap’s Oracle has become easier and cheaper to integrate.

- The transaction fee paid to the network is also lower than the old version

How to use the products of Uniswap?

Swap

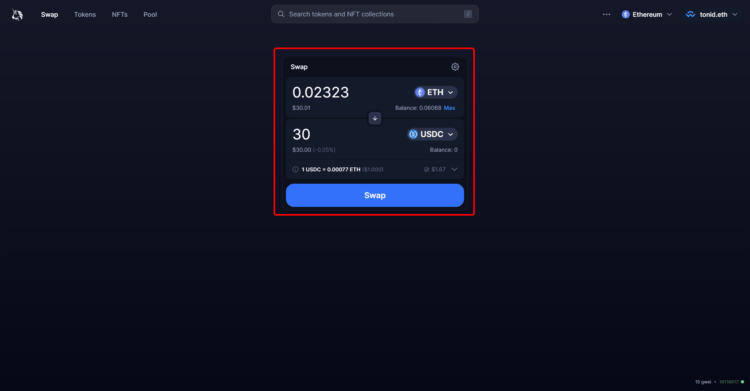

1. Access https://app.uniswap.org/#/swap and connect your wallet.

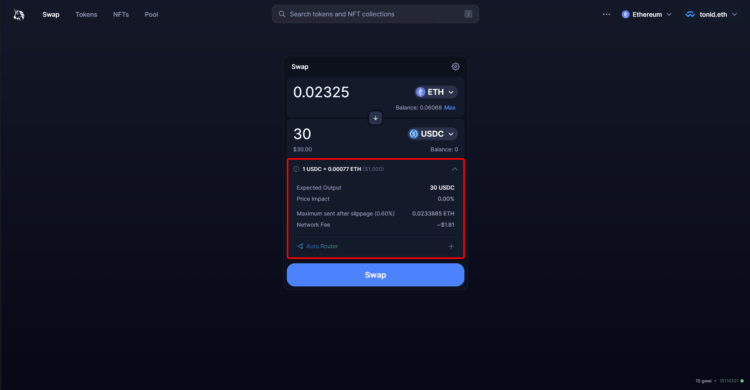

2. Select the two tokens you want to trade, then Approve the token (only once per token), then select Swap. Here, Ecoinomic is doing a transaction that converts 0.02323 ETH → 30 USDC.

Note:

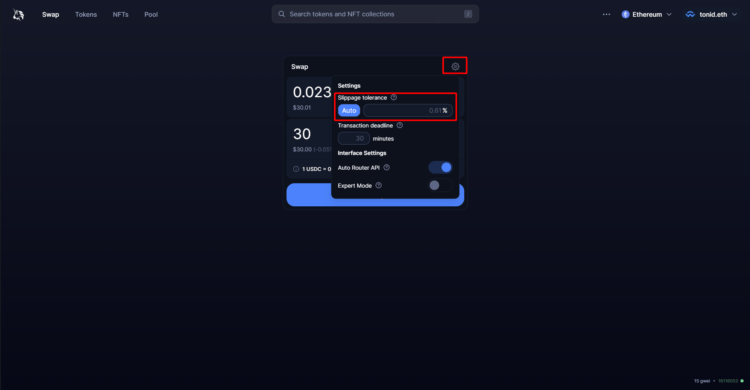

- You can customize the slippage for your order by selecting the setting icon.

- View details of transaction components such as Expected Output, Price Impact, Network Fee by selecting “extended cursor”

Provide Liquidity

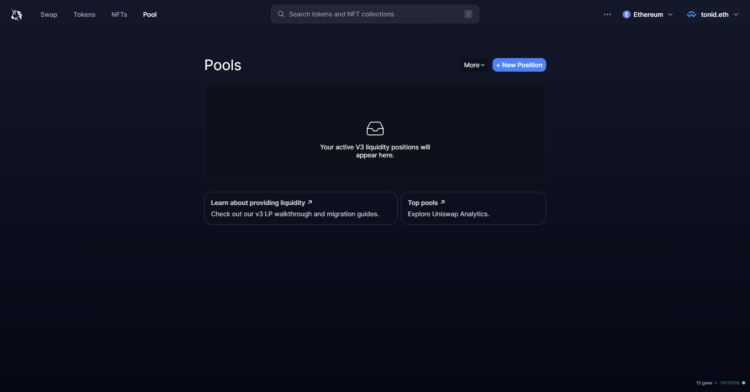

1. Access https://app.uniswap.org/#/pool or choose Pool on the homepage, then choose New Position to provide liquidity

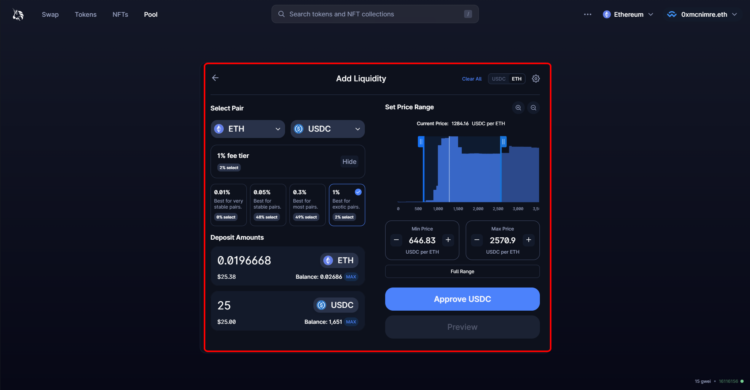

2. At the Add liquidity interface, select the 2 tokens you want to add liquidity to create a trading pair and customize the necessary parameters including:

- Fee tier: Transaction fee from 0.01% → 1% (This is the fee that users have to pay when transacting on Uniswap)

- Deposit Amounts: Amount of coins/tokens you want to provide

- Price Range: The price range you want to provide liquidity

3. Approve token and confirm is complete.

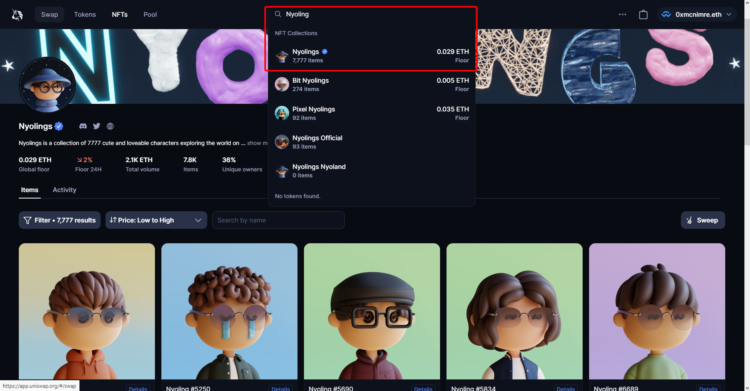

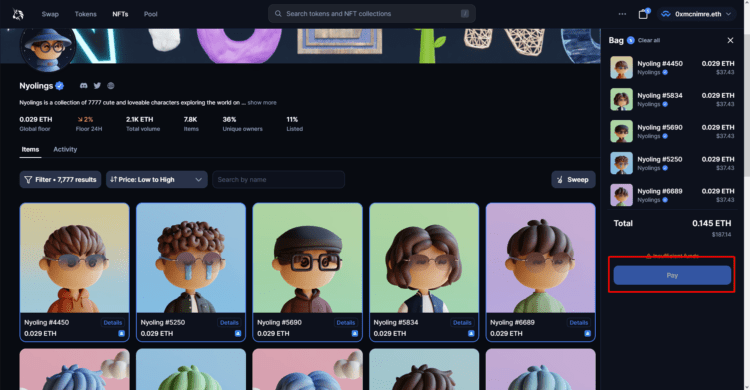

NFT Marketplace

This is a new feature added by Uniswap from Genie – NFT Marketplace Aggregator was acquired by Uniswap Labs to enter the potential NFT market.

1. Go to https://app.uniswap.org/#/nft) or select NFTs at the homepage, you will see an interface of collections prevalent.

2. Search for the collections you are interested in, the protocol will aggregate the NFTs that are being sold at the best prices at exchanges like Opensea, Looksrare, X2Y2.

3. Select 1 or more NFTs to add to the cart, then select Pay to proceed with the desired NFT purchase.

Frequently asked questions about using Uniswap

How does Uniswap earn money?

Basically, Uniswap makes money in two forms: transaction fees and UNI tokens

- For each transaction, the transaction fee the user will have to pay for the protocol is 0.3% of which:

– 0.05% is returned to the protocol

– 0.25% is used to pay liquidity providers

While it may sound insignificant, in 2021 alone, Uniswap has raked in over $1 billion in transaction fees.

Besides, the founders and company employees make money by holding UNI tokens. Uniswap employees hold 20% of the Total Supply of UNI tokens, which means that whenever the token rises in price, it brings huge profits to the development team.

How does Uniswap solve Impermanent Loss?

With the way Uniswap works, the proportion of cryptocurrencies in the protocol will change. In the event that the price of ETH rises, Arbitrage traders will add USDC or other stablecoins to withdraw ETH from the liquidity pool or simply withdraw ETH from the smart contract. This causes a temporary loss to Uniswap.

However, the exchange has measures to overcome the above situation:

- In Uniswap V2, liquidity is provided according to the x*y=k graph. By the development team’s calculations, most of this liquidity was never put to use. That’s why V2 LPs earn fees on only a fraction of their money. In addition, traders suffer from a high degree of slippage due to the spread of liquidity across all price ranges.

- Uniswap V3 released on Ethereum Mainnet on 05/05/2021 has resolved temporary loss issues. V3 allows LPs to customize the price range they want to provide liquidity. This means that pools need less liquidity to maintain certain price ranges, similar to Limit orders on traditional centralized exchanges. This forces LPs to optimize their price range to make more money instead of providing huge amounts of liquidity and creates an opportunity for arbitrageurs to take advantage of temporary losses.

Is Uniswap safe?

Uniswap is a secure exchange when built on Ethereum, its security is basically similar to Ethereum. Being a DEX in nature, Uniswap does not have the right to monitor user assets and does not have a central server to gain that right.

In terms of liquidity, funds deposited into a smart contract will be strictly audited and highly secure. Any funds can only be sent and deleted by the same crypto wallet.

Uniswap smart contracts have been thoroughly tested by the major accounting firm Consensys Diligence. Besides, Uniswap also built a bug bounty program, encouraging anyone to find a vulnerability and notify the development team instead of abusing it (similar to a white hat hacker), thereby receiving financial rewards. main.

Simply put, as long as users keep their personal wallets safe, the Uniswap exchange is still a safe platform to use.