Advertisement

BTC, ETH, and most altcoins were sold off sharply when The Merge started, but ATOM is bucking the trend with near double-digit gains.

The Ethereum Merge has finally taken place. Everything went smoothly without any major hiccups. As predicted by many, this event turned out to be an event of the style of “buy rumors, sell the news”. Or perhaps, the 9/12 price index is the real catalyst driving the market in its current direction.

Regardless of the reason for this week’s downturn, The Merge is over and the bulls have almost nothing. There is a possibility of a new rally or analysts will need to keep a close eye on smart assets to choose which assets are suitable for rotation.

So now that it's over, what's the new narrative? Surge, verge, purge, or splurge? Maybe dirge?

— Galois Capital (@Galois_Capital) September 15, 2022

Remember, “The Merge”, according to a lot of people means a bullish event that can cause the price of Ether to go higher, and the ETH PoW token vault hard fork means reality Billions of dollars of liquidity will likely pour into Bitcoin and help this asset break out of its current range.

However, there may not be that happening. Not to say that it certainly won’t happen, but the reality is now that it’s a “bright red” market. Bitcoin’s September 15 fall below $20,000, causing a market-wide correction that resulted in double-digit losses for the majority of altcoins. At the moment, there is not a single story for investors to believe that the market is bullish.

See also: Cosmos Analysis And ATOM Price (8/26/2022). Why ATOM Prices Can Fly to Cosmos.

Not all coins are dumped

Incidentally, one exception is Cosmos (ATOM). To some people’s surprise, it was one of the few “green” properties on the chart on the day The Merge took place. Currently, the altcoin has a gain of 9.4%, and it has recovered strongly from its September 14 low at $13.19.

Previous analysis has discussed how ATOM prices trade in an ascending channel, rising above the 20-day moving average, and showing that falling below and below the moving average reflects a good buying opportunity. A simple technical analysis of ATOM’s price action will focus on:

- ATOM price continues to generate lower and higher levels while trading in ascending trendlines.

- Atom price witnessed a short-term rally, touching the 200-day moving average and then correcting back to the moving average and the 20-MA line to confirm the upper lines as support lines.

- After testing the support, the price has resumed its uptrend and is now trading at the top of the current range and is likely to retest the 200 MA in an attempt to flip the support.

Let’s take a brief look at some of the possible factors behind ATOM’s bullish momentum.

Protocol migration, liquidity staking, rising TVL, and the potential of IBCs

Some protocols pivoted away from Terra after it crashed and were relaunched on the Cosmos Hub SDK. In September, analytics firm and protocol builder Delphi Digital also announced that it had chosen Cosmos as its main blockchain for building new projects.

When projects build on the Cosmos Hub, the value accrued to ATOM often leads to good results. The reason is that the DeFi protocol and other DApps will participate in the network’s chain security system operating via IBC. The Inter-blockchain Communication Protocol (IBC) is essentially an “internet of blockchains” and is a bridge that allows the transfer of cross-chain tokens and increases secure interoperability between different blockchains.

Typically, DApps, AMMs, and DeFi-style platforms built on the blockchain provide Staking services, and fees from this activity are often shared among distributors.

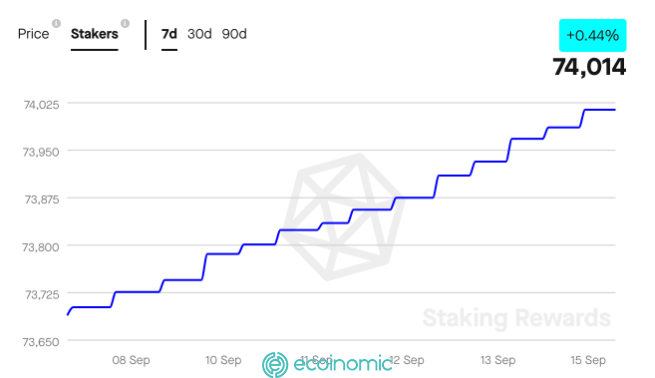

ATOM Staking currently offers 17.75% APY and according to Staking Rewards, 66.75% of the existing Circulating Supply is being staked. Cosmos is set to launch liquidity stasis, a phenomenon when implemented in other DeFi platforms, and on other blockchains that have led to increased buying pressure on the ecosystem’s native token(s).

The data also shows a steady increase in the number of unique authorization addresses in the network.

Many Cosmos ecosystem platforms, including COMDEX, are set to launch their own stablecoins (CMST), and it is likely that assets locked and staked in the platform will “return” to the $1 peg level of the aforementioned stablecoins. Given the structure of the Cosmos Hub and IBC, it seems likely that ATOM will be one of the main assets used in the “minting” process.

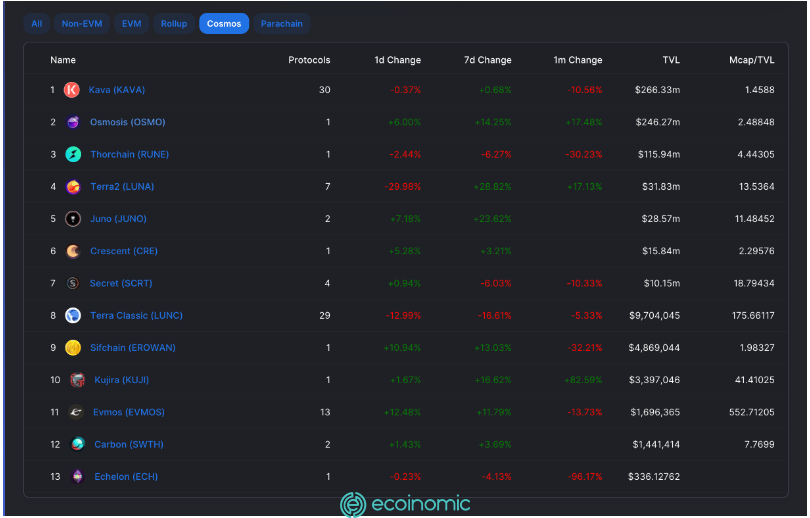

Of course, the Total Value Locked (TVL) in the Cosmos ecosystem collapsed as DeFi and the broader cryptocurrency market succumbed to the downtrend. This figure has not yet recovered significantly, but the chart below shows notable cash flow over the past 7 days. This will be a number worth keeping an eye on, along with the price of ATOM.

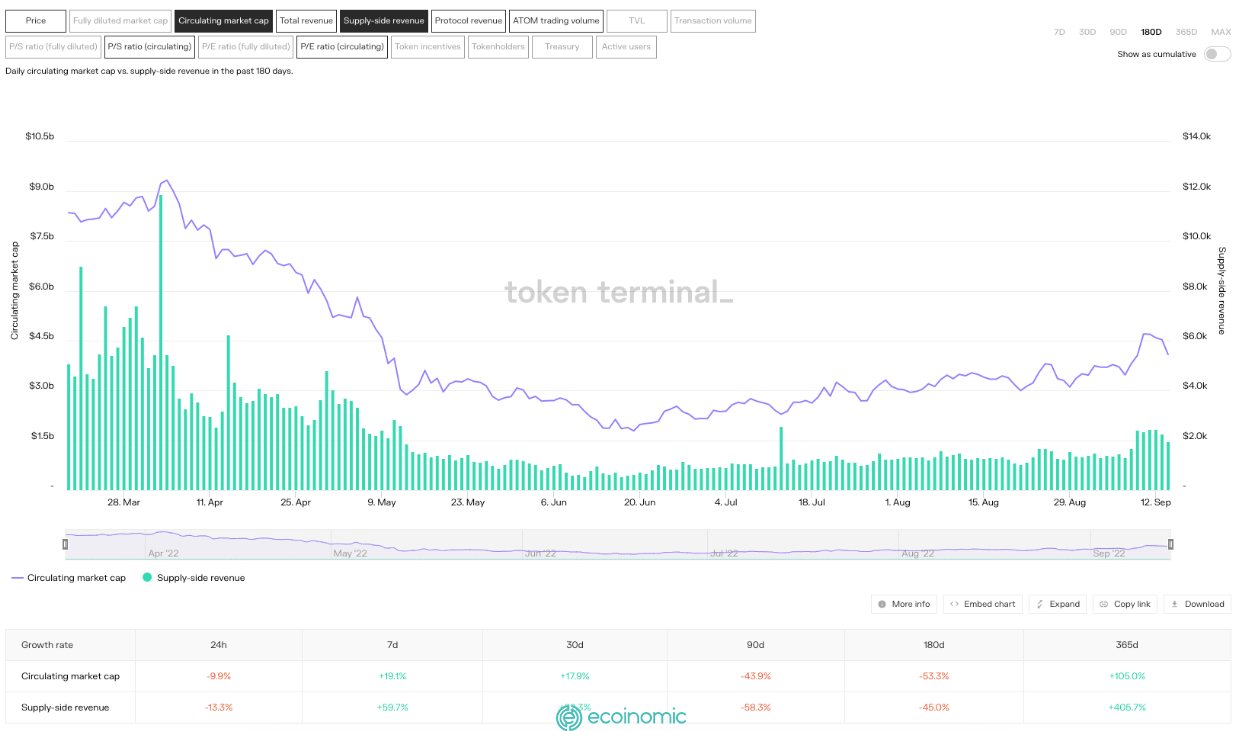

Additional growth indicators will make investors interested in Cosmos’ supply-side revenue, protocol revenue, and daily trading volume.

Revenue from the supply side reflects the number of transaction fees allocated to validators while total revenue is the total amount of transactions that the protocol user pays.

On the other hand, the revenue from the protocol is the number of transaction fees for the protocol, these people are the owners of ATOM and can share a part of this revenue with platform users and distributors.

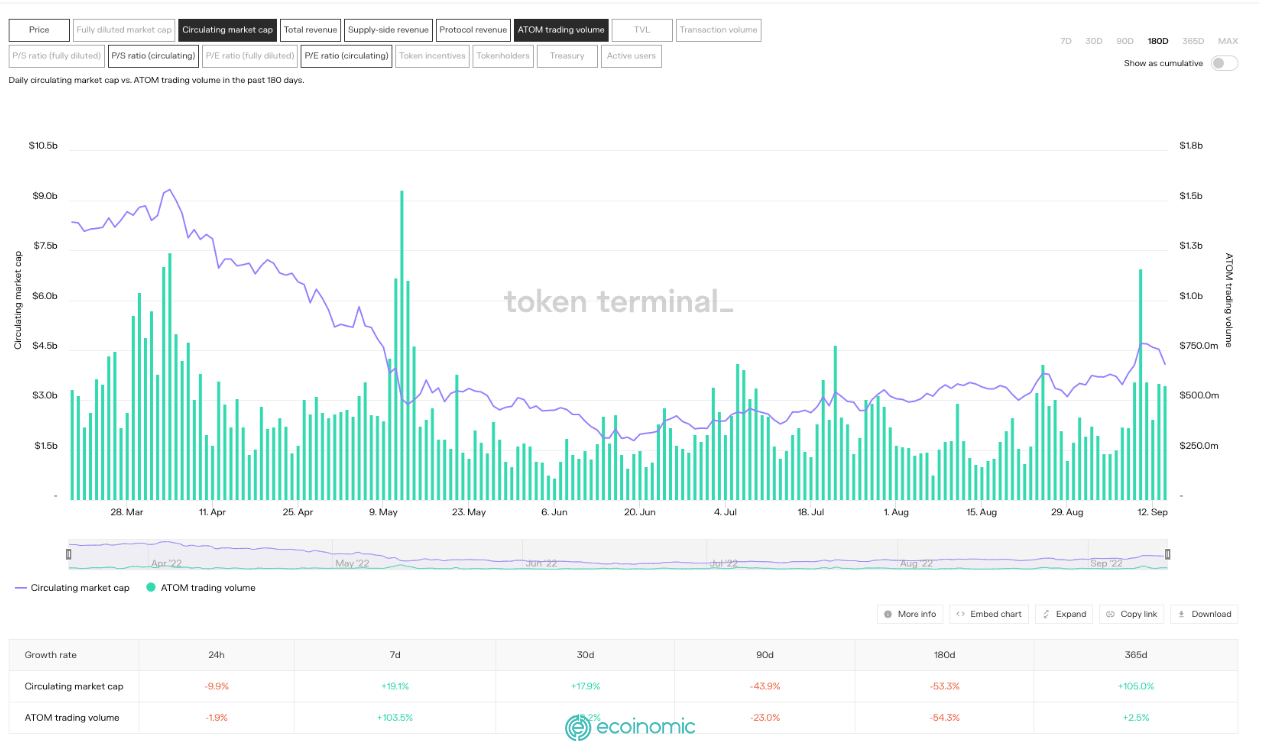

Cosmos circulating market cap and ATOM trading volume. /caption] Basically, what we see is Metcalfe’s law. As the ecosystem grows, the network grows, the total value is locked up, and liquidity staking provides an add-on to the assets to be staked, these assets also go into the cycle of being bought, staked, minted into stablecoins or IOUs and then used within the ecosystem to drive additional growth.

See also: ATOM has the biggest momentum in the market by maintaining a 4-month high