Advertisement

Many people are already aware of the risks of trading or holding cryptocurrencies. Even people who are not too interested in the cryptocurrency market have a certain understanding of the dangers. The volatility of some digital currencies, such as Bitcoin and Ethereum is the reason why many individuals and companies seek to maintain the value of their assets.

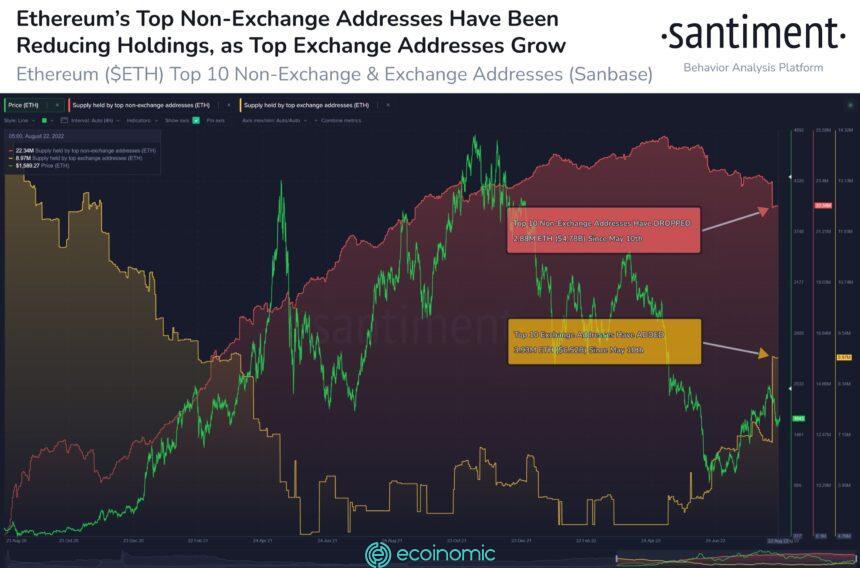

Ethereum whales are no exception, seeing a decline in the holding of non-exchange addresses, ETH whales have decided to transfer their holdings to on-exchange addresses.

One report found that, over the past three months, Ethereum assets in non-exchange addresses have dropped by 11%. Meanwhile, 78% are in whale exchange addresses.

The Ethereum Merge event and its value

One of the most important events in the cryptocurrency industry is the Ethereum 2.0 upgrade. Moreover, since the creation of blockchain, no event has been more important than the upcoming The Merge event. After this event, Ethereum’s PoW mining system will be moved to the PoS system.

The end of The Merge means that 2 of the 3 stages of the migration into the PoS system have been completed. Ethereum began moving to a PoS consensus in December 2020. This process begins with the introduction of a chain called Beacon. This is considered stage 1 of the transition.

Phase 2 of The Ethereum Merge process is expected to be completed in 2021. However, the plan was canceled due to certain delays in the process. This led to a change in schedule, bringing phase 2 into Q3 2022. According to the community, the final stage of the transition is the most important one. The purpose of this phase is to enable a number of important features, including reducing blockchain energy consumption and sharding.

According to a report from the community, the consolidation process will be 95% complete as of the predetermined date after the completion of the Goerli test network. Somehow, the news of The Merge positively impacted the price of the blockchain’s native token, Ether. This impact brought the price of Ether to a 6-month high of around $2,000. Although this was a great bullish move, hitting an important resistance level at the time caused the price to plunge early.

Data from then to date shows a decline in the price of several altcoins, including Ethereum. Moreover, market sentiment is also low.

This is becoming more and more apparent as The Merge approaches. In addition, the asset holdings of Ethereum whales have declined rapidly.