Advertisement

This interest rate has been near zero for more than two years. Traders are now betting that interest rates will rise above 4.25% before central banks pause rate hikes.

Until the final rate — which remains a matter of disagreement among central banks — is announced, some economists predict rates will likely remain at that level until Inflation falls significantly — to a target of 2% (currently 8.3%).

Joe DiPasquale, CEO of crypto hedge fund BitBull Capital shared:

“If the Fed remains hawkish, we are likely to see markets test lower lows and remain muted until inflation figures appear to start improving.”

The FOMC stated:

“Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low.”

What’s next?

“My main message has not changed at all” since the Fed’s economic symposium last month in Jackson Hole. The FOMC is strongly resolved to bring inflation down to 2% and we will keep at it until the job is done,” Powell said at a news conference after the interest rate decision.

“What we think we need to do and should do is to move our policy rate to a restrictive level,” Powell said.

“Today, we’ve just moved probably into the very, the very lowest level of what might be restrictive,” he added.

Why is the market shaking so violently?

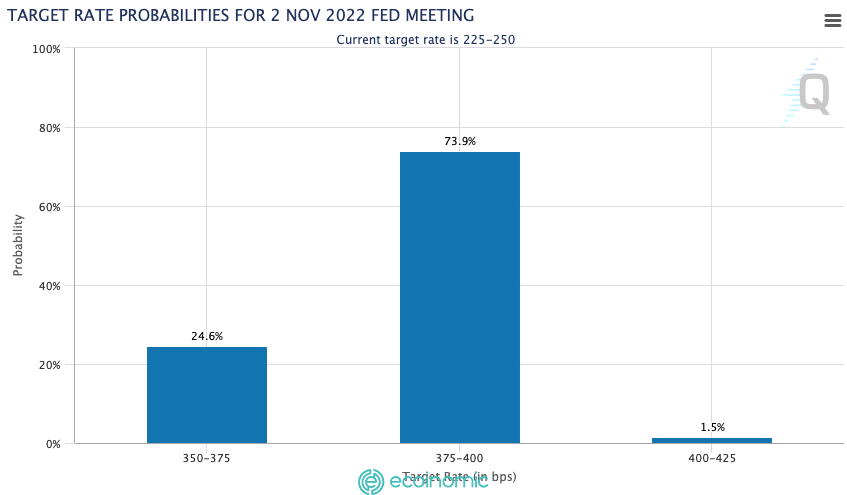

Before the official announcement of the Fed, the market had forecast 2 scenarios: the Fed would increase interest rate points by 0.75% (82% probability) or by 1% interest rate points (18%).

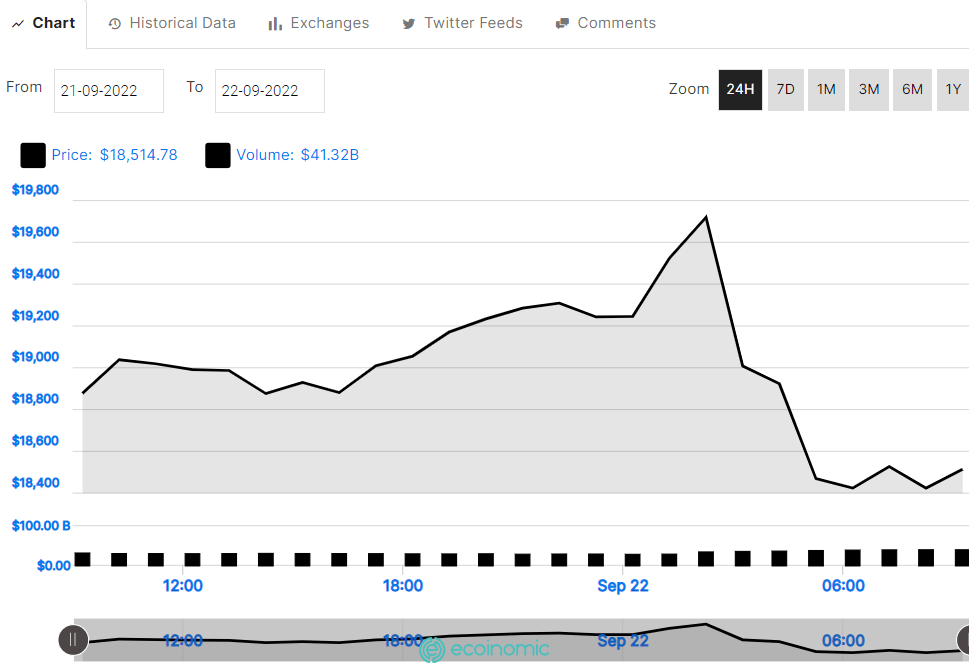

And the 0.75% scenario happened, The crypto market has been volatile following the Federal Reserve’s decision. Bitcoin quickly surged to $19,500, then slid to $18,900. Stocks also had big swings during Powell’s press conference.

The price movement of shares & crypto co-phases increased and decreased before and after the Fed announced interest rates.

The negative lies in the fact that traders in traditional markets have bet that a rate hike of 75 basis points is an almost probable scenario at the next FOMC monetary policy meeting in November. Just a month ago, that increase seemed unlikely.

The impact of the Fed’s policies on the cryptocurrency market

Alexandre Lores, director of blockchain market research at Quantum Economics, said:

“Markets are crazy in the short-term. Over a longer period I see this as a neutral or bearish move, and expect BTC and ETH to respond in a neutral or bearish fashion.”

Riyad Carey, a research analyst at cryptocurrency data firm Kaiko said:

“This is yet another reminder that crypto moves at the whims of the Fed. We saw this just last week when there was a sharper price reaction to the CPI release than to the [Ethereum upgrade] Merge. I don’t foresee crypto, especially BTC and ETH, bucking the Fed’s influence any time soon.”

“With Fed terminal rates in the mid-4% range, one thing we continue to hear is markets’ interest in real-world yields on-chain. This is a growing area, with on-chain credit to electronic market makers being the bulk of it.”

The total number of Derivative orders liquidated in the past 12 hours is more than $290 million, concentrated mainly in ETH and BTC.