Advertisement

Optimism Overview

Optimism is Ethereum’s solution for scaling the network and value, built on Optimistic Rollup technology. This Layer2 blockchain makes transactions much faster and cheaper than Ethereum Mainnet but retains the security of Layer1. After a period of strong growth in terms of price and attracting the attention of the community, let’s have deep dive into this Layer2 network with Ecoinomic.

Optimism token Airdrop – The beginning growth

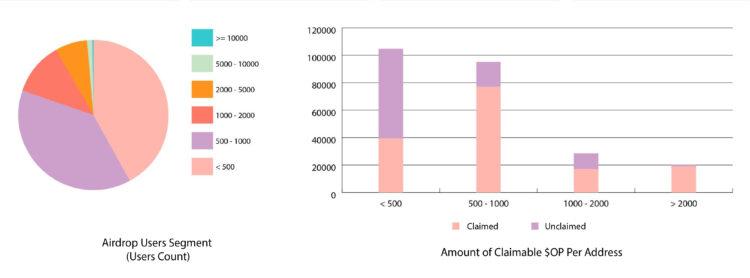

Optimism’s ecosystem has garnered a lot of attention since making the announcement of its first airdrop as well as the issuance of its governance token – $OP. More than 248K wallet addresses were eligible for the airdrop with a total of ~214M $OP distributed for the first retroactive strategy (accounting for 5% of the total supply). Let’s take a look at a several numbers related to this event.

Out of a total of ~248K wallet addresses eligible for the airdrop. Currently, only ~149K addresses have received airdrops up to 40% have not claimed after a period of nearly 4 months, a relatively large number for an airdrop worth thousands of dollars.

Note: Optimism’s tokenomic there is still 14% for airdrop purposes. You should focus on becoming real users if want a chance to receive the next airdrop from the project.

On-chain data analyses

Activities

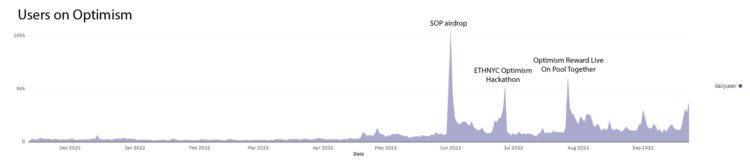

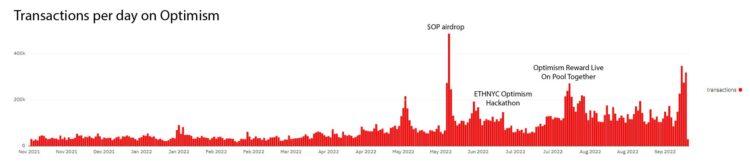

The initial goal of the airdrop event was to invigorate the ecosystem and attract new users from other networks. It’s easy to see that on the day the project gave the OP claim, the network recorded a spike in the number of users and the number of transactions.

Specifically, this number is up to 487k transactions and 106k users. That is, on average, each user will have ~4.6 transactions on the network on June 1, 2022.

On the day of the ETHNYC Optimism Hackathon and the day the Pool Together project awarded the OP reward for using dApps, there was also moderate growth, but only moderate.

Compared to the time before the airdrop event, the network of this Layer2 project is quite spare when user and transaction are always low. So the impact of this event is there, it attracts excitement on the network that has almost 2-3 times more growth than before.

However, user retention is still not really effective, the transaction volume remains stable, but users fluctuate quite a lot. This shows that the transactions that take place mainly come from a certain group of people.

dApps

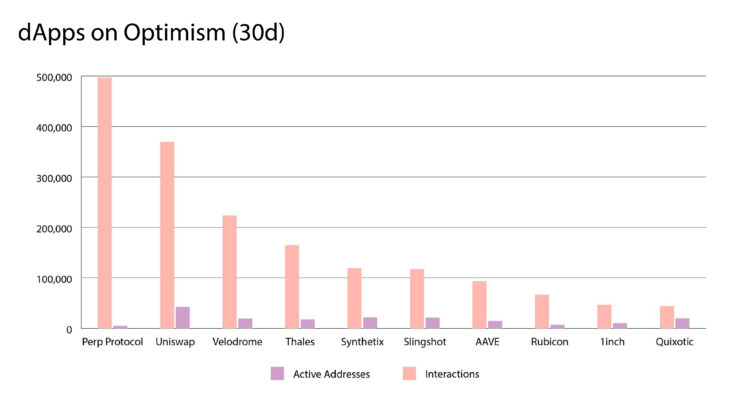

Users on the platform during the past 30 days have mainly been in Defi applications such as Perpeture Protocol, Uniswap, Velodrome, Thales, Synthetix, and Slingshot.

Perpture Protocol is an exchange that allows trading derivatives such as future contracts that have a very large number of transactions compared to the rest of the dApps when there are ~500K trans/30d. However, despite a large number of transactions, the number of users is not much, Perpeture Protocol only has ~4k9 users, the least of all the dApps in the top 10. This figure indicates that only a small group has a need to use the product. Synthetix is also a protocol that offers derivatives that we can see in the top 10.

It’s not uncommon to follow Perp with DEXs, which are always an important piece for any ecosystem as it allows users to trade assets. Also in the top 10, we have AAVE as a lending & borrowing application and Quixotic the largest NFT exchange today. To the chart above, users are still mostly using the big boy in Defi space, most of which are from Ethereum moving in and still gaining the trust of users.

Native products like Velodrome and Quixotic haven’t really gotten much attention.

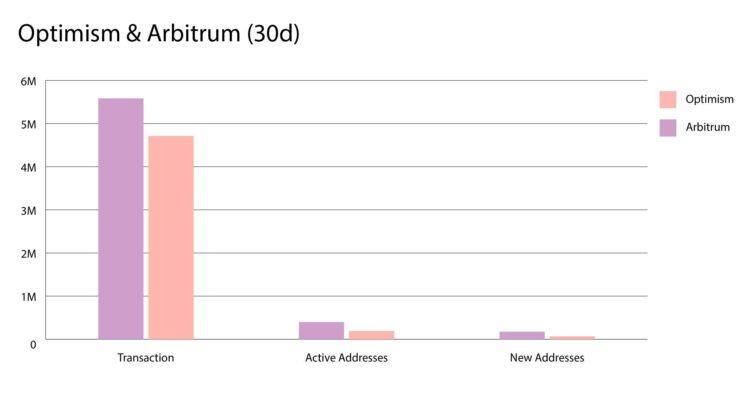

Comparison with Arbitrum – another Ethereum Optimistic Layer2 blockchain. Optimism is falling behind as all indicators of transaction counts, active wallet addresses, and new open wallet addresses are lower.

Total Value Locked (TVL)

Optimism’s on-chain indicators show a significant change. Total Value Locked (TVL) is undoubtedly the indicator of top interest for assessing the potential of an ecosystem. It shows how the cash flow is being moved, where this Layer2 also shows its positive points.

The value of assets locked across the ecosystem has started to take a turn since the end of May. At one point at the end of August 2022, Optimism surpassed Arbitrum. Overall, it has attracted nearly twice as many assets as it did before the airdrop and has cooled somewhat in recent times.

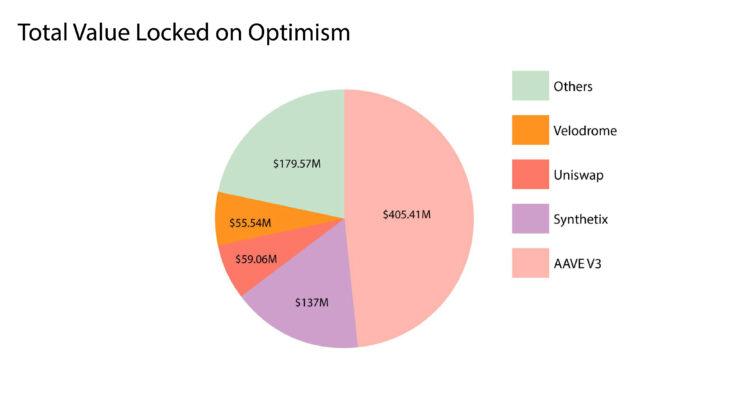

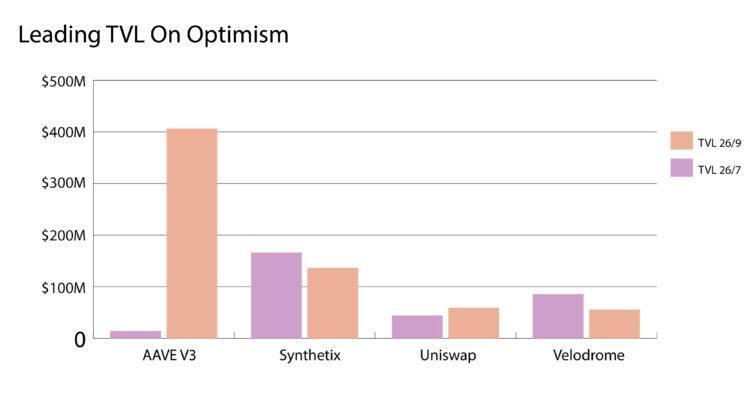

At present, It owns ~$836.58M TVL, so the cash flow is being unevenly distributed. The number of projects on the ecosystem is currently ~66 projects, but the top 4 projects are AAVE v3, Synthetix, Uniswap, Velodrome accounting for 78% of TVL. Cash flow on the network is being distributed quite centrally. Only AAVE v3 – lending & borrowing application accounts for nearly half of this index.

Observing the growth in each of these dApps over the past 60 days. AAVE v3 showed outstanding growth when it increased from $14.33M to $406.42M.

The velodrome has dropped it out, as the network heats up, which is the most notable project as it is a fork from a cult project on Fantom, Solidly. After being exploited about $ 350K from the high-worth wallets — were dedicated to operating funds such as salaries. Despite recovering the funds, the project’s TVL is still on the decline.

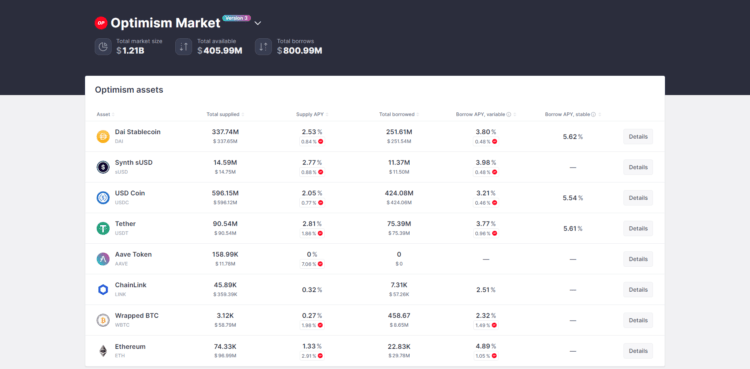

In more detail with AAVE V3, users are providing the project with an amount of about $1.21B (larger than the total TVL of the whole system) and borrowing up to ~$800M.

The ecosystem is unlikely to retain the flow of money to its ecosystem, as users only transfer money to provide liquidity for a lending project like AAVE and transfer money to another blockchain. This action is possible to look for future airdrop opportunities.

The whole ecosystem seems to be underperforming.

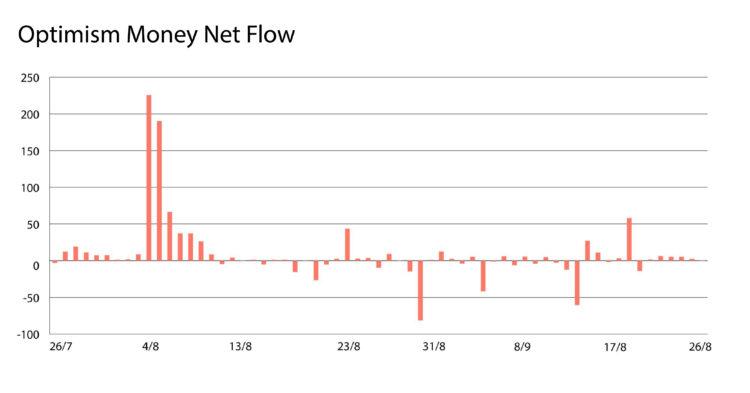

Bridge

The amount deposited and withdrawn on a daily does not fluctuate too much. Most notably only on 4/8, this is the day that AAVE announced the Liquidity Mining program, which will distribute to users on AAVE v3 to 5M $OP within 90 days. This is also the reason why TVL on AAVE v3 has a very strong growth and is at the top of the ecosystem today.

The @OptimismFND Liquidity Mining program is live on Aave V3

The program will run for 90 days with a distribution of 5M OP to the Aave Protocol’s Optimism Market users

Claiming support for rewards will be active soon!

Feeling Optimistic 👻

— Aave (@AaveAave) August 4, 2022

Since that event, the cash flow has been withdrawn back to other platforms and the number of deposits has not been outstanding. Even at the time when the airdrop took place, the number of users and transactions increased but there was no flow of money. It was only when there were ecosystem bootstraps like AAVE v3’s Liquidity Mining that it attracted the attention of cash flow. It is worth mentioning here that the RetroPGF program also allocates a certain number of $OP to many projects, but those projects have not really effectively used this money to attract users.

OP Summer has not really made the impact that the community initially expected as well as the development team.

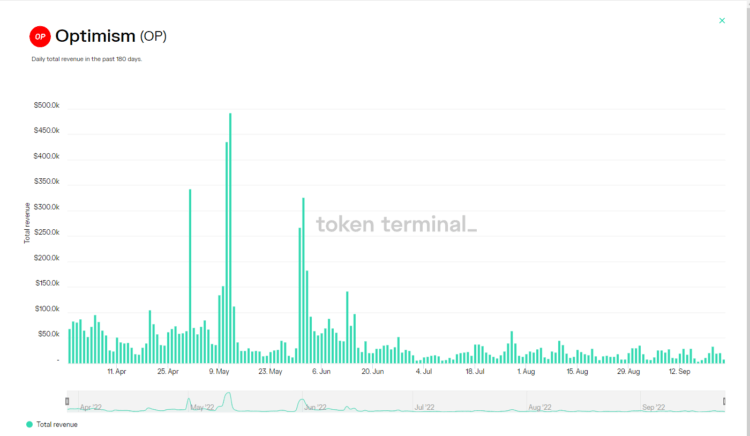

Revenue

The revenue of the project itself is also relatively low at the present time. Only at times of announcing airdrops and allowing the community to claim airdrops will the project really see growth in terms of revenue due to the increased number of transactions on the network.

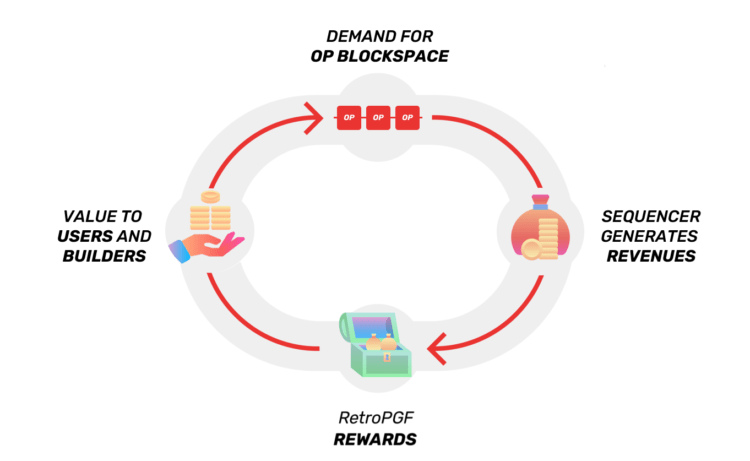

Note that, this is a non-profit ecosystem, all project revenue will be used to stimulate the ecosystem by funding projects on the platform. For such a low revenue stream the “flying wheel” is spinning quite slowly.

Conclusion

Although, it has caught the attention of the community during the past 3-4 months. Most of Optimism’s metrics are quite positive, even in terms of $OP or other pieces in the ecosystem like $VELO. But if you evaluate the effectiveness of the campaigns, it must be said that they are not really good. User retention rate and cash flow are not high.

The project development team has a lot of work to do to develop the ecosystem if it wants to compete with Arbitrum.

>>> Related: Binance Sign Up For Beginners Update 2022