Advertisement

While learning about market trends, you may often see updated articles about whales moving assets on the exchange, or buying a large number of Bitcoin. So where is that information sourced? That’s on-chain data.

What is on-chain data? In this article, Ecoinomic.io will go into detail about On-Chain Data and its importance in investment decisions.

What is on-chain data?

On-chain data is data stored on the blockchain that includes information on all transactions that have occurred on a blockchain network. These data are aggregated in a public, decentralized ledger system, allowing anyone to verify transactions recorded on the blockchain.

Whenever you perform an interaction on the blockchain, that action is saved and on-chain data is generated.

On-chain data classification

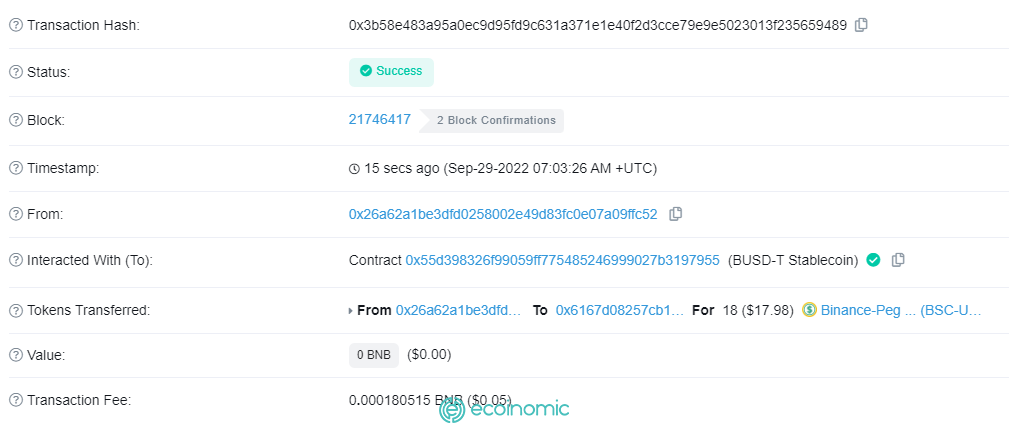

Transactions data

Data about transactions includes the wallet address sending and receiving tokens, the number of tokens transferred, any fees paid by the transaction owner, or the balance at both wallet addresses after the transaction is completed.

Block data

The block data shows the time that the block was validated, the gas fee required to successfully validate, the block reward awarded to ̣̣ miners (for each transaction miners are rewarded with a certain amount of BNB taken from the transaction fee), and some other information about the block.

Smart contracts data

Interactions with smart contracts are recorded on the blockchain. Examples include adding liquidity, token swaps, token transfers, and other interactive operations.

Benefits of on-chain data analysis

On-chain data covers all the activities on that blockchain, so if you know how to mine, you can find out the wallets that are working on the blockchain, how many people have invested in the project, and more.

On-chain data analysis can help investors answer a variety of questions from simple to complex and get a better overview of the market.

Reliable and accurate information

All activity on the blockchain leaves its mark. On-chain data therefore reflects the truth of what happened and provides the most accurate and objective information. Given blockchain’s dominance in transparent and clear transactions, it is no coincidence that most money laundering and crypto hackers fail.

On-chain data analytics make it easier for businesses to track stolen cryptocurrencies. to recover and keep users safe.

Fast real-time updates

Another benefit of on-chain data is the ability to record real-time transaction information. All activity on the blockchain is updated quickly when transactions are executed.

Many users use it to monitor whale wallet activity in the market for the purpose of predicting future trends. The reason is that these wallets hold large amounts of high-value cryptocurrencies, so once you transfer your funds to an exchange or start collecting or selling them, some of them have the power to change the market. Because it will have a big impact.

A launching pad for investment decisions

In volatile cryptocurrency markets, on-chain data plays an important role in analyzing market direction in order to formulate appropriate investment strategies. There are many ways to extract market information from on-chain data.

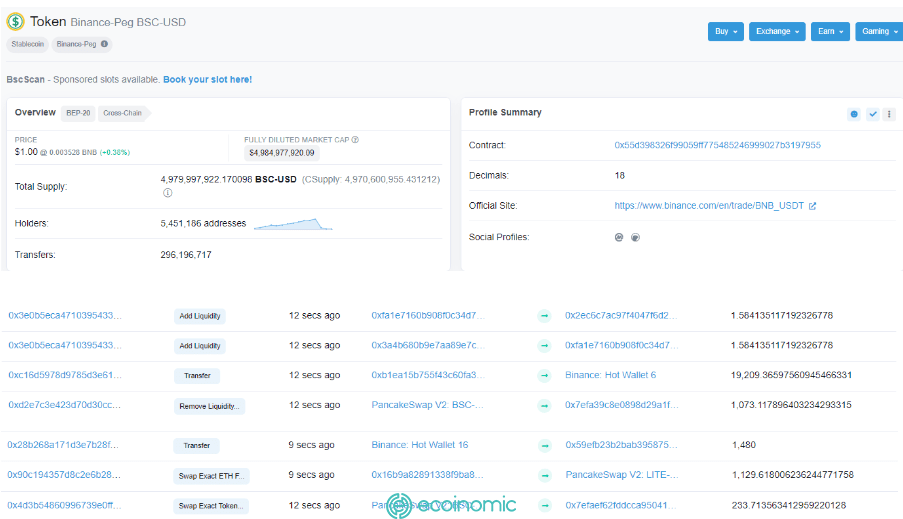

First, on-chain data allows you to see basic information about your project token, such as the token’s trading volume, number of token holders, and recent fluctuations in the token’s buying and selling power. Users can browse on-chain data to assess project potential.

In addition, monitoring the project team’s wallet helps to check cash flow, assess whether the project is fraudulent, and avoid unnecessary risk.

Contact to project roadmaps, many projects released tokens from developer wallets to generate profits, causing the price of tokens to plummet to the point where they were no longer worth it. It cheats others by sending tokens to wallets with no liquidity and trading volume, and steals tokens from users’ wallets by simply buying them without selling to impersonate other projects.

Another example of investment risk: If the Total Supply of tokens is 10 million, but 6 million of them are owned by a single wallet, the future of the project and the price of the tokens can be significantly dictated by just one person. may be influenced. – Linkage data analysis can help consider this risk.

Comparison of on-chain and off-chain data

Off-chain data, also known as real-world data, such as data on financial markets, transactions without blockchain. In stark contrast to on-chain data, off-chain data is any data that is off the blockchain, including transactions on crypto-related intermediaries, but does not transact through cryptocurrencies but uses the currency on their application.

Off-chain transactions do not have to pay gas fees like on-chain transactions, but will be subject to fees from intermediaries or do not have to pay fees depending on the agreement of the parties. If on-chain transactions stand out for their publicity and transparency, then off-chain transactions are private and non-public, and the data from these transactions is also not kept on the blockchain.

Tools to support On-chain data analysis

Blockchain Explorer

Blockchain Explorer is the most basic tool that displays all on-chain data, each blockchain has its own discovery, such as EtherScan, BscScan, TronScan,…

This is a reliable source of on-chain data, however the features do not support advanced on-chain analysis, but merely provide data.

Santiment

Santiment provides on-chain data on the market since 2009. This tool supports data up to nearly 2000 cryptocurrencies and NFTs on 5 blockchains.

In addition to the actual on-chain data, Santiment provides analytical tools and charts on market sentiment, community trends of projects, whale activities and research on investor behavior during price changes.

CryptoQuant

CryptoQuant provides market data and on-chain data via APIs, and is commonly used to analyze on-chain BTC, ETH stablecoins and some altcoins.

CryptoQuant provides on-chain data analysis of whale activity, miners, indicators of buying and selling pressure, market trends, fluctuations in the number of cryptocurrencies on exchanges such as Binance, Huobi.

Other features such as social networking allow the display of short analyses of users using the data provided by CryptoQuant.

Glassnode

Glassnode has features similar to CryptoQuant, including the Glassnode API, which provides live on-chain data, and the Glassnode Studio, which aggregates data into charts that help users explore on-chain data metrics.

The platform also provides market analysis from the Glassnode team. There are also in-depth analyses focusing on advanced innovations and developments in the Ethereum and DeFi ecosystems.

Nansen

Nansen is an on-chain data analytics platform that owns a data warehouse containing millions of labeled wallets. These labels help users classify wallets based on characteristics such as NFT collection wallets, specialized wallets for transactions, wallets containing project tokens, and many other wallet properties.

In addition, on Nansen’s dashboard, wallets are also tied with emojis, which are a visual representation of the type of wallet.

In addition, some other prominent on-chain analysis tools that you can refer to are: Token Terminal, Messari, IntoTheBlock, Dune Analytics.

Some notes when analyzing on-chain data

- Equip knowledge and experience: on-chain analysis tools only play a supporting and informational role, to understand and use those tools effectively, you must equip yourself with the basic knowledge as well as a multidimensional perspective to evaluate information.

- Regular updates: on-chain data takes place in real time, and activities in the market are constantly changing, so updating information regularly is the key to capturing investment opportunities quickly.

- Synthesis and reconciliation of multiple information sources: there are differences in on-chain data in some platforms, due to bad data collection mechanisms leading to false information. So to make investment decisions based on on-chain data, you should perform data analysis in large volumes, and from many reliable sources to ensure the accuracy of the information.

Conclusion

On-chain data is the first choice for updating and capturing market trends, and equipping knowledge and skills to tap into this source of information is essential.

Through this article, Ecoinomic.io want to help you better understand on-chain data as well as use on-chain data analysis tools to make appropriate investment strategies.

>>> Related: Binance Smart Chain Ecosystem Overview