Advertisement

Following the US Federal Reserve’s move to address inflation, many investors sold off their risky assets. The cryptocurrency market is also reeling from the consequences of a massive sell-off.

Psychological preparation for the fall of US stocks

The speech of Jerome Powell, chairman of the US Fed caused a wave of shock not only in the cryptocurrency market but also in the global financial market in general.

The results of a tally indicate that Jerome Powell’s 8-minute speech “evaporated” more than $2 trillion in stocks globally, of which $1.25 trillion in the United States alone.

#Fed's Powell has destroyed ~$2tn in global stock market cap with his 8-minute “Until the Job Is Done” Jackson Hole speech, makes $4.2bn loss per second. pic.twitter.com/05YE5yG693

— Holger Zschaepitz (@Schuldensuehner) August 28, 2022

Fed’s President said that when policies on cryptocurrencies are tightened, the rate of rising Inflation will decrease. A sustained restrictive policy stance will restore price stability.

Paul Christopher, director of global market strategy at Wells Fargo Investment Institute, told Bloomberg that U.S. stocks will fall further, and the S&P 500 will fall below 4,000.

US dollar reaches its peak again in September 2022

The strength of the US dollar is a factor that parallels the volatility of the stock market.

The U.S. Dollar Index (DXY) hit a new 20-year high this week. At the time of writing, DXY has posted its highest gain, 109.47 since September 2002.

The rise of the U.S. dollar has had a negative effect on other Fiat currencies. A typical example is that the Euro returned to the greenback equivalent (greenback – the slang term for US paper dollars) on 29/08.

The European Central Bank (ECB) and the Bank of Japan have been forced to launch a bill to raise interest rates. This move is similar to the Fed and has caused inflation to constantly escalate.

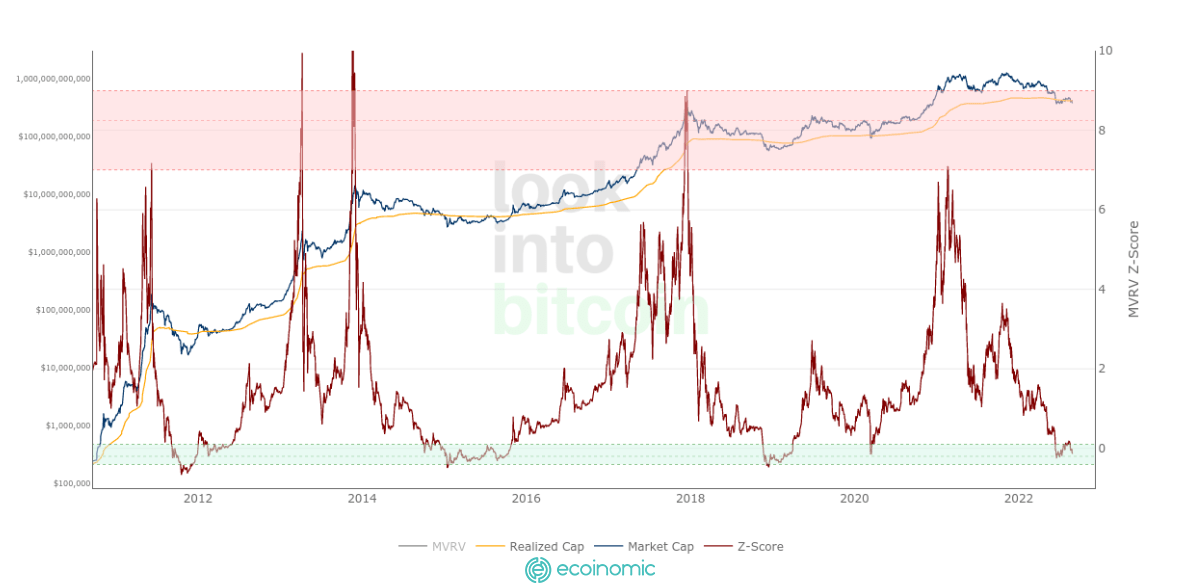

MVRV-Z score retreats to the “green” zone

MVRV is an indicator that expresses the relationship of Market Cap to actual capitalization. The MVRV-Z score is defined as the ratio between the difference of market cap and actual capitalization to the standard deviation of market cap.

In July this year, MVRV-Z caused the BTC floor price to bottom out at $15,600. This helped BTC break out of the buy zone for a short time before rising again in the second half of August.

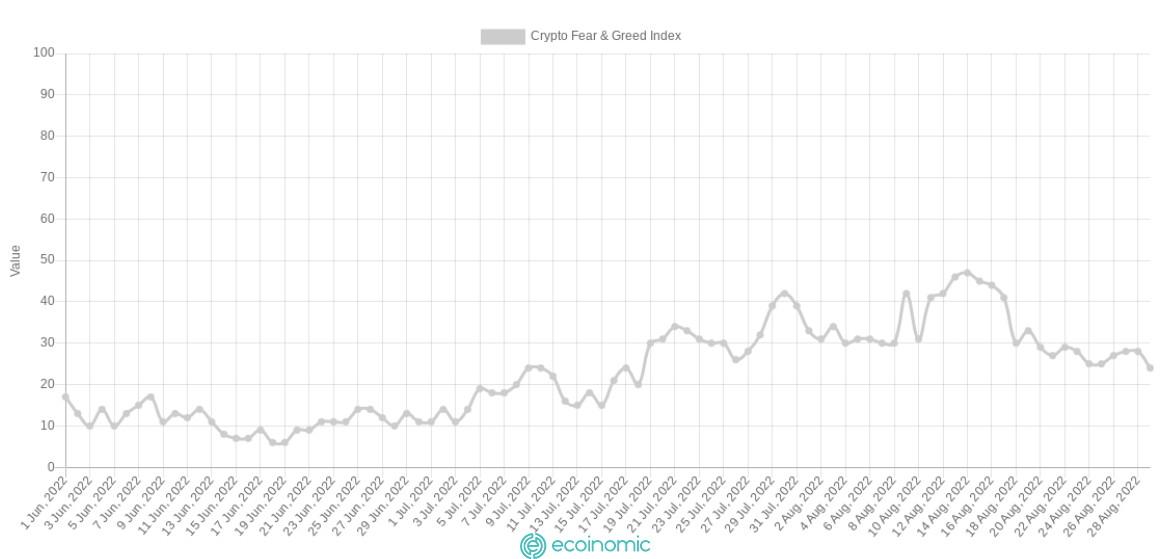

The “extreme fear” returns

Bitcoin market sentiment falls into the least optimistic state which is understandable when this coin falls below the $20,000 level.

Since 29/08, the Bitcoin Greed Index and Fear Index have fallen into the “extreme fear” zone, at the level of 24/100.

2022 is also the year that saw the longest “Extreme Fear” ever. Even the overall market sentiment score at one point only reached 6/100.

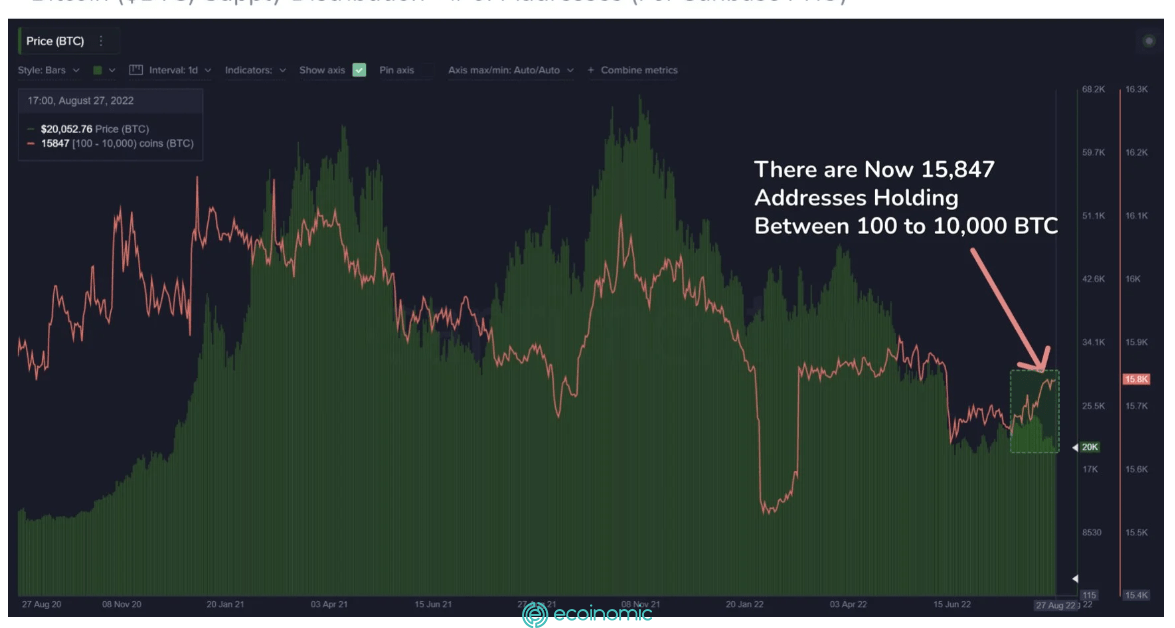

Santiment’s investor sentiment study indicates that whale holding volumes are less likely to cause divestment in the market. The fact that the bitcoin price hovered around 20,000 late last week is a positive sign in terms of the number of BTC whale wallet addresses.