Advertisement

The cryptocurrency market over the past 12 months has shown that many people would love to own a code that costs too much compared to a JPEG file. NFT will also soon be used to trade music ownership, real estate and debt instruments.

NFT has a strange relationship with cryptocurrencies, just like parents with children. When the NFT market was small, price actions depended on the cryptocurrency market. But as this market got bigger, they gradually separated from each other.

While the cryptocurrency market slipped sharply in January 2022, NFT blossomed with the NFT OpenSea trading platform reaching $5 billion in purchases, the highest number ever. Many cryptocurrency watchers think that the correlation between the cryptocurrency market and the NFT is inversely proportional: As the cryptocurrency market rises, the NFT decreases and vice versa.

Others point to a time when both markets go hand in hand. That was the case recently that the NFT market fell along with other markets when the war in Ukraine broke out.

Correlations Found

There is not much professional research on NFT because only a few years ago this market did not exist. A study on the topic called "Does the Price of Cryptocurrencies Affect NFT?" by Professor Michael Dowling of Dublin City University.

The study indicates that "People who follow the NFT market will recognize the intersection between cryptocurrency market participants and NFT market participants."

This is partly because: to buy NFT, users need to have cryptocurrencies to pay, which is no small complexity for many people.

However, cryptocurrency exchange Coinbase is planning to make the exchange easier. Their expected NFT market will allow users to buy NFT with Fiat money with their credit cards. In fact, companies like eBay, Reddit, and Instagram have all planned to integrate NFT and use fiat money. This further separates the NFT from cryptocurrencies. But until that happens, these two markets remain interconnected, and moreover, NFT will always need a blockchain platform like Ether and Solana to operate.

Dowling's research also points out that "The results clearly show that, compared to cryptocurrencies, the NFT market has a lower spillover effect." "Moreover, even in NFT markets, the spillover effect is quite limited, indicating that these markets are quite separate from each other."

A blockchain research lab work agrees with Dowling. "When the value of cryptocurrencies decreases, purchasing power is lower, which can adversely impact the NFT market," the study said. "Conversely, as the value of cryptocurrencies increases, investors often look for new or alternative opportunities. This is especially feasible in the context of ETH, the standard denomination of the NFT."

However, both of these studies were published in the first half of 2021, before the NFT market skyrocketed. Data this year suggests that there probably isn't much correlation to these two markets.

An independent market?

A report from Coin Metrics in February 2022 looked at the correlation between the price of Ether (ETH) and OpenSea's transaction volume to see if the rising eth price caused the NFT to fall. "These data show no consistent link between OpenSea's purchases and eth's price," the report said. "It seems that NFT is a relatively independent market and can largely move independently from the cryptocurrency market."

DappRadar also concluded that NFT reacts to macro factors differently than the cryptocurrency market. A DappRadar report from January 2022 states: "The undeniable role of NFT in both metaverse and Play-to-earn platforms has contributed primarily to positive on-chain indicators despite adverse macro factors."

However, some prominent traders still see connections between the NFT and crypto markets. They argue that when the prices of bitcoin and altcoins fall, money flows into the NFT. This may be because traders are looking for a place to make a profit or to pursue more profits or because trading JPEG files is a fun pastime amid market volatility.

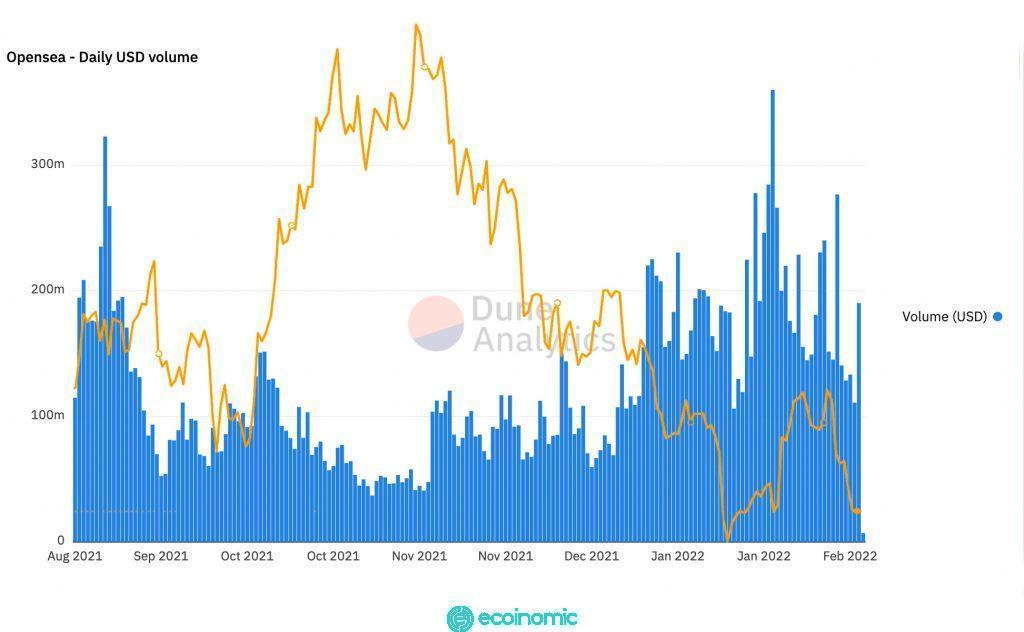

From Dune Analytics' data on OpenSea's daily sales, we can identify two times when NFT is bullish. The first period began at the end of July 2021 and soared in August before falling in September. Another uptrend of NFT began in mid-November 2021 and peaked in February 2022.

In July 2021, the amount of NFT began to increase as btc prices became gloomy. Both cryptocurrencies and NFT rose in August 2021, with bitcoin up 76% before falling in September along with the NFT. So the only obvious inverse relationship is in November 2021 to February 2022 when the amount of NFT increases while BTC and altcoins both fall.

A Messy Situation

Interestingly, the people who are convinced that there are links and correlations are all traders, whose job it is their job to observe volatility and act on beliefs. Analysts and scholars, on the other hand, are less confident with their conclusions. "I don't believe that cryptocurrency markets can be easily related to each other," said Lennart Ante, co-founder of blockchain research. "If bitcoin drops 10%, no one will buy NFT; instead, people will turn to stablecoins."

What is more clear is that when the NFT was still in its formative period – before March 2021 – there was a ripple effect from the larger cryptocurrency market. But since rising from the end of 2021, the NFT market has moved in a different way.

Maybe this is just a bubble effect big enough to lift the NFT market while cryptocurrencies struggle. Or maybe we're seeing a mature NFT market break away from cryptocurrencies and go its own way. "The proliferation of NFT in January 2022 was caused primarily by social media hype and fear of missing out (FOMO)," Ante said. "The bloom is still on the rise and you don't know how big it's going to be."

NFT seems to be leaving the cryptocurrency market that spawned them, but also not entirely independently. They are behaving like teenagers: they like to experience, rebel and want to go in their own direction.