Advertisement

What is bandwagon?

Bandwagon is a psychological effect that describes the tendency to act and make decisions according to the majority opinion.

From an economic perspective, bandwagon is a phenomenon refers that the price of goods falls, which leads to market stimulus. Some people buy this item more, then others also buy it that increases the demand for purchases. That caused the total market demand to be higher than expected.

In the field of cryptocurrency, bandwagon is considered the implementation of an investor’s trading decision according to a crowd trend. Especially, during the crypto market bubble in 2017, investors rushed to invest in cryptocurrencies with trading volume of up to $3 billion per day.

The history of bandwagon effect

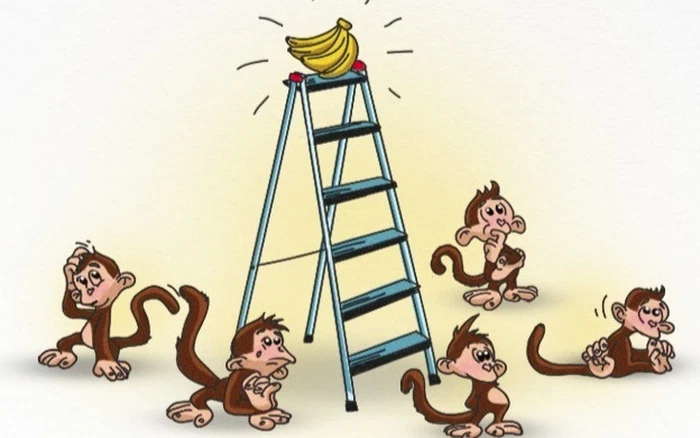

Effect of 5 monkeys and 1 banana

The bandwagon is known as the effect of 5 monkeys and 1 banana. Scientists conducted experiments when trapping 5 monkeys in a cage with a ladder and bananas hanging from the top. Whenever a monkey climbs a ladder, the rest will be sprayed with water. Therefore, the monkey climbing the ladder will be beaten by the rest.

After that, a new monkey is added to the cage, replacing an old monkey. Immediately, this monkey climbs the ladder and then is beaten by the rest of the monkeys. After several times replacing the monkeys one after another, everything goes the same, the monkey who has just climbed the ladder will be beaten. Although the rest of the monkeys are not sprayed with water, they still participate in the fight.

Train effect

Another name for the bandwagon is the training effect. The term originated during artist Dan Rice’s election campaign for president Zachary Taylor in 1848. Dan Rice and the Bandwagon convoy marched across the country and received a large response from the crowd who joined the train, supporting Taylor. After that, Taylor’s candidacy was a huge success.

In the early 20th century, trains became central to political campaigns. The training effect becomes a descriptive term for acting on the phenomenon of crowds, even if it goes against the rules and beliefs.

The effect of bandwagon on the crypto market

- Price bubble

Short-term speculators often take advantage of the bandwagon effect to manipulate the market. They call for and promote investment opportunities that cause the price of the coin/token to skyrocket and attract more and more other traders to invest in this coin/token.

- Liquidity black hole

In the face of unexpected events or negative news, most investors often tend to suspend trading to wait for market stability or sell off to cut losses. That has a great impact on the number of buyers and sellers and negatively affects liquidity.

Pros and cons of bandwagon in the cryptocurrency market

- Advantages

Investors can rely on the bandwagon effect to research the general trend of the market based on tastes, and investment sentiment,… and come up with a plan suitable for each different stage.

Investors can refer to the opinions and advice of experts in the investment community. Traders’ decisions are often influenced by celebrities in the community. The stronger the community, the more prestigious the experts.

- Disadvantages

The bandwagon effect prevents objective analysis of investment so investors tend to make decisions according to the crowd. That leads to a price bubble or collapse, depending on whether the investor buys or sells off.

A good example is the fall of Terra-Luna. With massive backing from industry investors such as Arrington Capital, Delphi Digital, and Pantera Capital, the demand for Luna tokens increased, attracting investors to join the ecosystem. However, later, it was the investors who fell victim after the collapse of this token.

Investors are driven by fear of missing out (FOMO) and bandwagon decisions, rather than making personal judgments of investments tailored to risk appetites.

How to avoid the bandwagon effect

Investment decisions should be based on an objective, comprehensive overview of market signals, analysis and evaluation of coin/token project potential. You need to Do your own research (DYOR), remain calm, consider alternatives and avoid fear if it goes against the majority view.

In addition, you should make decisions based on your risk appetite and personal financial ability so you can plan risk management, disciplined investments and diversify your portfolios.

>>> Related: [Kickback Rate 20%] Binance Sign Up For Beginners Update 2022