Advertisement

Fundraising is one of the important activities of a startup project. In fundraising rounds, it is impossible not to mention Security Token Offering (STO). In the article below, Ecoinomic.io will explain more about this funding round.

What is a security token?

Security tokens are a form of “shares” of the company, allowing the owner to receive “dividends”. Therefore, security tokens must comply with the provisions of securities laws.

The government or business may issue security tokens. Therefore, these tokens serve the same purposes as stocks or bonds. Security tokens differ from Utility Tokens because they represent ownership of assets.

Simply put, they are liquidity contracts in a digital format that represent shares invaluable assets such as company shares, real estate, or vehicles. By using the Security Token, the money owned is stored on a public ledger (Blockchain).

By encrypting securities, startups launching Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEO) offerings can improve the liquidity of their assets and attract more investors. There are also other benefits, such as lower issuance fees, high market efficiency, segmented ownership, and improved access to digitized real-world assets.

A token is considered a Security Token when the following conditions are met:

- That token must be a financial investment product.

- Investments must be made to the company or organization.

- Investors have the expectation of owning that token to make a profit.

- The expected profit is generated by the 3rd party.

What is Security Token Offering (STO)?

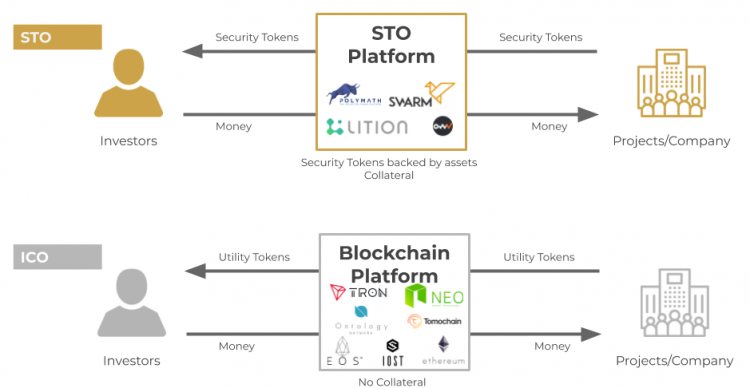

STO (Security Token Offering) is a type of public offering that facilitates the trading of financial assets through encrypted digital securities. Token transactions are stored and authenticated through a public ledger or Blockchain.

Security Token Offering is considered a more secure alternative to Initial Coin Offerings (ICOs). Since tokens are classified as securities, STO is also subject to rules and regulations, giving token holders the opportunity to invest safely and legally.

The ecosystem of Security Token Offering includes the following components:

- STO Platform: These are projects that allow tokenization and issuance of Security Tokens to implement STO.

- STO Projects: Projects issue their own Security Tokens. They are released through the use of the services of the STO Platform.

- STO Exchange: These are the exchanges that allow the trading of the above-mentioned Security Tokens.

the ecosystem of STO

How does Security Token Offering work?

Similar to ICOs, Security Tokens allow startups to raise capital for cryptocurrency projects and new business projects. The difficulties and limitations associated with securing capital through traditional venture capitalists have made other ways of sourcing other capital such as STO quickly become popular. STO is legal and safely managed so that companies get the funding they need.

Another function of the Security Token is the cryptocurrency segment, in which existing assets in the real world are secured through encryption or securitization. Total global real estate assets are worth about $326.5 trillion while the world’s total Market Capitalization is estimated at $91 trillion, and technically, these assets can be encrypted.

Tokenization facilitates easier securities trading, not to mention lower management costs. Likewise, paperwork will be significantly reduced or eliminated after securitization is applied on the stock market.

Security tokens usually represent assets:

- Real estate: Similar to real estate investment trusts (REITs), real estate equity can also be converted into securities tokens.

- Capital markets: Organizations can encrypt their shares, give token holders the benefit of voting rights, earn dividends, or both.

- Commodities: Commodities can also be divided into tokens that can later be offered in STO.

- Equity funds: Equity funds can also tokenize their shares, with token holders entitled to a portion of the equity fund’s earned profits.

It is important to note that STO technically offers the same type of securities available on traditional investment platforms. Tokenization does not alter these underlying securities in any way. Instead, STO only offers a new investment approach.

Factors to consider before launching Security Token Offering

What is being encrypted?

Security tokens represent a variety of asset classes and interests such as physical assets, equity gains, or debt,… Therefore, the type of encrypted asset will not only require different legal attachments but also have different levels of attractiveness among investors. Therefore, it is important to consider before launching Security Token Offering.

Authority of tokens

The combined area of the token has a significant impact on its STO structure. Therefore, jurisdiction must be considered, depending on the following:

- Location of real assets

- Security regulations and other laws specific to the region

- Categorize encrypted interests

- Water, the origin of the founders, for tax purposes

- Marketing strategies and efforts will work in the said position

A company with the right structure and management

This is a very important consideration before launching STO. For example, if tokens are similar to traditional equity securities, then their issuance must also be authorized in the issuer’s company documents.

Other limits and rules may apply, in accordance with the law. For example, the number of token holders may be limited. In the United States, most encrypted securities are limited to 99 investors residing in the United States.

AML, KYC

The majority of countries today have anti-money laundering (AML) and identity verification (KYC) requirements. These apply to financial businesses including security token issuers. AML and KYC ensure that the investment amount has been purchased legally.

Encryption platform

There are many different online encryption platforms, such as Securifying, Tokensoft and IQ Tokens,… It is important to consider which platform to use as each platform has a different approach. You must also consider the price of the support partner after launch, as well as the percentage of commissions on the amount raised.

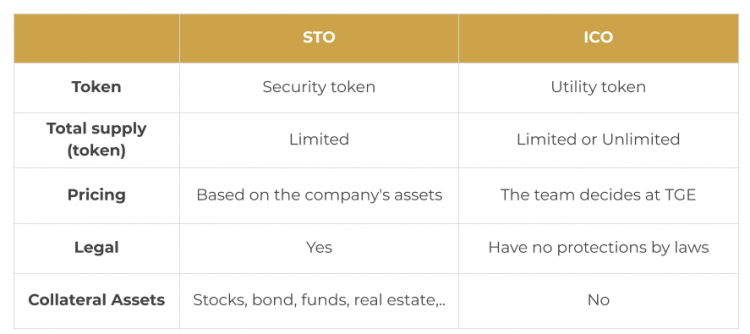

Comparison of STO and ICO

On Tokens:

- STO will issue security tokens.

- ICOs usually issue utility tokens.

Token valuation:

- STO: The price of security tokens is priced according to the company’s assets.

- ICO: the token price is initially decided by the dev team.

Legally:

- STO is protected by law (developing a legal framework).

- ICOs are not, and are even restricted in some countries.

Collateral:

- STO: company assets, securities, stocks,…

- ICO: No.

Some of the huge differences between Security Token Offering and ICOs are in number. Security tokens are tied to the real value of the company, so it has a limited supply (of course no company has assets or boundless value). Utility tokens of ICO projects are not required. The number of tokens and the limited supply depends on how the team dev is designed.

Advantages of Security Token Offering

STO is considered safe and has a lower risk than ICOs. This is because the law is strictly enforced on Security Token Offering. Since security tokens are also technically tied to a real-world asset, it’s easy for potential investors to assess whether it’s fairly valued against their current market value.

STO is also more cost-effective than initial public offerings or IPOs. Through the use of Smart Contracts, you do not need to have a legal advisor. Meanwhile, blockchain also eliminates traditional paperwork and dependency procedures, significantly reducing processing time.

Moreover, Security Token Offering opens up the market to beginner investors who may not have the opportunity to invest if they do not want to segment cryptocurrencies. Trading can also be done 24/7, giving investors convenience and liquidity.

Disadvantages of Security Token Offering

One of the advantages of STO is also the biggest challenge: regulation. STO platforms are subject to an increase in regulation that makes processes more administratively complex. The STO platform must constantly keep up with changing regulations related to AML, KYC, exchange approvals, ownership monitoring, and the like to ensure compliance with applicable laws.

Regulations in some areas may also restrict who can invest in STO (e.g., only as residents or citizens), thereby reducing investor groups and reducing investment opportunities for investors.