Advertisement

An investment strategy is essential to limit risk and minimize the impact of price volatility in the cryptocurrency market. In particular, DCA is an effective method for capital allocation and portfolio management.

In the following article, Ecoinomic.io will analyze the benefits of DCA and how to apply this strategy to optimize profit.

What is DCA?

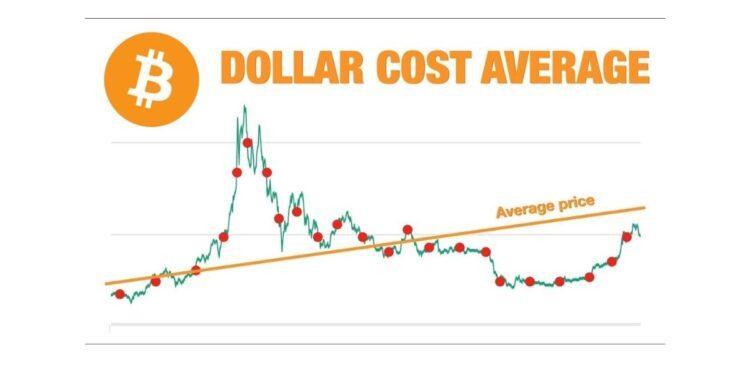

DCA is a dollar-cost averaging strategy, investors divide their capital investment into small part in different period of time instead of investing it all in one go.

In the highly volatile cryptocurrency market, DCA helps reduce the impact and price risk on the portfolio, shortening the break-even time.

DCA implementation process

- Select potential coins based on the assessment of factors: large capitalization, strong team, development path in the short and long term.

- Allocate funds and investment cycles, dividing funds into small part at certain ratios depending on financial capabilities and risk appetite.

- Choose the right form of DCA.

DCA formula

- The number of new tokens/coins purchased is less than the number of previous purchased tokens/coins

Weak DCA = (Previous purchase price x number of previous tokens/coins bought + new purchase price x number of new tokens/coins purchased) : total number of tokens/coins purchased.

For example:

On August 30, 2022: buy 1000 USDT for $2.

On August 31, 2022: buy another 500 USDT for $1.5.

In particular, the total amount of USDT purchased is 1500.

DCA = (1000 x 2 + 500 x 1.5) : 1500 = $1.83.

- The number of new tokens/coins purchased equals the number of previous tokens/coins purchased

Equilibrium DCA = (previous purchase price + new purchase price) : 2

For example:

On August 30, 2022: buy 1000 USDT for $2.

On August 31, 2022: buy another 1000 USDT for $1.5.

In particular, the total amount of USDT purchased is 1500.

DCA = (2 + 1.5) : 2 = $1.75.

- The number of new tokens/coins purchased is more than the number of previous tokens/coins purchased

Strong DCA = (Previous purchase price x number of previous tokens/coins bought + new purchase price x number of new tokens/coins purchased) : total actual number of tokens/coins of times

For example:

On August 30, 2022: buy 1000 USDT for $1.

On August 31, 2022: buy another 3000 USDT for $1.5.

In particular, the total amount of USDT purchased is 1500.

DCA = (1000 x 1 + 3000 x 1.5) : (1000 + 3000) = $1,375.

Advantages and disadvantages of DCA strategy

Advantages

- Reduce price risk in the face of market fluctuations, increase the liquidity of assets.

- Balance the portfolio and help the asset have long-term potential.

- Help investors build a disciplined investment strategy, avoid emotional investment decisions.

Disadvantages

- The greater the number of transactions, the higher the transaction fee.

- The target profit is only average which is not the optimal solution for short-term investors.

- Time-consuming because investors have to trade many times.

Notes when using the DCA strategy

- DCA should not be applied when trading margin, or futures. The higher the leverage ratio, the greater the risk, investors may face the risk of margin call.

- It is not recommended to choose illiquid altcoins or altcoin/BTC pairs. DCA should only apply to top potential coins such as BTC, BNB, ETH,… on reputable platforms.

- DCA is only effective for holders with long-term investment goals, which is not suitable for day traders who seeks profits based on the rise/fall of the coin price.

- Investors need to develop an effective capital management plan, avoid being psychologically affected by market fluctuations.

FAQs about DCA

When to stop DCA?

In fact, investors should not stop DCA. Besides, investors can also apply DCA strategy when selling assets.

Does DCA make a high profit?

In fact, dollar-cost averaging is not a strategy that generates high profits. However, when applying effectively DCA, investors can optimize their profits based on target assets and personal expectations.

Is DCA safe?

DCA is a relatively safe investment strategy that avoids significant price fluctuations in the market. However, that doesn’t mean you’re guaranteed a positive cumulative return if you don’t apply an efficient DCA. DCA is only suitable for long-term investors.

DCA method offers opportunities for newcomers to the investment market in the same way as veteran investors, even when they don’t have a good knowledge of crypto market and investment time.

However, experienced cryptocurrency traders do not invest a fixed amount on certain days of the month but use corrections as a buy signal.

Conclusion

DCA is a simple tool that helps investors accumulate potential assets in the long term. Holders need to assess the potential of the coin and consider the investment prospects to develop an effective capital allocation plan.