Advertisement

The cryptocurrency market has been going through a tough period for the last few weeks, as almost every recovery rally ends without showing any significant results.

Shiba Inu failed to break the local resistance level, Bitcoin could not reach $21,000 and Ethereum is continuously losing value.

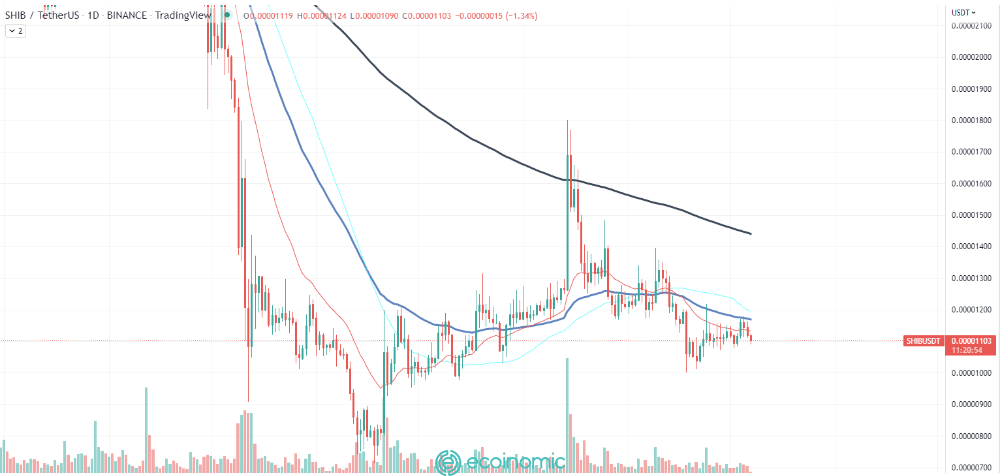

Shiba Inu turns into a ghost

The lack of volatility, poor price performance and the disappearance of whale support led to catastrophic consequences for the token, as the speculative interest was the main fuel for it back in 2021

According to volume profiles, Shiba Inu is losing most of its support from short-term investors and traders. The most likely scenario for the token remains the continuation of the prolonged downtrend it has been in for the whole year.

After reaching the ATH, Shiba Inu whales were actively supporting the token on its way down, aiming for a reversal at some point. Unfortunately, the huge dominance of whales on the assets did not help it to enter an uptrend, as the percentage of retail investors who are willing to get rid of their tokens as soon as possible is too high.

According to market data, after every noteworthy price increase, the selling pressure on assets exceeded the regular amount by almost 20%, suggesting that some traders are specifically aimed at providing selling volume when the asset is making a breakout attempt.

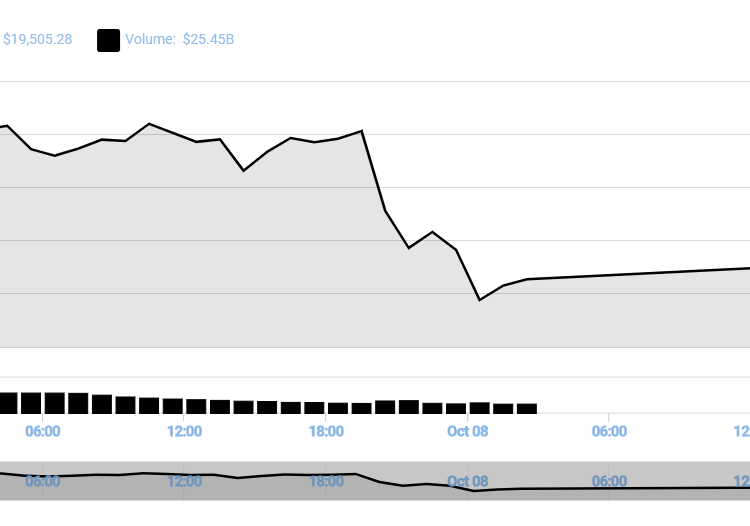

Bitcoin fails yet again

As we have mentioned in our previous market review, Bitcoin is not gaining enough traction and will most likely aim for a reversal as soon as it hits the local resistance level at around $20,000.

The lack of inflows, low trading volume and questionable conditions of the economy in the U.S. are driving the price of the first cryptocurrency way down. Yet another failure to break the local resistance level will lead to a reversal back to the lower border of the consolidation range.

Unfortunately, Bitcoin is not showing any signs that would suggest an upcoming breakthrough from the channel it has been moving in for the last 100 days. Some experts believe the current sideways market is nothing but an accumulation period for large retail investors and whales.

However, on-chain data does not support the theory as the buying volume and network activity have not been showing any spikes since May, when the price of the first cryptocurrency tumbled to the values we are seeing today.

The situation on Bitcoin is projected for other cryptocurrencies, Ethereum included, which still has not recovered from the massive loss it took after the implementation of the Merge update.

The inability to break the first untested resistance level shows the lack of power behind every movement of Ether. The situation will most likely change with the general recovery of the cryptocurrency market.

Source: u.today

>>> Related: Shiba Inu ($SHIB) leads the portfolio of Ethereum whales as burn rates rise