Advertisement

The EU’s legal tightening of cryptocurrencies has put a lot of pressure on the cryptocurrency market in particular and the financial investment industry in general.

The legal picture of cryptocurrencies in the EU

The cryptocurrency market has made strong progress in the EU. A number of well-known traditional banks have joined the blockchain. The European Central Bank (ECB) has kept interest rates unchanged to help financial markets stabilize and recover.

However, since February 2022, the EU has established tougher measures to control the stability of the cryptocurrency market and protect the interests of investors.

Matolcsy, the governor of the Central Bank of Hungary, has backed a ban on cryptocurrencies in the EU based on the market base of China and Russia.

Erik Thedéen, vice-president of the European Securities and Markets Authority, called on the EU to ban bitcoin mining, saying it was a national issue for Sweden. He has issued a warning about the overuse of electric energy extraction leading to environmental pollution problems.

MiCA Bill

After two years of deliberations, lawmakers of the European Union (EU) have unanimously passed the bill “Markets in the Crypto Assets Industry” (MiCA).

MiCA applies the legal framework in the use of cryptocurrencies in the EU. Initiated in September 2020, the bill requires the European Central Bank (ECB) to establish uniform rules for providers and issuers of crypto assets in the EU.

Initially, the MiCA included a provision prohibiting cryptocurrencies from using a consensus mechanism that negatively impacts the environment until 2025. However, that was met with fierce public opposition. If this request is adopted, it will destroy the growth potential of the cryptocurrency industry in the EU, making it impossible for regulators to store PoW coins.

Lawmakers later accepted the removal of the controversial request from the MiCA’s draft. Stefan Berger, MiCA’s rapporteur in the European Parliament on July 1 stressed that the final version did not ban coins from using the PoW mechanism.

MiCA Trilog: Durchbruch! Europa ist der erste Kontinent mit einer Krypto-Asset Regulierung. Parlament, Kommission & Rat haben sich auf ausgewogene #MiCA geeinigt. Für mich als Berichterstatter war wichtig, dass es hier keine Verbannung von Technologien wie #PoW gibt /1

— Stefan Berger (@DrStefanBerger) June 30, 2022

Anti-money laundering and identity verification regulations

In early April 2022, the European Parliament voted to adopt a new regulatory framework aimed at expanding anti-money laundering (AML) and identity verification (KYC) regulations to the cryptocurrency industry.

The regulation will impose AML standards on crypto transactions valued at EUR 1,000 or more. In addition, the law also requires verification of the identities of those who send and receive in cryptocurrency transactions.

At the end of June 2022, the Council of Europe reached an agreement to establish an Anti-Money Laundering Authority (AMLA) with the power to monitor high-risk and cross-border financial institutions. That put anend to the era of cryptocurrencies being out of control, closing in on major loopholes in Europe’s anti-money laundering rules.

The European Central Bank (ECB) is at war.

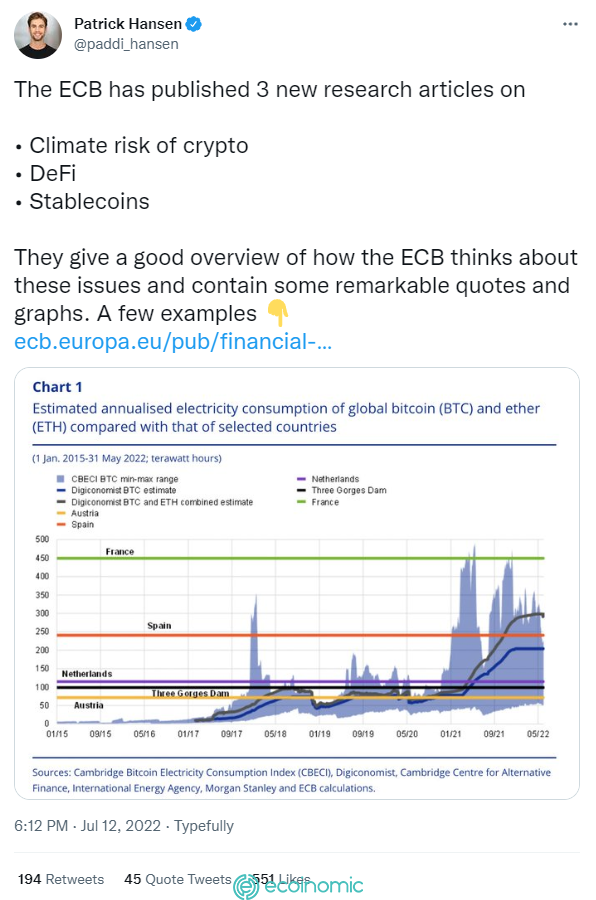

On July 12, the ECB published its studies on specific risks to the entire cryptocurrency market.

In particular, European Central Bank President Christine Lagard stated that the ECB will continue to assess the costs and benefits of issuing CBDCs to ensure people will still trust Fiat money. As the head of the general regulation-setting body for the MiCA, the ECB has fired the official shot representing the entire EU into the cryptocurrency legal sector.

In the report, the ECB stressed the need to take tough, appropriate measures in receiving Proof-Of-Stake in place of Proof-of-work to overcome the serious damage that PoW is causing to the environment.

The ECB argues that deFi protocols are actually still in a centralized state and Ponzi scheme, rather than of a decentralized nature. That is the cause of the collapse of lending platforms in particular and the liquidity crisis in the market in general.

Finally, the ECB affirmed the need to introduce strict regulatory regulations on stablecoins, especially after the incident that shocked the crypto industry that LUNA-UST.

How is the cryptocurrency market affected?

In the face of the EU’s tough moves, the cryptocurrency market has suffered negative impacts. However, this effect is only in the short term.

Cryptocurrencies have overcome many legal barriers during their formation and development, in order to gain widespread community recognition. In particular, typically the battle for more than 10 years in the Chinese market, however, Bitcoin and the entire market still exist, even growing rapidly.

Besides, the EU appears to be lagging behind in terms of regulation and reception compared to other regions such as the US and Asia. That contributes to mitigating the pressures on the overall market as the EU tightens its legal grip on cryptocurrencies.

In addition, the EU’s legal tightening of cryptocurrencies is a necessary step to help purify poor-quality projects, prevent risks, and set the stage for sustainable development.

Conclusion

Given the pressures that cryptocurrencies are facing from the EU, it is hoped that investors have an overview of the market to weigh in and make the right and informed investment decisions.