Advertisement

If you have some money and want to save, interest lending is the simplest and most popular method of choice. But if you are still wondering how to lend to optimize profits as much as possible then this article is exactly for you. In the article below, ecoinomic.io will introduce “What is Compound Interest? Simple way to calculate compound interest for newbies.”

What is compound interest?

Compound interest (also known as gross interest) is the interest on a loan or deposit calculated based on both the initial principal and interest accrued from previous periods. This formula originated in Italy in the 17th century and is considered “interest on interest. Unlike the mere interest rate charged on the principal amount, compound interest will cause an amount to increase at a faster rate.

The compound interest accrual rate depends on the frequency of compound interest. The higher the number of gross terms, the greater the compound interest. For example, compound interest accrued over $100 compounded 10% annually would be lower than over $100 compounded 5% half-year over the same period.

How to calculate compound interest for newbies

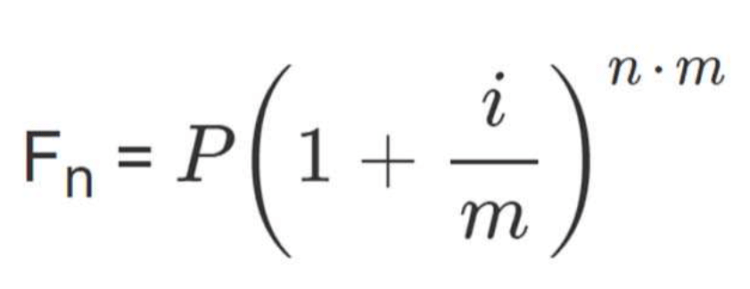

The compound interest calculation formula

It is calculated based on the following formula: With:

- P: initial capital amount

- i: annual interest rate (e.g. 10% interest, i = 0.1)

- n: number of years

- m: number of interest compounds during the year

- Fn: the amount received after n years

Example:

You have a capital of 10 million. You save for 3 years with an interest rate of 10% / year.

If you send a single interest, the amount of interest will be calculated as follows:

- First-year interest rate: 10% *10,000,000 = 1,000,000

- Second year interest rate: 10% *10,000,000 = 1,000,000

- Third-year interest rate: 10% *10,000,000 = 1,000,000

So the total interest rate after 3 years, the interest you receive is 3,000,000 VND.

Applying the formula, the same amount, you bank with compound interest. The amount of interest you receive after 3 years will be as follows:

- First-year interest rate: 10% *10,000,000 = 1,000,000

- Second year interest rate: 10% * (10,000,000 + 1,000,000) = 1,100,000

- Third-year interest rate: 10% *(10,000,000 + 1,000,000 + 1,100,000) = 1,210,000

Thus, after 3 years of savings, the interest received is 3,310,000 VND higher than the single interest deposit.

See also: Binance Account Registration Guide for Beginners

Factors affecting compound interest

The strength of the interest is determined by 4 main factors: Interest rate, principal amount, frequency, and duration.

Interest

The interest rate is directly proportional to the amount of interest. The essence of compound interest is to reinvest with the amount of interest received, so the higher the profit, the higher the profit will be in the next periods.

Principal amount

Similar to interest rates, the higher the initial principal amount, the higher the interest at subsequent cycles.

Frequency

The frequency is the reinvestment timelines (i.e. interest is compounded with the principal). These timelines can be daily, monthly, quarterly, or yearly. If the frequency is repeated at regular intervals, the higher the interest received at subsequent stages.

Time

This is the most important and influential factor. If you take compound interest seriously, and regularly save for 10, 20, or 30 years,… then from a small amount of capital, your assets can increase to a terrible number.

Pros and cons

Called the eighth wonder of the world and man’s greatest invention by Albert Einstein, compound interest can also leave consumers with high-interest loans facing huge debts. Such as credit card debt with a $20,000 credit card balance made at a 20% monthly compound interest rate will result in a total compound interest rate of $4,388 for a year or about $365 per month.

However, in a positive way, compound interest can be beneficial when you use it to make a profit. Exponential growth from compound interest is also important in mitigating wealth-depleting factors, such as rising cost of living, inflation, and reduced purchasing power.

Of course, compound interest income is taxable, unless the money is in a tax-exempt account. Typically, compound interest is taxed at the standard rate associated with your tax bracket, and if portfolio investments depreciate, your balance may drop.

Invest with compound interest

An investor who opts for a dividend reinvestment plan (DRIP) in a brokerage account is essentially using the power of compound interest on whatever they invest in.

Investors can also experience compound interest when buying coupon-free bonds. Traditional bond issuance provides investors with periodic interest payments based on the initial terms of the bond issuance. These are paid to the investor in the form of checks, so the interest rate is not compounded.

Zero-coupon bonds do not send interest checks to investors. Instead, this type of bond is purchased at a discounted price compared to its original value and grows over time. Issuers of zero-coupon bonds use the power of compound interest to increase the value of the bond so that it reaches its full price at maturity.

Pooling can also be useful for you when making loan payments. For example, paying off half of your mortgage twice a month, instead of paying it in full once a month, will cut down on installment time and save you a significant amount of interest.

Conclusion

At the present time, there are many options for a person to increase his wealth from a free amount of money, such as investing in cryptocurrencies, securities, savings, or buying gold … And compound interest lending is also an option worth considering because of its quickness, convenience, and high profitability. However, long-term lenders need to take into account all possible possibilities, especially inflation in the context of a volatile global financial situation. Ecoinomic.io wish you the right investment decision!

See also: The most detailed Hotbit Registration Guide for Newbies