Advertisement

What is Euler Finance?

Euler is a lending protocol that helps users profit from their crypto assets or hedge against market fluctuations without the need for a trusted third-party intermediary.

Characteristics of Euler Finance

Unlicensed listings

Euler allows users to determine what type of assets are listed. To activate this function, Euler uses Uniswap v3 as its core dependency. Any property with a WETH pair on Uniswap v3 can be added to the loan market on Euler by any user immediately.

Classification of assets

Isolation-tier

Isolation-tier assets are available for conventional lending and borrowing, but are not used as collateral for borrowing other assets. They can only be borrowed individually and cannot be borrowed along with other assets using the same group of collateral.

For example, if a user has USDC and DAI as collateral and they want to Borrow ABC Isolation-tier assets, then they can only borrow ABC. If they then want to borrow another token, XYZ, then they can only do so using a separate account on Euler.

Cross-tier

Cross-tier assets are available for conventional lending and borrowing, which are not used as collateral for borrowing other assets, but can be borrowed along with other assets.

For example, if a user has USDC and DAI as collateral and they want to borrow ABC and XYZ cross-assets, then they can do so from a single account on Euler.

Collateral-tier

Collateral-tier assets are available for conventional lending and borrowing, cross-borrowing and can be used as collateral.

For example, users can deposit DAI and USDC collaterals, and use them to borrow UNI and LINK collateral, all from a single account.

Interest rates adapted to market conditions

Euler uses control theory to help automatically orient borrowing costs to a level that maximizes capital efficiency on the protocol.

Specifically, the project uses PID controllers to amplify (reduce) the rate of interest rate change when usage is above (below) the target usage level. This gives rise to interest rates that respond to market conditions for the underlying asset in real time without the constant intervention of management.

MEV-resistant liquidations

On Compound and Aave, liquidation is encouraged by providing borrower collateral to the liquidator at a fixed percentage discount, which usually ranges from 5-10%.

One of the problems with this strategy is that liquidators have to participate in gas fee priority auctions (PGA) for profitable liquidation, which suggests that the liquidation reward is called miner’s extractable value (MEV).

Another problem with this approach is that fixed discounts can have an impact on large-value liquidations, while not being enough to cover costs and encourage smaller-value liquidations.

To address these issues Euler uses a Dutch-style auction model in combination with increased discounts for liquidity providers to help limit the extraction of value from liquidations.

Protected collateral

Collateral deposited into the protocol is always available for lending on compound and Aave protocols. Euler allows collateral deposits, but uses the assets for lending. So collateral is protected, which keeps users from incurring interest and not taking risks when borrowers default. In addition, assets can always be withdrawn immediately and help protect against borrowers who use tokens to influence governance decisions or perform short positions.

Multi-collateral stability pool

On other lending protocols, the liquidation is usually handled using an external source of liquidity. That is, the liquidator will generally take the refund amount of the borrowed property from a third party, repay the loan, receive the collateral and any bonuses for themselves.

One of the disadvantages of this method is that the price feed used to determine the liquidation price of the borrower does not always accurately reflect the exchange rate in the external market, which means that the liquidator is not always able to liquidate at that price.

Reasons for this include slippage, swap fees, strong volatility, the use of price softening algorithms such as TWAP (as on Euler) and delays in posting new prices.

To alleviate this problem, Euler allows lenders to support liquidation by providing liquidity to stability pools related to each lending market. Liquidity providers in stability pools send eToken and make a profit while they wait for liquidation. The unstaking interval will prevent them from moving the property in and out of the pool.

When a liquidation is processed, the liquidator uses liquidity from the stability pool to cancel the borrower’s debts and they return the discounted collateral to the stability pool (minus a fee they retain for themselves). Stable liquidity providers essentially end up swapping their eTokens for the mortgage’s discount index.

This approach can be considered an expanded form of mortgaged assets of the stability pool idea pioneered by the Liquity protocol. The main advantage of using the stability pool is that the liquidation can be handled immediately without the liquidator needing to source the assets from the third party on their own.

Euler Finance token basics

- Token Name: Euler

- Ticker: EUL

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: 0xd9Fcd98c322942075A5C3860693e9f4f03AAE07b

- Token Type: Governance

- Total Supply: 27.182.818 EUL

- Circulating Supply: Updating

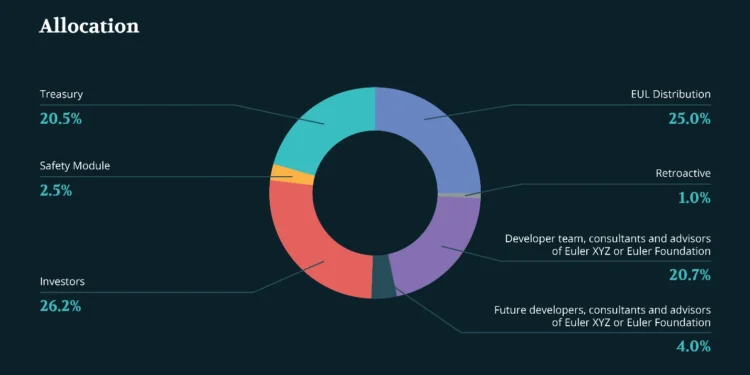

Token allocation

- 25% (6,795,704 EUL) lends to users in community-selected markets on Euler for more than 4 years.

- 1% (271,828 EUL) for all users who sent or borrowed assets on Euler during the soft launch.

- 2.5% (679,570 EUL) for users who put EUL into the Safety Module for more than 4 years.

- 20.54% (5,585,389 EUL) into ecosystem coffers, unlocked when TGE

- 26.2% (7,122,577 EUL) for investors in Euler XYZ Ltd, with an 18-month linear allocation schedule

- 20.75% (5,640,434 EUL) for employees, advisors and consultants of Euler XYZ Ltd or Euler Foundation, with a linear allocation schedule of 48 months.

- 4% (1,087,312 EUL) for future employees, advisors and consultants of Euler XYZ Ltd or Euler Foundation, with a linear allocation schedule of 48 months.

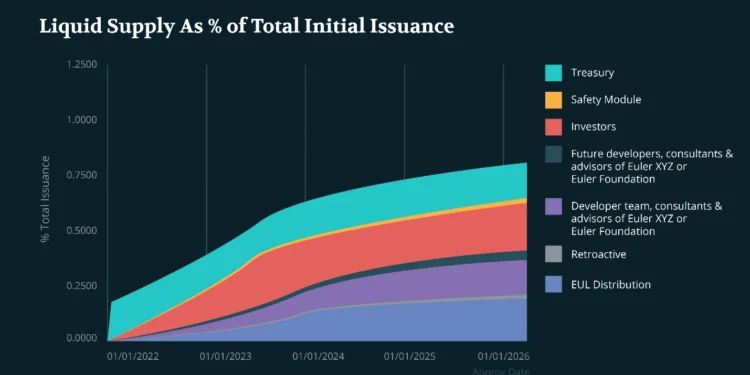

Token Release Schedule

Development team

- Dr Michael Bentley, Co-founder + CEO: Michael previously worked as an evolutionary biologist modeling complex systems using Game Theory and dynamic systems theory at the University of Oxford.

- Doug Hoyte, Co-founder + blockchain dev: Doug is a programmer, author and teacher specializing in cybersecurity and financial applications.

Euler raised $8 million in a Series A round led by Paradigm along with Lemniscap.

On June 7, 2022, Euler successfully raised $32 million from Haun Ventures, Variant, FTX Ventures, Jump Crypto and Uniswap Labs Ventures among others.

>>> Related: What Is Binance Labs?