Advertisement

What are Terraformers?

Likened to the “World Tool for the Terra Ecosystem”, Terraformer provides developers and creators with the tools they need to raise capital, increase liquidity, and counter-maximize the likelihood of success for their projects.

The platform is designed to provide a hub where early-stage Terra ecosystem projects can launch in an efficient, sustainable way while bootstrap the initial user base and manage their original token offering.

Terraformer’s original utility token, also known as TFM, plays many roles in the Terraformer ecosystem. Used to access both early-stage token sales as well as unlock exclusive interests on Terraformer DEX.

The platform is being managed and built by a team of experienced financial experts and business development professionals. Leading the project is Pedro Pereira, CEO of Terraformer and a successful strategic developer who has previously worked on a number of projects by the European Commission and the European Space Agency.

Dao Maker’s co-founder, CMO and Chief Strategist, Hassan Sheikh, joined as principal advisor, helping the company streamline its trading process and maximize market share.

See also: Crypto’s Uses And Misuses: Quarrel Between Reuters And Binance

How does Terraformer work?

Allow both early-stage projects and developed projects to raise capital through a variety of token selling formats. Includes initial DEX offerings, auctions and liquidity bootstrap groups.

In addition to supporting money increases for utility tokens Terraformer supports a variety of NFT selling formats – allowing artists and NFT-backed projects to easily raise funds and distribute their assets to users.

While the platform is primarily interested in helping projects raise funds and reach their goal milestones, Terraformer also has a number of extra features. These include:

- An Automated Market Maker (AMM) type DEX: Terraformer’s AMM will primarily focus on low-cap tokens. The newly launched asset built on Terra will be directly connected to the platform’s token offering solution – allowing startups to easily list their tokens after raising capital.

- Liquidity promotion tool: Terraformer will offer a variety of white-label LP farms, helping projects increase liquidity, reduce circulating supply, and better manage the liquidity of their original assets.

selling formats The platform divides users into one of 5 tiers based on the number of TFM tokens deposited. At the top end of the spectrum is the rank ‘Terraformer’, while ‘Lieutenant’ is at the end of the street. The more TFM tokens, the better the user has access to Terraformer’s IDO and other features.

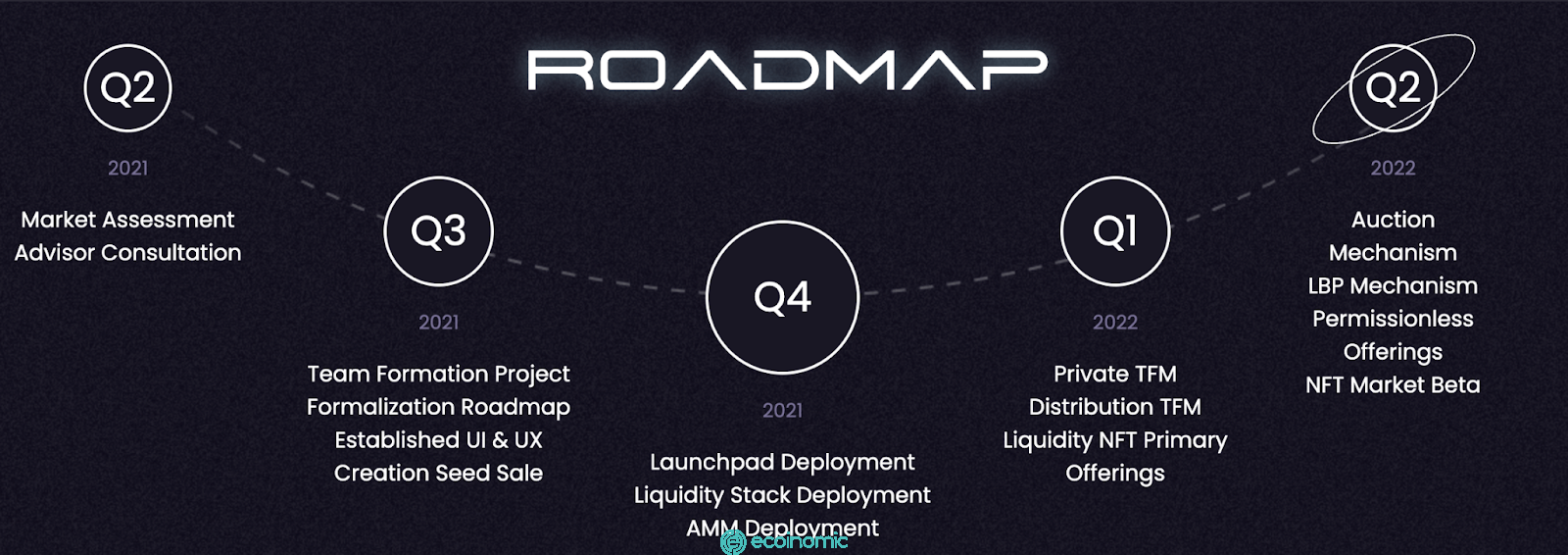

The platform was established in mid-2021 and is initially in the development phase. Although it has not yet been launched, its own original utility token, Terraformer, has conducted its first IDO and several other tokens are in the process of rolling out – including Knight Lands, Breach and DragonSB. Likewise, a basic version of DEX worked.

According to the official roadmap, in Q1 2022 Terraformer will begin to conduct NFT offerings and will complete the token creation event (TGE), while a series of additional token selling formats will launch in Q2 2022, along with a beta version of the Terraformer NFT Market.

See also: What Is DEX – An Important Role In The Crypto Economy?

What makes Terraformer unique?

Terraformer participated in multiple launchers aimed at attracting construction projects on Terra. Its differentiated strategy is to provide the entire set of tools and services that projects can use to not only raise funds but also continue to grow and succeed after launch. Some of its outstanding features include:

Built for Terra

Widely touted as the most powerful platform for next-generation financial applications, Terra recently became one of the five largest Smart contract platforms by TVL — thanks in large part to the success of platforms like Anchor Protocol and Mirror Protocol.

Terraformer wants to help grow the Terra ecosystem from its base by giving projects access to the financial resources and resources they need to launch and grow successfully. By focusing on quality over quantity, Terraformer aims to continue developing and applying Terra by providing the next generation of Terra-based financial products and services.

All-in-one launchers

Unlike many other launchers that are primarily focused on IDO, Terraformer allows projects to raise funds in a variety of ways, whether it’s IDO, fixed-rate swaps, auctions, or LBP. It also supports both the sale of replaceable and irreplaceable tokens, giving TFM holders access to a wide range of projects built on Terra.

It remains to be seen whether Terraformer can deliver on the promise of high-quality IDO. But so far, its ecosystem has a lot of prospects.

Automated Market Maker (AMM)

Terraformer allows projects to instantly list and provide liquidity to their tokens through the built-in AMM platform. Secondary market participants will be able to use DEX to be exposed to ongoing and Terraformer-related projects, giving them first access to some of the most sought-after projects built on Terra.

How does Terraformer compare to the Pylon protocol?

Terraformer is not the first platform to rely primarily on the Terra ecosystem. Others currently operating such as StarTerra, Pylon Protocol and Terra Pad are less well known.

However, Terraformer is said to be the most similar to Pylon Protocol in terms of its set of installation features, as it offers many things that are not just a simple project platform but offer a wide range of other tools and features to better organize their launch and development.

Pylon Protocol’s startup platform, called Pylon Gateway, is a platform that allows users to deposit Terra savings (UST) to earn tokens of projects launched by the platform – essentially trading their profits to gain access to new projects.

Terraformer, on the other hand, uses a traditional launch pad approach that allows users to bet on TFM Tokens to unlock the rank, then determine the size of their investment. This feature provides a lower entry barrier that keeps users from being limited by the size of stablecoin deposit yields.

Besides, Terraformer and Pylon Protocol vary in the range of additional features they offer. Although Terraformer offers more capital raising options than Pylon Protocol, the main feature of Pylon Protocol is to provide a platform for profit-based recurring subscriptions and payments.

In addition, Terraformer is primarily interested in features that aim to maximize the success of the projects it has launched, ensuring investors have the best chance of generating their return on investment. So far, no launch pad has prevailed on Terra. That proves that, terraformer launches, the competition is definitely heating up.