Advertisement

Derivatives have been around for a long time in the world. It is one of the oldest types of financial contracts that exist in the market. After the ICO craze, IEO, recently, the market is welcoming cryptocurrency derivatives as a new trend. It is being discussed a lot by investors, especially issues related to bitcoin or altcoin futures contracts.

Traditional derivatives are financial transaction contracts between two or more parties. It is based on the future value of a certain underlying asset. The underlying assets can be tangible assets such as gold, silver, and gemstones… or invisible such as stocks, bonds, and interest rates … Simply put, derivatives are other products, born from traditional products.

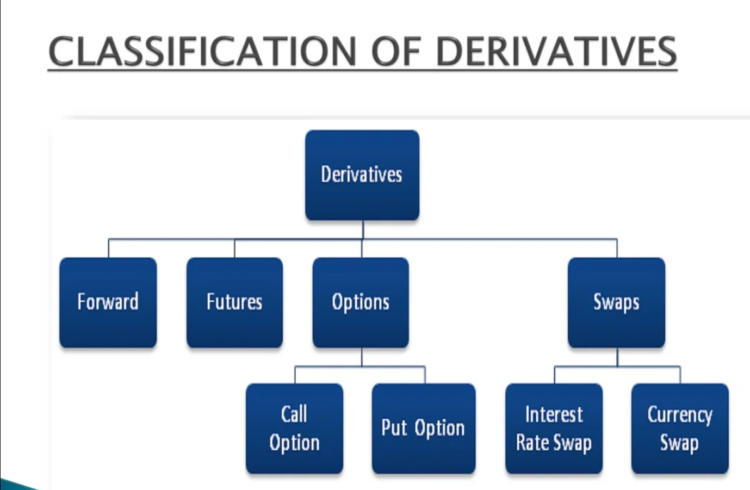

Common derivatives are Future Contracts, Options Contracts, Swap Contracts, Forward Contracts, etc.

According to the above definition, crypto derivatives are asset classes inherited from cryptocurrencies. Investor’s Derivative cryptocurrencies are based on the price of cryptocurrencies, rather than directly trading them.

It must be seen that the cryptocurrency market was born after stocks a lot, which is why cryptocurrency derivatives have only recently been born. However, it quickly gained buzz and strength from investors, which is expected to become the trend in the cryptocurrency world. Especially in the context of the Covid 19 pandemic the activity of the exchanges is significantly affected.

Overview of the cryptocurrency derivatives market

The first exchange to be licensed to trade Bitcoin derivatives was LedgerX in 2017 with the Bitcoin derivative being Swaps and Options Contracts. At that time, only authorized investors and institutional investors were licensed to trade Bitcoin derivatives on the exchange.

Bitcoin futures contracts were first launched in December 2017 by the Chicago Mercantile Exchange (CME) and the Chicago Options Exchange (CBOE).” CME holds up to 20% of global derivatives trading volume and is rated as the largest derivatives exchange in the world. Investors can trade derivatives on CME through suppliers or brokers.

At 07:00 on September 23, Bakkt’s physical Bitcoin futures trading was launched under the backing of the Intercontinental Exchange (ICE).” It is considered the third largest Exchange Group in the world (after CME and Hong Kong Exchange).

On July 1, 2019, there were 6 pure cryptocurrency exchanges that offered cryptocurrency derivatives. After exactly 3 months, this number nearly tripled (17 exchanges). This shows that cryptocurrency derivatives trading is becoming a trend in the Bitcoin and Altcoin communities, even traditional financial exchanges.

Factors in cryptocurrency derivatives trading

The purpose of any transaction, not foreign from cryptocurrency derivatives trading, is to make a profit. To do that, any investor before trading must understand the following factors.

Leverage (leverage)

This is a key factor in cryptocurrency derivative trading, it helps investors improve profits. However, it also comes with many risks. The higher the leverage, the higher the profitability, and the higher the risk, and vice versa.

Trading Fee (transaction cost)

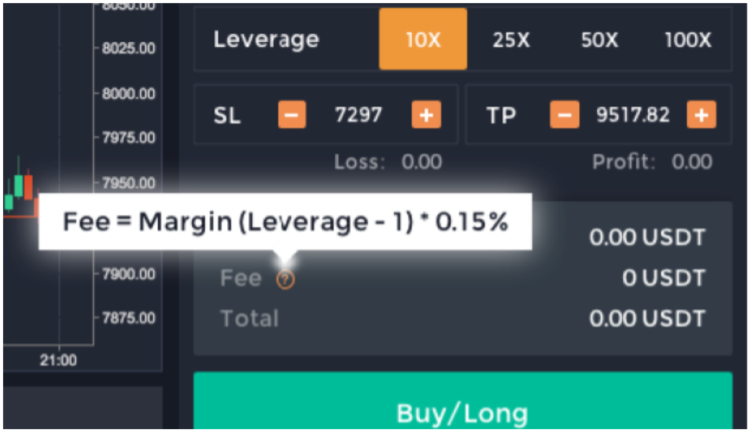

This is the cost that the exchange collects from each investor’s transaction. It’s the margin fee. In the transaction there will be leverage and investors will be able to Borrow margin for their trading volume, which is actually used as leverage. The beneficiary of the interest rate from this loan is the exchange.

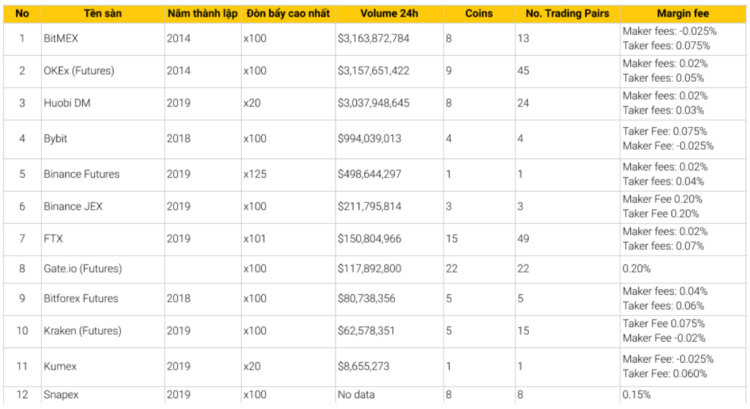

The trading fee of each exchange is different. It is calculated based on the trading volume of an order.

Overnight Fee (Overnight Trading Order Holding Fee)

This is the overnight trading fee that the exchange will collect additionally (considered as an interest rate) when the investor holds that trade overnight. For example, on Snapex, the Overnight Fee is 0.045% of the total loan volume, investors can calculate the specific fee as follows: Margin Fee = 0.15% of the total loan volume.

Margin Level = $100

Leverage Leverage Leverage = 10

Trading fee = Margin * (Leverage -1) * 0.15% = 100* (10-1) * 0.15% = $1.35

Overnight fee = Margin * (Leverage -1) * 0.045% = 100* (10-1) * 0.045% = $0.405

Trading volume

In derivatives trading, Leverage will push the volume of an investor’s order very high. If an exchange does not have enough trading volume, it will not be able to meet the needs of large capital investors.

Characteristics of cryptocurrency derivatives trading

Advantages

- Leveraged trading is a huge advantage of derivatives trading, especially in the cryptocurrency market. It helps to increase investors’ profits.

- Derivatives trading is simple. With Spot Trading, investors must have wallets to store and trade their cryptocurrencies. However, for derivatives trading, investors can deposit Fiat money directly or a certain type of crypto to trade.

- Derivatives trading supports two-way, i.e. making profits on both sides of the market. With traditional transactions, investors only profit when the price of crypto goes up. However, with derivatives trading, investors can profit from both sides of the market with Long orders when it goes up and Short when it goes down.

Disadvantages

- Having leverage is two-sided. If the market goes against expectations, the losses suffered by investors are not small. Moreover, all costs are calculated based on the ratio and multiplied by the corresponding leverage coefficient. That is, the higher the leverage, the higher the transaction fee.

- Derivatives trading will likely manipulate trading platforms based on Long or Short orders. For example, when a large number of Long orders appear but only at the low price threshold, the market will not move and stagnate. Then huge amounts of money will be executed through strong sell orders through these areas and liquidated them until those waiting to catch the bottom can not be able to hold the exit. Then the market will quickly restore its original state.

Classification of cryptocurrency derivatives by mechanism of operation

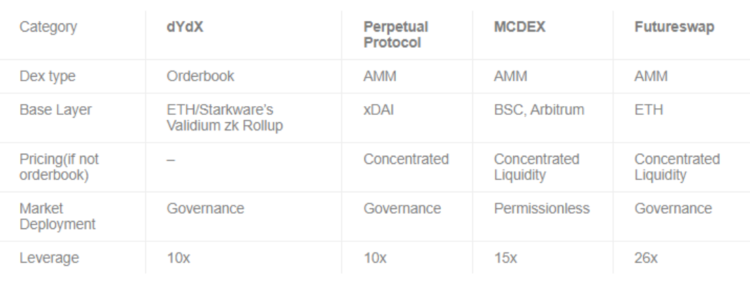

Order book

This is a data system that lists all sellers and buyers as well as transaction prices. This mechanism allows trading to execute orders only when the lowest selling price is the highest purchase price.

Based on this mechanism, investors can take the initiative in the timing and price of the order by pre-placing the desired price and waiting for the order to match. Based on the indicators shown, investors can be aware of some signs of price activity thanks to the trading volume to be able to make timely decisions in the trade. However, order books require a relative amount of liquidity to be able to execute trading orders completely.

AMM

This is an automatic liquidity delivery mechanism, which owns an exchange protocol based on mathematical formulas for valuing assets. The transaction between sellers and buyers will take place in a token pool called a liquidity pool.

See also: Full episode of DEX, AMM and liquidity pool.

The AMM mechanism works on two factors liquidity pool and liquidity providers. The liquidity pool provides tokens to users and liquidity providers offer token pairs in the liquidity pool to receive rewards from investors’ trading fees.

Application of cryptocurrency derivatives trading

The use of derivatives transactions in cryptocurrency trading allows investors to take financial actions. It can give investors greater returns, or it can also protect the portfolio from sharp market volatility.

Defensive ability

This is a popular application of cryptocurrency derivatives trading. This means hedging against market price fluctuations. For example, if Bitcoin falls in price, a derivatives transaction that makes a Bitcoin short (in anticipation of a short-term price drop) will be successful and make a profit. The core problem behind this result is that trading does not depend on the performance of the actual asset but rather a contract that speculates on the price movement of the asset.

Bitcoin miners may want to enter the cryptocurrency derivatives market to secure a portfolio of their mining operations. The more miners are active, the bitcoin’s hash rate and other difficulties of declaring will automatically adjust accordingly. That is, the value of the mining process will gradually decline over time. Improvements in mining technology give advantages to miners with improved conditions but are difficult for the vast majority. At this time, derivatives trading takes on the role of limiting risks for miners and protecting investors.

See also: NFT Membership – The Future For Businesses And Their Customers

This is another case where derivatives trading can be made when the number of Long and Short positions can be tracked. When combining price action with the development of the cryptocurrency network, investors can grasp useful information about market sentiment. From there, speculative trading positions can assist investors in accurately predicting future market movements and values.

Comparison of the spot cryptocurrency market (Crypto Spot) and crypto derivatives

| Market | Crypto Spot | Crypto Derivative |

| Volume in 24 hours | $55B | $7.5B |

| Number of exchanges | 370 | 17 |

| Average volume | $0,15B/exchange | $0.44 billion/exchange |

Conclusion

Derivatives in general and cryptocurrency derivatives in particular both have certain requirements and risks for investors. One of the biggest risks when trading derivatives is the liquidation of positions.