Advertisement

Fed rate hike “sledgehammer” in focus

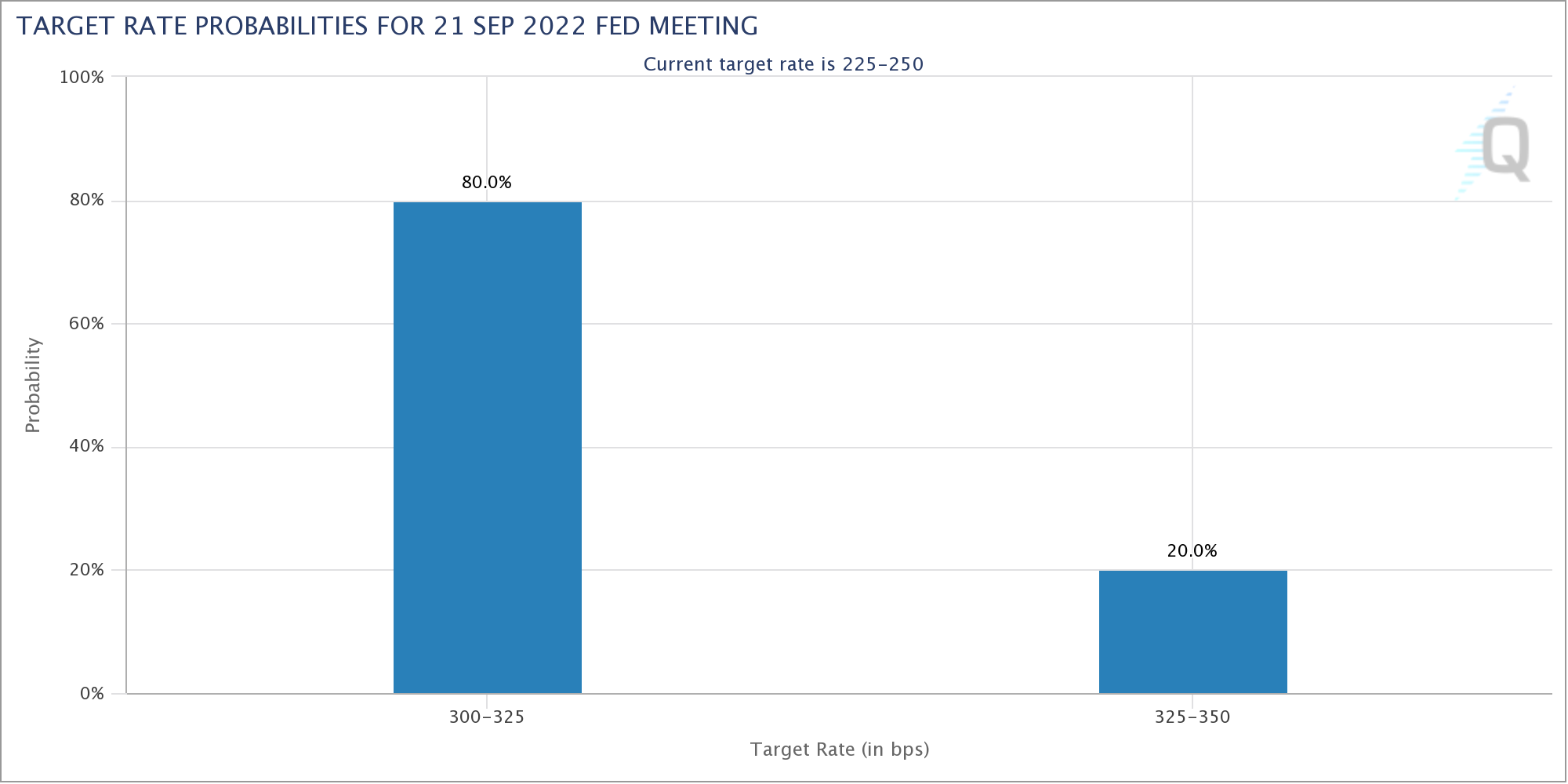

The Federal Open Market Committee (FOMC) will hold its meeting on September 20-21 and will release a statement confirming the price increase and the Fed’s support.

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, said that risk asset growth since March 2020 has gone too far, and it is now “very clear” that the reversal will hold. The cryptocurrency will calculate during the overall market reset, and Bitcoin will eventually come first. McGlone went on to reiterate a longstanding theory about the future of cryptocurrencies.

Gold will also be better, but for both, the pain must come first. A 100 basis point move this week would accelerate that process. Central banks outside the United States began raising interest rates to combat inflation.

Meanwhile, popular analyst account Games of Trades on Twitter said that this is a difficult time for the S&P 500 before it starts trading Wall Street.

“In times like this, with major uncertainty across the board, the crypto market is not gonna do much without permission from equities,” analyst and commentator Kevin Svenson added.

#SP500 has reached its “line in the sand” level.

This is the point of sink-or-swim. Fly-or-fall. Fish-or-cut-bait. pic.twitter.com/ZaCfAfcHcE

— Game of Trades (@GameofTrades_) September 18, 2022

Spot price sinks after poor weekly close

Over the past week, BTC price action fell. According to data from Cointelegraph Markets Pro and TradingView, BTC/USD lost more than $2,000 in a weekly candle, closing below $20,000, its lowest close since July.

The close was followed by a sharp downturn, in which BTC/USD fell below $19,000.

The bearish trend is perhaps understandable – Ethereum Merge has become an event that attracts top interest and together with macro triggers have contributed to the creation of new risk assets.

For now, analysts predict the chances of a downtrend at least until the Fed’s rate announcement is passed.

“BTC has chopped through the weekend, but there’s always potential for some volatility before the close.

Huge economic and FED announcements next week will make things spicy again,” on-chain analytics resource Material Indicators told Twitter followers in part of a post on Sept. 18.

An accompanying chart shows the current situation on the Binance order book, with support at around $19,800 since the failure to sustain price action.

Back in the day, Material Indicators argued that a deeper drop could hardly be avoided. Judging from the order book, bidding activity is still not strong enough to support current levels.

If #Bitcoin was really near THE BOTTOM, do you think there would be a liquidity gap between $18k – $18.5k, and wouldn't you also expect there to be solid bids at least to the June low at $17.5k? #FireCharts

I have no more questions. pic.twitter.com/Xstusqg2T8

— Material Indicators (@MI_Algos) September 16, 2022

Meanwhile, considering the timing of a possible macro bottom, prominent trader Cheds bet on Q4 of this year, suggesting that Bitcoin will be “on the right track” as such.

“$BTC weekly starting to press range lows,” he added in a further tweet into the weekly close.

At the time of writing on both Binance and FTX, short orders have been successively placed, indicating a concerted effort to drive the market down by derivatives traders. A well-known Ninja account argues, this will ultimately not succeed beyond Wall Street’s opening times.

U.S. dollar coils beneath multi-decade peak

Meanwhile, the US dollar has recovered from losses ahead of the CPI report.

The US Dollar Index (DXY) is currently just below 110, which has been consolidating for several days. The index reached 110.78, its highest level since 2002, in early September, while avoiding the risk of significant retracements. Hyland warned that a recession peak for DXY would be accompanied by a “speculative event” in risky assets.

We are heading toward a capitulation event

-Gold

-BTC

-StocksWe are also heading toward a blow off top of the US Dollar

When? No clue but there is nothing that says the DXY has topped

It's actually currently in position for the highest weekly close of the year: pic.twitter.com/UHrJfYsSQP

— Matthew Hyland (@MatthewHyland_) September 15, 2022

Meanwhile, a look at the inverse correlation between DXY and BTC/USD confirms the impact of the former’s strong upward moves on the latter.

Ethereum drops in price after the Merge

After the merger, Ethereum is experiencing a massive price drop. ETH/USD fell 25% last week, a move that could alter bitcoin’s Market Cap share. Eth is currently trading below $1,300, its lowest level since July 16, and analysts and traders worldwide expect ETH to continue falling.

Svenson warned that “Ethereum is not holding a critical support level” as the weekly closing price is unable to draw a line below the loss level. Meanwhile, analyst Matthew Hyland has set a $1,000 target for ETH/USD, adding that $1,250 “will be held as some support.”

$ETH There is also the grab of the $1355 low as I mentioned would be a good level to take out.

Will the bulls be able to run it back?

A 4H close above $1355 would be decent for the bulls. If not, I'd be targetting $1285 next. https://t.co/LZACSzzJok pic.twitter.com/Za2Ln5ydgj

— Daan Crypto Trades (@DaanCrypto) September 18, 2022

Compared to BTC, Ethereum has dropped as much as 19% over the week, while Bitcoin’s share of the total cryptocurrency market cap is up 1.2% since March 14. 9. Samson Mow, CEO of Bitcoin adoption startup JAN3 noted that while ETH/USD is currently above the 200 WMA level, Bitcoin is below its own equivalent.

#Bitcoin is trading 16% below its 200 WMA.#Ethereum is trading 7% above its 200 WMA.

ETH is down 6% for the day, while BTC is just down 2%. ETH is still trading at a premium based on Merge expectations and can go much much lower. ETH 16% below 200 WMA would be ~$1k. pic.twitter.com/jh7j13ivMd

— Samson Mow (@Excellion) September 18, 2022

The 200 WMA acts as an important trendline in the cryptocurrency Bear market and withdraws it after the loss as support once represented a strong comeback.

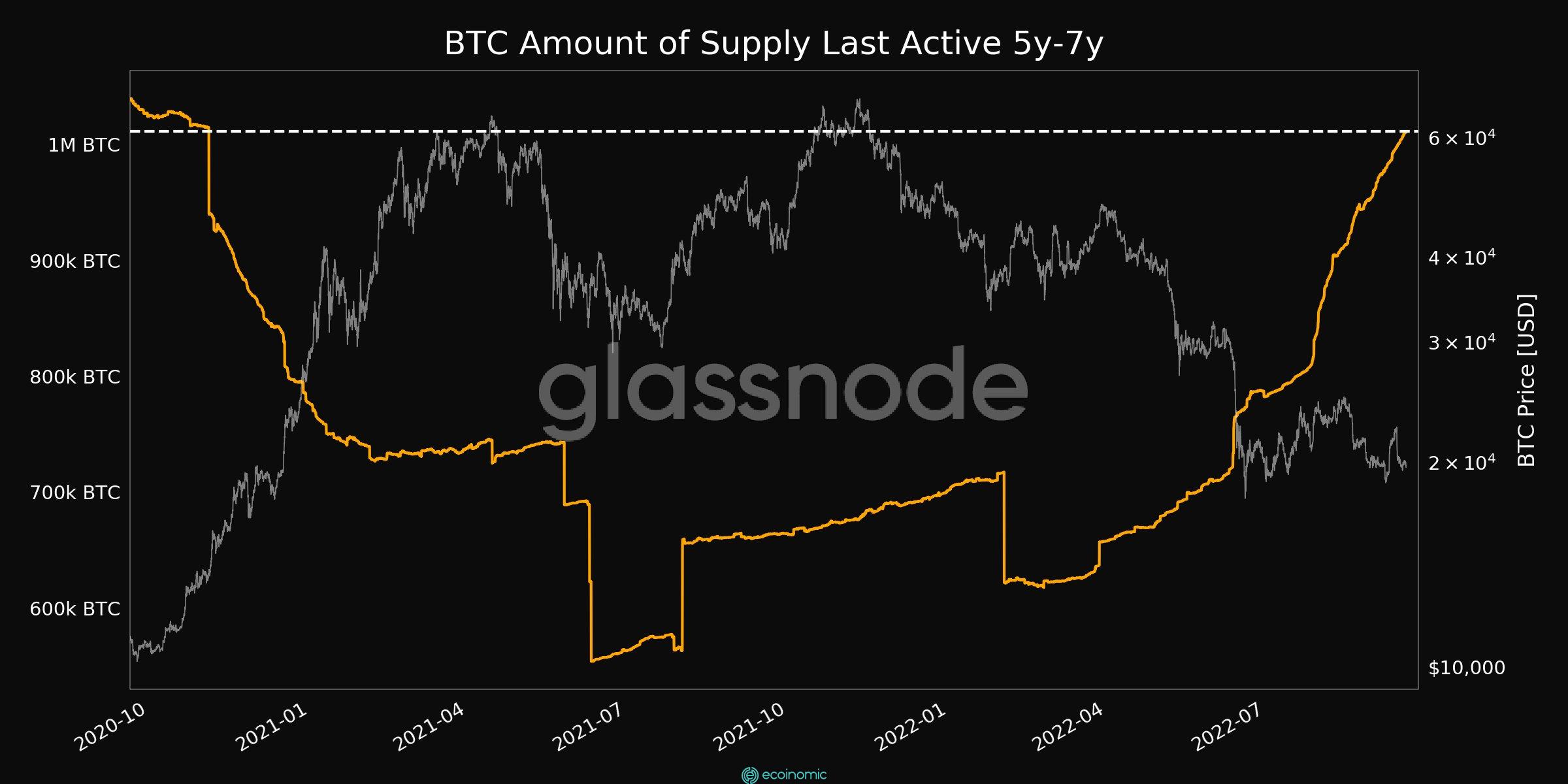

Dormant Bitcoin supply continues to age

Even as recent price volatility sees an increase in on-chain activity, the target is continued. According to analytics firm Glassnode, coins held for a period of at least 5 years show only an uptrend.

In new data for the day, Glassnode confirmed that the percentage of btc supply last active in September 2017 or earlier reached a new ATH level of 24.8%.

Meanwhile, the last active supply was five to seven years ago, reaching its highest level in nearly two years – 1.01 million BTC.

At the same time, “younger” coins are also shifting, with the 6-12 month bracket seeing its own 5-month highs. However, professional traders tend to make long-term investments in Bitcoin, as evidenced by the supply held by long-term holders (LTH).

“LTH Supply is the volume of Bitcoin which has been dormant for 155-days, and is statistically the least likely to be spent during market volatility,” Glassnode explained last week as the metric hit all-time highs of 13.62 million BTC.

Following the published CPI report, the one-day flow of Bitcoin to exchanges saw the largest number in several months.