Advertisement

After blocking withdrawals from consumers, lengding platform Celsius Network is said to be preparing its "bankruptcy" process.

The Wall Street Journal reported on The Morning of June 15, in preparation for the "debt restructuring" process Celsius Netword had hired law firm Akin Gump Strauss Hauer & Feld LLP. At this point, the lending platform has become the focus of the cryptocurrency market sell-off.

According to the WSJ, Celsius is considering financial resources from investors, while also not ignoring other possibilities such as restructuring the company.

Crypto lender Celsius hires restructuring lawyers after account freeze – WSJhttps://t.co/t3UXRJEWCF

— IGSquawk (@IGSquawk) June 15, 2022

Celsiu announced a successful $750 million fundraising with a valuation of $3.25 billion in November 2021, and many major investment institutions have joined the fundraiser, including Canada's second-largest pension fund. Due to major fluctuations, from putting money into the hacked project to investing in LUNA-UST, to stETH, within 6 months Celsius' inspection has been significantly eroded, the numbers have reached an alarming threshold.

The project's Twitter page posted the latest update a few hours ago with the following statement:

.@CelsiusNetwork is working around the clock for our community. It’s all hands on deck, so there will be no Twitter Spaces this week.

— Celsius (@CelsiusNetwork) June 14, 2022

"Because the Celsius community has worked hard. There will be no exchanges on Twitter Spaces this week because all the personnel have their own tools."

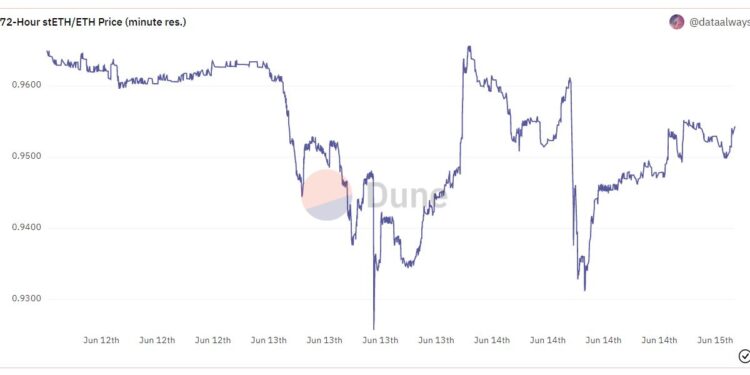

Ever since the stoken coin started stETH – which represents ETH stacking on lido slipped against ETH on curve – Celsius' problem has officially begun. This is because many people fear that the project will no longer have enough liquidity to check users and conduct massive withdrawals because the majority of Celsius' assets are in the form of stETH.

On the morning of June 13, Celsius caused a panic in the crypto market with the announcement of blocking, withdrawing and trading on its own platform. This has caused the price of BTC, ETH and many large altcioins to plunge to their lowest levels from December 2020 to January 2021.

Many people have "dug back" Celsius' announcement on Twitter that in bad cases such as default, bankruptcy or incapacity of financial autonomy, the crypto assets of users in the Earn service or collateral in the Borrow service may not be recovered and users will have no rights to Celsius externally. except to become a creditor of this platform in accordance with the applicable law.

Oof pic.twitter.com/vrQ8SQHwle

— icebergy ❄️ (@icebergy_) June 13, 2022

In response to liquidity Celsius still actively mortgages the remaining snar assets with the aim of maintaining dai loan orders on Maker. As of the morning of June 15, Celsius had spent 39,862 WBTC with a value of more than half a billion DOLLARS to borrow DAI 231 million. This is also the largest loan order on Maker to date. If the btc price falls to $14,000, the loan will be liquidated.

On June 13, Celsius' loan orders were assessed to be more stable: two $304 million loan orders on Aave and $217 million on Compound. Despite using collateral to spicy stablecoins, this is still all stETH and WBTC.

1/10 Celsius on-chain positioning update🧵

TL;DR: Significantly healthier.

Celsius continue to find more shekels, adding to their collateral across the board for 3 main positions:

1) Maker wBTC Vault now has a liquidation price of $14k, having paid down more of their DAI debt pic.twitter.com/UWBB1BUgAC

— DeFiyst (@DeFiyst) June 14, 2022

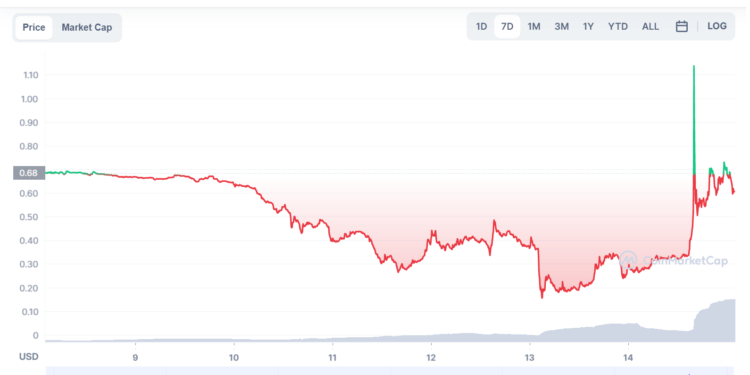

There was a surprise 300% increase in the price of CEL tokens on the evening of June 14, it is highly likely that this could be a "short kill" before the price drops back to the same.

After the two days of June 13 and June 14 continuously collapsed to 0.92 and 0.93, the stETH/ETH exchange rate is gradually showing signs of recovery when it reaches 0.95. Major hedge funds, including Alameda Research and Three Arrows Capital, said it could be attributed to the mass discharge of stETH in recent days. With the market situation going down, Three Arrows Capital has sparked rumors that it is facing a lot of difficulties before the situation.

—

Telegram: https://t.me/+XqnDmxy-bz0wMTE1

Group: https://www.facebook.com/groups/655607162536305

Fanpage: https://www.facebook.com/WikiBinancecom

Twitter: https://twitter.com/wikibinancevn