Advertisement

CoinEx Futures and CoinEx Margin are the two trading products trusted by many investors

CoinEx is a professional cryptocurrency trading service provider. With its unique execution system and excellent user experience, this exchange always makes an attempt to build a safe, stable, and efficient trading system for users.

CoinEx Futures and CoinEx Margin are the two trading products trusted by many investors. In particular, CoinEx Futures is considered as the most prominent derivatives trading platform for newbie 2022.

What is CoinEx Margin Trading?

Basically, Margin trading on CoinEx is the same as other exchanges. It is a trading form that you can Borrow funds from a third party, usually the CoinEx exchange. This means that investors using CoinEx Margin can access higher capital and take advantage of their positions.

On all exchange, including CoinEx, when using Margin trading, you have the opportunity to enhance your trading results. This means that traders can make huge profits if their trades are successful. This number can even be many times larger thanks to the leverage mechanism.

CoinEx Margin trading allows you to use leverage to increase your long position. Therefore, CoinEx Margin attracts speculators, Arbitrage traders, and market makers.

What is CoinEx Futures Trading?

CoinEx Futures is a feature in CoinEx ecosystem, allowing investors to trade futures contracts. Investors receive profits thanks to the price movement of a futures contract representing a particular coin/token over a period of time.

Especially, investors do not necessarily own any coin but they can still make a profit. CoinEx Futures help us profit from anticipating the price movement of a trading contract at a future date. Currently CoinEx Futures is supporting 102 trading pairs.

Pros and Cons of CoinEx Margin and CoinEx Futures

Pros of CoinEx Margin and CoinEx Futures

- Good liquidity

- Help investors make big profits if they accurately predict market trend

- Diversify portfolio with only small capital

- There are flexible mechanisms to support investors in controlling risks

Cons of CoinEx Margin and CoinEx Futures

- The higher the leverage used, the greater the risk leading to the risk of asset liquidation.

- The cryptocurrency market is subject to manipulation from maket maker which is a potential risk if you decide to invest with large leverage.

>>> Related: What is Futures? What is margin? Compare Margin and Futures

Instructions for transferring funds to CoinEx Futures/CoinEx Margin wallet

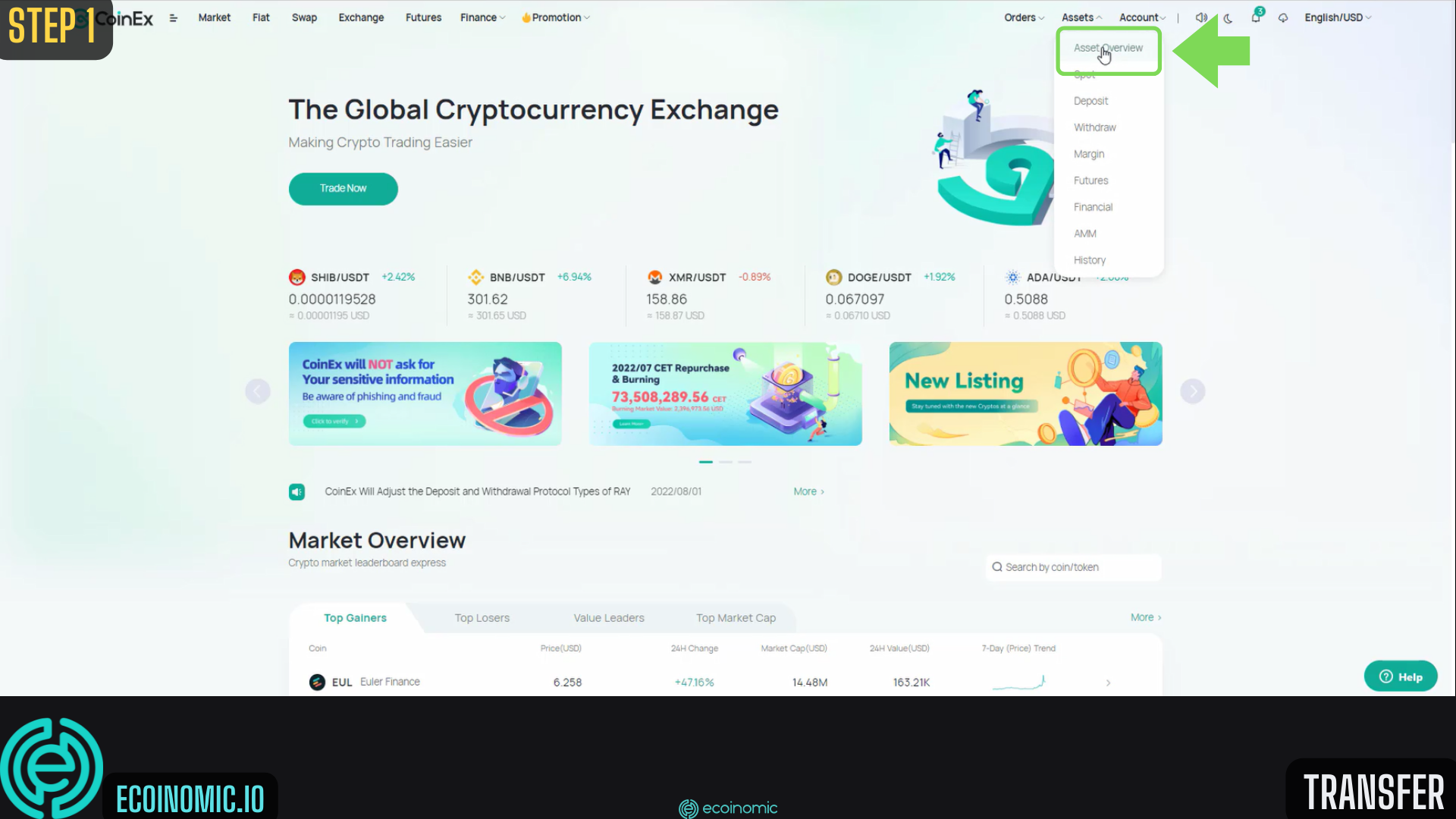

Step 1: After successfully logging in to your CoinEx account, select “Asset” ⇒ “Asset Overview”.

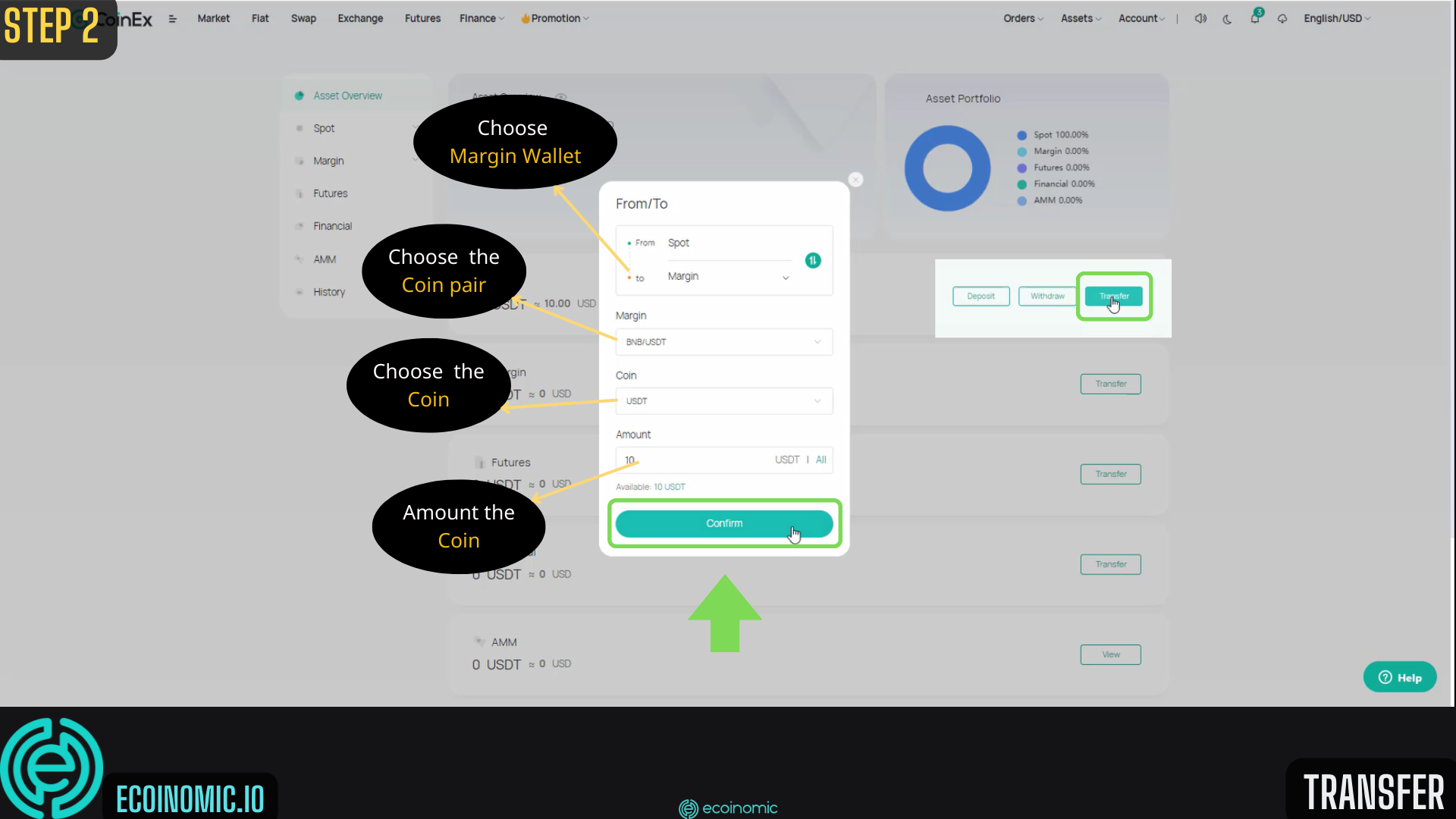

Step 2: Select “Transfer” to deposit into the “CoinEx Margin” wallet.

At “To” section, select “Margin”.

At “Margin” section, select the pair of coin you want to trade.

At “Coin” section, select the coin/token you want to trade.

At “Amount” section, select the amount you want to trade.

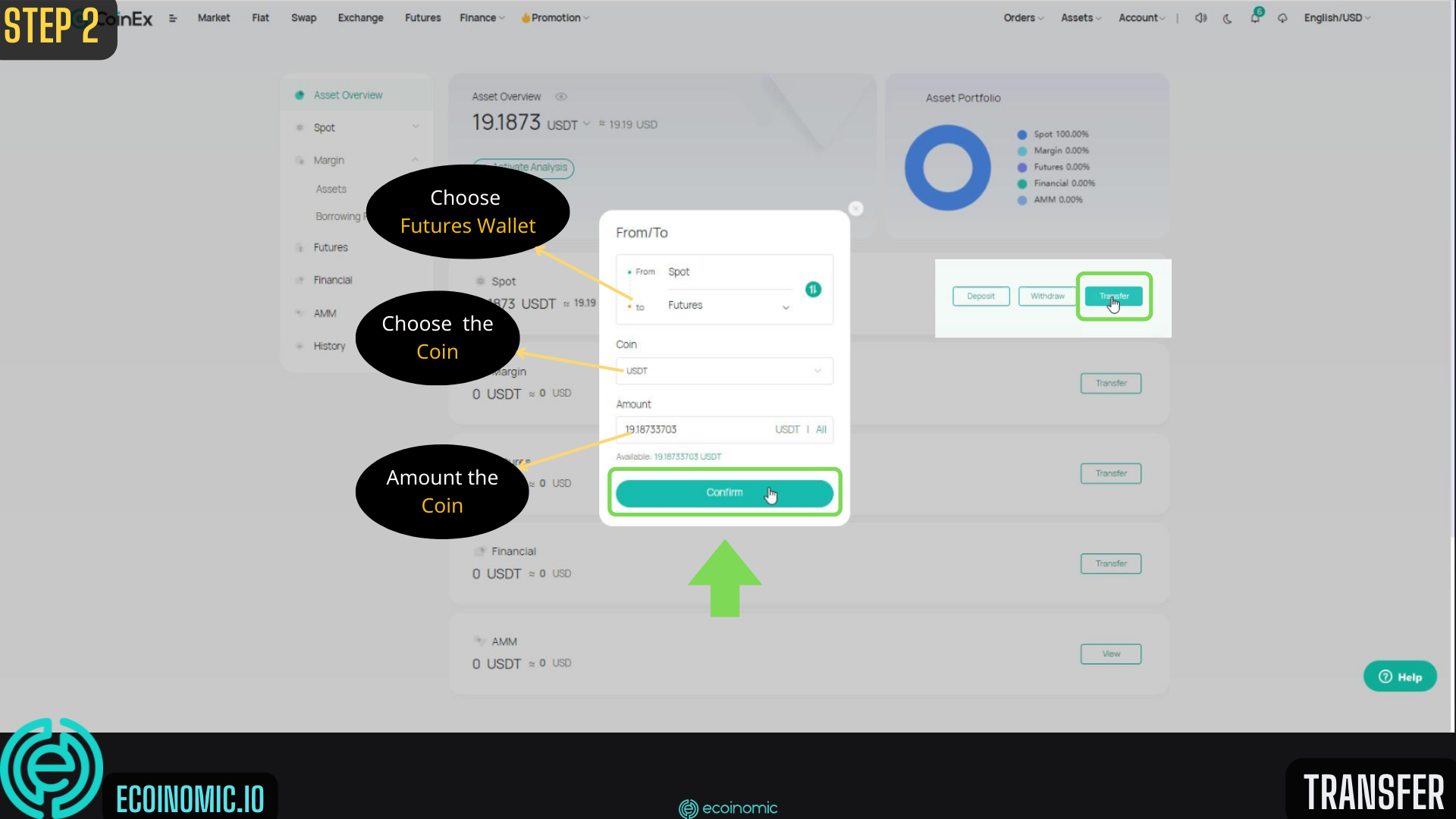

Select “Transfer” to deposit the “CoinEx Futures” wallet.

At the “To” section, select “Futures wallet”.

At “Futures” section, select the pair of coin you want to trade.

At “Coin” section, select the coin/token you want to trade.

At “Amount” section, select the amount you want to trade.

CoinEx Margin Trading Guide

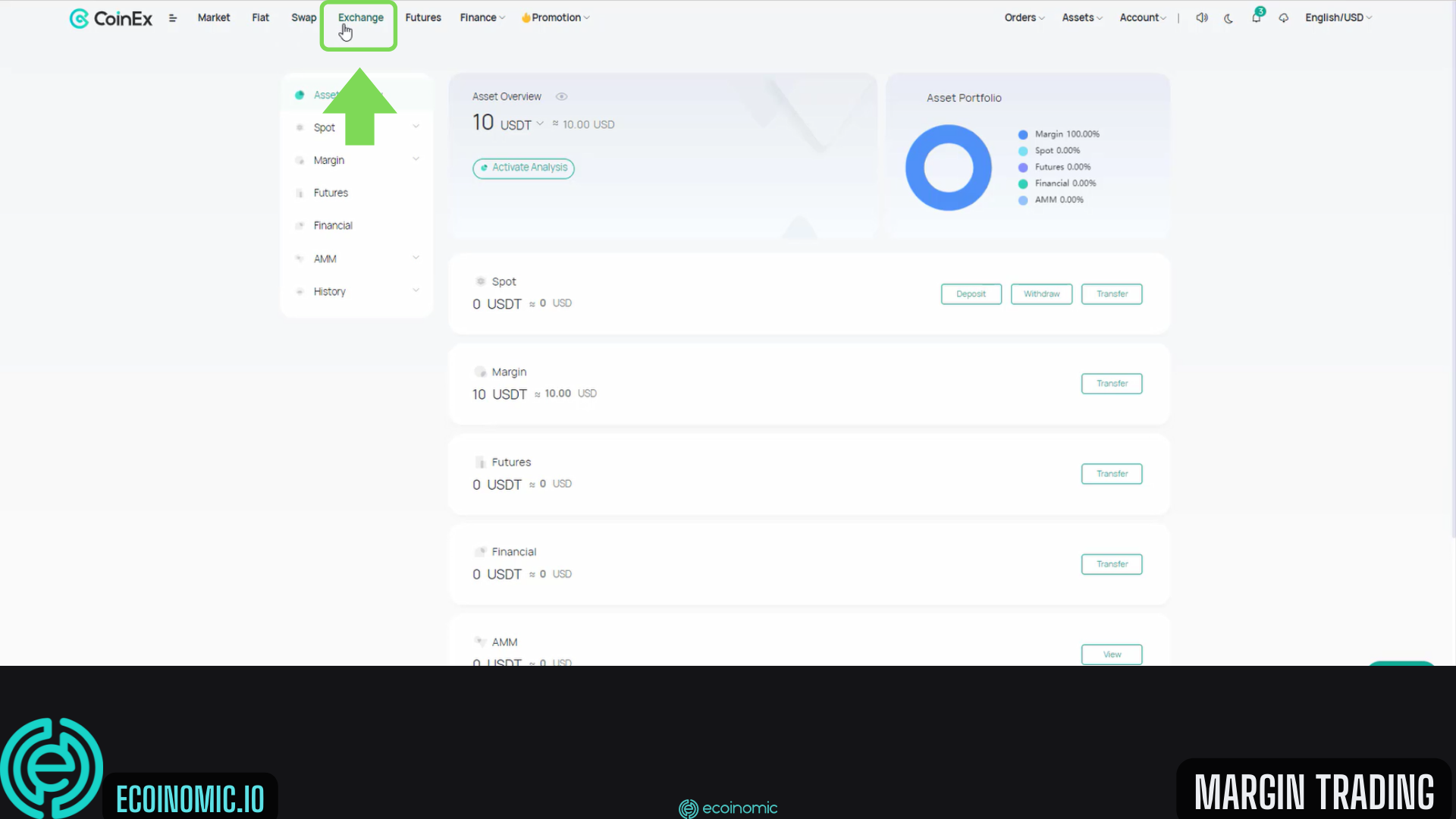

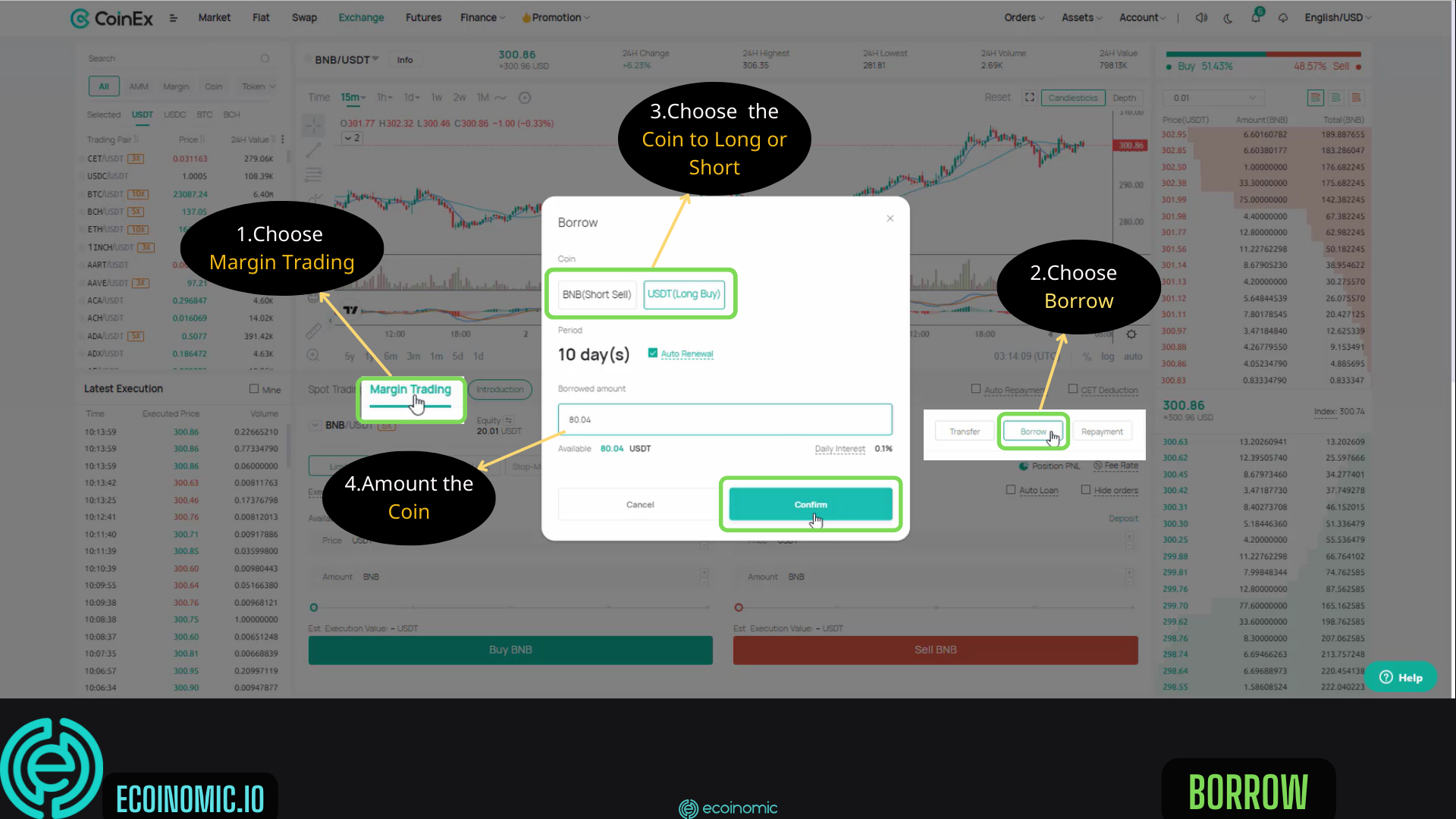

Step 1: To start trading CoinEx Margin, select “Exchange”

Step 2: Select “Margin Trading” ⇒ choose “Borrow”.

At “Coin” section, select Short Sell or Long Buy.

At “Borrow amount” section, select the amount of coins you want to borrow.

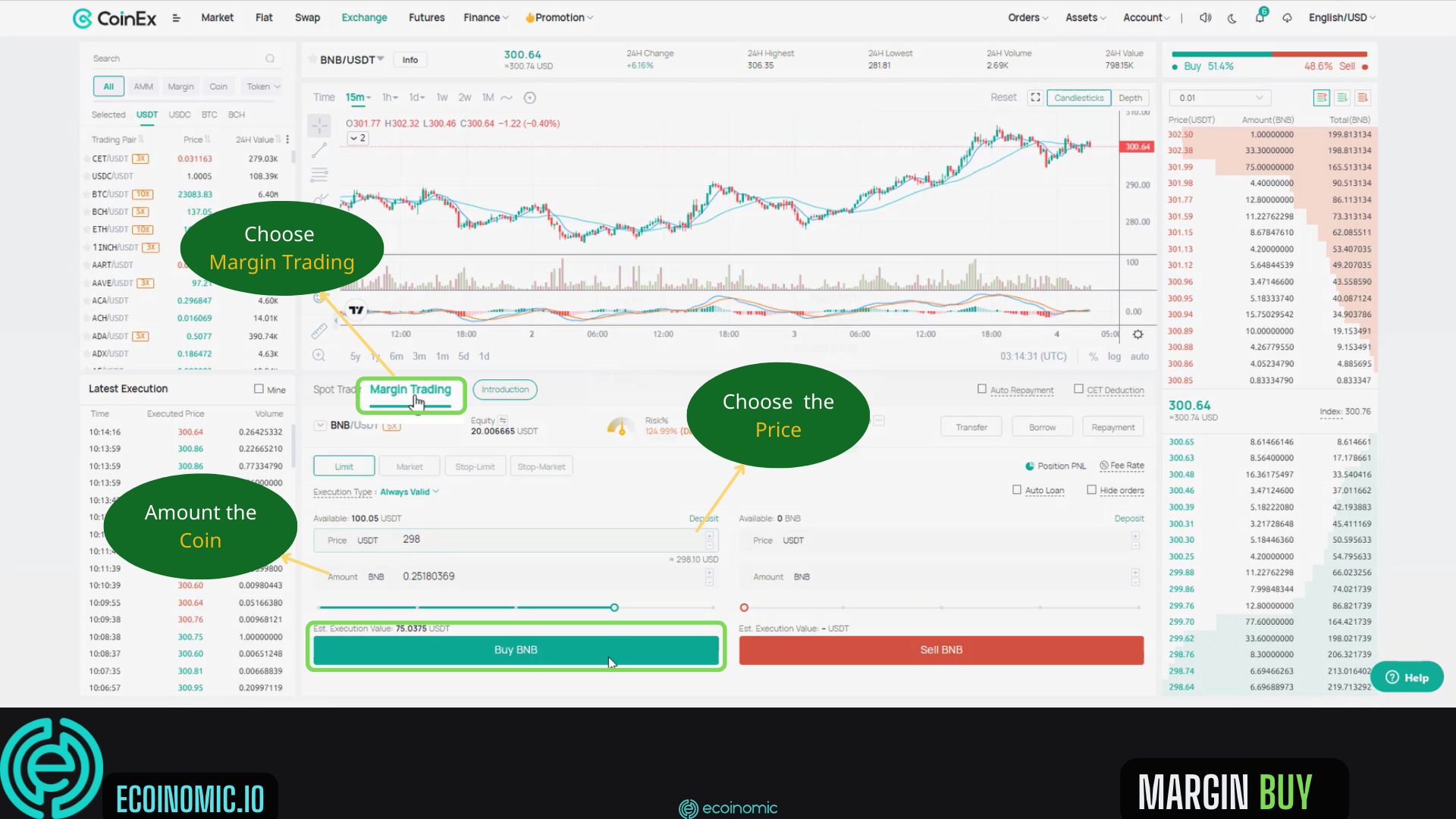

Step 3: To take a Long position, select “Margin Trading”.

Select the order “Limit”.

At “Price” section, select the price you want to buy.

At “Amount” section, select the amount of coins you want to buy.

Finally, click on “Buy BNB” to place an order.

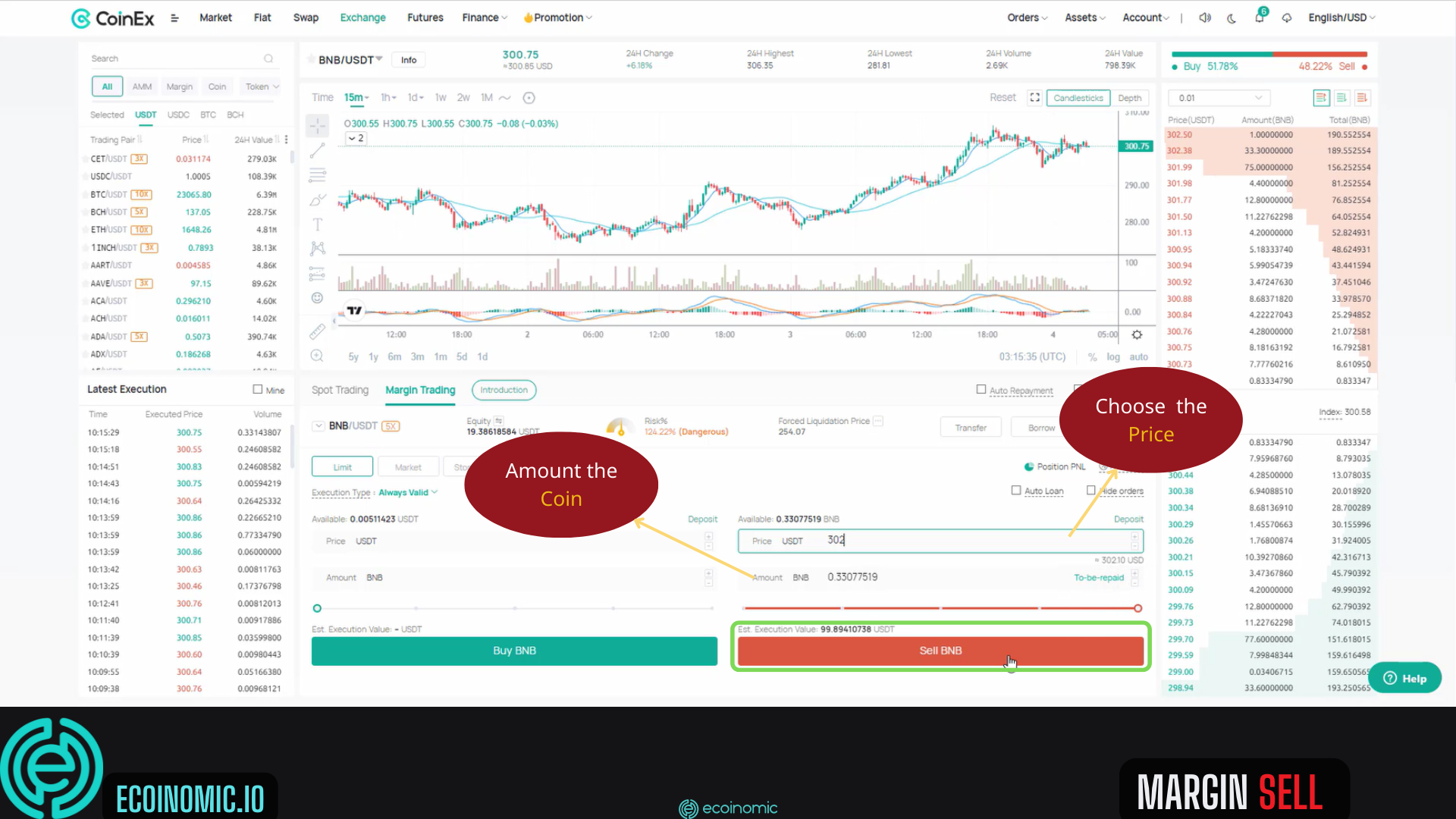

To take a Sell (Short) position, select “Limit” order

At “Price” section, select the price you want to sell.

At “Amount” section, select the amount of coins you want to sell.

Finally click “Sell BNB” to place an order.

CoinEx Futures Trading Guide

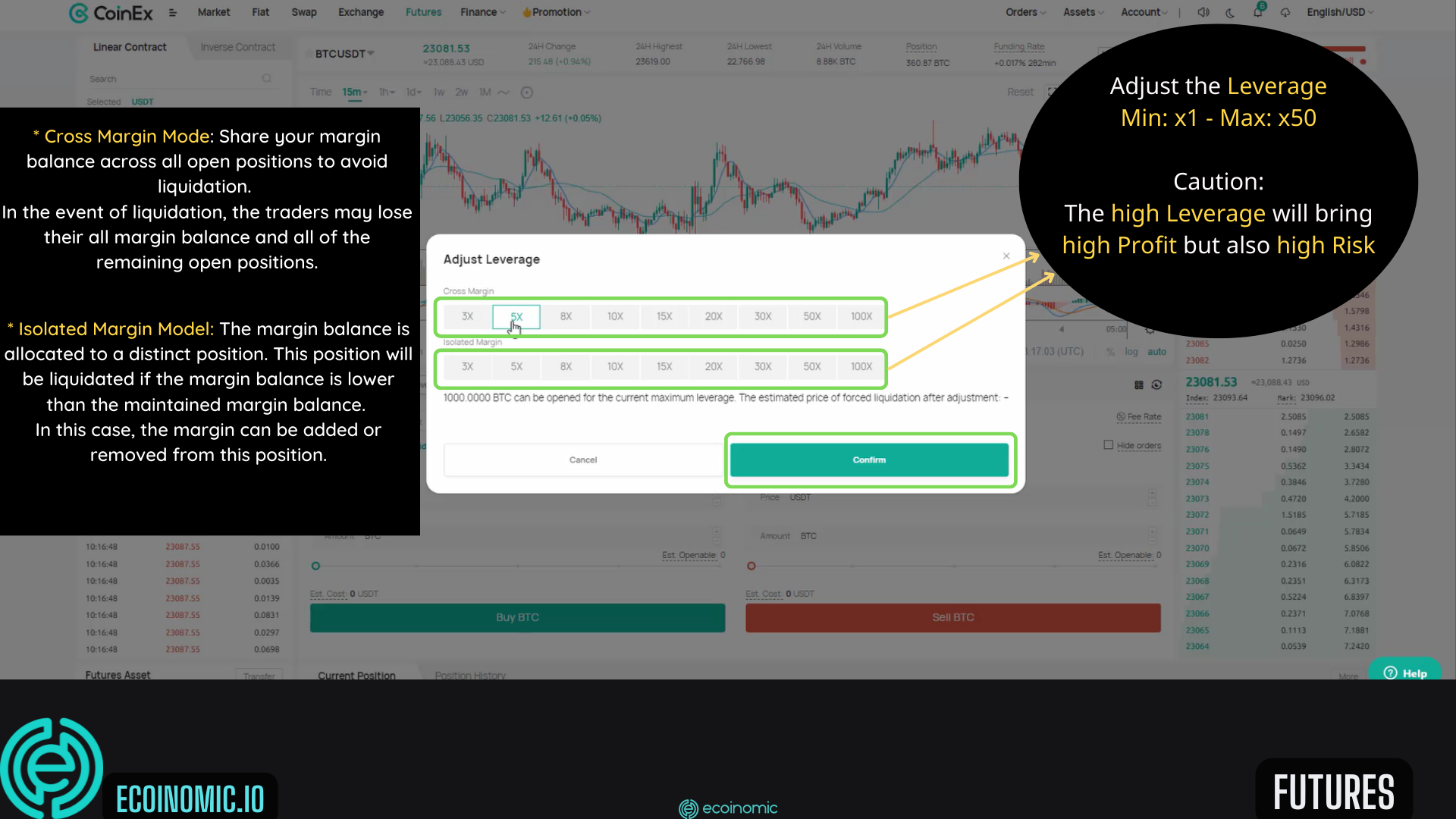

Step 1: Select “Futures” ⇒ Select the contract you want to trade.

Choose Futures model (Cross and Margin) and adjust leverage

You will then need to choose between Isolated Margin and Cross Margin

Related: Isolated Margin and Cross Margin

Choose the leverage level from 3x-100x, note that the higher the leverage, the higher the profit, the higher the risk.

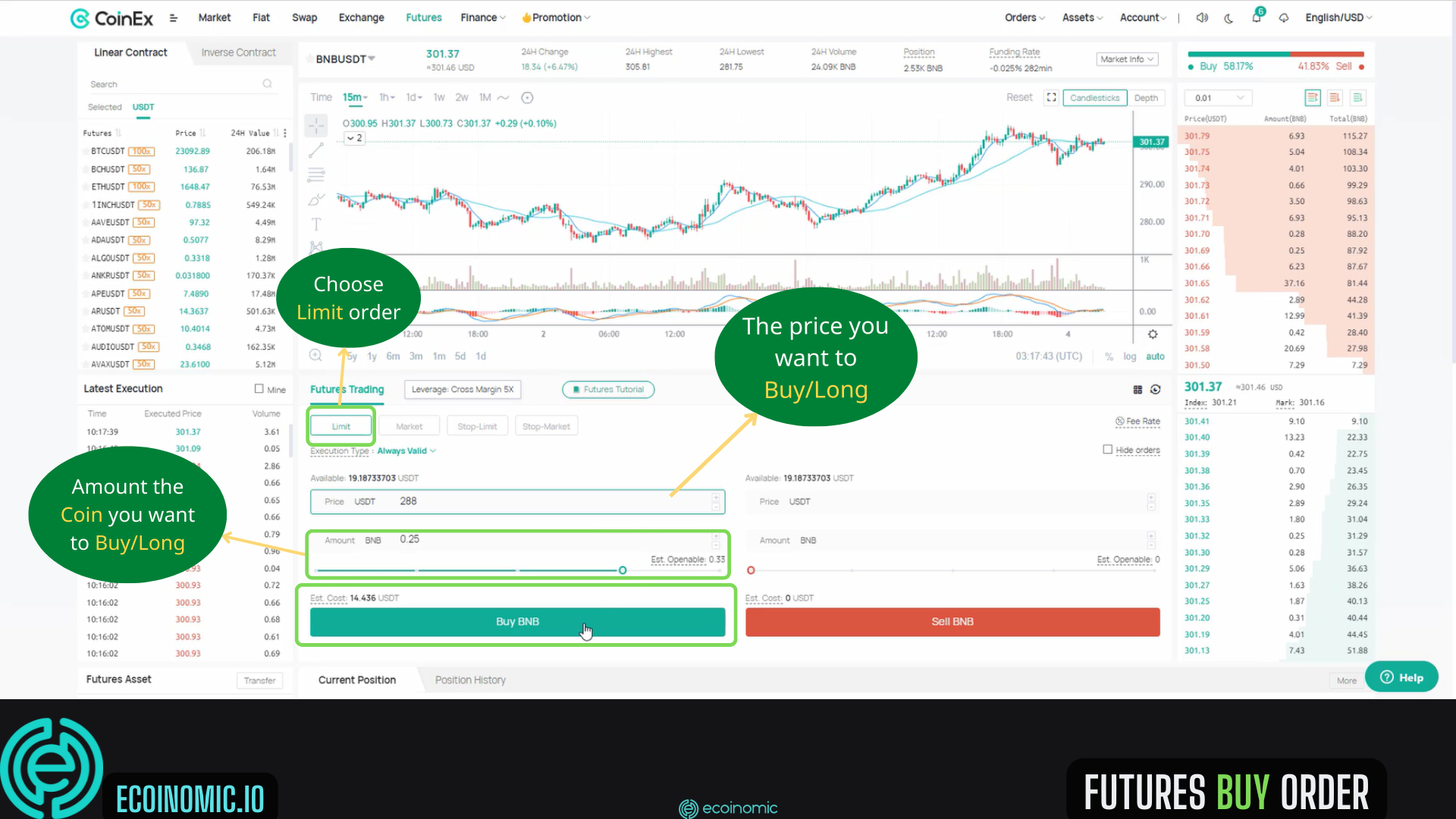

Step 2: To make a buy order, you open a Long position with a “Limit” order.

At “Price” section, select the price you want to buy.

At “Amount” section, select the amount of coin you want to buy.

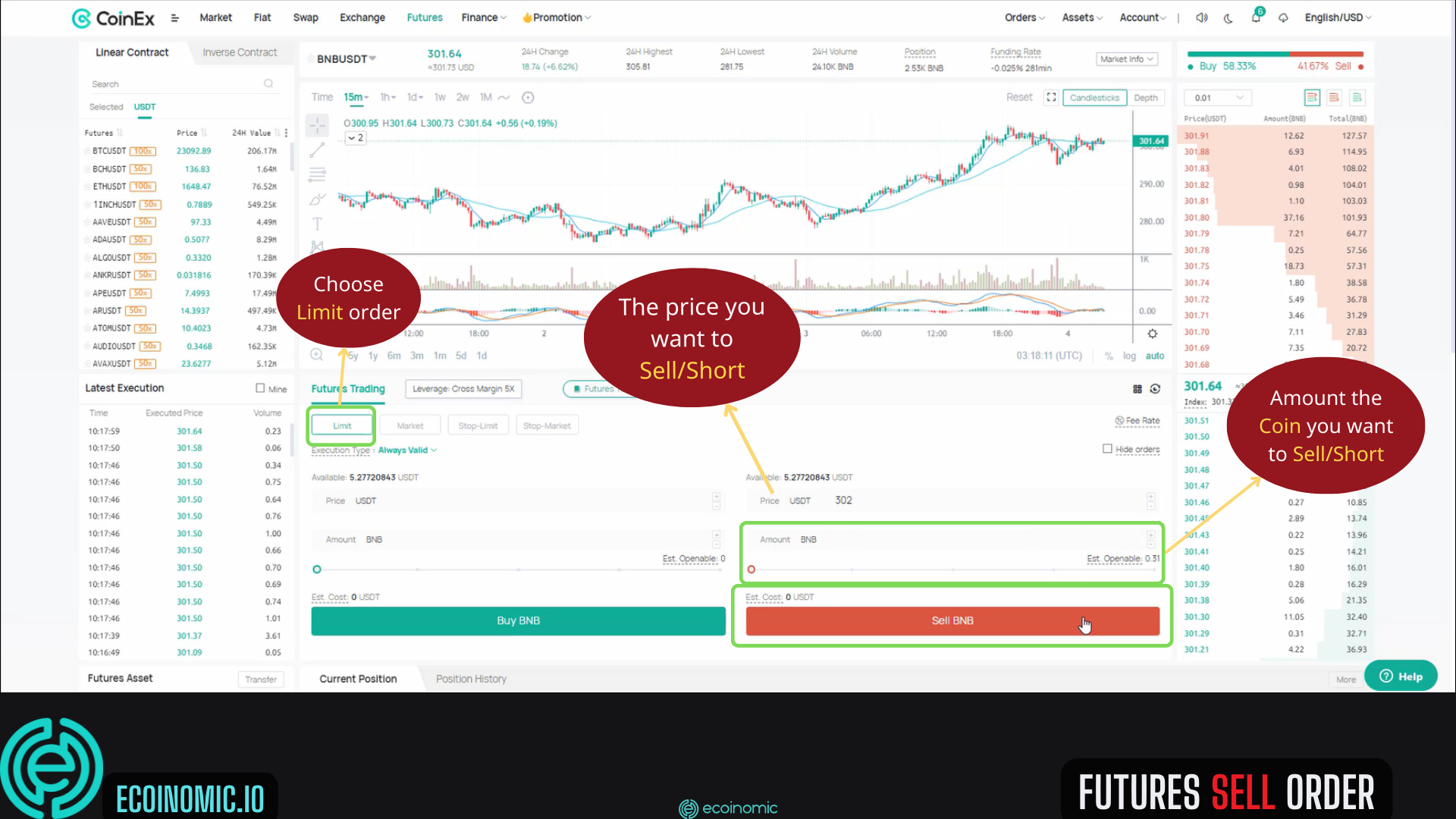

To make a sell, you open a short position with a “Limit” order.

At “Price” section, select the price you want to sell.

At “Amount” section, select the amount of coins you want to sell.

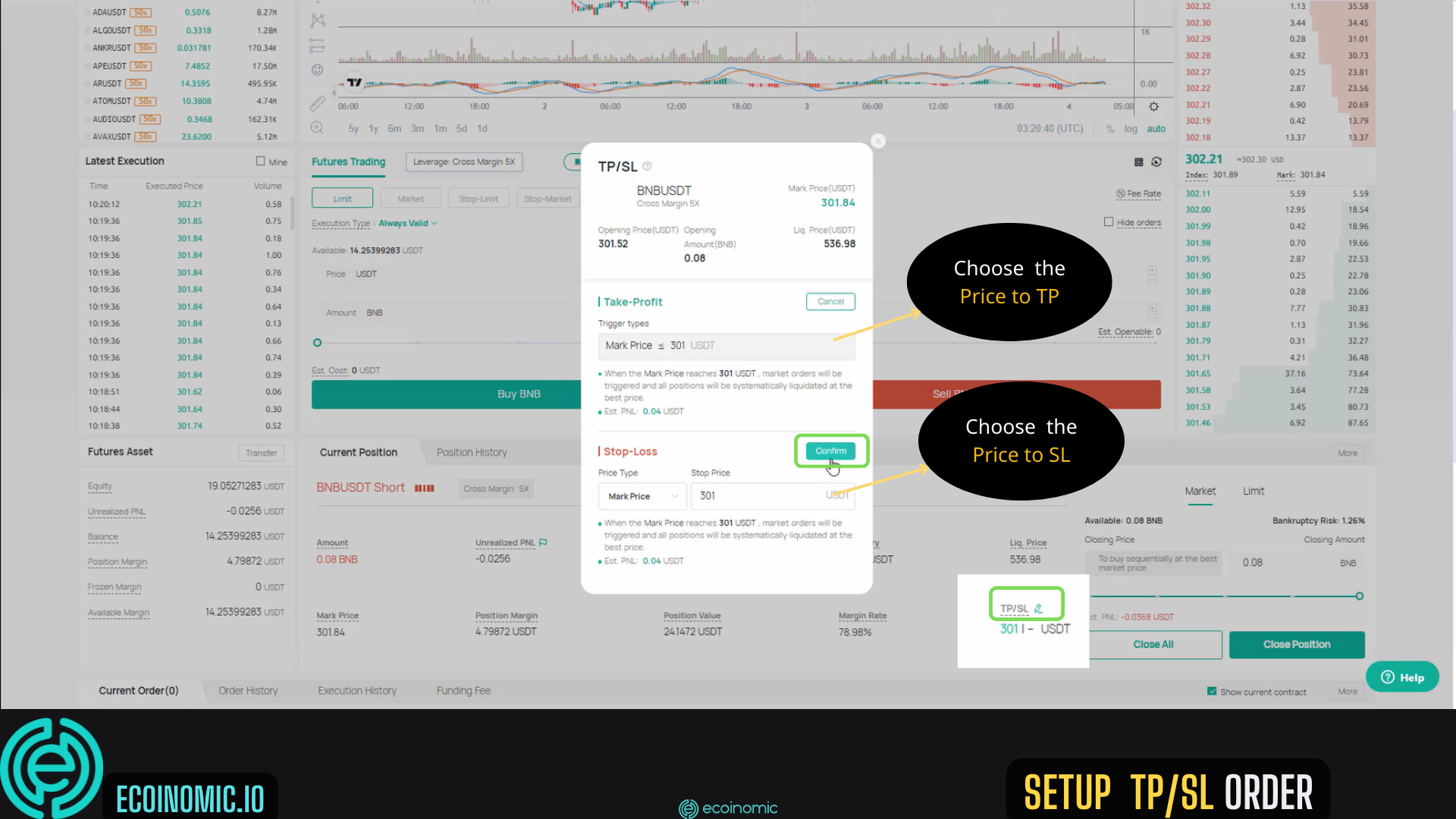

Note that when using CoinEx Futures orders, you can also set Take Profit and Stop Loss prices to preserve profits and hedge risks when prices reverse suddenly and you can not react in time.

“Take-profit”: Select the price you want to take profit.

“Stop-loss”: Select the price you want to stop loss.

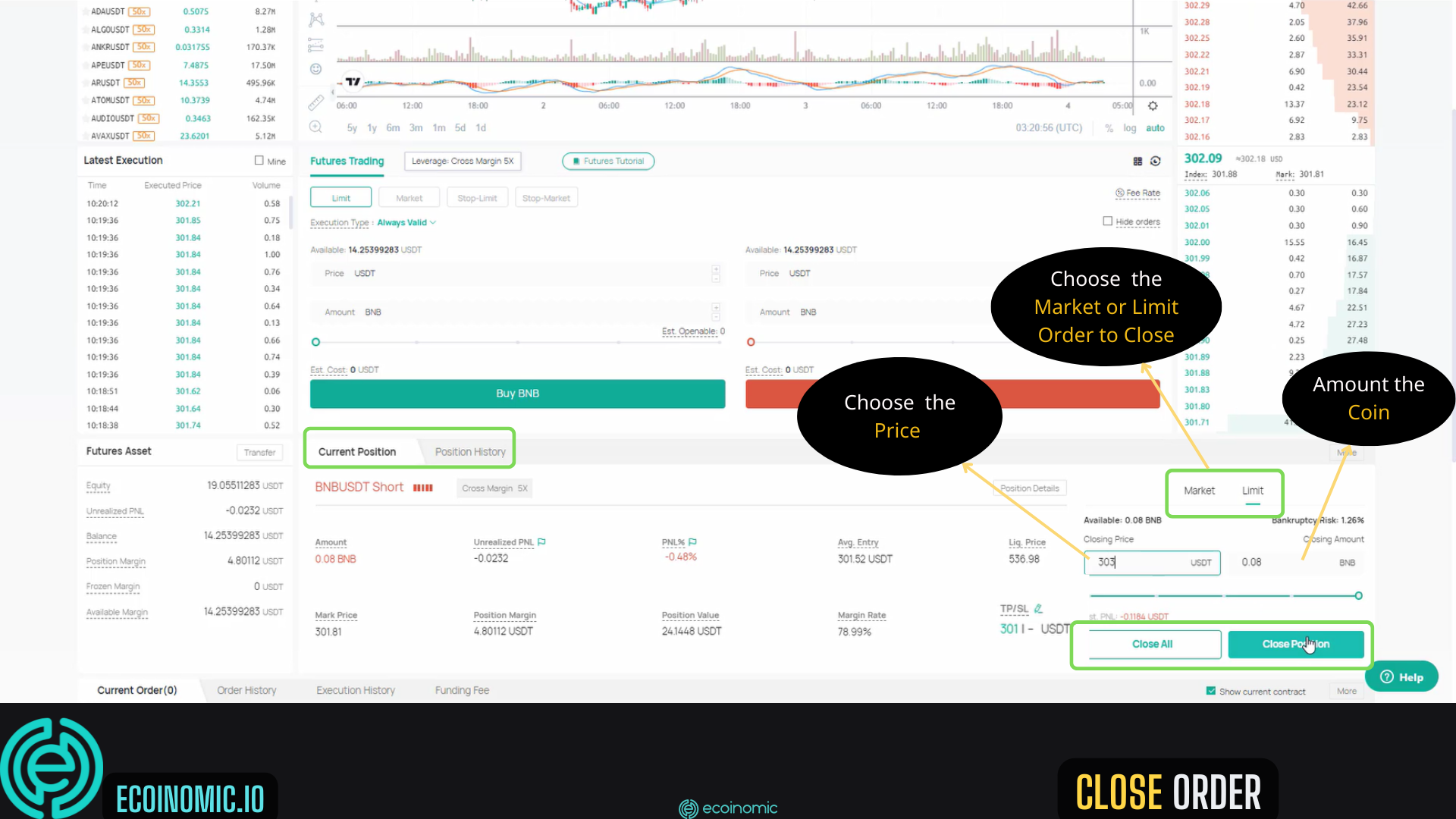

Instructions for canceling and closing Coinex Futures/Coinex Margin order

Sometimes, you may have punched a wrong key on the keyboard or clicked the mouse at wrong place when trading or after transaction, you realize you have done something wrong. Then, you will want to cancel the order immediately to avoid risks.

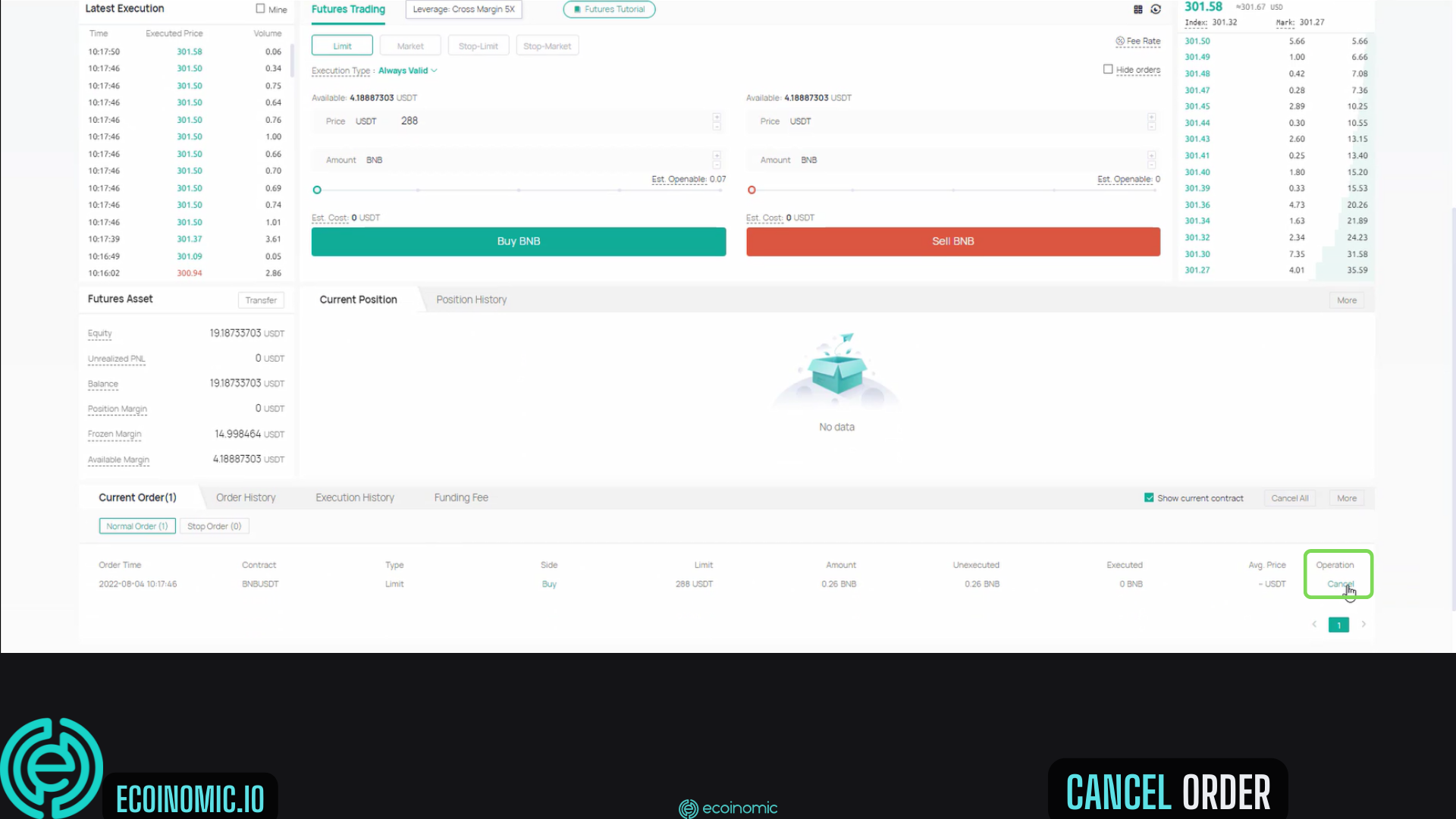

We will guide you to cancel your order on CoinEx Futures/ CoinEx Margin. To cancel a CoinEx Margin/CoinEx Futures order, select “Current Order” ⇒ “Cancel”

You can also close an open position with a Limit or Market order.

Conclusion

The above article is a detailed guide on how to trade CoinEx Futures and CoinEx Margin for newbies. Ecoinomic hopes that traders and investors will make the right investment decisions to earn profits.

>>> Related: Step-by step guide to sign up for Binance account update 2022