Advertisement

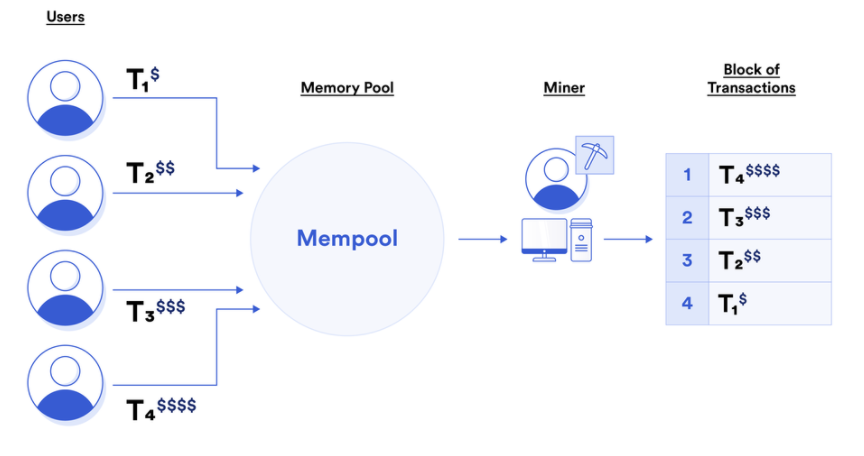

Blockchain technology promotes the development of cryptocurrencies, allowing making transactions on a P2P platform without intermediaries. During pending transactions in the mempool, miners or validators will aggregate and put transactions on the block for Nodes in the network to validate.

Since each block contains only a certain number of transactions, miners have the option to choose higher-fee transactions to maximize their profits. This strategy is called Miner extractable value (MEV).

In the following article, Ecoinomic.io will help you better understand MEV as well as the transaction processing process on the blockchain.

What is miner extractable value (MEV)?

Miner extractable value (MEV) is the profit that a miner or validator can earn from selecting and arranging transactions on the blockchain for a certain period of time.

Miners (or validators) have the privilege of selecting any transaction to form a certain block and arbitrarily excluding and arranging transactions in any order. That leads gas fees to rise and causes slippage.

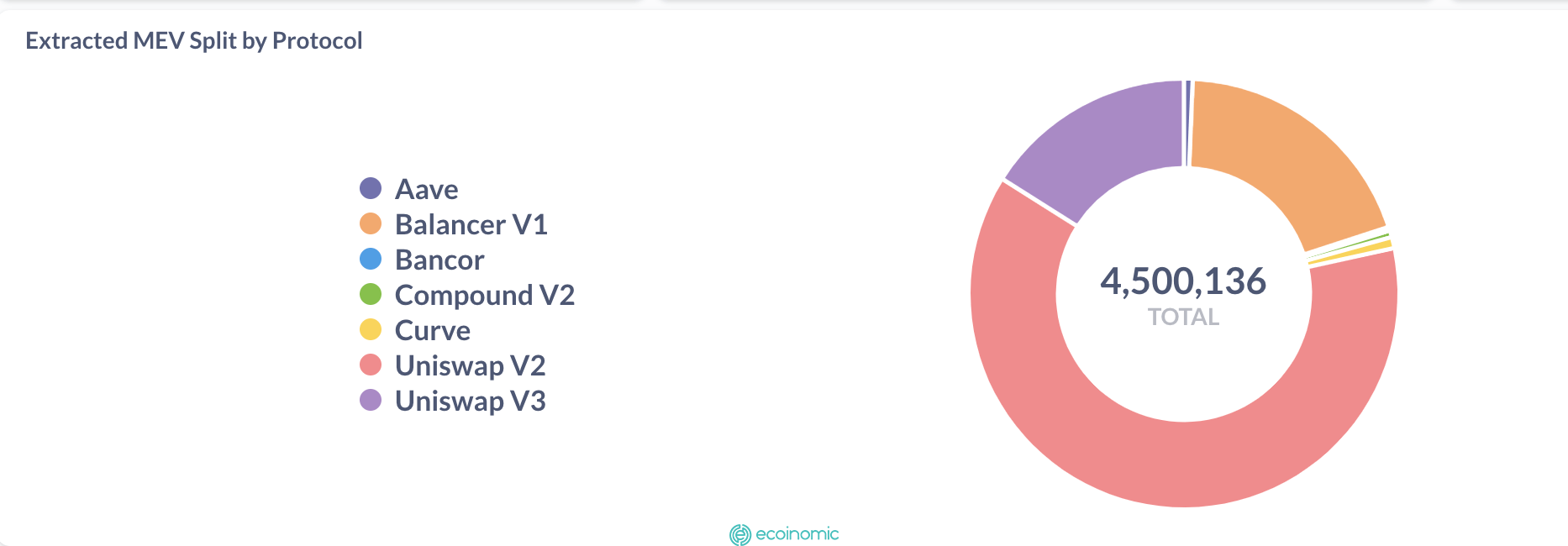

According to data from Flashbots, the profit gained from arranging transactions on Ethereum amounted to $674 million from January 1, 2020 to press time. This is a huge number in the gas fee battle among MEV bots.

In particular, profits mainly come from major platforms such as Uniswap V2 (accounting for 63%), Uniswap V3 (accounting for 16%) and Balancer V1 (accounting for 19.4%) in the total number of transactions from MEV.

Types of MEV

Arbitrage

Arbitrage is trading based on the Arbitrage of the same asset over a short period of time. This form appears not only in the cryptocurrency market but also in the traditional financial market.

Users will create bots to look for opportunities when the market fluctuates, causing the value of an asset to be unbalanced at different exchanges. At this time, bots often buy low on an exchange and sell high on others. That helps coordinate liquidity between exchanges, rebalancing market prices.

However, when bots compete with each other, pushing up gas fees, miners will prioritize high-fee transactions to maximize profits, which makes users forced to accept unprofitable transaction rates.

Front-running

Frontrunning is the insertion of another profitable transaction before the initial user’s transaction.

For example, trader A places an order to buy an NFT when the NFT is listed below the floor price, miners have the right to insert a purchase before A’s transaction to obtain that NFT.

Besides, front-running bots can copy transactions in the mempool and place orders with higher gas fees. The bot’s transaction will be executed first, resulting in slippage.

Sandwich Attack

Sandwich attack is a method of creating buy/sell trading pairs immediately before and after a transaction of user on DEX to profit from price spread.

For example, A places an order to buy DAI at a price of $1 on Uniswap. When the transaction is pending in mempool, the bot places a buy order with a higher gas fee to push the token price higher. After that, the user buys DAI at a higher price, MEV bot will place an sell order and benefit from the spread.

Sandwich attacks usually occur in pools with low liquidity, while pools with low slippage such as Uniswap V3 or stableswap algorithms are less susceptible to attacks.

Just-In-Time Liquidity

Just-in-time liquidity is adding liquidity to the related pools before a major swap is confirmed.

Miners will receive a large number of transaction fees and withdraw liquidity in the same block, while liquid providers will lose the fees they would have received.

Solution to MEV issues on blockchain

EIP-1559

Proposed in 2019, EIP-1559 offers a solution to stabilize the rise of transaction fees.

Users need to pay a minimum fee per transaction.

- The base fee is based on the size of the blocks and will be burned for removal from the circulating ETH supply.

- Tip is the amount of money users can pay miners to speed up the transaction execution process.

- Cap is equal to the basic fee included in the block.

User pays = gasLimit * min {base fee + tips, cap}

Miner receives = gasLimit * min {tips, cap – base fee}

EIP-1559 also proposes to change the maximum block size from 12.5 million gas to 25 million gas.

Flashbots

Flashbot allows users to send one or more specifically arranged transactions directly to miners via Private RPC. Transactions don’t have to be pending in the public mempool and will be secured until they are confirmed on chain.

That prevents MEV bots from front running, flashbot miners will receive directly rewards from the users.

>>> Related: What is RPC in blockchain?

Chainlink FSS

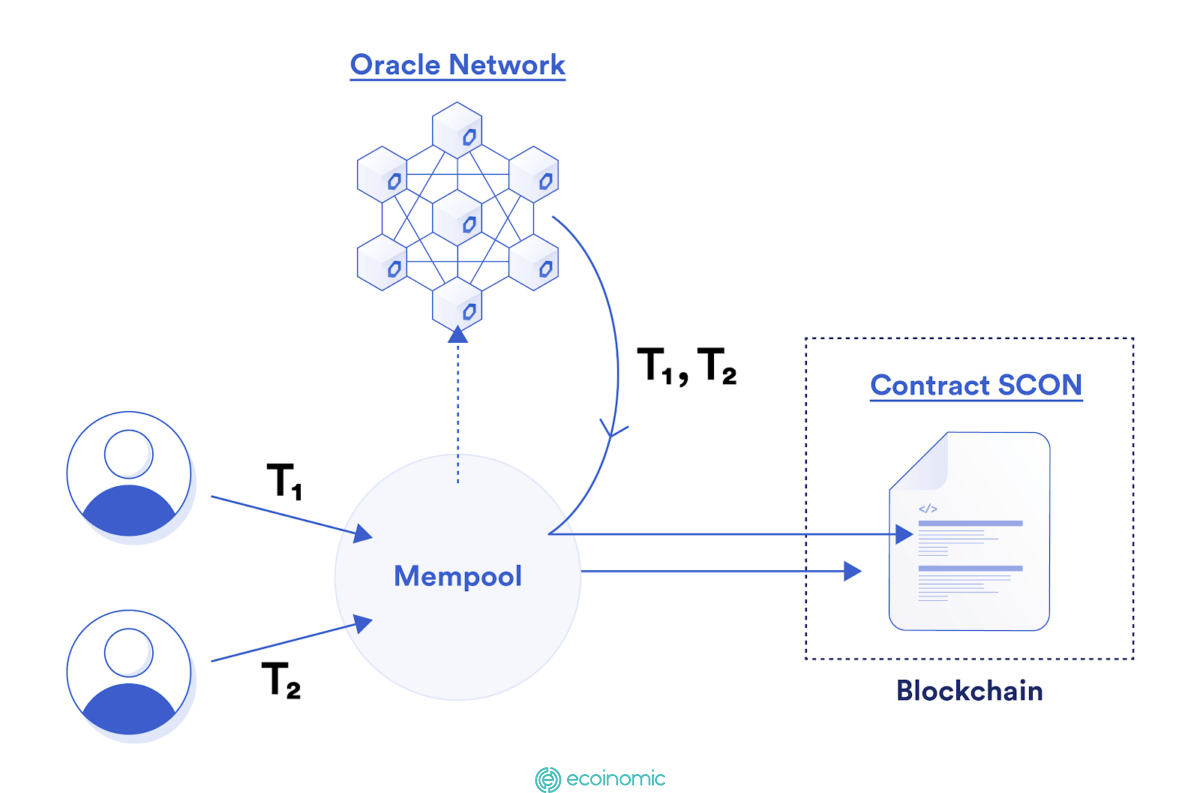

Chainlink FSS works by encrypting user transactions, oracle arranges transactions based on the time they are sent to the mempool and then sends transactions to smart contracts.

Chainlink FSS aims to create consensus during transaction arrangements, ensuring that smart contracts process transactions fairly without any preferential arrangements.

Besides, FSS also helps reduce gas fees, improve user experience.

>>> : How to sign up for Binance update 2022

Conclusion

MEV is one of the blockchain dilemmas that causes slippage. However, with the development of the blockchain ecosystem and the cryptocurrency industry, many new solutions and proposals are expected to overcome the above limitations to enhance the user experience.

Hopefully, the above article has given you a better grasp of MEV as well as how transactions work in the blockchain, so you can build smart investment strategies to optimize profits.