Advertisement

Aries Markets announced the launch of the Devnet phase of the project on October 10.

What are the outstanding features of this project’s ecosystem? Let’s experience Aries Markets testnet through the detailed guide below.

Aries Markets overview

Aries Markets is a Decentralized exchange built and developed based on Aptos’ Move language.

Aries testnet aims to allow any user to experience key features on Aries Markets such as account management, borrowing, lending, swapping and margin trading through a decentralized order book and AMM.

With a unified margin account, users can earn interest on deposits, Borrow from collateral-based shared liquidity pools, and access other DeFi products with ease.

With the vision of becoming a “DeFi super app”, Aries Markets aggregates and simplifies the user experience across all DeFi in the Aptos ecosystem.

See also:Join Testnet with Pontem Wallet – Opportunity to get airdrop with Aptos ecosystem

How to join Testnest Aries

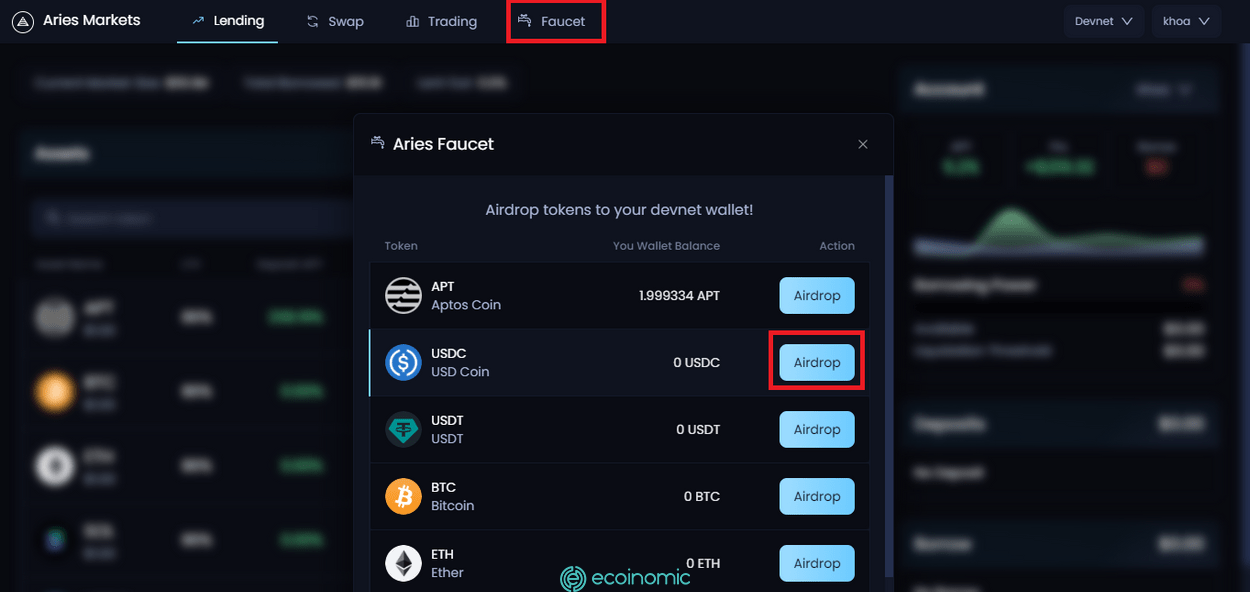

How to claim token on Aries Markets testnet

Step 1: Access the Aries Markets homepage using the following link: https://app.ariesmarkets.xyz/

Step 2: To start participating in the Devnet experience, you need to create a wallet compatible with Aptos.

If you do not have an Aptos wallet account, refer to the following article for detailed instructions: Get to know wallets on Aptos – The gateway to the ecosystem

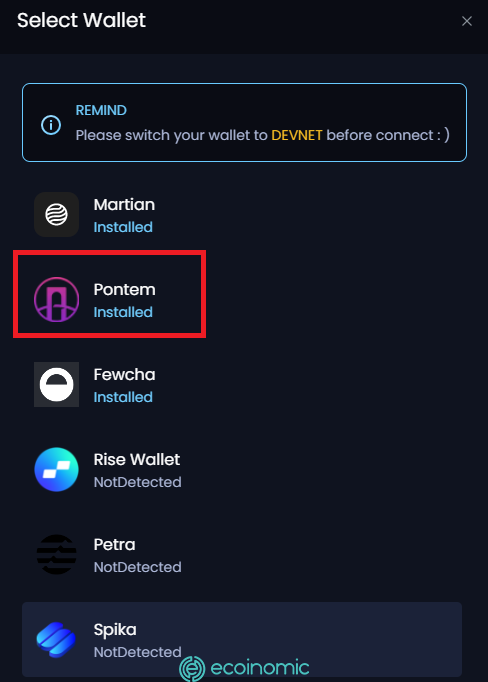

If you already have an Aptos wallet, select [Connect wallet] in the top right corner of the screen and select the appropriate wallet type to log in.

Aries Markets currently supports wallets on Aptos ecosystem such as Poorcha, Martian, Rise, Petra, Spika, Pontem,… In the following article, Ecoinomic.io will select Pontem wallet.

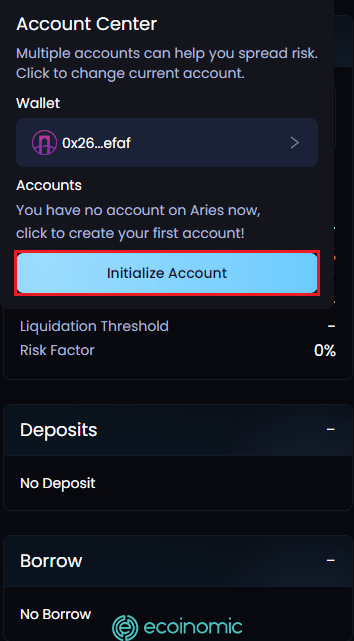

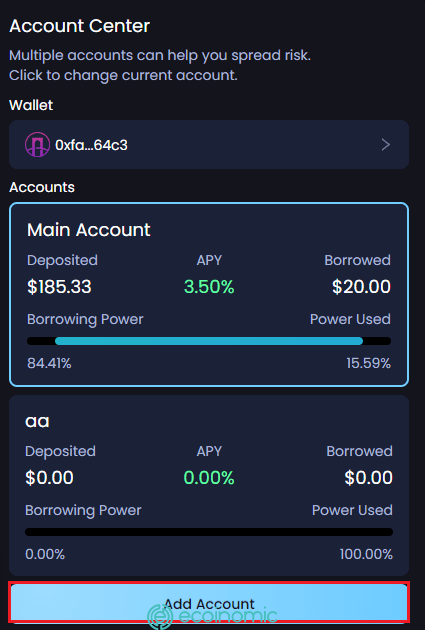

Step 3: After connecting the wallet successfully, select [No account] → [Initialize account] to create the main Aries account. First of all, users need to secure the APT testnet balance in the wallet and switch to the devnet network to continue.

Aries Lending User Guide

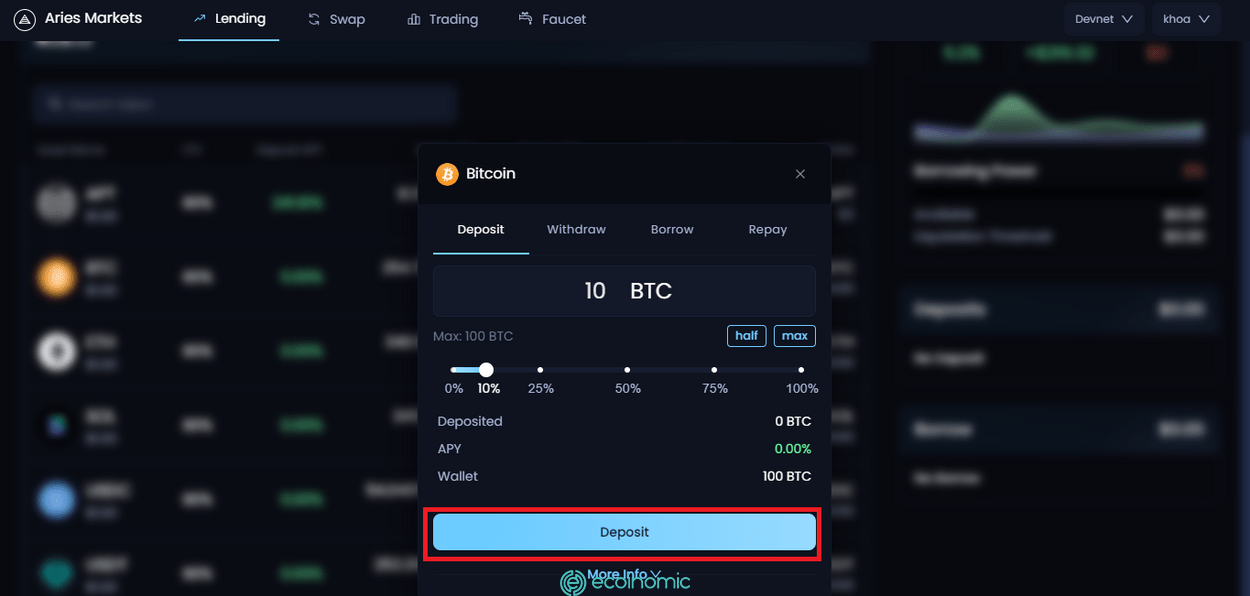

Step 1: To deposit funds on the platform, select [Lending].

Step 2: Select the asset, the amount you want to lend to the protocol (provide liquidity) by entering a specific amount or using the slider and then selecting [Deposit].

Step 3: Select [Confirm] to complete the deposit process.

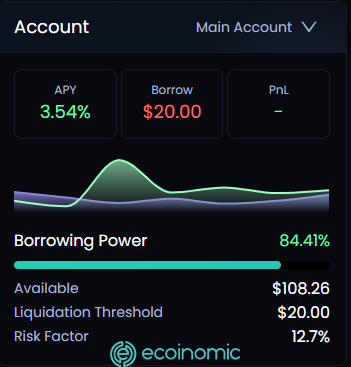

Step 4: The assets you have deposit on the protocol will become collateral that allow you to borrow other assets. Select [Borrow] to make other asset loans with the same steps as the deposit process. The maximum amount you can borrow is 80% of the total collateral value.

Note:

- You are not allowed to deposit and borrow the same asset on Aries Markets.

- Available: Loanable amount (80% of collateral value)

- Liquidation Threshold: Liquidation Limit

- Risk factor: If risk factor reaches 100% reproduction, it will be liquidated)It is not allowed to deposit and borrow the same asset on the AriesMMarkets

You are not allowed to deposit and borrow the same asset on Aries Markets

How to swap tokens on the Aries Markets testnet

-

Swap directly from the deposit on the platform

Funds deposited into the platform can be used to swap and trade on various AMM markets.

Aries Swap allows users to swap tokens on AMM pools with the highest liquidity and best return.

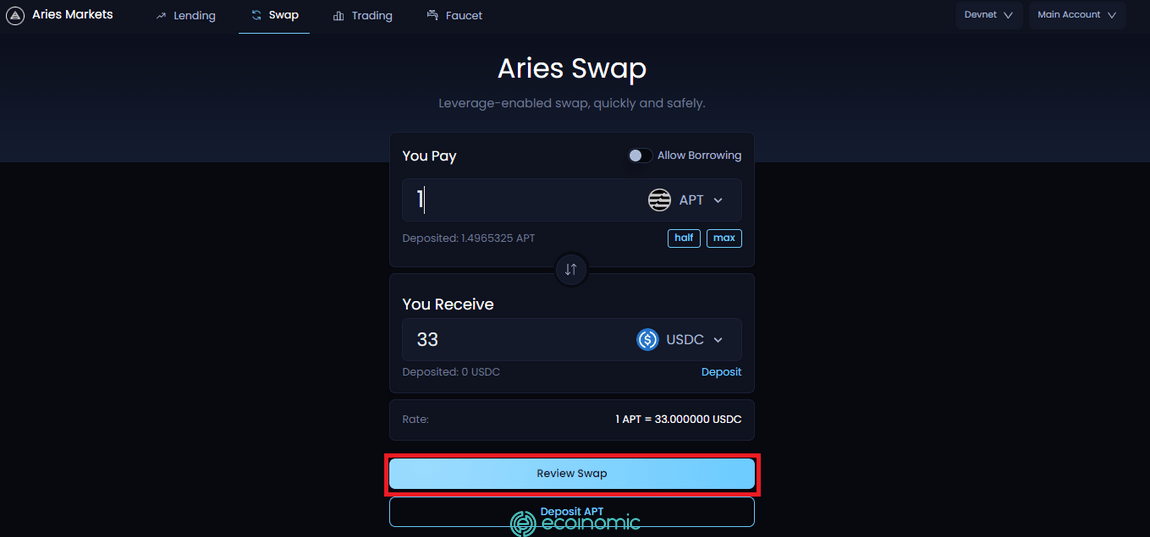

Step 1: Click [Swap], select the asset pair you want to swap, enter the amount.

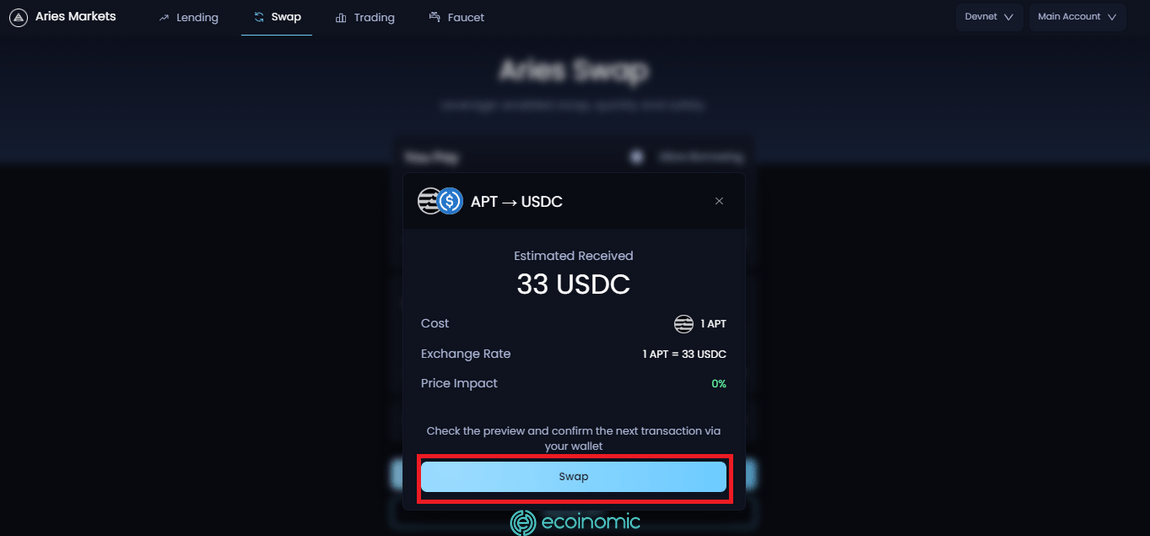

Select [Review Swap] to preview the transaction, the estimated amount received to assess the impact of the price and the minimum expected number of tokens.

-

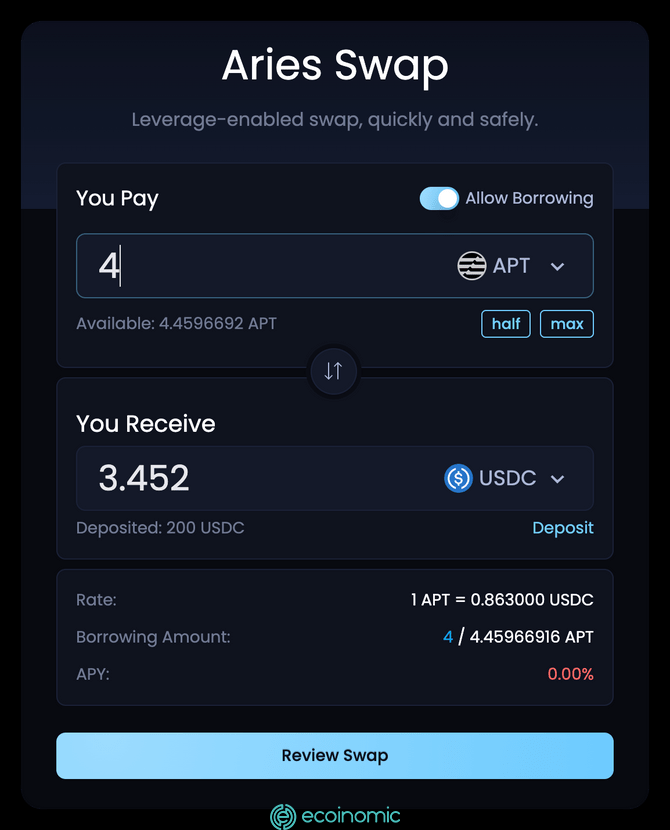

Leveraged-enabled swaps

Aries swap allows you to use leverage to swap assets you do not yet own but have on Aries Lending.

Step 1: Turn on the [Allow borrowing] button to borrow any token from the Aries Lend pool and swap it into another token.

Step 2: Select the swap asset pair and enter the amount and then select [Review Swap].

Step 3: Select [Swap] to complete the transaction.

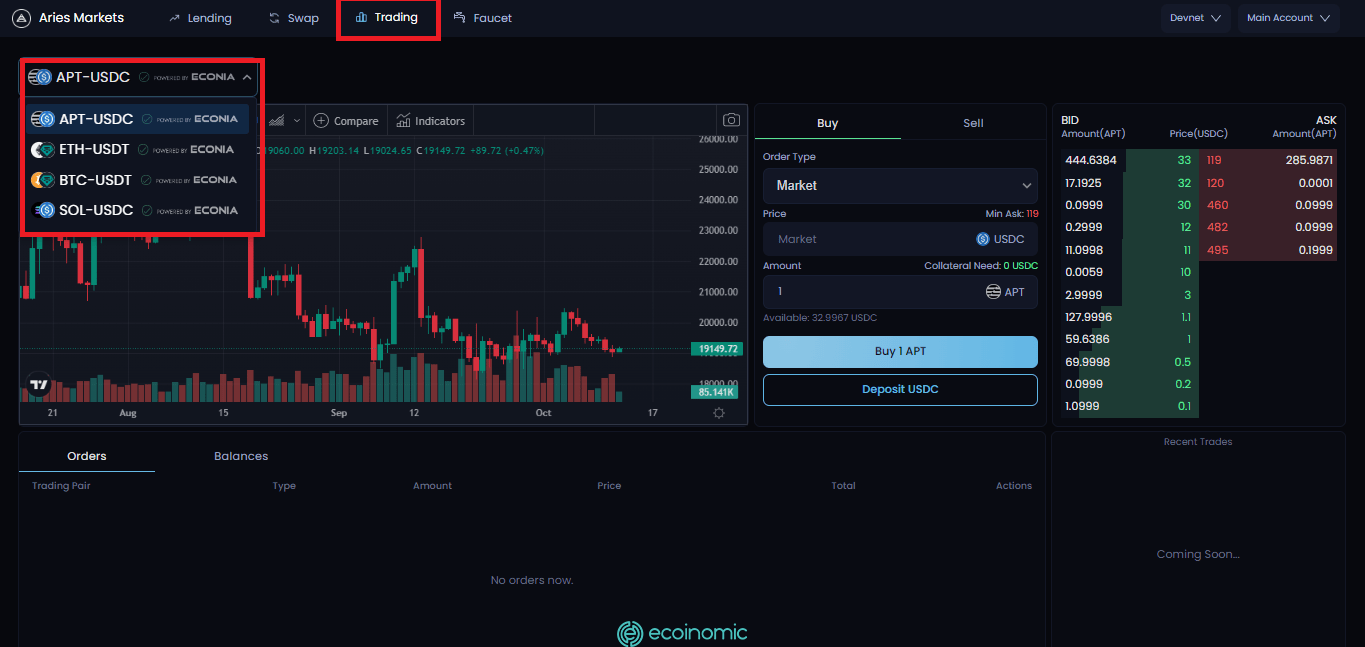

How to trade on Aries Markets testnet

Users can make “Spot Margin” trading on Aries Markets. Spot Margin trading is similar to spot trading, but it allows the borrowing asset to be used to take advantage of fluctuations in the underlying asset.

Aries offers cross-collateral services, allowing margin trading through single margin asset with a variety of asset classes on margin.

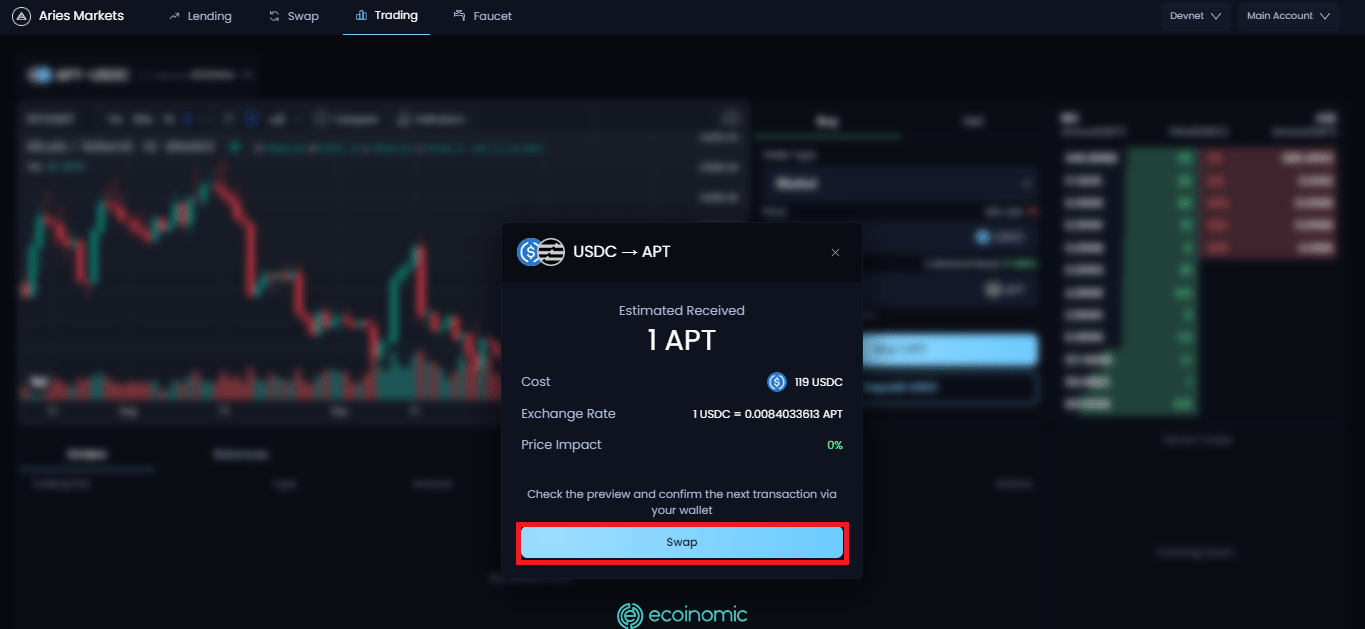

Aries Trade offers margin trading through a decentralized order book where users can place both market and limit orders.

Step 1: In the Trading section, select a trading pair. Users can switch between different trading pairs in the top left corner.

Step 2: Select [Buy] or [Sell] to place a buy and sell order respectively.

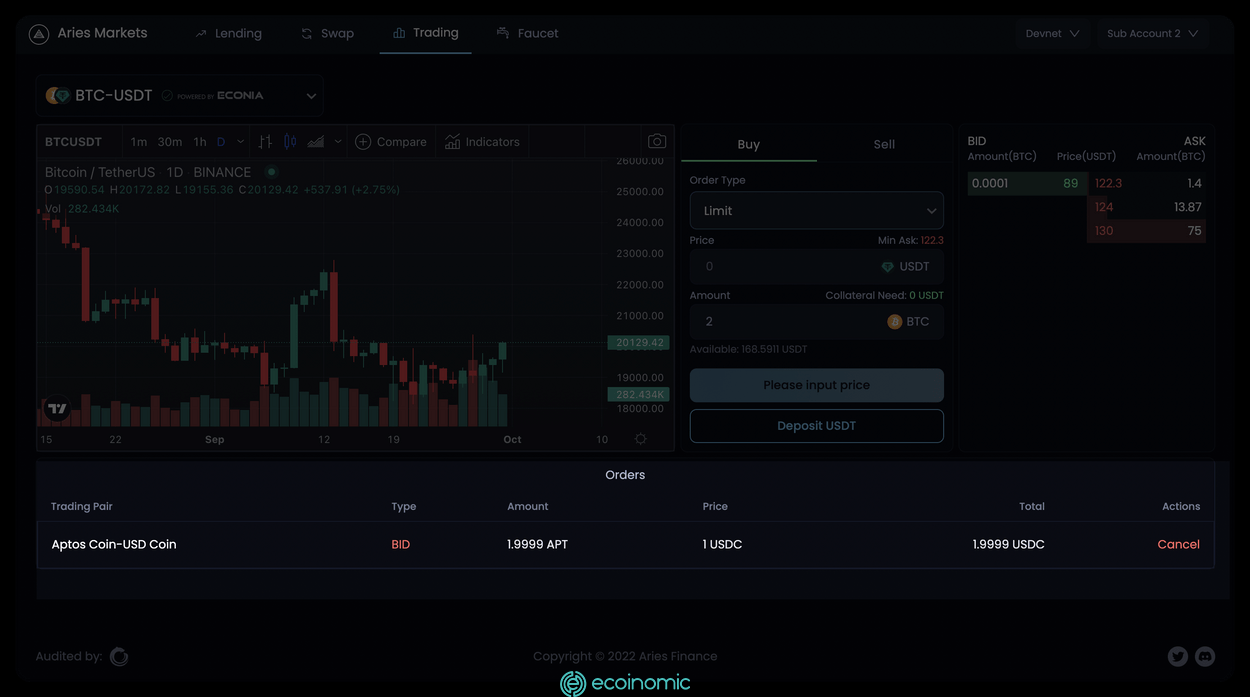

Choose the appropriate order type:

- Market order: buy or sell the asset based on the market price at the time of placing order.

- Limit order: buy or sell the asset at a fixed price. Your order will be successful if the price action of the asset in the order book reaches that price (or higher).

Enter the price and quantity then select [Buy] or [Sell].

Step 3: Select [Swap] to complete the transaction.

Click on the [ Cancel] button in the right corner if you want to cancel the order.

Conclusion

Aries Markets is a potential trading market on Aptos that users should experience the full range of lending, swap and trading features to have the opportunity to receive airdrop from the project in the future.

Hopefully, through the above article, Ecoinomic.io has helped you understand the basic information about the Aries Markets ecosystem as well as how to claim tokens, make transactions and swap on this platform. Therefore, you can prepare suitable investment strategies when the network launches Mainnet .