Advertisement

Futures and Margin trading are 2 methods of trading in the cryptocurrency markets. These are 2 forms of trading using high financial leverage, which require in-depth trader experience. Financial leverage is “it cuts both ways”, it can help your account increase multiple many times very quickly, however, that can also make the wallet emptied at any time. In this article, Ecoinomic.io will let you understand: What is Futures trades. What is margin? The difference between Futures and Margin.

What is futures?

Besides Spot trading ( basic trading), Futures trade is the advanced trade that many investors prefer because you can make a profit even if the market increase or decreases.

Futures trading allows traders to bet on the future prices of underlying assets – be it stocks, baskets of stocks, gold, cryptocurrencies (Bitcoin, Eth, BNB, ,…), or basic commodities such as oil, food, gold, silver, nickel… In crypto futures trading, investors can choose a Long order against 1 specific cryptocurrency to buy it on a specified future date. On the contrary, there will be other investors who believe that the price is down, then they place a Short order, that is, a short sell order – although they do not currently have that amount of cryptocurrencies, but on the specified future date when the contract is liquidated they will have to buy the coin at the market price to sell to the person who placed the Long order.

Futures trading is a Zero Sum Game: When the price rises, the person who places the Long order makes a profit, the person who places the Short order loses money. When the price falls, the person who places the Short order makes a profit, and the person who places the Long order loses money. Money is not born and lost by itself, it is only from one person’s to wallet the other.

Bitcoin Futures trading is currently the most popular type of crypto futures contract.

Advantages of Futures Trading

- When trade futures contracts, with a good investment strategy, can help you make a profit whether the market is up or down.

- Using leverage, in Futures trading can increase their profits increase multipiler.

- Many traders use futures trading as hedging against the market, which makes it trusted by many investors for any portfolio.

Disadvantages of Futures Trading

- Unusual changes in the future may be fortunate but also a threat to your property.

- New investors, who lack of experience using leverage when trading futures contracts will lead to significant losses even losing all the money.

What is margin?

Besides Futures trading, many investors in the cryptocurrency market are also very usual of using Margin trading as a way to increase profitability. Margin trading allows investors to Borrow money from a cryptocurrency exchange and use it to make trades. This allows the investor to be able to use an amount of money several times greater than the capital spent.

This allows investors to increase the efficiency of profitability. In case if your investment suffers losses when trading margin, you should attention to liquidation price. If the loss exceeds the liquidation price relative to the entry point, the exchange will automatically execute the liquidation order. This is done so that traders only lose their own money and not the money the brokers have lent them.

Advantages of Margin Trading

- Increased profits and increased purchasing power give you the opportunity to buy more cryptocurrencies than money in your wallet. The more cryptocurrencies you own, the greater your potential profit if the market change in line with your expectations.

- Diversify the source of income, when you use Margin it will allow you to be able to buy many cryptocurrencies when you are not 100% sure of 1 fixed cryptocurrency now with large amounts of money you can diversify the investment to minimize risks.

- Flexibility when paying, the amount you have borrowed does not exceed the specified margin maintenance requirements, and you can repay your loan easily before the set time.

Disadvantages of MarginTrading

- The risk of losing more money, when using Margin can give you a chance to achieve more profit, it also leads to the risk of losing more money than a regular trade.

- Incurred cost, because it is borrowing money from exchanges to invest, so you will also have to add another small fee called loan interest. It works similarly to the bank’s borrowing mechanism but the interest rate is higher so if this situation persists it will cost you high costs.

- Cryptocurrency trading needs a high concentration. Especially in Margin trading, when you borrow assets from a third party (exchange), you will have to make a high profit in short time, if you do not want to bear interest on the loan for a long time.

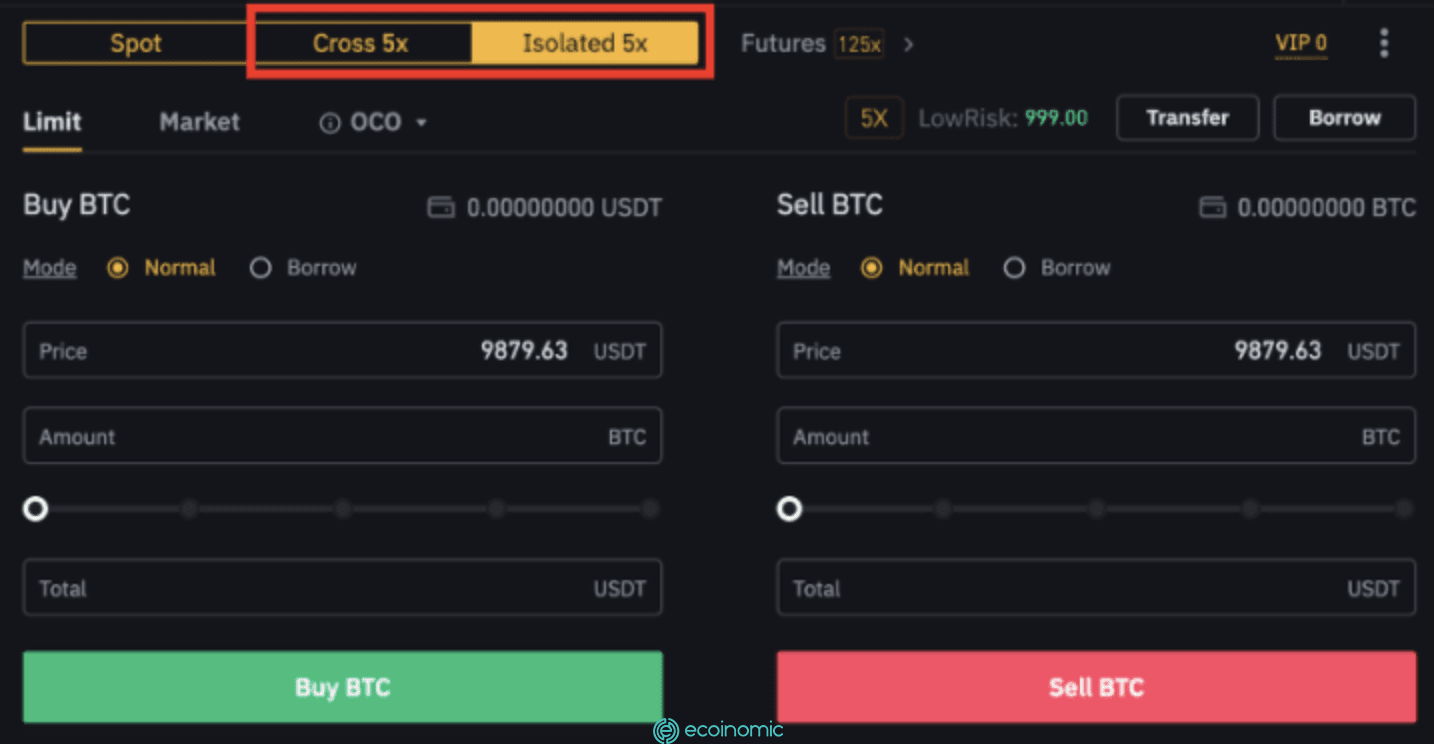

Isolated Margin and Cross Margin Trading

Currently, margin trading platforms and Futures trading on many major exchanges such as Binance, FTX, Coinex,.. there is already Isolated Margin and Cross Margin support. These are also 2 popular forms of trading in the cryptocurrency market. Before deciding to invest, in this section, we will help you better understand Isolated Margin and Cross Margin and illustrate the differences between two types of investment, to minimize risks for investors.

Cross margin:

- Cross Margin is a mode that allows all investors to use all margin balances in your Futures/Margin market to avoid liquidation . When your investment is at a loss and reaches the liquidation level, the investor will lose all margin asset balance and open positions. To put it more simply, Cross will use the entire balance of your account to avoid liquidating your position. Overall comment this is an investment strategy that can bring great profits but comes with a very high risk.

- Cross Margin example: You invest $200 and the Margin balance in your Futures/Margin account has $2,000. And when the position is at risk, it will automatically deduct from $2,000, which you will be liquidated until the funds in the account run out.

Isolated Margin:

- Isolated Margin the amount of margin in the Futures/Margin account of the position will be limited to 1 certain interval. In case when your investment is at a loss and falls below the maintained margin level, your position will be liquidated. However, for Isolated will allow you to add or remove Margin as you like. Simply understood , Isolated users will only have to spend the maximum amount of your money signed and only preserve the money that is in the account. It can be clearly seen that Isolated is a form of investment with a lower level of risk than Cross. Isolated helps you allocate assets to Short/Long positions, avoiding ambiguity between positions, and “separating” funds from different open positions. This reduces risk in case your open positions go against the market. Thereby helping you to better manage the overall risk.

- Isolated Margin example: If your open position is $100. If you run a risk, then you only lose $100 and will not be deducted from the amount in your wallet

General comments:

- If you are a new trader then you should choose Isolated Margin. Because it has a lower level of risk compared to Cross Margin, this makes it easier to manage risk. If you are “gambling person” and prefer to use x125 leverage in the Futures market, this should also be kept in mind.

- If you are someone who already has experience in cryptocurrency trading, Cross Margin will be suitable for you if you are someone who wants to make a quick profit. Since Cross margin will use the entire balance in your margin wallet, you should be aware when using too high leverage.

Compare Margin and Futures

Similarities between Margin and Futures.

Both Margin and Futures 2 trades can use financial leverage to generate many times more profit than regular trading

- Can help you make a profit whether the market is up or down. You can significantly increase your profits if you make predictions that are true to the trend of the market.

- Diversify your portfolio with a small amount of capital.

- The higher the risk when you use leverage, the easier it is to liquidate the asset.

- Vulnerable to price manipulation by “whales”, causing the account to be liquidated quickly.

The difference between Margin and Futures

| Margin | Futures | |

| Leverage factor | With each Coin, there will be a certain level of leverage. Moderate leverage Example: Binance exchange for x10 leverage | Change the leverage level within the limit. Very high leverage Example: Binance exchange for x125x leverage |

| Market | The actual market. Volatility based on the spot market | Derivatives markets. Volatility is simulated based on the Spot market, but with large spreads. The data is calculated based on the futures contracts of buyers and sellers. |

| Costs | Incurring expenses due to interest on the loan | Avoid incurred costs. This is an advantage with long-term holders |

| Level of risk | Less risky than futures. | Higher Margin Risk |

Conclusion

And that is all the basic knowledge about Margin and Futures Trading as well as the similarities and differences between them. In the coming articles, Ecoinomic.io will guide you in more depth about Margin and Futures. You will be guided in detail on how to trade on different exchanges.

See also: Margin and Futures on Binance – What are the differences?