Advertisement

Bitcoin [BTC] has returned to the undervalued zone. That’s the information studied by CryptoQuant, the On-Chain Data platform. But how did BTC stay in that underappreciated area, when its price was still above $20,000?

Although the overall weekly performance was not impressive, BTC managed to hold the consolidation level between $20,900 and $21,800. These levels are where BTC has moved over the past few days. At the time of this writing, one BTC is worth $21,412.38, down 6.12% from seven days ago.

Returning to its valuation position, CryptoQuant analysis’s recommendations also indicate that BTC’s bottom could be in or near the corner.

Has the time to “fill the wallet” come?

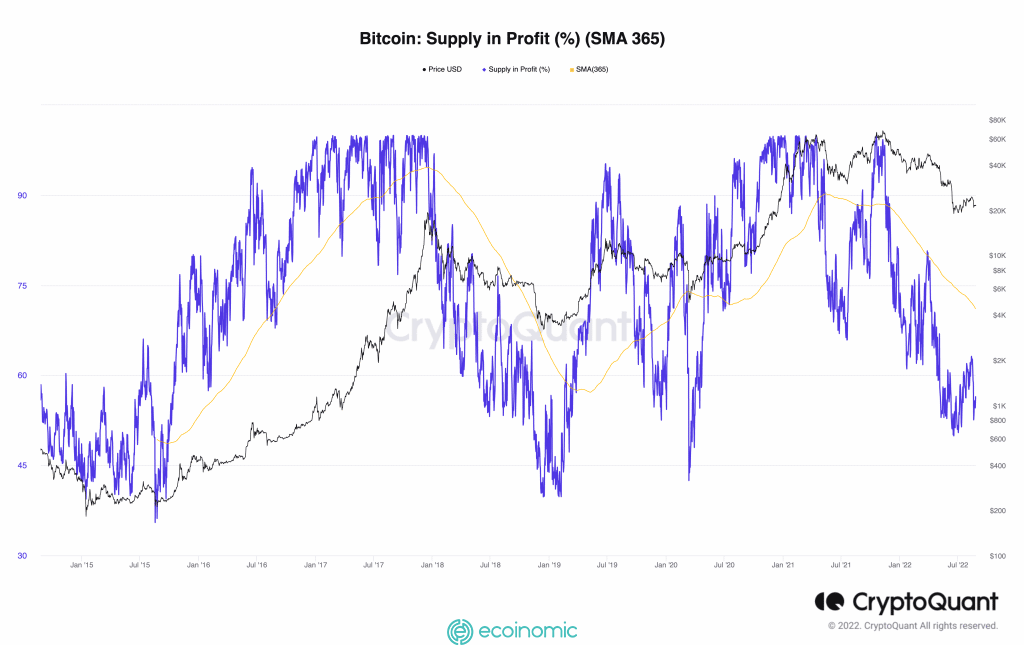

According to the report, CryptoQuant noted that the 365-day Market Value compared to the Actual Value (MVRV) of Bitcoin is lower than 1.

Looking at the data at the time of writing, the MVRV is around 0.9956. The chart shows that the average BTC holder over the aforementioned time period is currently losing money. This proves that BTC will soon rise in price.

However, the BTC assessment from the above data alone is not really accurate. Consider other metrics, including spending by long-term BTC holders over the same period. In addition, CryptoQuant has included supply in the rate of return.

The data revealed that the total profit supply of BTC fell rapidly during the week with a value of 56.43%, for long-term owner spending of 0.5774, or 44%.

With the decline of these indices, CryptoQuant concluded that it may be time to accumulate BTC.

Earlier, it was reported that there is a high demand for BTC by institutions, and BTC whales are in a state of “wallet filling”. However, small investors should be really cautious for the time being.

Let’s accumulate BTC and observe the market

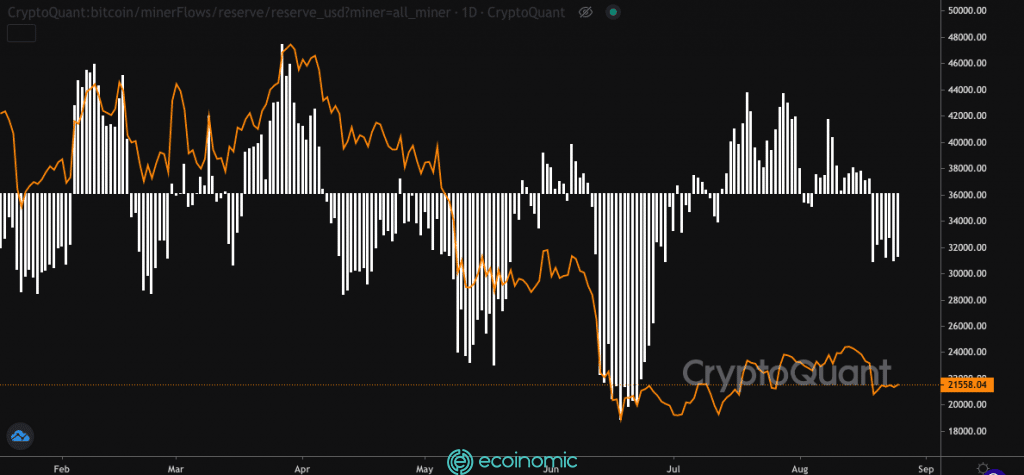

According to BaroVirtual, the personal analyst who operates on the CryptoQuant platform, the activity of Bitcoin miners often affects the price of BTC. The current stance of BTC miners is unlikely to show signs of a near bottom.

Past data shows that a drop in miners’ balances or reserves has led to a drop in the price of BTC.

BaroVirtual’s stance is confirmed by the position of the Relative Strength Index (RSI). At the time of this writing, the RSI value is 39.94.

Despite the views from all sides, BTC’s next move may depend on a number of fundamental factors. A prudent decision is still needed at this time.