Advertisement

Nilos, a startup that aims to build a unified platform to manage crypto and fiat treasuries, raised $5.2 million in a fundraising round led by Viola Ventures and Fabric Ventures.

According to an announcement today, the deal, which ends in April, also involves investors such as Mensch Capital Partners and backers including The Sandbox co-founder Sebastien Borget and former deputy CEO of French banking giant, Société Générale, according to an announcement today.

Nilos aims to consolidate cryptocurrency wallets, corporate Fiat accounts, payment service providers, and cash flows that can be tracked on one platform. It will also allow cryptocurrencies to identify payments in currencies, the ability to generate accounting reports on such data, and be able to monitor suspicious sources of funds in accordance with anti-money laundering requirements.

Omry Ben David, partner at Viola Ventures said: “We are believers in web3 infrastructure operations. The Nilos team is addressing a major vulnerability, connecting financial services and treasury to both web2 and web3 companies, who are looking to enter the revenue chain from Fiat operations in an advantageous, regulatory-compliant and secure manner.

Nilos said in the announcement that it wants to tap into the growing number of businesses that transact with both fiat and cryptocurrency treasuries themselves, or those looking to enter the crypto space. The company says its customers include AnotherBlock, Rocket3, Metafight and Rarecubes. When things start, companies have to handle two very separate financial systems to track multiple accounts, which can cause a host of regulatory compliance issues.

The company will use the funding to attract new customers, fund research and development, and build sales and marketing teams.

Yesterday, web3 accounting software Tres raised $7.6 million in seed funding. In March, Coinbooks raised $3.2 million to build accounting software for decentralized autonomous organizations (DAOs). In June, Request Finance, which automates payroll for crypto companies, won the backing of Venture Capital firm Balderton Capital and gaming firm Animoca Brands in a $5.5 million seed funding round.

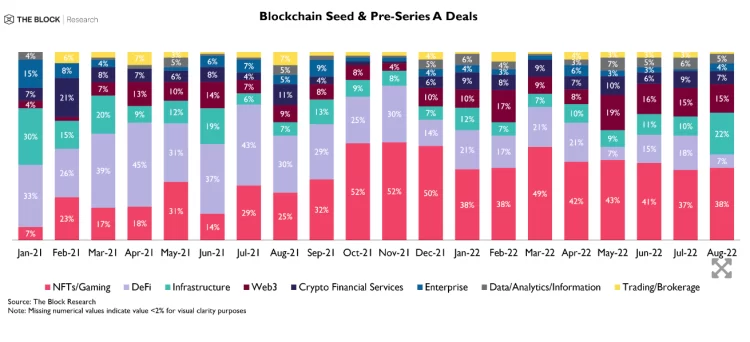

According to the study, 22% of the investment raised from seeding round and Pre-Series A in August came from the infrastructure sector – second only to NFTs and Games.

See also: OpenSea NFT Marketplace supports Arbitrum for new collection