Advertisement

Positive signals in the market

The cryptocurrency market has showed positive signals as the price of Bitcoin (BTC) rises 4.7% and trades above $19,300, Ether (ETH) rises 6.5% to regain the $1,300 level.

RSR and Astar Network (ASTAR) also rise 23% and 17%, respectively, but more notable on the day is XRP.

Currently, the XRP price reflects an increase of nearly 25%, and the asset has increased by 41% over the past month.

After a long period of consolidation, Ripple (XRP) seems to have finally gained momentum to recover from months of battering. The reason behind this sudden price pump is that the battle between Ripple and the SEC is gradually coming to an end and will make a final ruling.

According to defense lawyer James K. Filan, on September 18, Ripple Labs filed a motion for summary judgment instead of a trial order and a decision by mid-December on whether XRP is an unregistered securities transaction.

>>> Related: Ripple’s (XRP) legal battle will come to an end. Instead of applying the law, the SEC will amend the law

Settlement rumors aiding bullishness

Amid rumors of a settlement for the lawsuit between Ripple and the SEC, deadlines for moves to seal requests to block evidence have been determined.

According to defense lawyer James K. Filan, on September 18 Ripple Labs filed a motion for summary judgment — a legal process involving the court making a final decision based on the data provided, rather than ordering a trial — and a decision on whether XRP is a security will be made by mid-December.

In a recent interview, Ripple CEO Brad Garlinghouse stated that the U.S. Securities and Exchange Commission (SEC) has “lost its way” and “completely lost its mind.”

Garlinghouse’s statement has further paved the way for rising market expectations. In addition to the external news that heavily impacted investor sentiment, several technical indicators and on-chain indicators also paint a pleasant picture for XRP.

XRP whales back in action

The XRP price hovers at $0.536 at press time with a 27.27% increase on the 24-hour chart and a nearly 67% increase on the weekly price chart.

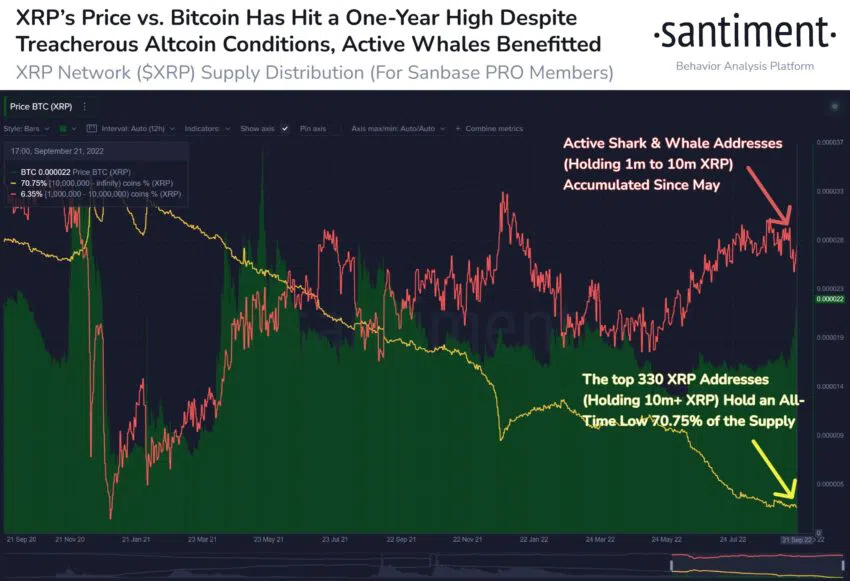

Online data from Santiment has shown that active shark and whale addresses holding between 1 million and 10 million XRP have accumulated since the end of 2020.

The fact that whales and sharks are accumulating describes a healthy long-term trend for XRP, which could help the price rise further. The XRP/BTC ratio broke the long-term downtrend and reached a one-year high of 0.000025.

Psychology shifts to positivity

From a technical perspective, the price of XRP has recovered from the resistance of the long-term descending trendline as trading volumes and open interest rates on futures contracts see large gains.

The XRP price is gradually securing a second daily candle close above the resistance level of the long-term descending trendline, and trading volumes as well as open interest rates on futures contracts have risen sharply over the past 24 hours.

The daily RSI is overbought indicating high buying pressure in the market as the bulls prevail. Long-term signals also seem to turn bullish as the weekly RSI breaks out of its own descending resistance line.

OI for futures and perpetual markets increased by 65.43% in just 24 hours. Besides, a $14.1 million XRP short order was liquidated following bullish price action.

In the short-term, looking at the saturated market if a short-term pullback takes place, XRP could return to the $0.39 support level. According to market analyst Marcel Pechman:

“XRP’s open interest rate is now $575 million, up from $310 million just a week ago.”

Traders who have not yet identified positions can consider waiting to see if the MA200 at $0.49 is flipped to support for the next few daily closes.

Typically, day traders and rotations take profits at longer-term resistance levels and they also anticipate price rejections and retest lower support levels after the asset manages a breakout from a long consolidation period, lowest price, or move to change the market structure.

Cryptocurrency analytics data provider TheKingfisher expressed a similar view by suggesting that buyers would “have less chance of buying XRP”

You'll likely have an opportunity to long $XRP lower if that's what you're looking for

Don't FOMO, Long the long liquidations 🎣https://t.co/jmaCFVVOvn pic.twitter.com/TP9SW6OmXO— TheKingfisher (@kingfisher_btc) September 22, 2022