Advertisement

Users stuck with money in the FTX exchange are having difficulty waiting for bankruptcy proceedings from the courts. On the other hand, they can quickly get their money back by “reselling the right to claim the property” to the purchasers, but at a price of only 1/10 of the value.

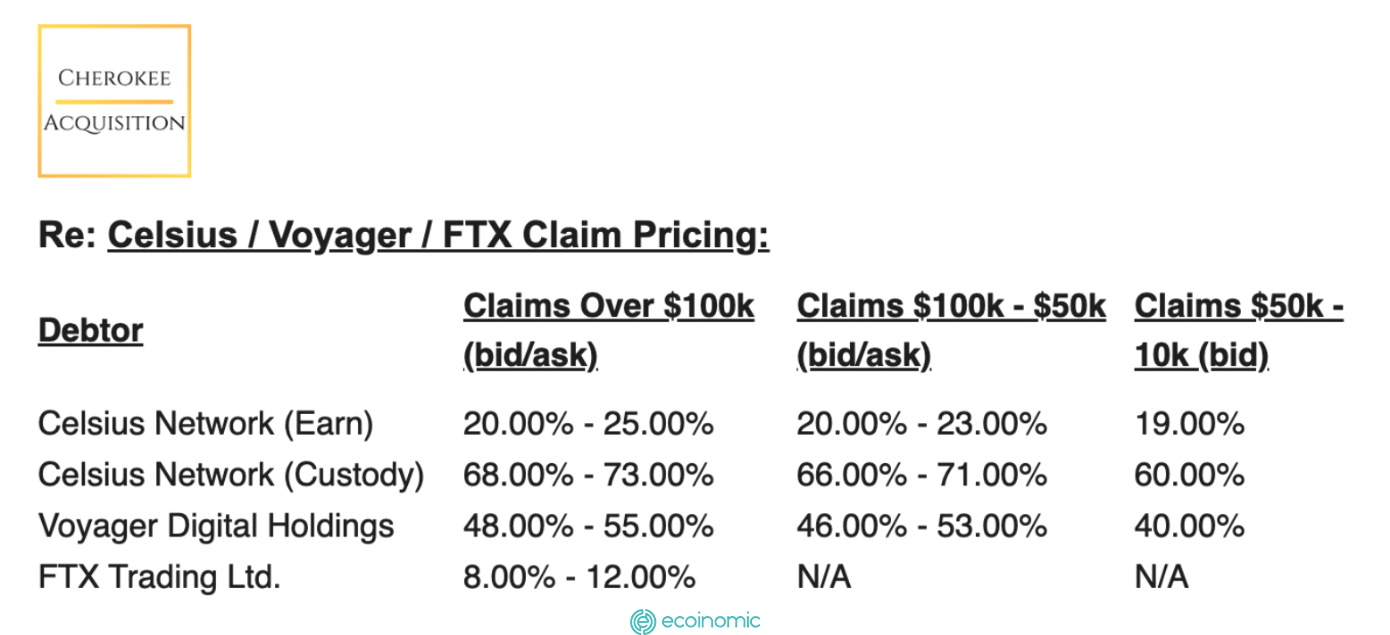

Cherokee Acquirition, an organization that specializes in acquiring assets from companies that claim bankruptcy, offers prices ranging from $0.08 to $0.12 for $1 of assets on FTX (with a minimum application of $100,000). That is, up to 10 times lower than the user value that can be claimed if “FTX successfully settles”.

But this is not an easy task, when buyers consider the ability to pay as well as the financial capacity of FTX at present to set the appropriate price. It seems that the relatively low price of 0.08 – 0.12 USD indicates that the probability of users getting back enough money on FTX has been reduced.

Compared to when Celsius went bankrupt, liquidated assets were priced at $0.2/1. Whereas with Voyager Digital, users can resell $0.4/1 for property rights.

Celsius/Voyager/FTX property rights resale price statistics. Source: Cherokee Acquisition

Celsius/Voyager/FTX property rights resale price statistics. Source: Cherokee Acquisition- Thomas Braziel, founder of 507 Capital, a company that finances insolvent and bankrupt organizations, said that “prices are still high and no one is going to buy them.” He offers a more realistic price of $0.03 to $0.05.

- FTX, the most popular exchange, and more than 130 subsidiaries filed for bankruptcy protection on Nov. 11. After the former SBF CEO was caught illegally using customer deposits for loans and investments, FTX was exposed to a $10 billion hole in its balance sheet, users massively withdrew money and the liquidity crisis began to spread from here.

- Countless users and institutions including large companies such as Genesis Trading, Galois Capital, and Ikigai Asset Management are all stuck with money in the trading platform. Last week, a Telegram group was created to “sell off” FTX accounts after the exchange froze its withdrawal service for the first time.

Source: Coin68