Advertisement

The Ethereum network finally moved to PoS on Thursday, September 15, 2022, marking the end of outdated PoW mining infrastructure. The transition ushered in a new era in the field of eco-friendly cryptocurrencies, with the Ethereum blockchain consuming 99.95% less energy than before.

The Merge Takes Place Successfully – The New crypto Era Begins

Ethereum founder Vitalik Buterin confirmed on Twitter that The Merge was a success:

And we finalized!

Happy merge all. This is a big moment for the Ethereum ecosystem. Everyone who helped make the merge happen should feel very proud today.

— vitalik.eth (@VitalikButerin) September 15, 2022

The development has silenced critics, especially those. who has criticized that blockchain technology is a danger to the environment? Previously, Ethereum’s PoW protocol consumed as much energy as it supplied Finland with power for a year. However, things have now changed for the better, as The Merge will significantly reduce Ethereum’s carbon footprint.

The cryptocurrency community “welcomes” Ethereum Merge to the high volatility of the market. One advantage that investors get after this event is that Ethereum is like a traditional financial asset. The post-Ethereum Merge world will pay interest to users, similar to bonds or certificates of deposit (CDs).”

That way, investors can earn passive income by Staking their Ether on the network with a return on investment paid in ETH. So how does The Merge affect the price of Ethereum?

Will Ethereum go up in price after The Merge?

Ethereum Merge is making headlines globally. ETH was influenced by CPI data released on Tuesday, which showed US Inflation at 8.3%. Bitcoin and the cryptocurrency market slumped after the data was released and the Dow Jones fell 1,276 points.

Currently, the price of ETH is hovering at $1,632, slightly higher than the $1,600 mark before The Merge took place. In this context, this flash dump was also somewhat anticipated before studying the previous important updates of Ethereum. Overall, this is an important time for investors to quickly “exit” before deflationary dynamics for ETH occur to subsidize the token.

On-chain data also partly confirms this prediction. A few hours before The Merge took place, a large amount of ETH was withdrawn to centralized exchanges. This is a move to prepare “ready” to sell off ETH by investors after this event.

In addition, the Fed will meet on September 20 and 21. The rate hike of 100 BPS has reached 48% according to some analysts. Therefore, analysts expect the market to continue to hold up this month. ETH may not recover despite The Merge’s success due to the economic downturn. Do your own research and make personal judgments because none of this information is considered completely accurate investment advice.

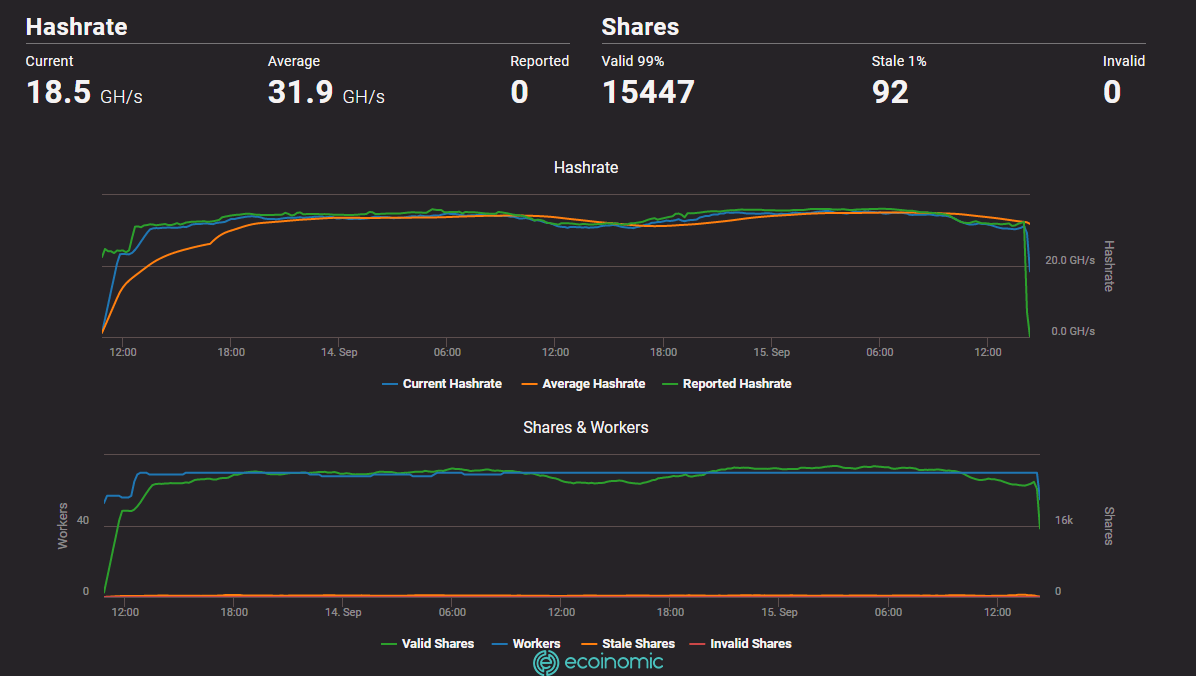

Adjusting mining operations after The Merge

The move to PoS is also set to have a significant impact on Ethereum’s inflation rate. The Ethereum foundation said the amount of ETH will plummet. About 13,000 ETH were released per day before The Merge – the number will drop to around 1,600 ETH per day.

However, one thing that the new update won’t do is make the cost of doing business on the Ethereum network more affordable. Transactions will not be discounted until further updates are rolled out.

The speed of the network remains essentially the same as it was before the update was deployed. Following the Ethereum Foundation, Ethereum founder Vitalik Buterin said the network is now a big step towards achieving the founders’ vision.

“This is the first step in Ethereum’s big journey to becoming a sustainable system. And there are still many next steps to be taken. We still have to scale. We still have to fix privacy. We still have to make things really safe for users. And I think we all need to work hard and do our best to make those things happen.

For me, The Merge symbolizes the difference between early-stage Ethereum and Ethereum on the way to development. So let’s get started and build all the other aspects of that ecosystem and make Ethereum what we want it to be. ”

A group called ETHW Core has promised to fork the main Ethereum blockchain and launch the version of PoW offered to miners. The fork offers potential for anyone holding ETH, and they all receive the same number of forked tokens.

Cryptocurrency exchanges have detailed plans to conduct a fork, from listing coins for trading at the time of the fork to scrutinizing coins that have been forked similarly to other asset classes.

See More: What To Expect Next When The Ethereum Merge Is Complete