Advertisement

What is backtest?

In the 1980s, Traders made trades on a chart (with a buy or sell operation) thanks to their experience and understanding, then recorded their trading results in a journal. Re-checking the system is a simple concept. About a decade later, in the 1990s, traders trading often gave basic analyses of market patterns and displayed data on a computer screen. It is preferred to call such traders “investment innovators”. From there, the concept of backtesting, or backtesting, was born.

Backtest is a general method with the aim of viewing and studying strategies, and trading patterns and making judgments about how they will perform. Backtest can assess the viability and manner of that trading strategy using historical data. If backtest performs well, traders and economic analysts can confidently use those trading strategies and models in the future. That is, that strategy has a high opportunity and ability to be profitable when conducted in practice. In a backtest that gives bad results, the initial strategies and models will be changed by traders or analysts, even refused to use for future trading.

Today, backtest is widely adopted in many markets, especially the crypto market.

See also: What Is Ransomware?

Why do traders need to backtest the system?

There are many trading systems in the crypto market, and transactions always carry a lot of risks. So traders are always looking for a trading system that helps them minimize the risks they may face. Besides being vigilant so as not to fall into unsafe systems, investors must also focus on analyzing, and making the choice of the safest system, the most effective operation to trade. To satisfy the requirement to find safe and highly profitable trading, backtesting the trading system before execution is an optimal method that offers many benefits, including:

- As mentioned above, a backtest helps traders determine whether the strategies they choose are really as effective and profitable as they expect and whether there are any risks they will face in implementing that strategy.

- Practise: Backtest provides an opportunity for traders to practice and develop their market analysis skills, reviewing past price movements, volatility cycle analysis, and periodic patterns. From there, they can spot potential trading opportunities, which are highly profitable.

- Exercise confidence when trading: Traders after performing backtests, and checking past price information, they can draw on experiences that help them confidently trade “real”.

Backtest forms

Automatic backtest

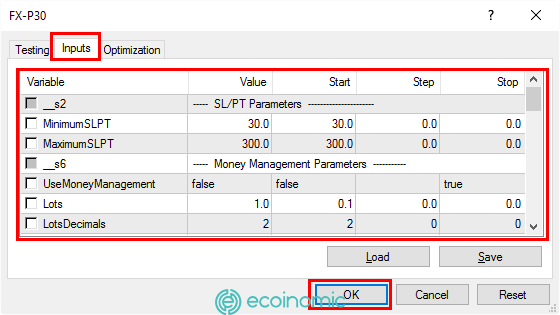

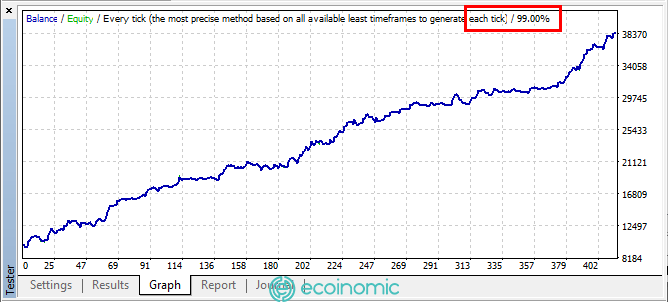

Automatic backtest is the construction of an automated program with open source and it will automatically backtest transactions. The interface of backtesting software usually displays two windows. Window 1 is where traders change the parameters of the strategy to run the test. Door 2 displays the test results report with statistics on the number of transactions, the number of short-term transactions, and the number of long-term transactions…

Manual backtest

Manual backtest is the form of traders manually scrolling and moving charts on the trading screen to previous stages. Manual movement makes it possible for traders to observe how that strategy will work under different market conditions. Steps to backtest a manual strategy

- Step 1: Open the chart of the currency pair that wants to test and analyze the strategy. Apply the necessary technical tools and indicators and adjust the time frame on the chart;

- Step 2: Move the chart bar with the scroll bar and find the right trading settings as desired;

- Step 3: Record the details and system of potential transactions, specify the date, time of entry, loss, profit, and other necessary information;

- Step 4: Repeat the process until you find the required number of potential transactions.

After earning enough numbers, traders should make a list, and calculate the success rate of the trading strategy. If the strategic audit results are not good, replace each variable based on the observations on the chart. Repeat this process until the test results are repeated as desired.

Manual backtesting requires a lot of time and effort. However, if done correctly, the preferred trading strategy will bring a high success rate. Moreover, manual backtests also help traders increase their understanding of the market and train their ability to determine input and output prices.

The principles of backtesting the system

- Number of signals: Choose multiple signals put into the backtest, a minimum of 30 so that the results are solid and objective

- Backtest time: The backtest execution time should not be too short, it must be longer than one trading quarter. The reason is that the market is always fluctuating, and the trading pattern is always changing. A system that can work very well in one quarter, but fails in the next quarter. Therefore, prolonging the backtest time will flatten the results better.

- Count the pip number: After completing the backtest, traders should re-system all profitable and loss-making trades. From there see the correlation between the number of winning and losing orders and the total number of pips in those orders.

- If the number of pips in the profitable orders is 55% it means that the trade has made a profit;

- If the number of pips in the orders is more profitable than in the loss orders, but the rate is less than 55% which means that the backtest time is not enough, it should be extended further;

- If the general order and the total pip lose more than the winning order, then the selected system has a problem, so look for another system that is more positive.

Factors that can affect backtest results

- The accuracy and reliability of data and sources is the most important factor. Therefore, it is necessary to authenticate the data carefully;

- Backtest results will be similar if done multiple times on a data set. Therefore, the data used must be 100% determined;

- Commercial execution logic is an important factor when implementing backtests. Traders need to be alert to market movements and persistently test tactics in the long run. Because infrequent liquidity is normal in the market, and the market is always dominated by a lot of external objective factors.

Note

Backtest results only reflect the partial efficiency of the transaction. Actual results and backtest results always have certain differences. That depends on many different objective factors. The actual results of the strategy may be worse or better than the backtest result. However, usually backtest results are usually better than they actually are. Worse backtest results than they actually are usually due to problematic trading tactics.

See also: What Are The Differences Between Investment And Speculation?

Conclusion

Backtest is an important task when developing a trading system, it can help investors find the “wisest” strategy to succeed in trades. Backtesting for traders is not a difficult task. With the technical era of development, instead of manual backtesting, a lot of software, platforms are released by reputable developers, supporting fast and accurate backtest traders such as Deltix-QuantOffice, QuantDEVELOPER, Profit Finder, MetaTrader …