Advertisement

Among the top 3 largest cryptocurrency exchanges globally, Huobi offers a wide range of digital currency trading services including Huobi Futures and Huobi Margin.

Among the top 3 largest cryptocurrency exchanges globally, Huobi offers a wide range of digital currency trading services including Huobi Futures and Huobi Margin. In the article below, Ecoinomic.io will provide information about two trading forms and how to use them.

However, if you do not have a trading account on Huobi Global, read the Huobi registration guide.

What is Huobi Futures?

Similar to other cryptocurrency exchanges, Huobi Futures is a form of trading futures contracts.

In essence, it allows the buyer and seller to make a transaction of a futures contract. Currently, Huobi supports a variety of coins and tokens. Users can profit from the rise or fall in the price of contracts representing digital currencies by buying or selling.

What is Huobi Margin?

Huobi Margin is similar to margin trading on other exchanges such as Binance or MEXC. This trading method allows you to Borrow funds from the exchange to open positions larger than the account balance based on the leverage.

Despite being considered a high-risk trading method, this trading form becomes more and more popular. It allowed users to make significant profits with limited capital.

However, before starting Margin trading, you should know how much you will have to pay for your loan. This depends on the margin mechanism of your choice and the leverage ratio you set.

The higher the leverage ratio, the higher the profit you will earn if the trade is successful. In contrast, you will have to pay huge debt if the transaction fails.

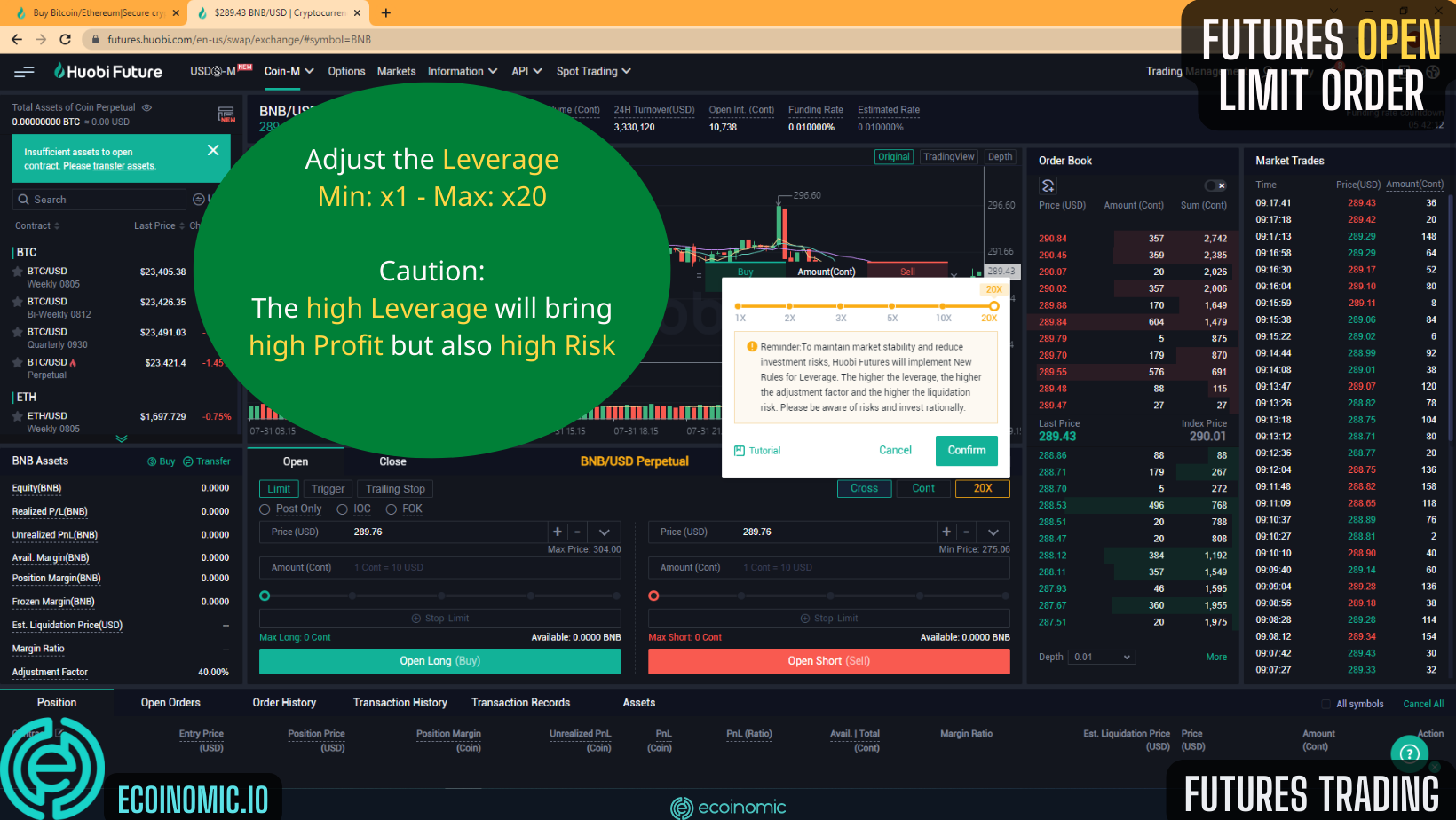

There are two margin modes in Huobi Margin trading:

- Cross: The position will automatically use all your Margin/Futures account balance to bear losses and minimize the risk of account burnout.

For example, if your Margin/Futures account balance is $1000, you choose to trade with a margin of $100. In case the position is at risk, the position will automatically gradually deduct from the remaining $900 in the account. To put it simply, $900 is the amount of capital used to bear losses. Until the funds in your account run out, your position will be liquidated.

- Isolated: The position will be limited to the amount you spend from the beginning. This avoids the risk of losing all your asset. Similar to the above example, if you use the Isolated mode and unfortunately take risk and liquidate the position, the amount you lose will be only $100.

However, you can still adjust the position or bear your own losses by adding or removing capital to the position from the remaining $900 balance in the account.

>>> Related: What is Futures? What is margin? Compare Margin and Future.

Huobi Futures Trading Guide

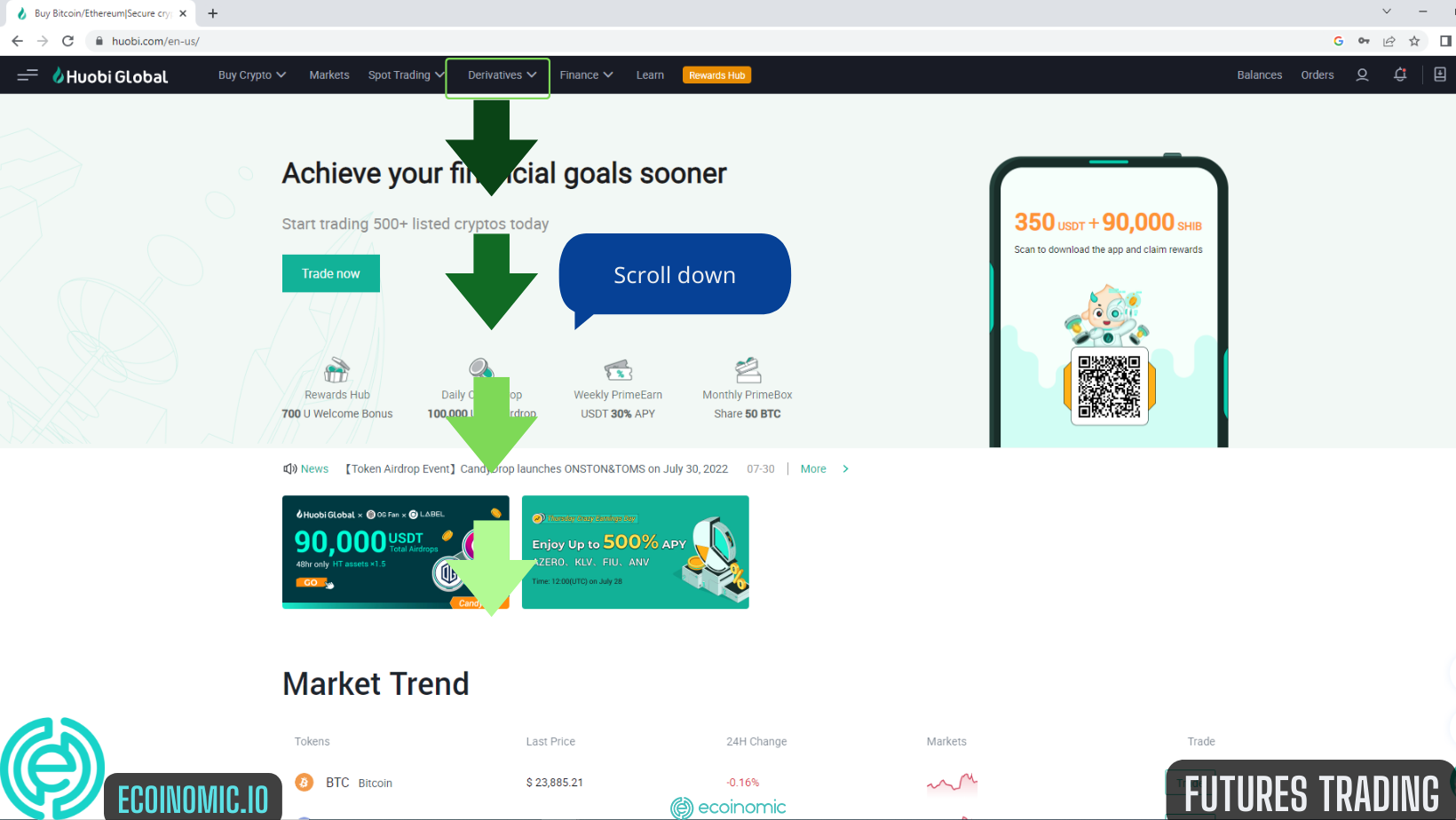

On the Huobi Global homepage, select Derivatives.

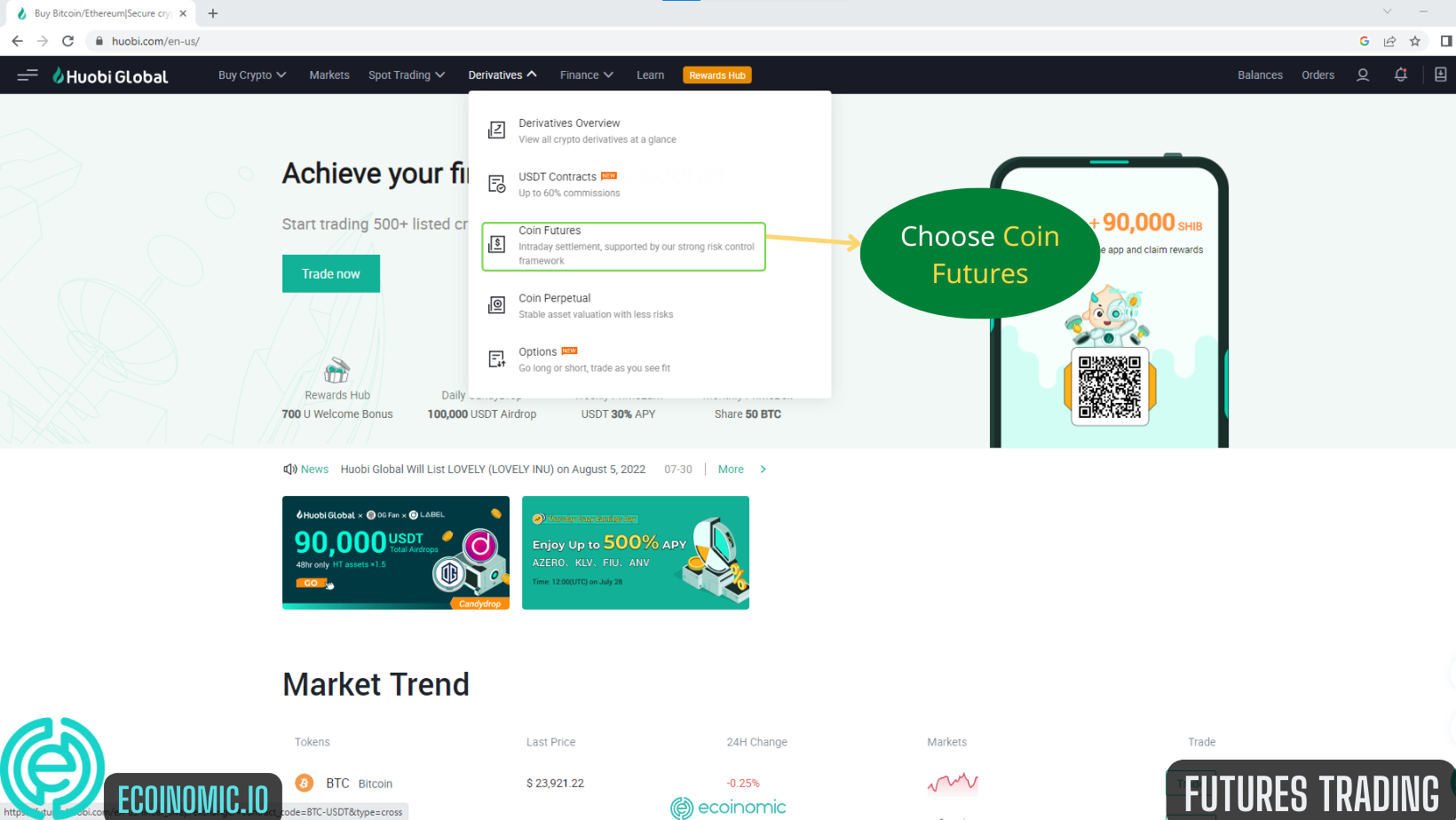

Select Coin Futures

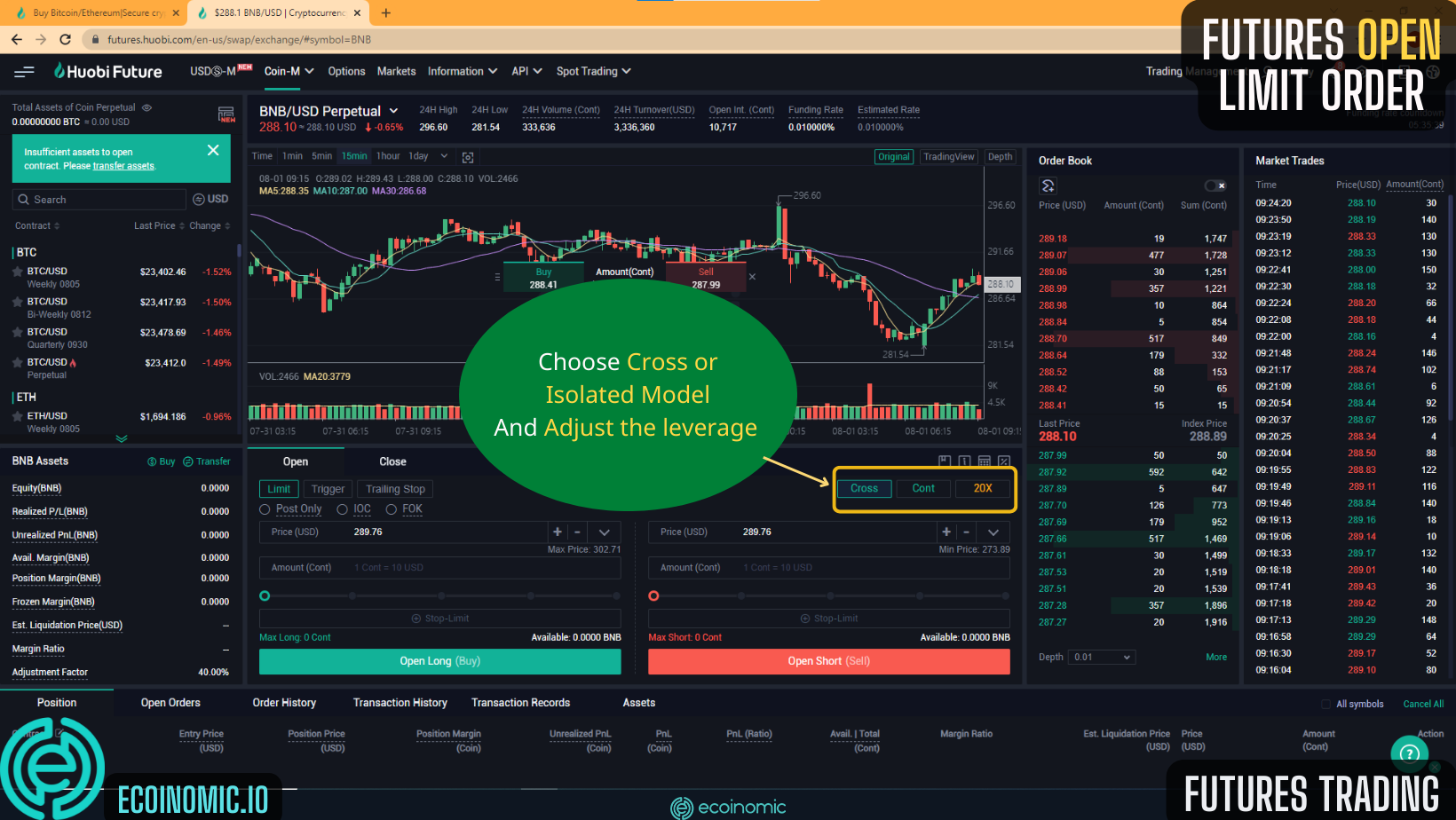

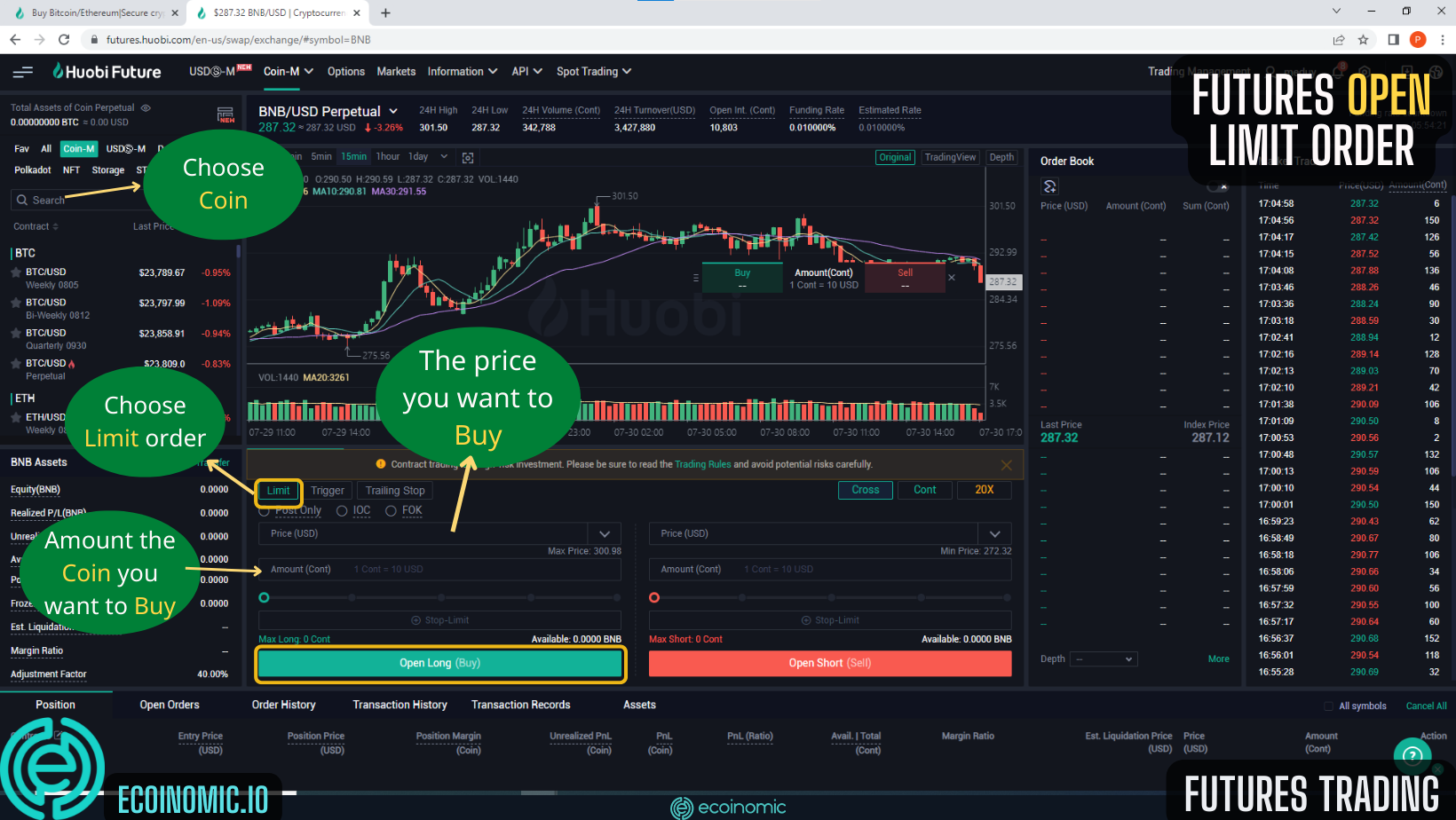

The Huobi Futures trading window will appear. Select a Limit order.

Choose a margin mode (Cross or Isolated).

Set the leverage ratio. The minimum coefficient is 1x and the maximum is 20x. Then click Confirm.

Find and select the name of the coin contract you want to trade, enter the amount of coins you want to buy. Then, set up the price that you want to buy. Finally, click Open Long (Buy)

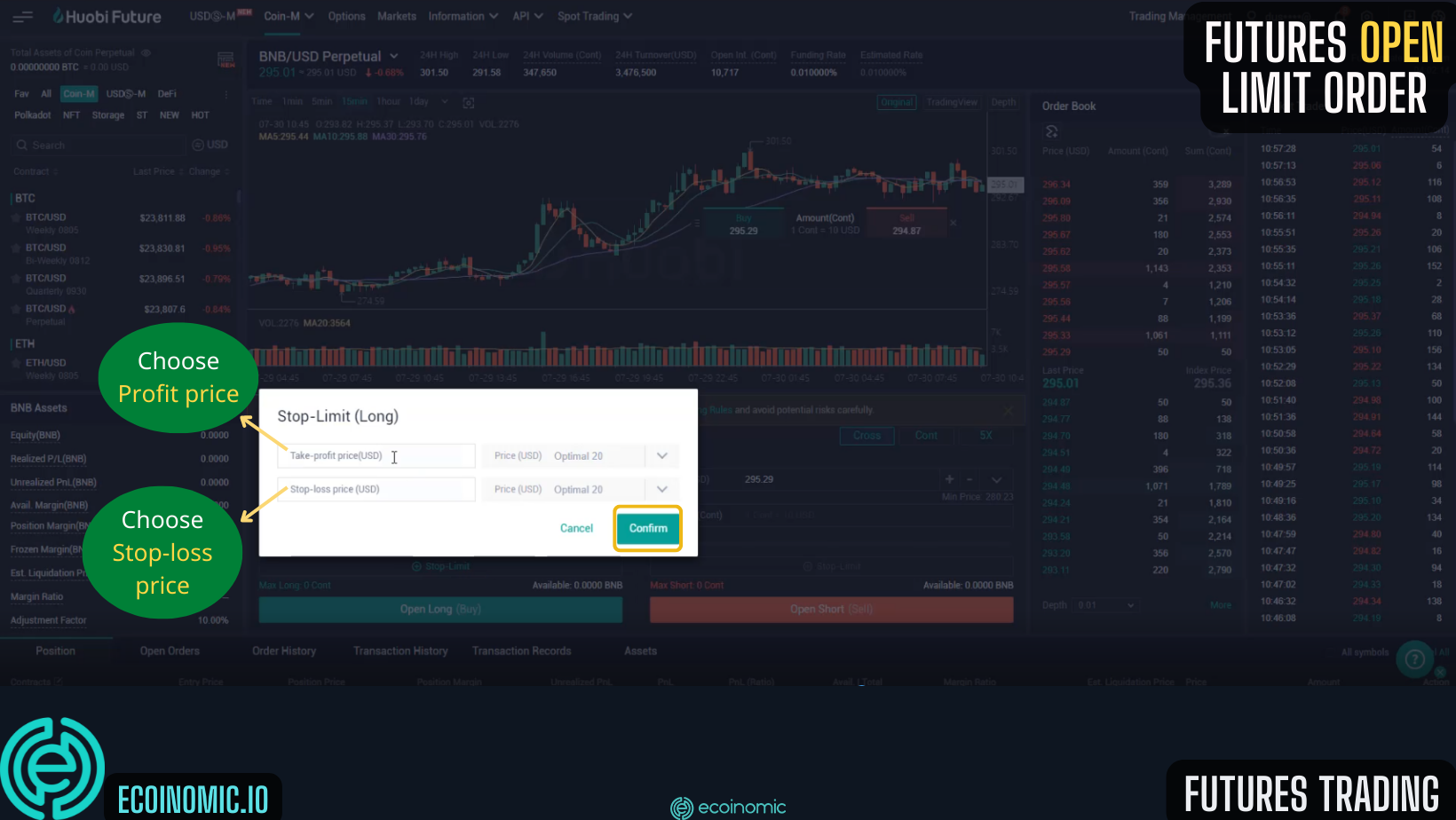

Now, you need to set a stop loss and take profit price for your position. When the price of the market reaches this level, the system will automatically take profit for you, or stop loss to minimize risks. Then click Confirm to complete the order opening process.

Huobi Margin Trading Guide

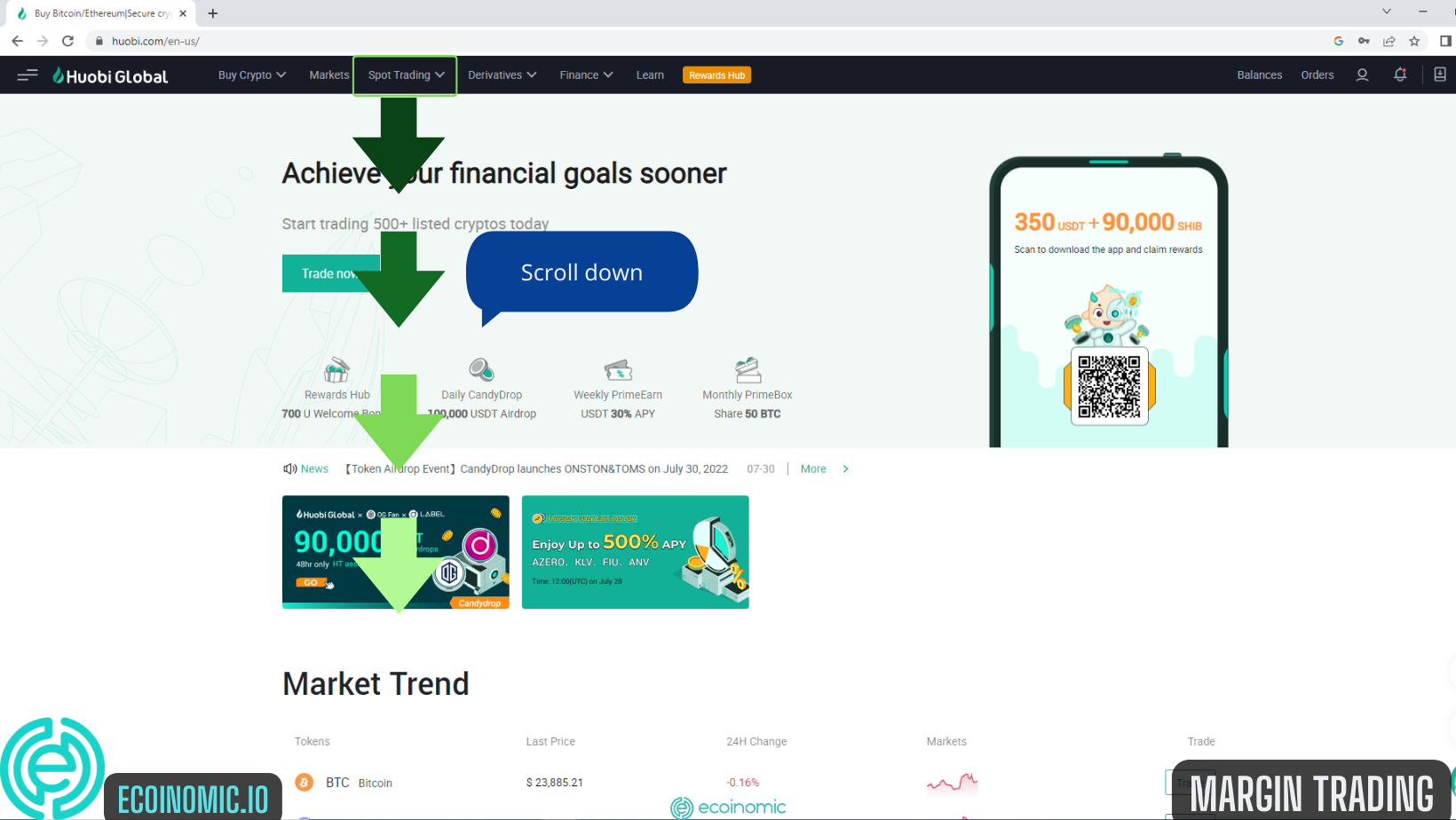

On the Huobi homepage, click spot trading

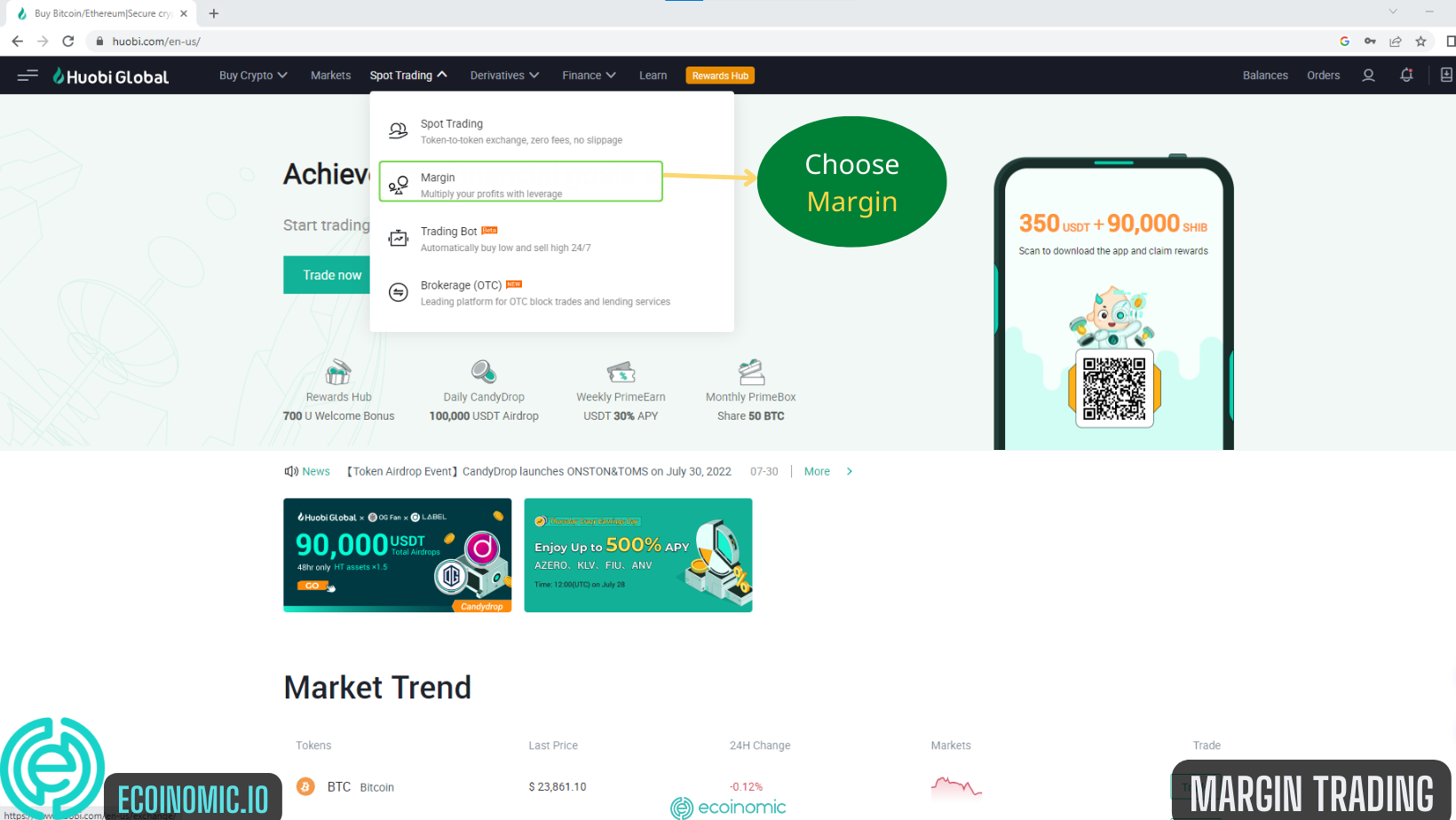

Select Margin

Similarly, the Huobi Margin trading interface will appear.

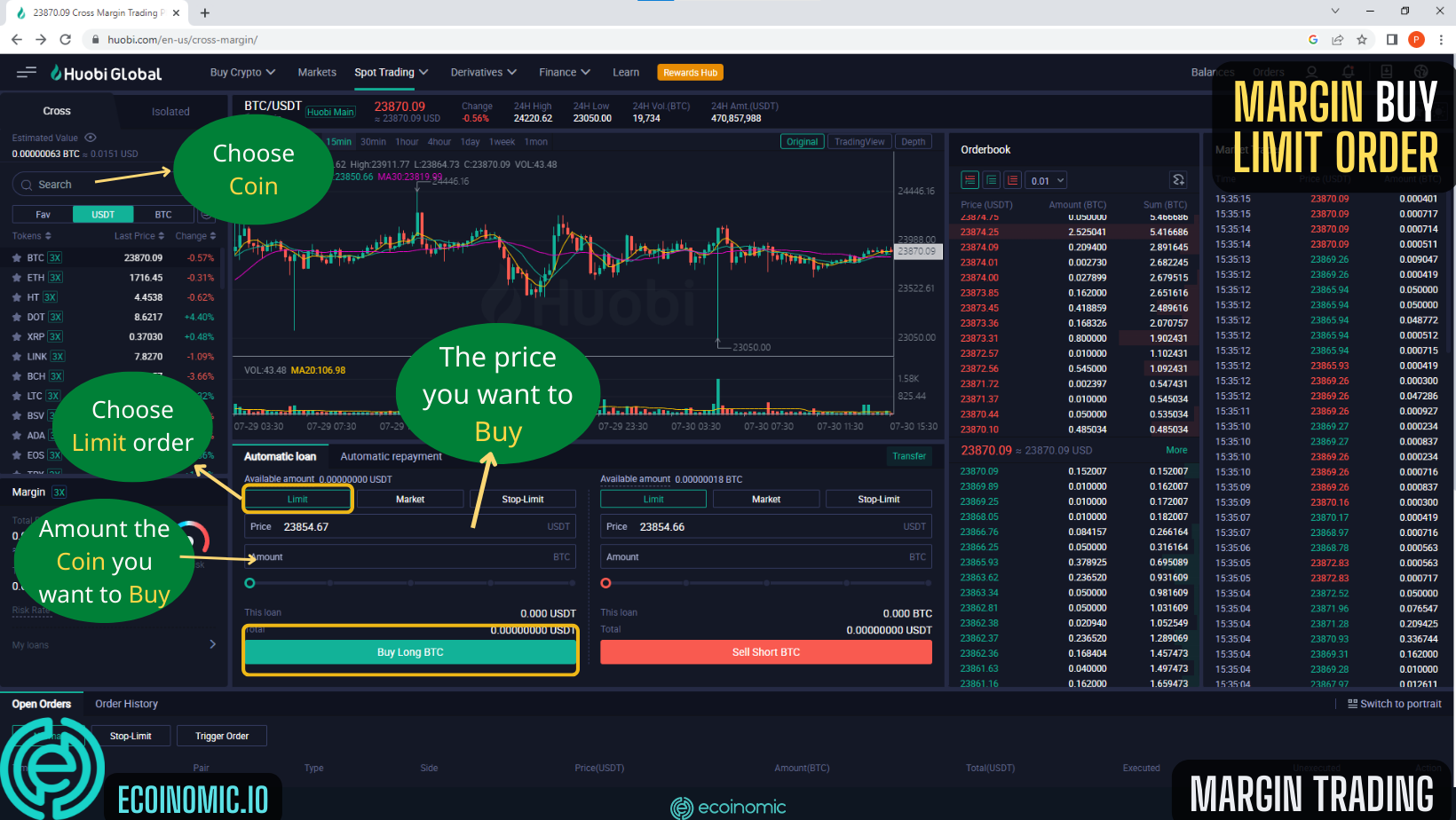

Huobi Margin trading with Limit orders

Buy Coin with Limit Order

First, select the Limit order and find the name of the coin you want to trade. Then, enter the number of coins and the price you want to buy. Finally, press Buy/Long BTC.

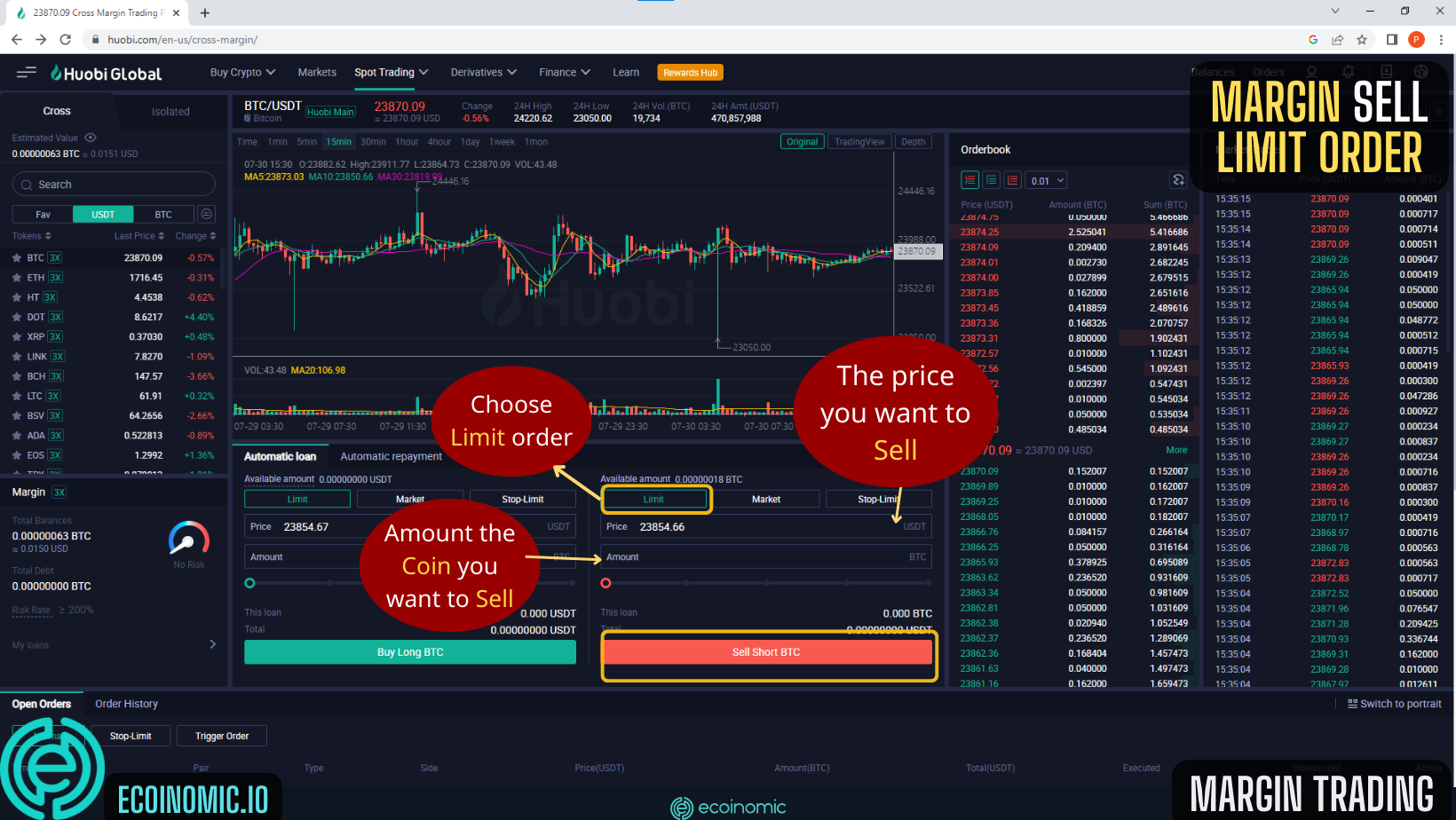

Sell Coins with Limit Order

Similar to buying coin, you also select a Limit order, enter the number of coins and the price you want to sell, then click Sell Short BTC.

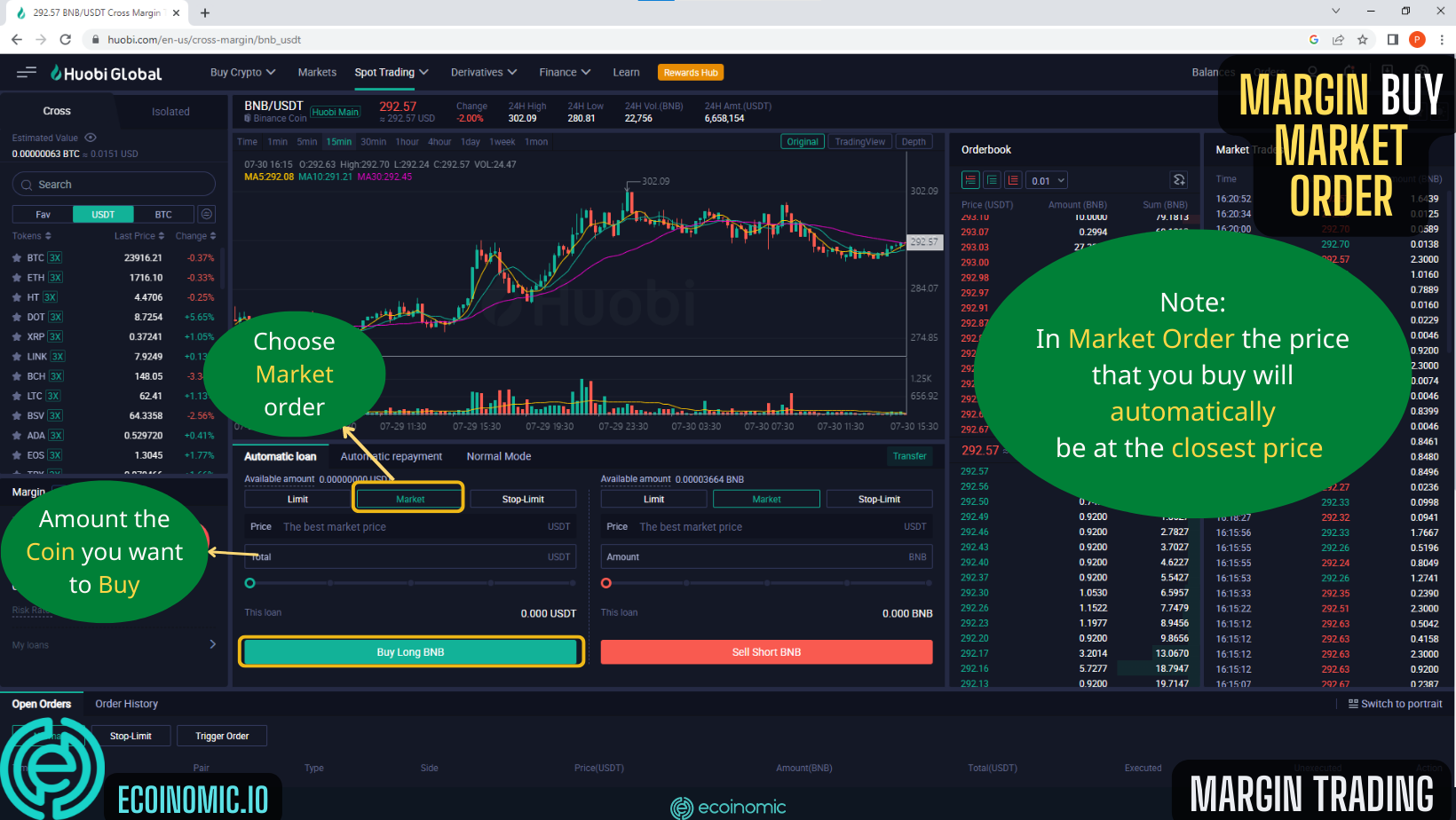

Huobi Margin trading with Market Orders

Buy coins with Market order

First, click the Market order and enter the amount of coins you want to buy. Then click Buy Long BNB.

Note that, unlike Limit orders, Market orders do not allow you to set the desired trading price.

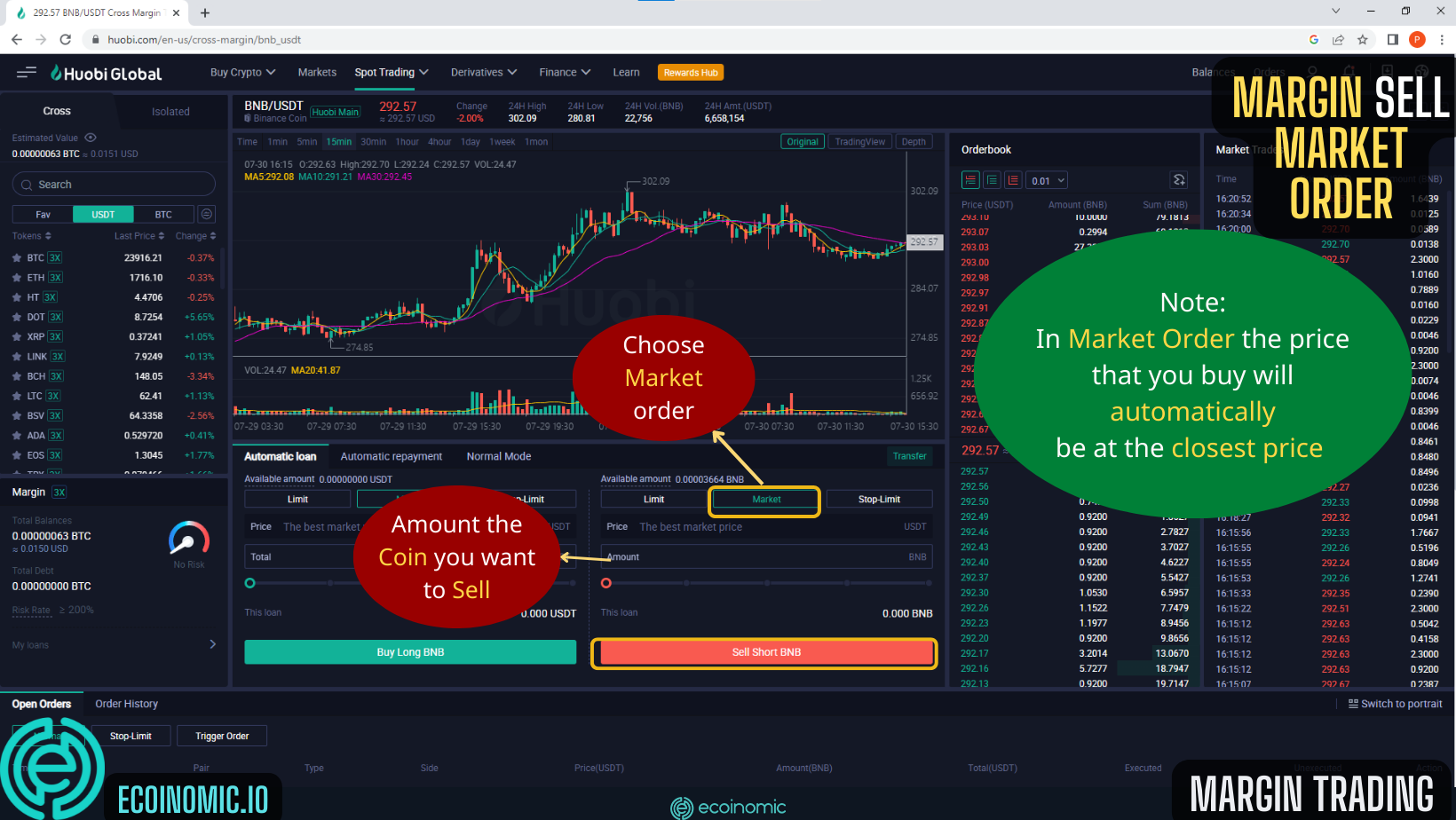

Sell coins with a Market order

You also select the Market order and choose the amount of coins you want to sell. Then click Sell Short BNB. The price of the sell trade is also set similarly to the buy trade.

Conclusion

Although Huobi Futures and Huobi Margin allow traders and investors to gain huge profits, these trading form carry high potential risk. Therefore, in order to go a long way and invest sustainably, knowledge of the market is still the key factor that any investor or speculator needs to understand when participating.

In the above article, ecoinomic.io has provided you with the most basic knowledge on how to trade Huobi Futures and Huobi Margin to help you make the right investment decision.

>>> Related: Bybit Futures and Bybit Margin Trading 2022