Advertisement

Bitcoin’s role in preventing inflation is increasingly common. One expert commented that “you will need to buy Bitcoin”.

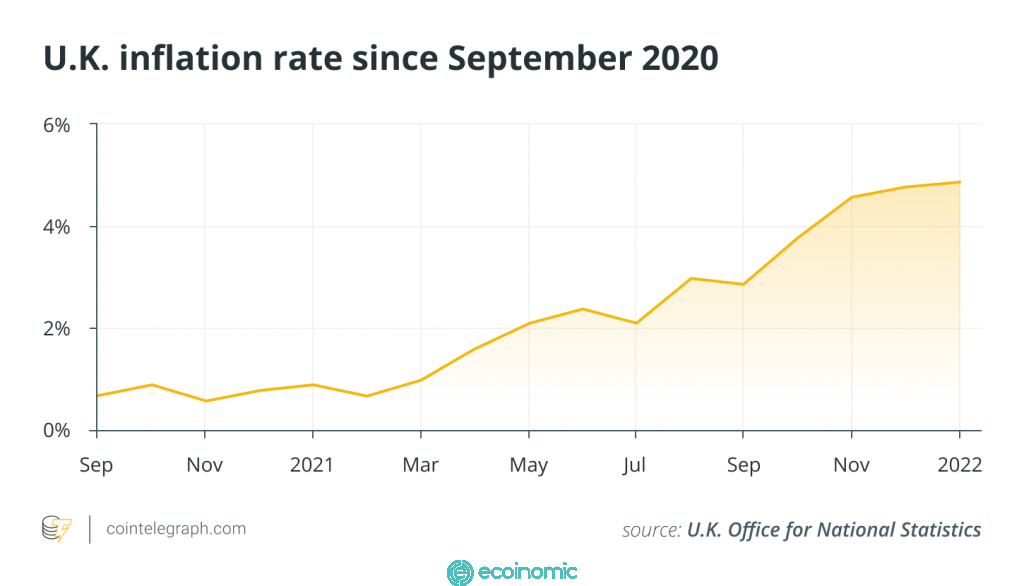

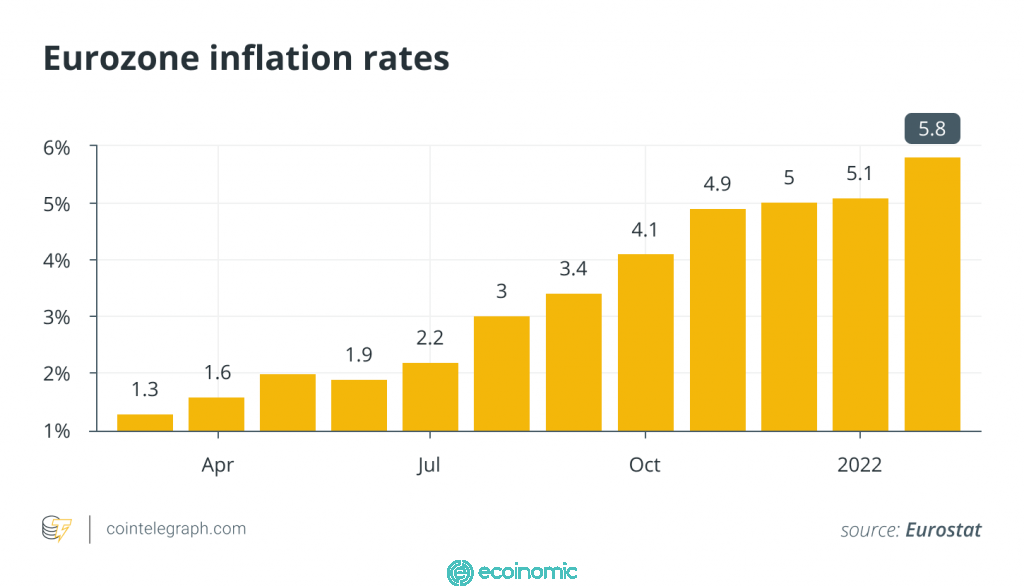

Rising prices are attracting attention around the world. Inflation in the U.S. has broken a 40-year record. The situation is even tenser in Europe, with prices up more than 5% across the eurozone and 4.9% in the UK by March 2022.

While the price rises, Bitcoin (BTC) remains at around $39,000. This raises many questions: Is Bitcoin a good way to hedge against rising prices? What role does Bitcoin play in the high inflationary environment? Do Bitcoin players know that inflation is going to happen?

Experts in bitcoin, finance and European politicians have answered these questions, sharing their views on the alarming price increases in Europe.

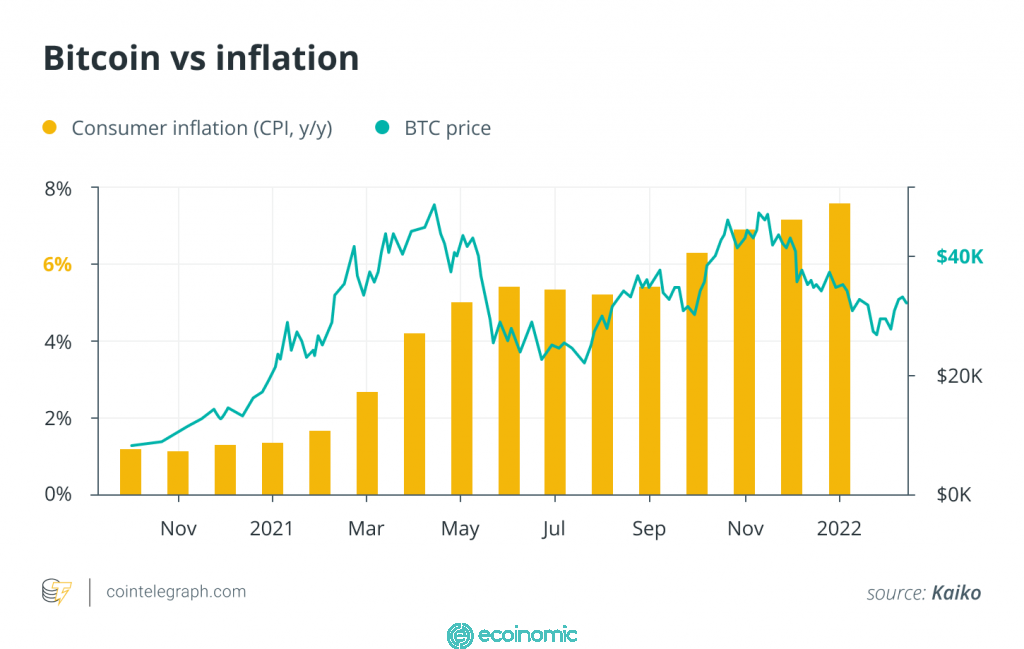

From the monthly report of Kaiko data analysts, the price of Bitcoin rose above inflation. This suggests that Bitcoin players may have foreseen the price increase and invested to hedge inflation.

Danny Scott, CEO of leading UK exchange CoinCorner, supports this argument. He’s not surprised by the level of inflation we’re seeing around the world.

This has been in the works for a decade, and Covid pushes it to happen earlier. Real inflation is being hidden to keep a positive attitude about inflation being “under control.”

Another Bitcoin player, a member of Congress, was also “not surprised” by the alarming inflation. Christophe De Beukelaer, an influential belgian, was the first politician in Europe to earn income in Bitcoin.

“When we pump in trillions like we did, at some point we have to pay the price.” But not only does it have a negative impact on the economy, “people may not see and not realize, but inflation has a big impact on their well-being.”

Nicolas Bertrand, ambassador for the Global Blockchain Business Council and Chief Financial Officer from Borsa Italia and the London Stock Exchange, said: “Expanding monetary policies are making a big contribution to inflation and I wouldn’t be surprised to see this situation last longer than people think.”

For De Beukelaer, however, he said that “at some point, we will have to go through a major currency crisis.”

With the crisis in Ukraine exacerbating the problem, how does this affect short-term inflation levels? Dessislava Aubert, research analyst at Kaiko, said that “rising commodity prices could keep inflationary pressures large and slow growth because of the close economic links between Europe and Russia.”

She added that the current price movements that caused Bitcoin to slip from its old peak of $69,000 in November 2021 may be due to “markets pricing in a rate hike from the European Central Bank this year.”

Inflation is still lingering, should we invest in Bitcoin?

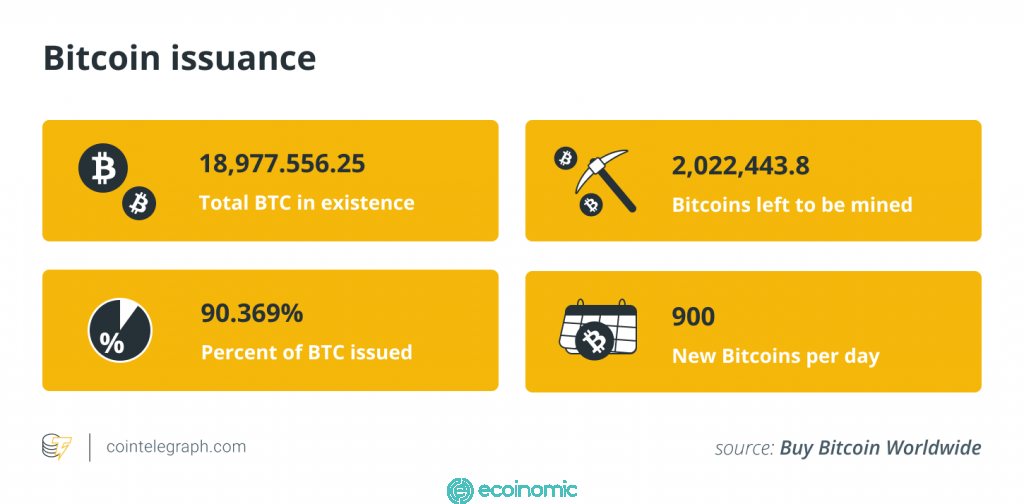

Bitcoin as an inflation preventionist role is a common story in the US. In Europe, this is inconclusive, as De Beukelaer puts it, “it’s hard to say with assertiveness.” That is, “because its growth is limited and clear, it can be expected to be a bulwark against inflation.”

For Bertrand, given his experience in financial markets, the situation is clear: “Unlike Fiat currencies, popular investment assets and even gold, the value of Bitcoin cannot be adversely affected by the issuance of new coins. This forms a solid foundation and makes Bitcoin an interesting asset in the context of higher inflation.”

However, there are some objections to this idea. “There is not enough data to prove that Bitcoin is a good way to cope with inflation.” Furthermore, Bertrand shared that we “haven’t used much to be able to see Bitcoin as a precautionary measure.”

Aubert takes a similar view, explaining that “Bitcoin has moved simultaneously with risk assets over the past months and probably won’t be separate from the current volatile currency environment.”

Related: What Are The Differences Between Investment And Speculation?

In contrast, Bendik Norheim Schei, Director of Research at Arcane Crypto, and Scott are focusing entirely on Bitcoin’s role in the inflationary environment. Schei stated, “Bitcoin is a good option for those who want to bet on crazy inflation. Or, rather, defend in this situation. A rare asset with a fixed supply is a solid alternative in the global economy that is shifting into extreme inflation.”

For Scott, “Bitcoin solves the problem of separating money from the government but also offers many benefits as a good prevention against inflation and a decentralized and global approach.”

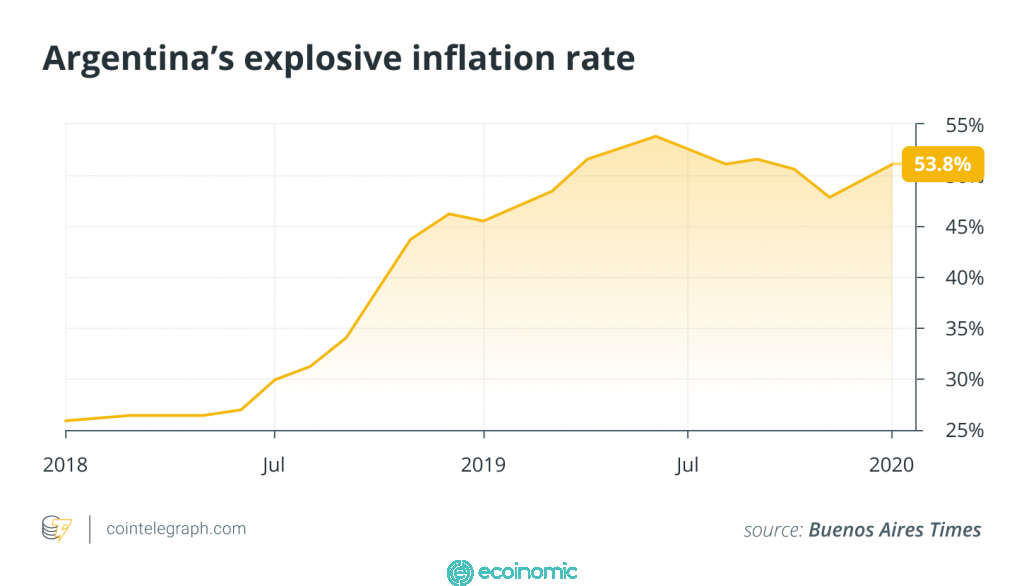

For large emerging countries like Argentina, “exceeding inflation by 50%, people are looking for many solutions – and Bitcoin is one of them.” He also warned that “you will need to buy Bitcoin.”

Bitcoin and an inflationary future

Whether Bitcoin is a hoard or a defense against inflation remains controversial. But according to De Beukelaer, it’s important that “we have a choice.” If a citizen “no longer trusts the Euro, dollar or other fiat currencies, they can switch to Bitcoin/Crypto. And that’s possible. If power is held only by one person, it always leads to abuse. It’s healthy that another currency appears to balance power.”

Bertrand also believes that balance is the deciding factor. “People need to think about the allocation of their assets thoroughly and with balance.”

However, with “purchasing power half eroded within 10 years,” according to De Beukelaer, this puts a new pressure on. If there’s a good time to invest in Bitcoin, it’s now.

Schei’s conclusion on the cryptocurrency issue: “This is a long-term bet on an asset that will grow in the future world. That’s when fiat currencies are no longer valid because of uncontrolled money printing and extreme inflation.”

With more and more billionaire leaders and investors backing Bitcoin and commenting that Fiat money is losing value, it’s probably worth considering investing in it as well.

Related: Bitcoin back below $19,000 as crypto market falls following U.S. inflation data