Advertisement

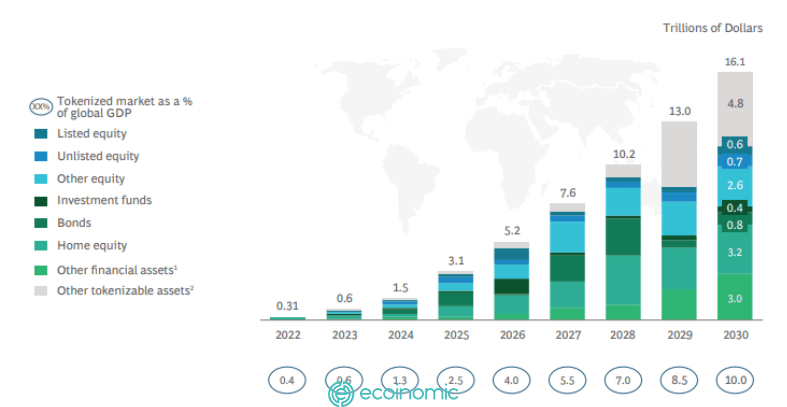

According to the Boston Consulting Group (BCG), the total size of tokenized illiquid assets, including real estate and natural resources could reach $16.1 trillion by 2030.

In a newly published report from BCG and the digital exchange for the PRIVATE MARKET ADDX, BCG CEO Sumit Kumar and ADDX co-founder Darius Liu noted that “the majority of the world’s assets today are locked in illiquid assets.”

According to the report, illiquid assets include pre-IPO stocks, real estate, private debt, revenue from small and medium-sized businesses, physical artwork, private funds, bonds, and more.

The reason for the illiquidity of this asset is attributed to factors such as limited affordability for public investors, lack of expertise in asset management, and limited access – such as when the asset is restricted to upper-class groups (in the case of antique fine art and automobiles), legal barriers and other situations in which users have difficulty buying or trading assets.

Tokenization of on-chain assets can solve this problem, the market surpassed $2.3 billion in 2021 and is expected to reach $5.6 billion by 2026.

The authors added that in just the past two years, the daily trading volume of global digital assets has increased from 30 billion euros in 2020 to 150 billion euros in 2022, noting that it is “still very small compared to the total potential of illiquid assets.”

By 2030, the authors forecast on-chain asset tokenization opportunities to reach $16.1 trillion – much of which is made up of financial assets (such as insurance policies, pensions, and alternative investments), home equity, and other cryptographic assets, such as infrastructure projects and patents.

The authors also note that this is only a forecast, and in the best case, tokenization of global illiquid assets could reach $68 trillion.

However, the potential of digital assets will vary from country to country due to regulatory frameworks and asset class sizes.

In Singapore, the Monetary Authority recently launched Project Guardian, a blockchain-based asset encryption pilot with decentralized finance (DeFi) applications in the wholesale financing market by establishing a liquidity pool of bonds and tokenized deposits to implement on-chain borrowing and lending processes.

In addition to Singapore, token issuance is regulated in Hong Kong, Japan, the European Union, the United Kingdom, the United States, the United Arab Emirates, Germany, Austria, and Switzerland. Other authors in the report include BCG’s project chief Rajaram Suresh, deputy director Bernhard Kronfellner and BCG advisor Aaditya Kaul, noting:

“Tokenization of assets on the chain offers the opportunity to remove many barriers to asset illiquidity as well as the current traditional method of segmentation.”

Real estate could be among the illiquid assets that could benefit from tokenization from investors looking for real-world asset-backed investments in DeFi.

Cointelegraph Research Terminal revealed that real estate assets account for up to 40%, making it one of the main areas for offering security tokens.

Earlier this month, digital asset investment platform Zerocap announced that companies on the Australian Securities Exchange (ASX) can trade crypto bonds, stocks, funds or carbon credits after successful proof-of-concept testing.