Advertisement

POW – Proof-of-work ANALYSIS

The proof-of-work mechanism of block discovery is called “mining” because participants must do the job using the energy from their computer to solve or guess a very difficult problem called a hash function.

Every miner competes for the correct answer is a 64-character sequence.

Solving this in front of their opponents is a feat that a miner will try to perform countless times per second.

The winner will announce its achievements by sending random blocks and particles (nonce) to the entire network to verify that the hash function solution to detect the new block has actually been solved correctly.

They will also win a block reward, a predetermined amount of bitcoin.

The process is energy intensive, but that energy is needed to ensure the legitimacy of the trading records on the ledger and establish an ethical structure to bring new currencies into the world.

Like similar gold miners, those who invest time, effort, and capital are the ones who – rightly so – discover the property

.While critics continue to make claims about illegal energy use, Bitcoin’s PoW industry is contributing more to humanity’s progress than any mainstream hate and fear you believe in.

THE GATEKEEPER OF THE “FREE MARKET”

Unlike many major industries around the world, there are very few regulations that affect entry for new entrants.

The biggest barrier to entry is simply one’s desire to participate.

While there are unfortunate exceptions, Bitcoin Mining is not more regulated than personal computers, allowing the free market to actually be realized.

While regulations can sometimes be a form of consumer protection, it is inevitable that government constraints are used as a way to modify and control the outcome of capitalism to ensure winners and losers, It makes many industries feel like the dice are loaded.

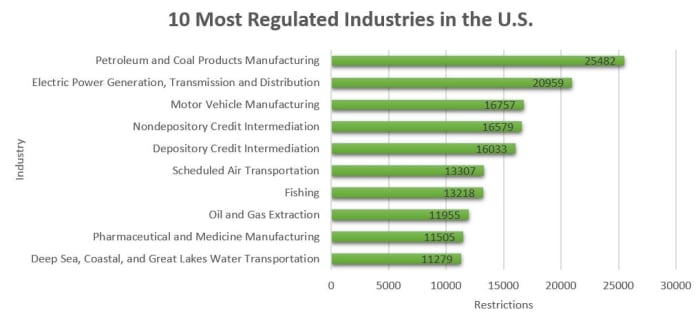

The list, published in 2014, shows the number of regulations that bind and may even completely prevent new entities from challenging incumbents in many industries.

It wouldn’t be too far-fetched to assume that it’s even harder these days.

Exploitation of raw materials, electricity generation, automobiles, finance, aviation and pharmaceuticals: these industries are better known for their relationship of cronyism to government than the free-market economy.

Social orientation towards these industries can best be described as alien or unreliable.

Detractors, however, try to blame “capitalism” in general instead of finding proper blame for the government’s inclusion in the free market.

The government does this to control the money supply and facilitate some institutions over others, essentially “geomorphicizing” the economic world.

Detractors, Bitcoin mining is a good example of the dynamics of the free market: obtaining operating capital; look for stranded or low-cost energy sources; turn on the machine; create money without borders, scarce and not forfeiture.

Anyone can do this and the more participants are activated, the more free market forces there are.

In contrast, Proof-Of-Stake cryptocurrency systems use political processes such as voting or the number of units frozen or “deposited” in the network to determine who receives newly created units.

To liken this to a more personal similarity: if you have a project in the workplace that you have worked extremely hard for recognition, but the credit is given to others because they are vice presidents and you are a low-level employee, You will feel light.

Another example is your favorite band announcing that they are going to give away tickets.

They can choose winners from people who really want tickets because they will invest time to register their name or even write a letter explaining why they feel justified.

Instead, the band decided to give random tickets to anyone in the world, even if they really didn’t care much about that band.

I’m sure they’ll lose a lot of fans that day.

In the same way, equity proof systems try to socialize units in the network in a “fair” way.

Of course, this is a short-sighted mechanism.As we understand through living life, when you rush into work, you are acceptable, not anyone else will reap the fruits of your labor.Some people will say that it is your first principle, your natural ownership.

OPT IN TO SAVINGS VERSUS THE FIRST SCAM

Bitcoin mining allows for cooperation with the free market.

As previously stated, block rewards are earned about every 10 minutes (taking into account the difficulty factor) by a miner.

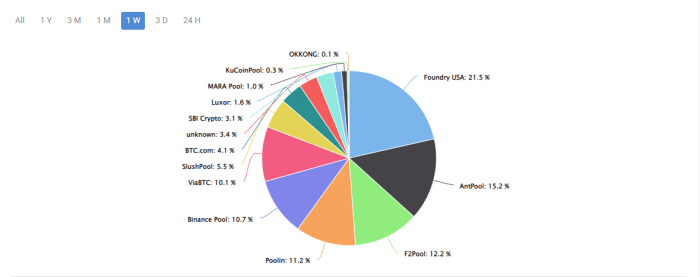

Confronting an entire world of block rewards, one can increase their ability to profit by joining the mining group.

The mining group is a common group of bitcoin miners who combine their computing resources over the network to enhance the probability of finding a block.

While you won’t get the full bonus, you will increase your chances of making a predictable profit.

The choice of collaboration or not is a characteristic of the free market economy.

No one is forcing any miner to be in one mining group or another.

If everyone decides to join a supergroup, then they will address the consequences of the reward being fully socialized.

If we compare it to real life, earning a reward for ourselves makes sense in the real world.

A poker tournament with 500 people doesn’t end before it starts with everyone agreeing to split their purchase amount evenly.

Each person is betting on their own ability, or “job,” to get better returns.

Even at the last table of nine players, how long will it take for that last group to decide to split into 9 ways?

I’ll say it’s thin.

There may be some room to negotiate for the last two or three players depending on the payment structure, but it is clear that in a competitive industry such as poker or bitcoin mining, there is a strong desire to secure the entire prize by some strategic socialization.

Sadly, the Proof-of-Stake cryptocurrency removes this dynamic from the picture because block rewards are often the result of subjective ideas of voting consensus like governance structures or socialized distributions based on the number of tokens you’ve placed in the network.

An even more dangerous fact is the process of “pre-mining” or pre-distribution (similar to stock options in a traditional Venture Capital project), in which the cryptocurrency development team and investors were initially given tokens before they were made available to the public.

This maintains an exclusionary economic model that maintains that only a privileged few continue to leverage profitable business projects from the support of ordinary investors – not characteristic of Bitcoin or the actual productivity-based free market economy.

These practices set up the standard “pull the rug” opportunity for early investors.

We’ve seen many of them since the market panic began in late November 2021. It’s absurd to think that Bitcoin could be defeated by networks operated by elite groups that run ahead of the exit before participants and developers can actually develop the system they’ve created.

QUITTEM’S PIONEERING SPECIES THEORY

The evolutionary nature of bitcoin mining encourages the discovery of untapped, wasteful, or redundant energy sources across the globe.

Efficiency is the key to the incentive structure.

There would be no bitcoin mining operations if miners didn’t envision a profitable opportunity.

Any energy source is a candidate, renewable or otherwise.

For the first time in history, humanity has a way of making money from energy.

When human nature dictates, we create more than anything we value.

If we value gold, we will mine more.

If we take Fiat debt seriously, we will create more debt.

If we value energy, we will generate more energy.

The energy generated is a precursor to civilized society.

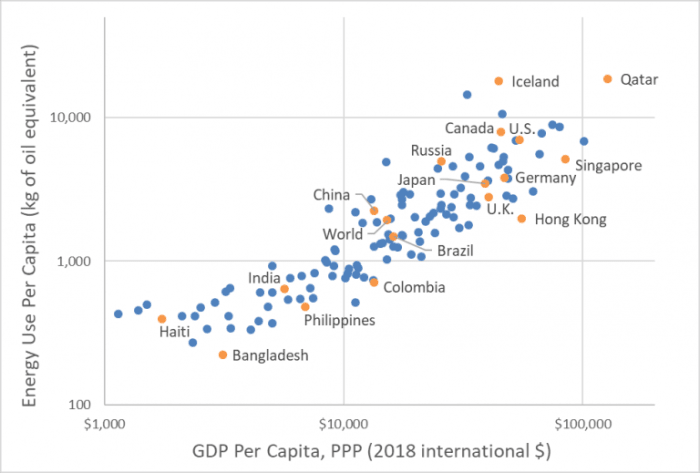

As seen in the image above, countries with access to energy are often considered the most advanced countries in the world.

Bitcoin miners are encouraged to seek out and partner with energy producers to compete for bitcoin rewards.

That in turn nurtures energy sources that then attract energy consumers to the region.

If one energy source attracts enough demand to raise prices beyond profitability, then the miners’ mobility will allow them to move to another inexpensive source.

Meanwhile, the power supply still makes consumers raise the level of civilization in the region.

This concept of “Bitcoin as a Pioneer Species” is further detailed by Brandon Quittem.

The serious nature of the proof-of-stake system is that the incentive structure remains in line with current problems in our world.

As we said before, if we value debt, we will create more and make money from debt.

What do these systems value the most?

If they are not proof of work then they value and therefore make money, at the discretion of their ruling class.

Fiat’s system is built on IOU that real management entities can never pay off – just as they don’t want to.

The process of “robbing Peter to pay Paul” was constant and the ordinary man, sadly, was Peter.

Inflation through an unrestricted monetary system will steal the value of previous currencies.

The motivation to be a participant creates almost unprofitable value by being a participant who has positioned himself as an early recipient of newly created currencies.

This is a political “share” structure, not a “value through work” structure.

It is easy to see that the PoS cryptocurrency is no better than the current monetary system.

Like the fiat system, these crypto projects bring disproportionate benefits to their ruling class, and there’s nothing stopping the traditional elite from co-opting those systems, maintaining the class structure as before.

COMPETITION STIMULATES PROGRESS, POLITICS STIMULATES COMPLIANCE

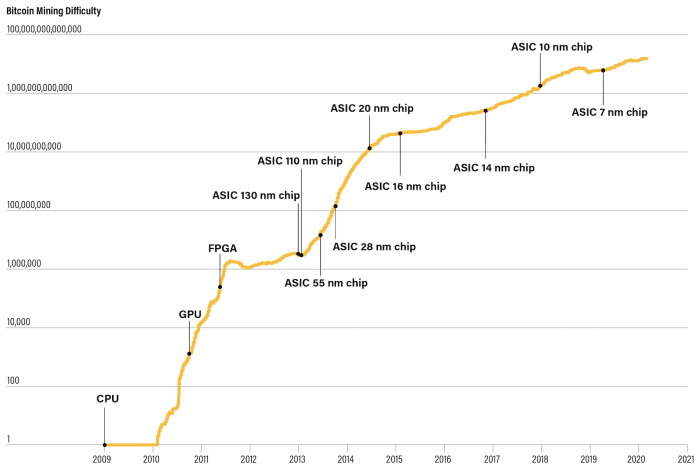

The competitive nature of bitcoin mining encourages developments in computer chip research.

In the chart below, one can see the progress of the application-specific integrated circuit bitcoin mining (ASIC) capabilities.

There’s no magic formula here.

Bitcoin stands out in the influence of the research and development of transistors and integrated circuits (IC) because energy has been monetized and human ingenuity directly impacts the ability to earn more money.

This doesn’t mean ic won’t continue to grow if Bitcoin doesn’t exist – but the drivers drive human progress.

Apollo’s missions were largely motivated by a political rivalry.

When the competition was over, so did our trips to the moon.

The political dynamics are strong, but I would risk guessing that if the moon had a large amount of gold, we would definitely see more missions in 1969. When the curve in mining strength is flat, the mining strategy will need to “look at other areas in it to gain a competitive advantage.

These may lie in innovations in the field of energy supply, the paper says.

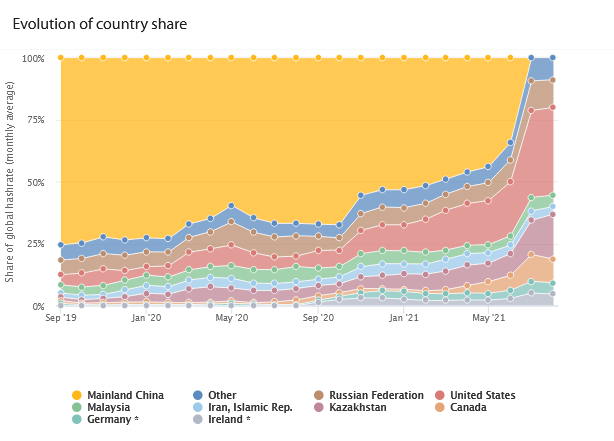

We’ve seen evidence of that right now based on the chart below.

Kazakhstan isn’t the first country you’d think of to operate advanced technology, but considering low energy costs (~2.5 times cheaper than the U.S.), the short shipping process from China’s heavily mined region, and friendly tax laws, it’s an incredibly big incentive to generate a portion of the world’s toughest money. In a country that is often forgotten.

For proof-of-stake networks, incentives are not for human innovation and progress but limitations and influences.

Proof-of-stake discourages science from advancing human progress because energy production and consumption are not part of the equation.

Instead, the use of energy is actually suppressed as a mechanism to entice participants through virtue signals and political positioning.

These networks are not protected by proof of work and are often the target of serious vulnerabilities when hackers attack weak code seeking to protect their networks.

The Proof-of-stake cryptocurrency is quite similar to the current fiat currency system: The incentives are not really suitable for productivity.

The most recommended attempts are to gain a position or “stake” near the creator of the currency.

The first entities to line up to receive new units or control the receipt of those units are entities that are immune to the effects of the Cantillon effect, the adverse byproduct of unfettered money creation.

This dynamic is not widely talked about, but this is why politics is such a favorable endeavor.

When the Ethereum elite decided to “merge” into a PoS blockchain, the Polygon board decided to increase gas fees or did CEO Cardano change the size of their blocks, has the user community ever been consulted?

Why would management care if they own enough Total Supply to basically hold the entire network hostage?

Carl Schmitt said, “Sovereignty is the one who decides the exception.

In the case of thousands of cryptocurrencies, each of them seeks to recreate the current system with the dominant person setting the exception of their own insider group.

See also: What Are The Differences Between Investment And Speculation?

EVERYONE WILL SEE.

If indeed bitcoiners are to empower individuals to the state, they will agree to the right to choose their means of exchange, account units and stores of value.

While Bitcoiners will try to lobby others to accept Bitcoin; they would never encourage the government to ban proof of stake.

Not because of political affiliation, but because they recognize the inability of a government trying to limit free market forces in a world that has discovered Bitcoin!

It simply doesn’t matter!

This is a world that offers an alternative to rulers looking to control your ability to act freely in the economy.

In due time, all will surely find it to be the best amount ever made!

Have you had the opportunity to see and sign domi?

Take a look at your statement page and take you to hundreds of people who want to separate money from the state.